Source: https://www.earnestanalytics.com/later-shorter-visits-spell-trouble-for-theaters-foot-traffic-data/

Key Takeaways

Customers are returning to major theater chains Cinemark, Regal, AMC, and Marcus, but they aren’t going at the same time as before the pandemic. Overall theater visits fell to nearly zero in the early months of Covid-19 in 2020. As theaters reopened in geographies with varying levels of restrictions and work-from-home adoption, the time of day people visited those theaters also changed.

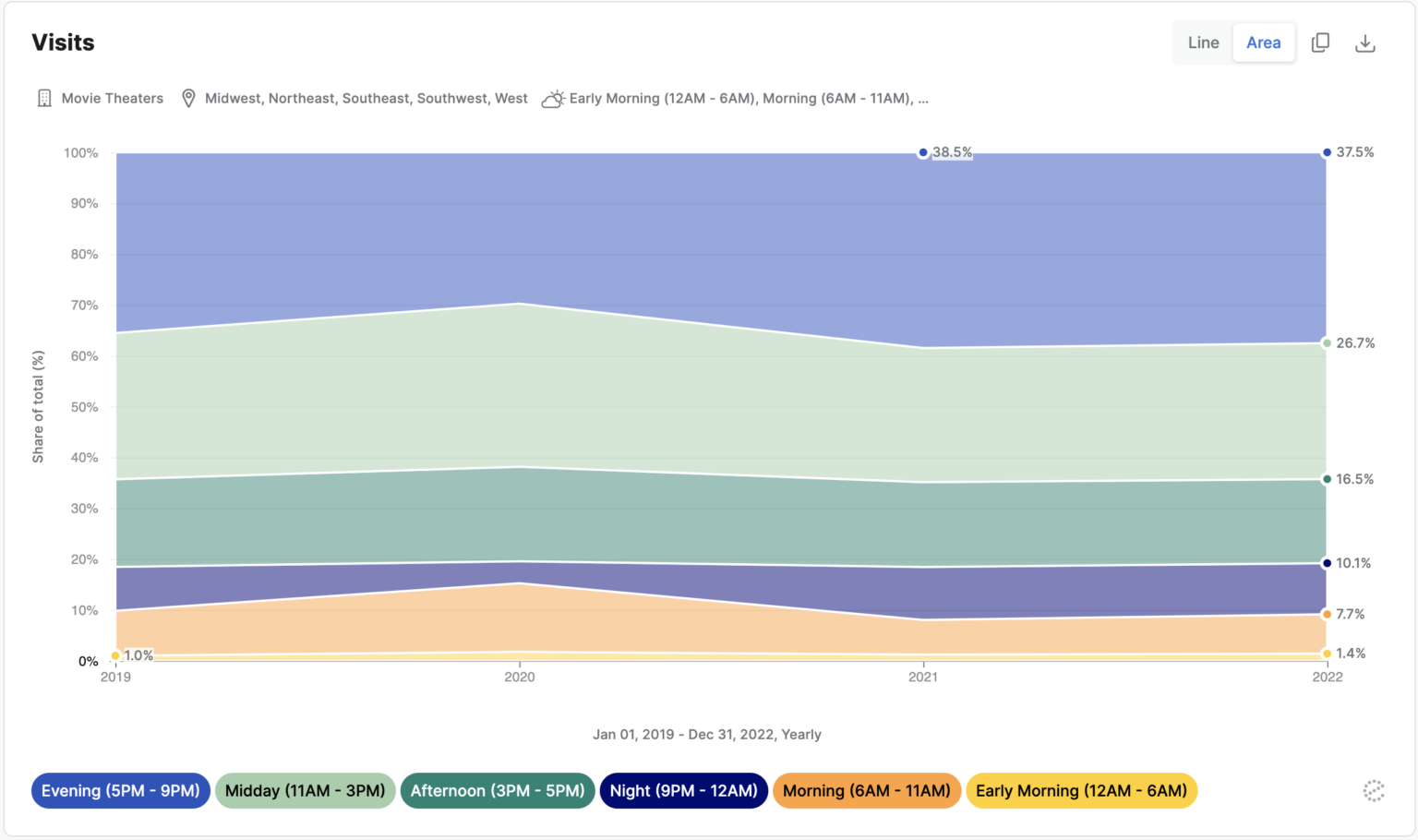

In 2020 and 2021, consumers working from home and flush with stimulus cash, frequented theaters in the morning (8a-11a) and midday (11a-3p). But by early 2021 when offices and schools reopened and people resumed their workday commutes, evening (5p-9p) and night (9p-12a) visits returned in popularity. Both gained 2 points more share of daypart visits in 2022 than 2019. That share came at the expense of midday visits (-2 points from 2019 to 2022), afternoon visits (-1 point from 2019 to 2022), and to a lesser extent early morning, which is likely post-midnight showings.

The increasing popularity of evening and night visits could be in part due to people no longer waking up as early to commute into work, and therefore taking advantage of more night time activities. More dinner-time visits could be good news for theaters who make most of their money on concessions despite recent experiments in ticket pricing.

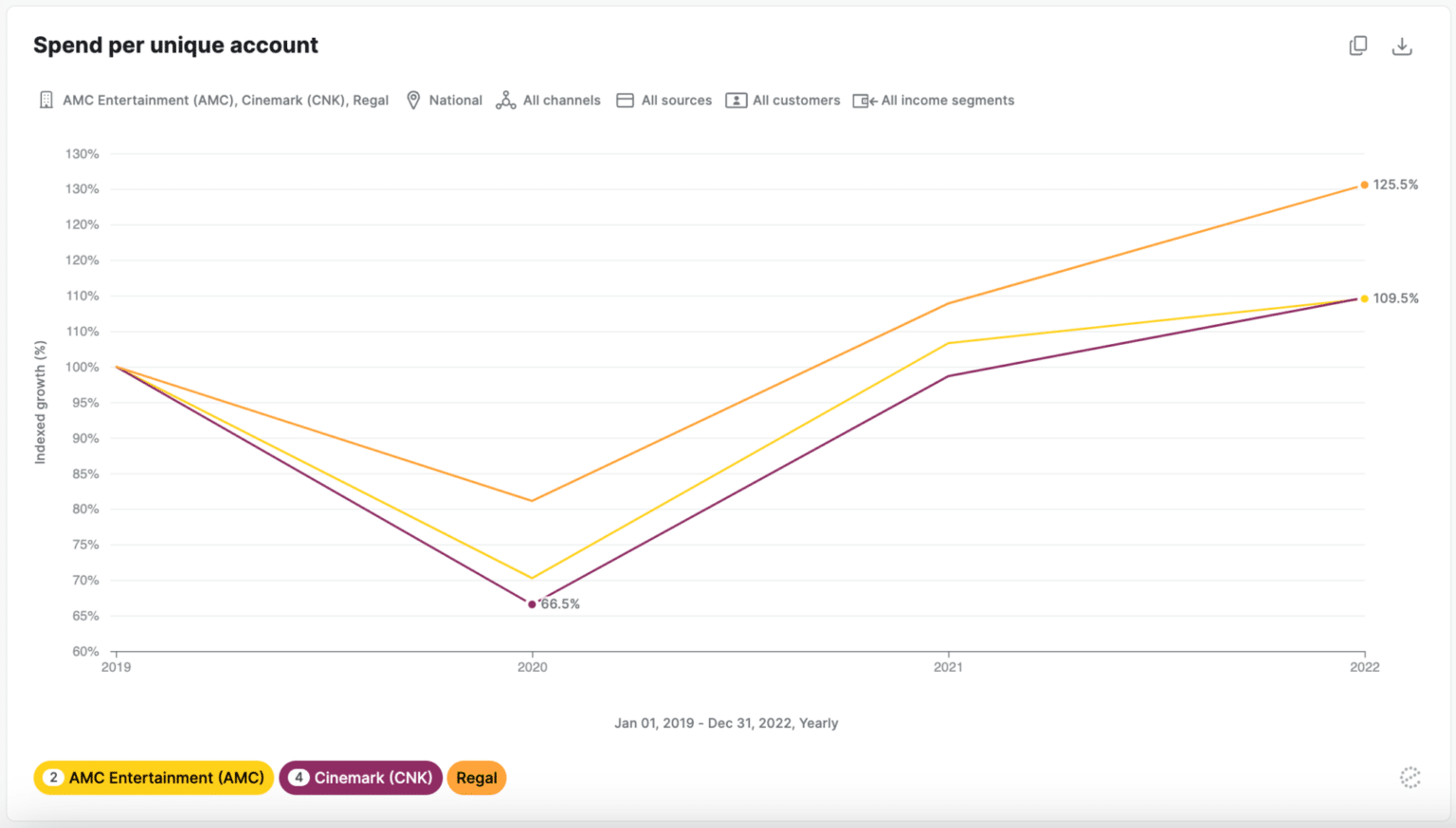

Customers are spending much more than pre-pandemic per visit…

AMC, Cinemark, and Regal succeeded in pushing up the average spend per customer between 10-25% since 2019 they try to recover from yearslong decline in foot traffic to theaters. Much of that increase came from high concessions prices. As they find it more difficult to increase concessions pricing, one solution may be to keep theater goers in the building longer by adding new activities and shows, and therefore increasing the likelihood of a concessions purchase.

…but theater visits are still shorter than they used to be

Dwell time, or the time spent in the venue by a customer, remained 12-25% below 2019 levels in 2022. This suggests theaters have ample room to increase sales, simply by returning to pre-covid dwell times. Nevertheless the dwell time trend is moving in the wrong direction for AMC and Regal, and only slightly improved for Cinemark between 2021 and 2022.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.