In their most recent earnings report, HFGG-ETR highlighted the variability in performance across geographies, especially reopening economies and those hit hardest by inflation. Since CE Transact Global is now able to track individual performance across seven different markets, it can provide key insights into performance differences. In today’s Insight Flash, we look at share performance for the Domestic US segment versus the International transactions for six European countries, as well as individual country growth rates and repeat purchase behavior in the US and UK.

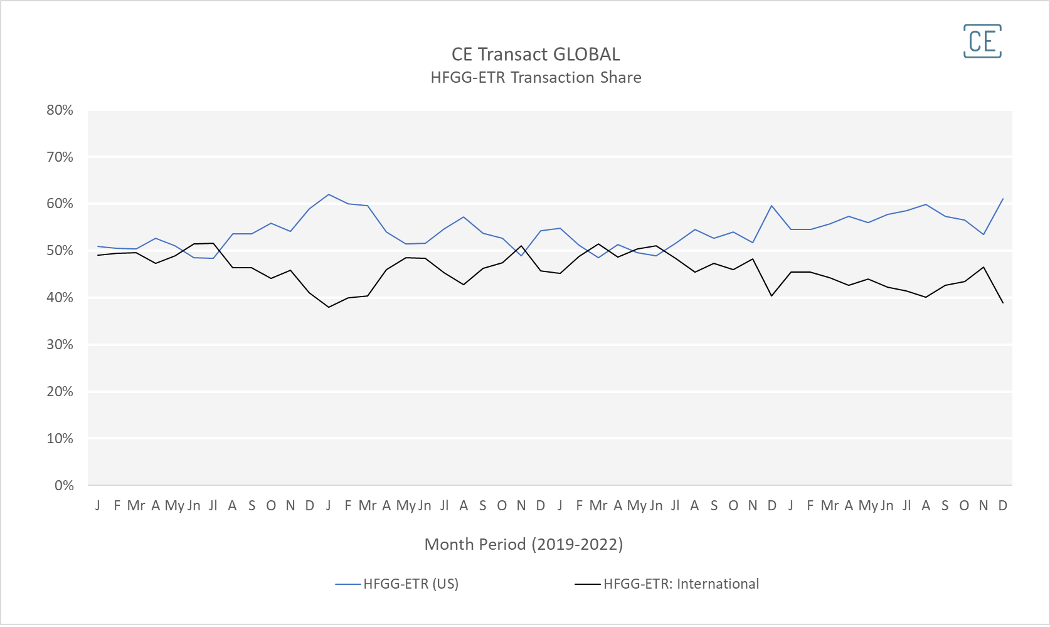

Among our tracked markets, the US comprises the majority of HelloFresh’s transactions across all brands. Our recently launched International segment combining UK and EU data did come close in share during the beginning of the COVID-19 pandemic, but since then the spread has widened with the company’s domestic US segment reaching as high as 60% share in the last few months of 2022.

Transaction Share by Geography

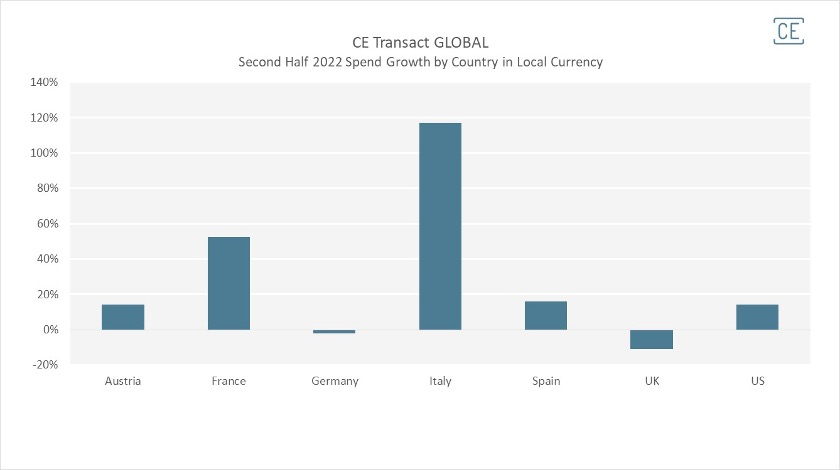

Digging into individual country spend, however, paints a more diverse picture. In the last half of 2022, the UK, which makes up the majority of European transactions, saw a double-digit decline in HelloFresh spend across brands. Italy and France saw very strong growth off of a lower 2021 base, while US spend increased almost 15% in local currency.

Spend Growth by Geography

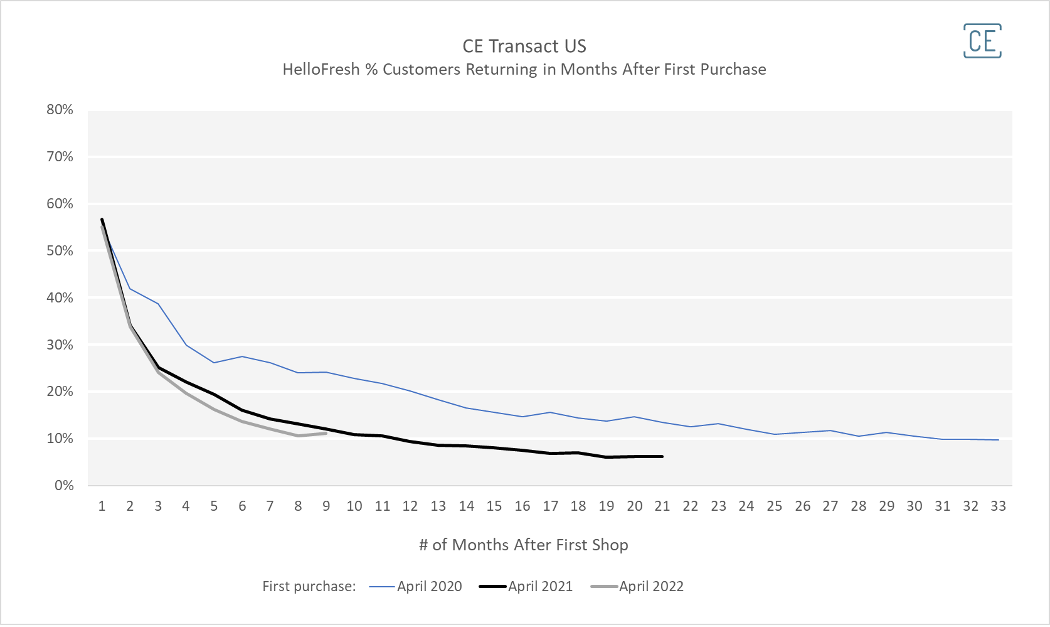

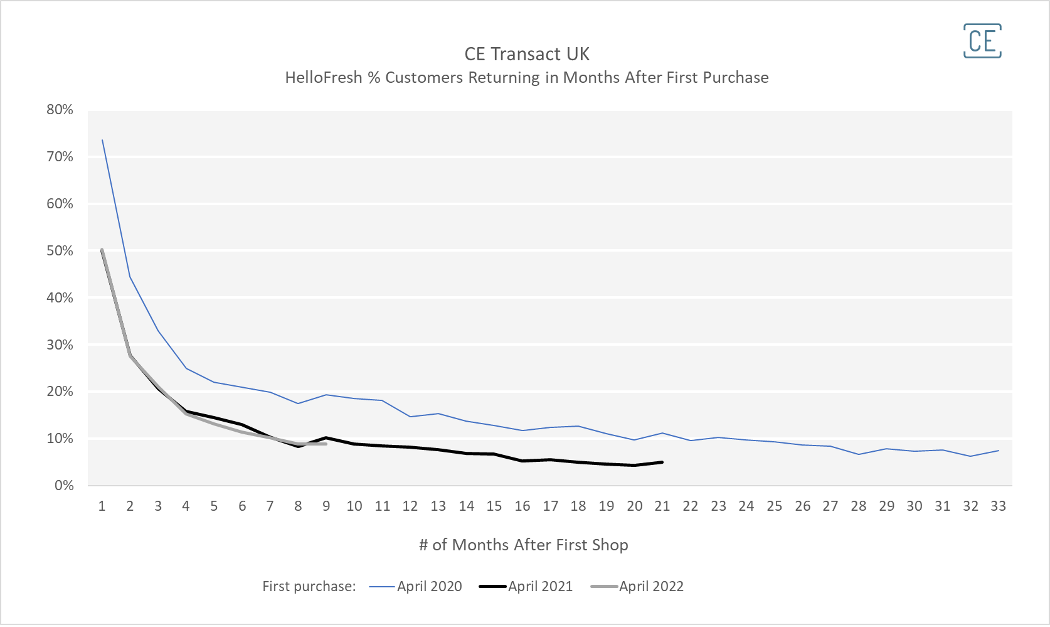

Looking at how many customers come back after their initial purchase (which is often at a promotional price) provides insight into one driver of the higher-level spend trends. For instance, during the beginning of the pandemic when International transactions were about on par with US transactions, UK retention for the HelloFresh brand one month after a first purchase in April 2020 was 74% while US retention was only 55%. However, after three months, 33% of UK customers who first purchased HelloFresh in April 2020 were still making an order versus 39% of US customers. For later cohorts, only about 10% of UK customers were still buying a HelloFresh meal six months after their first purchase, while 15% of US customers continued to use the service.

Repeat Purchases

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.