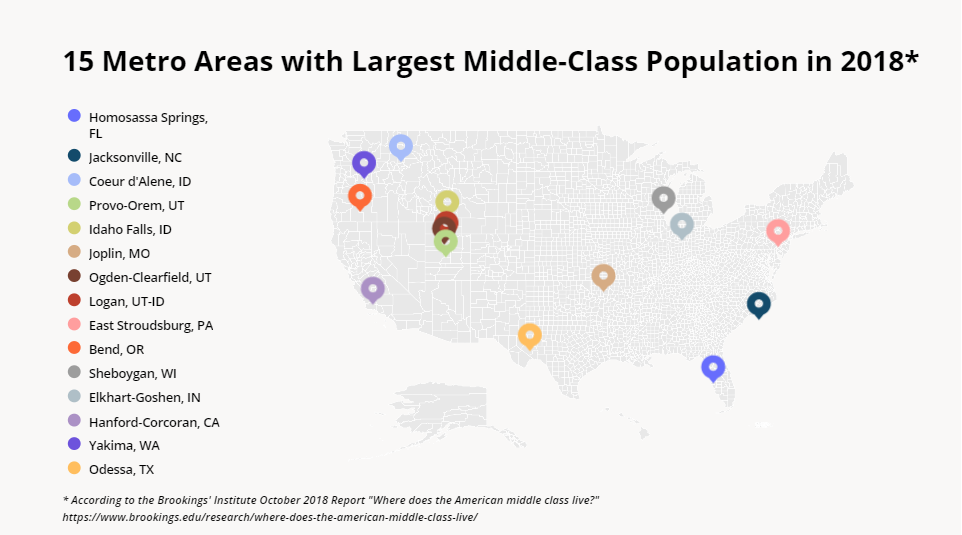

In its 2018 report on America’s middle class, the Brookings Institution identified the 15 metro areas nationwide – all of them small and mid-size –with the largest shares of middle-class households. Brookings defined “middle-class households” as those falling in the middle 60% of the national income distribution (meaning households that earn more than the bottom 20% of household income but less than the top 20% of households nationwide), adjusted to account for household size and for local differences in the cost of living.

A lot has happened since Brookings published its report, including a global pandemic, ongoing inflation, and a massive jump in housing costs. So with 2023 already underway, we dove into the data to check in on these middle-class hubs and see how the changes of the past five years impacted demographic trends and housing prices in these cities. How are 2018’s top middle-class hubs faring in 2022? Are they growing or shrinking? Who’s moving to them? And how are population shifts impacting local markets?

Middle-Class Centers of Gravity

Most of the 15 middle-class centers identified by Brookings are in the West and Midwest. Just three are in the South, and one is in the Northeast. But foot traffic data shows that regardless of region, the majority of these hubs are attracting meaningful inbound domestic migration relative to the size of their populations. (Positive net migration reflects population increase due to migration and does not account for population change due to other factors like births and deaths.) All but five of 2018’s top middle-class metro areas have experienced positive net migration exceeding 1.0% of their populations over the past three years – meaning that since 2019, a lot more people moved to these areas than left. While the absolute numbers of new residents relocating to these communities may not be huge, the impact on the local landscape can be substantial.

Meanwhile, net migration over the past three years has been negative for the top 10 upper- and lower- class hubs identified by Brookings in the same report.

Topping the list is Homosassa Springs, FL, which has experienced positive net migration representing 9.1% of its population. Recently ranked the sixth most affordable place to live in Florida, Homosassa Springs is also a popular destination for snowbirds seeking refuge from the winter cold.

Next in line is military-town Jacksonville, NC, which experienced positive net migration of 7.4%, and Coeur d’Alene, ID, and Provo-Orem, UT, which saw 5.4% and 3.1%, respectively. Idaho Falls, ID, Joplin, MO, Ogden-Clearfield, UT, Logan, UT-ID, East Stroudsburg, PA, and Bend, OR, for their parts, attracted net inflows ranging from 1.2%-2.0%.

A Quest for Affordable Living

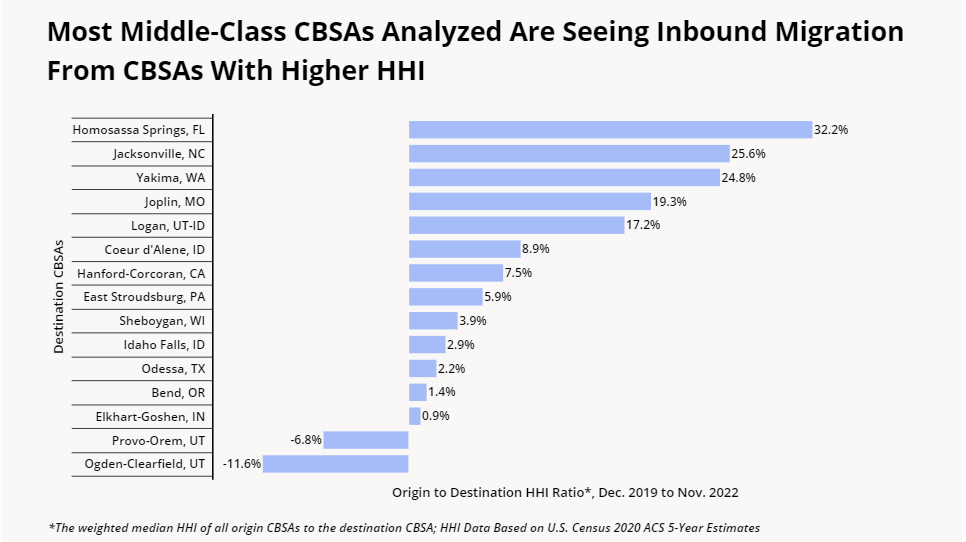

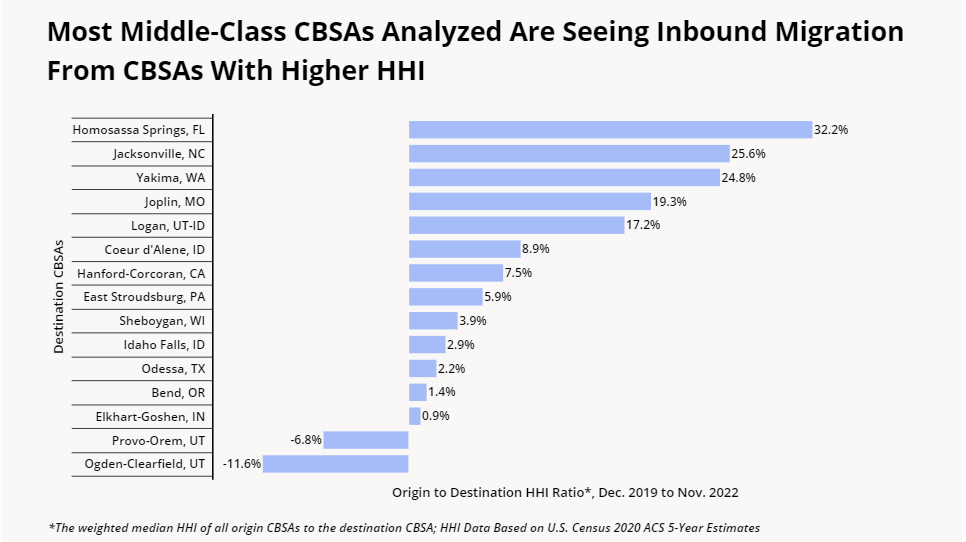

Like other metropolitan areas around the country, these middle class hubs appear to be attracting individuals and families seeking a lower cost of living. Indeed, data comparing the median household incomes (median HHIs) of these middle-class havens to the median HHIs of the relocators’ areas of origin – weighted to reflect the share of people coming from each CBSA – shows that nearly across the board, people are moving from more affluent areas to more affordable ones.

And once again, Homosassa Springs, FL and Jacksonville, NC top the list with origin-to-destination HHI ratios of 32.2% and 25.6%, respectively – meaning that the domestic migrants coming to these towns hail from CBSAs with median HHIs that are 32.2% and 25.6% higher than that of local residents. Given the large population shares represented by these migrants, the influxes portend significant demographic shifts.

Two exceptions to this trend are Provo-Orem, home to Brigham Young University, and Ogden-Clearfield, both in Utah. Both of these CBSAs have HHIs that are significantly higher than the other analyzed CBSAs ($77K and $79K, respectively, based on the U.S. ACS 5-Year Estimates for 2020) which can help explain why their HHI ratio is negative despite their significant inbound migration – 3.1% and 1.5%, respectively. The presence of Brigham Young University in Provo-Orem may also impact the HHI ratio of inbound migrants.

Inbound Migration Fueling Home Price Appreciation

How are these demographic changes impacting the local landscapes of American cities?

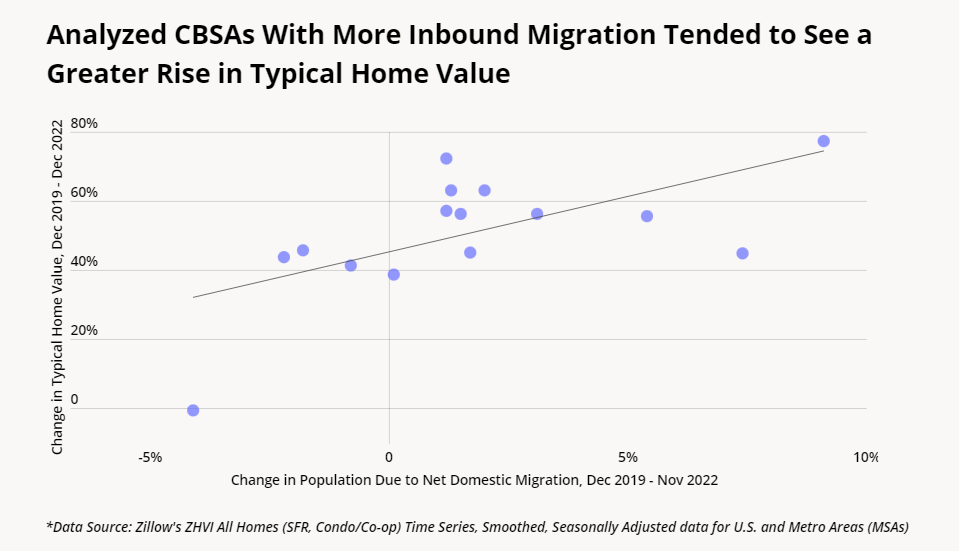

To get a sense of how migration-driven demographic changes are affecting housing costs in the 15 middle-class hubs we analyzed, we took a look at changes in Zillow’s Home Value Index (ZHVI) between December 2019 and December 2022. And perhaps unsurprisingly, there appears to be a correlation between inbound migration and the state of local housing markets – particularly at the extremes. Homosassa Springs, FL, which ranked first for net migration, saw housing values increase by a whopping 77.4% over the past three years, while Odessa, TX, which lost 4.1% of its population to outbound migration, saw a drop in the cost of a typical home. (Additional Zillow data shows that Odessa’s home prices rose 3.1% over the past year, but a spike in prices in late 2019 makes for a more difficult year-over-three-year comparison).

An additional factor that may be impacting housing markets is the origin-to-destination HHI ratios of the inbound populations. Hanford-Corcoran, CA, for example, saw a housing value increase of 45.8% despite a negative net migration level of 1.8%; however, the new residents that did move to this area came from wealthier places.

Of course, not all cities experienced these patterns in the same ways. In Jacksonville, NC, for example, housing prices went up just slightly more than the national benchmark of 43.5%, despite high relative levels of inbound migration, from more affluent areas – perhaps reflecting the particular market patterns of a military town.

Key Takeaways

Looking ahead, middle-class hubs appear likely to continue to attract individuals and families in search of affordable living – and influxes of domestic migration, especially from more affluent areas, can have a significant impact on local landscapes. As Brookings correctly pointed out, efforts to strengthen the middle class require local insights. Up-to-date and accurate data on emerging local trends – including domestic migration patterns – will become increasingly important for policy-makers seeking to effectively navigate the challenges of shifting populations.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.