In 2022, high inflation impacted sales trends across various retail sectors in the U.S.—from big-box stores and discount chains to grocery companies. While inflation began easing in mid-2022, food prices have remained elevated throughout 2022 and into 2023. Amid rising food prices, discount grocery chain Grocery Outlet (NASDAQ: GO) saw its sales in the first two months of 2023 grow more than in comparable periods of 2021 and 2022, Bloomberg Second Measure transaction data shows. Apart from food price hikes, another possible factor behind the company’s sales growth is expansion into new markets. Additionally, our data shows growth in average transaction values, possibly due to a shift towards shopping for value.

Grocery Outlet’s (NASDAQ: GO) sales growth in the first two months of 2023 was higher than in comparable months of 2021 and 2022

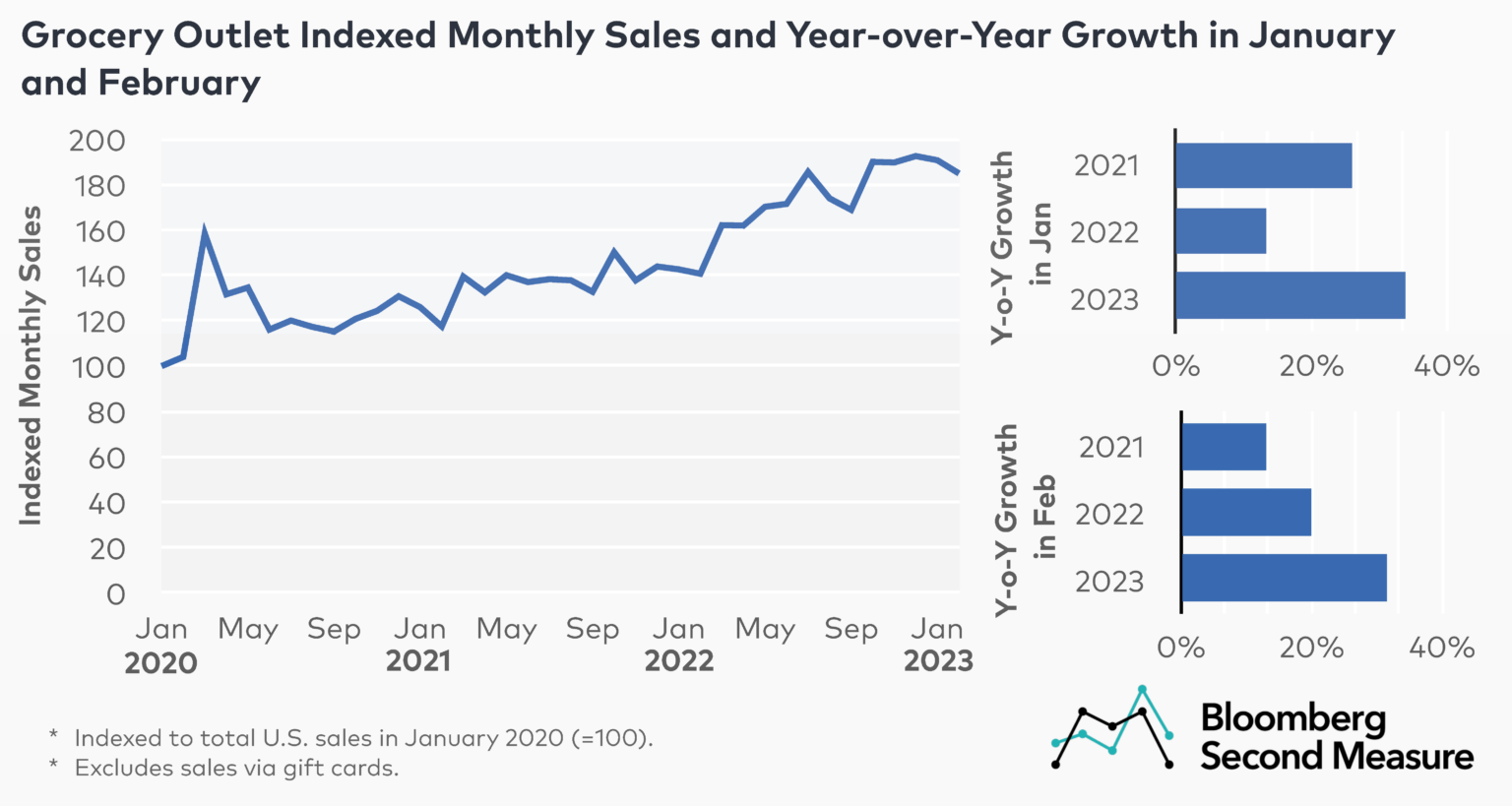

Consumer spending data shows that sales at Grocery Outlet increased 34 percent year-over-year in January 2023 and 31 percent in February 2023. The discounted grocery chain also saw year-over-year sales growth in comparable periods of 2022 and 2021, but at lower rates. In 2022, the company’s sales were up 13 percent year-over-year in January and 20 percent in February. Meanwhile, in 2021, the company’s January and February sales grew 26 percent and 13 percent year-over-year, respectively.

Similar to other grocery companies, Grocery Outlet‘s sales spiked at the onset of the pandemic, as consumers stockpiled on pantry essentials, with sales between February and March of 2020 up 52 percent. While off their early pandemic peak by April 2020, the grocery chain’s sales saw steady growth throughout most months of 2020.

Looking at 2021, Grocery Outlet’s monthly sales grew, on average, 12 percent year-over-year, while in 2022, the company’s average monthly growth was 25 percent year-over-year. Interestingly, our consumer transaction data shows that Grocery Outlet’s sales growth rate increased in the second half of 2022. Each month between July and December of 2022, the company’s sales grew more than 25 percent year-over-year.

A factor likely contributing to Grocery Outlet’s growth in sales in recent years was the company’s expansion into new markets and opening of new brick-and-mortar stores. At the end of its 2020 fiscal year, Grocery Outlet had 380 stores in 6 states. By the end of its 2022 fiscal year, the grocery chain’s store presence increased to 441 locations in 8 states, with 10 new stores added in the last quarter of that fiscal year.

Grocery Outlet’s average transaction values continued growing in January and February of 2023

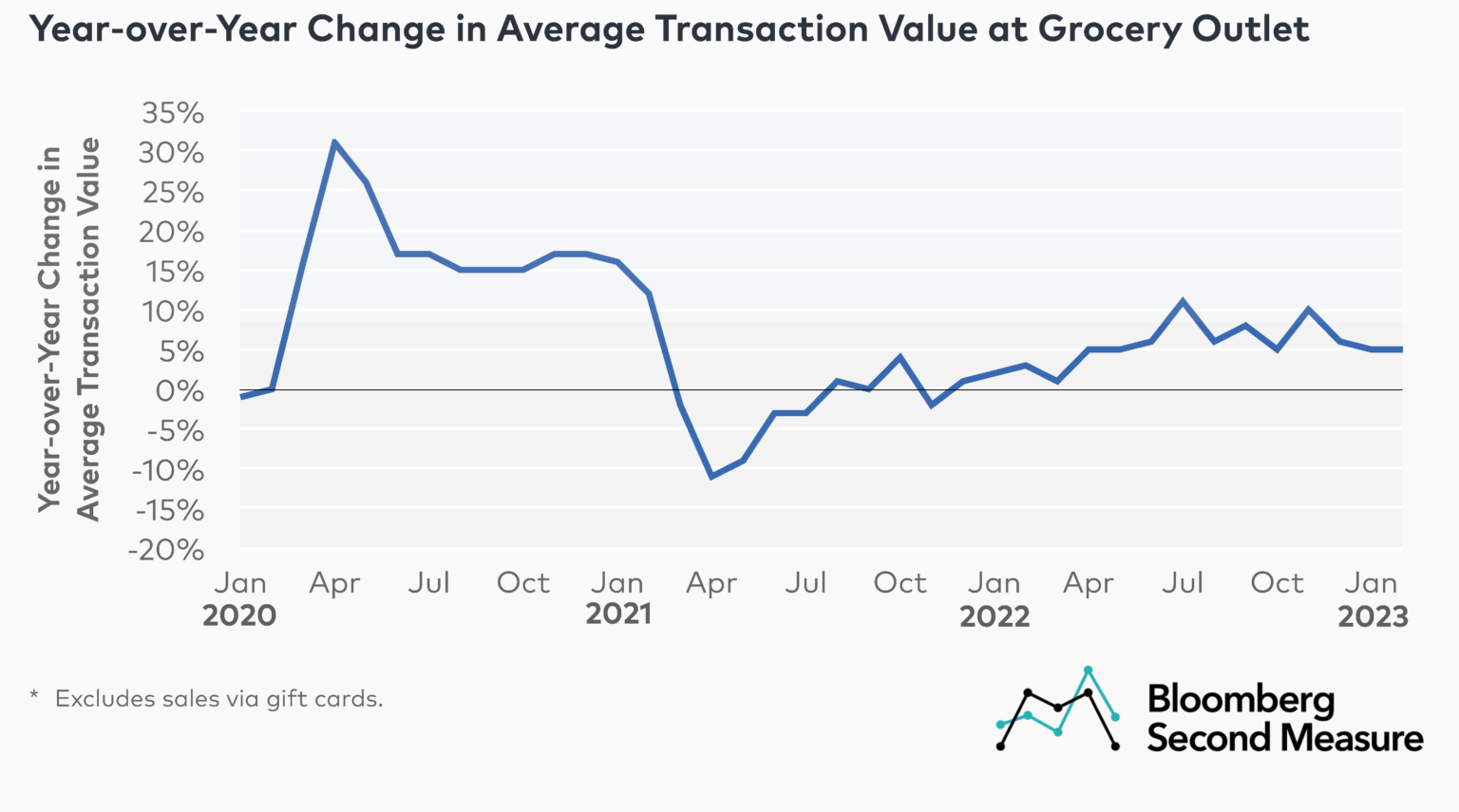

In addition to the company’s expansion efforts, another factor likely contributing to Grocery Outlet’s sales growth over the past three years was the increase in consumer spending per visit, transaction data shows. While this may be partially due to grocery inflation, another possibility is that consumers might have shifted more spending toward discounted groceries as they increasingly shopped for value.

Looking at the first two months of 2023, Grocery Outlet’s average transaction value in each month was up 5 percent year-over-year compared to the same months of 2022. Notably, U.S. grocery prices increased 11.3 percent year-over-year in January 2023, according to the U.S. Bureau of Labor and Statistics.

Zooming out, Grocery Outlet experienced a sharp increase in average transaction values early in the pandemic. Between March and April of 2020, the average transaction value at Grocery Outlet jumped 17 percent. On a year-over-year basis, Grocery Outlet’s monthly average transaction values grew at a double-digit rate between March 2020 and February 2021, before the trend reversed in the spring of 2021.

Compared to pre-pandemic levels, Grocery Outlet’s average transaction values in the first two months of 2023 remained elevated and were up 23 percent between January 2020 and January 2023 and up 22 percent between February 2020 and February 2023.

What’s next in store for Grocery Outlet?

Aiming to increase its online presence, in November 2022, Grocery Outlet announced the nationwide expansion of its grocery delivery partnership with Uber Eats. Earlier in 2022, the company also announced similar partnerships with Instacart and Doordash.

The company is also planning a further expansion of its physical store presence. During the FY22 Q4 earnings call, Grocery Outlet’s president announced that the company plans to open between 25 and 28 new stores this year. During the FY22 Q4 earnings call the company leaders also revealed that Grocery Outlet is likely to expand its private label portfolio.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.