Source: https://secondmeasure.com/datapoints/foot-locker-earnings-surprise-nike-direct-to-consumer-sales/

On March 20, 2023, Foot Locker Inc (NYSE: FL) reported fourth quarter revenue that exceeded investors’ expectations and remained relatively consistent compared to the year before. The day after Foot Locker’s earnings call, Nike Inc (NYSE: NKE) also announced an earnings surprise for its third fiscal quarter of 2023. Bloomberg Second Measure’s transaction data correctly projected the earnings surprises for both Foot Locker and Nike within one percent of reported revenue, beating mean consensus estimates. Additionally, our consumer transaction data reveals that Foot Locker’s monthly U.S. sales growth in 2022 was lower than Nike’s direct-to-consumer (DTC) sales growth, and its in-store sales growth outpaced its online sales growth in the U.S. over the past year.

Prior to the earnings calls, transaction data projected earnings surprises for both Foot Locker Inc (NYSE: FL) and Nike Inc (NYSE: NKE)

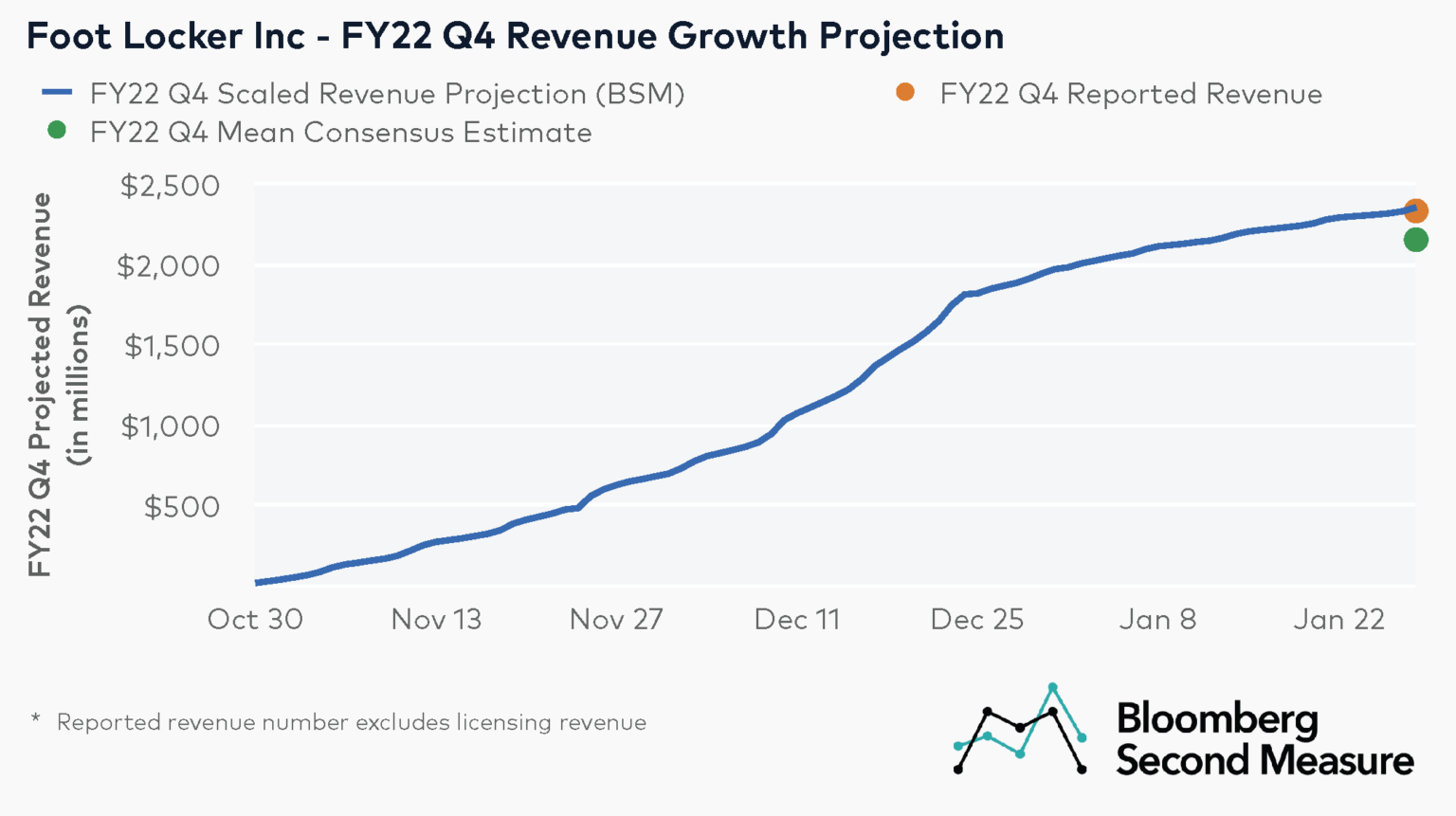

Ahead of Foot Locker’s earnings surprise announcement for FY22 Q4, Bloomberg Second Measure’s transaction data-based scaled revenue projections anticipated $2.36 billion in revenue—within 1 percent of Foot Locker’s reported revenue (minus licensing revenue) of $2.33 billion—while the mean consensus estimate was about 8 percent lower than reported revenue, at $2.16 billion. The full consensus estimate range for Foot Locker in FY22 Q4 was between $2.10 billion and $2.29 billion—lower than Foot Locker’s reported revenue as well as Bloomberg Second Measure’s scaled revenue projection.

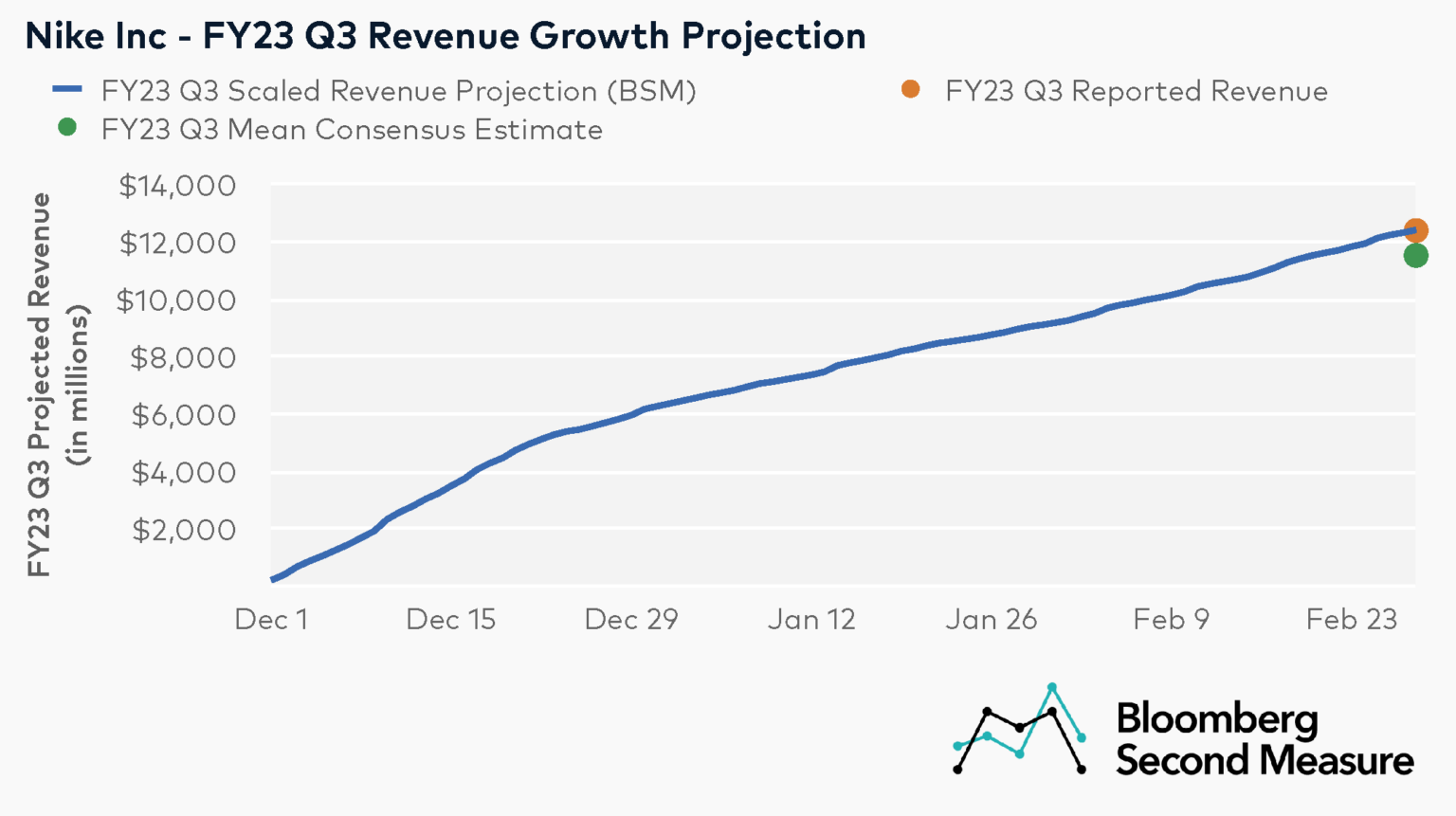

Likewise, Bloomberg Second Measure’s FY23 Q3 revenue projections for Nike Inc were within 1 percent of reported revenue, which were respectively $12.41 billion and $12.39 billion. Meanwhile, the mean consensus estimate of $11.52 billion was about 7 percent lower than reported revenue.

Looking ahead, Foot Locker reportedly anticipates a decline in sales and profit going into the next fiscal year. Nike, on the other hand, forecast revenue growth for the rest of its fiscal year.

Nike’s direct-to-consumer sales growth outperformed Foot Locker’s throughout 2022

As part of an Investor Day call held the same day as Foot Locker’s earnings surprise, the athletic shoe retailer announced a revitalized partnership with Nike, which reportedly accounted for around 70 percent of Foot Locker sales in 2021. In recent years, Nike shifted its focus toward its DTC channels rather than wholesale partnerships such as with Foot Locker. However, excess inventory challenges at the end of 2022 prompted Nike to supply a higher volume of products to wholesalers. Aside from Nike, Foot Locker has partnerships with other footwear brands such as Reebok and Adidas.

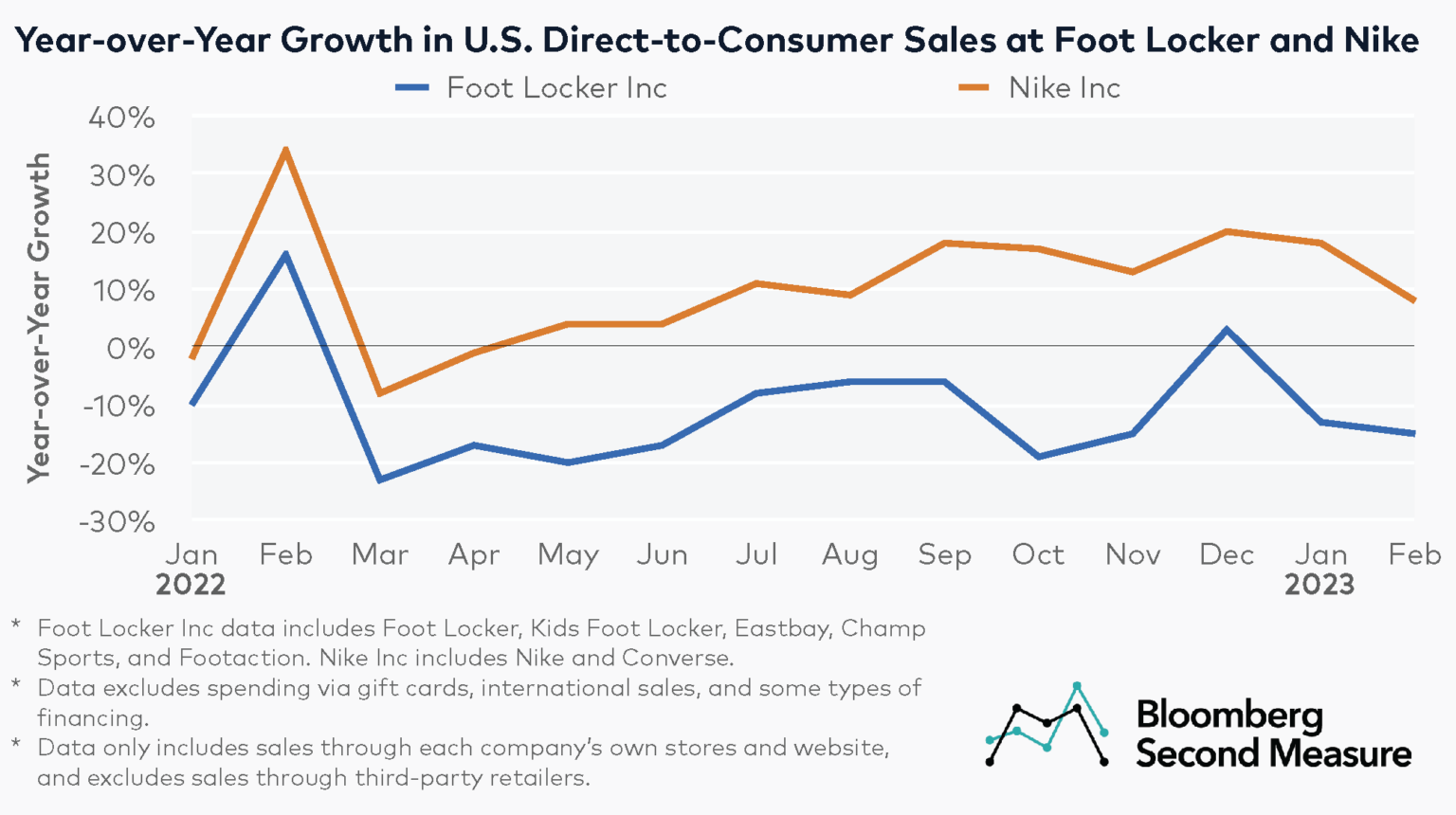

Bloomberg Second Measure data shows that Nike’s direct-to-consumer sales had higher monthly year-over-year growth rates than Foot Locker’s sales over the past year. The average monthly year-over-year growth rate for U.S. DTC sales in 2022 was -10 percent at Foot Locker Inc (which is composed of Foot Locker, Kids Foot Locker, Eastbay, Champ Sports, and Footaction in our data), while it was 10 percent for Nike Inc (which includes Nike and Converse). In February 2023, Foot Locker’s U.S. DTC sales decreased 15 percent year-over-year, but Nike’s increased 8 percent.

Notably, our consumer transaction data only captures sales through each company’s own stores and website. It excludes sales through third-party retailers. For example, Nike sales sold through Foot Locker are attributed to Foot Locker, but not to Nike. Our data also excludes non-U.S. sales, as well as sales made via gift card and some types of financing.

Foot Locker’s sales growth for the retail channel surpassed that of the online channel

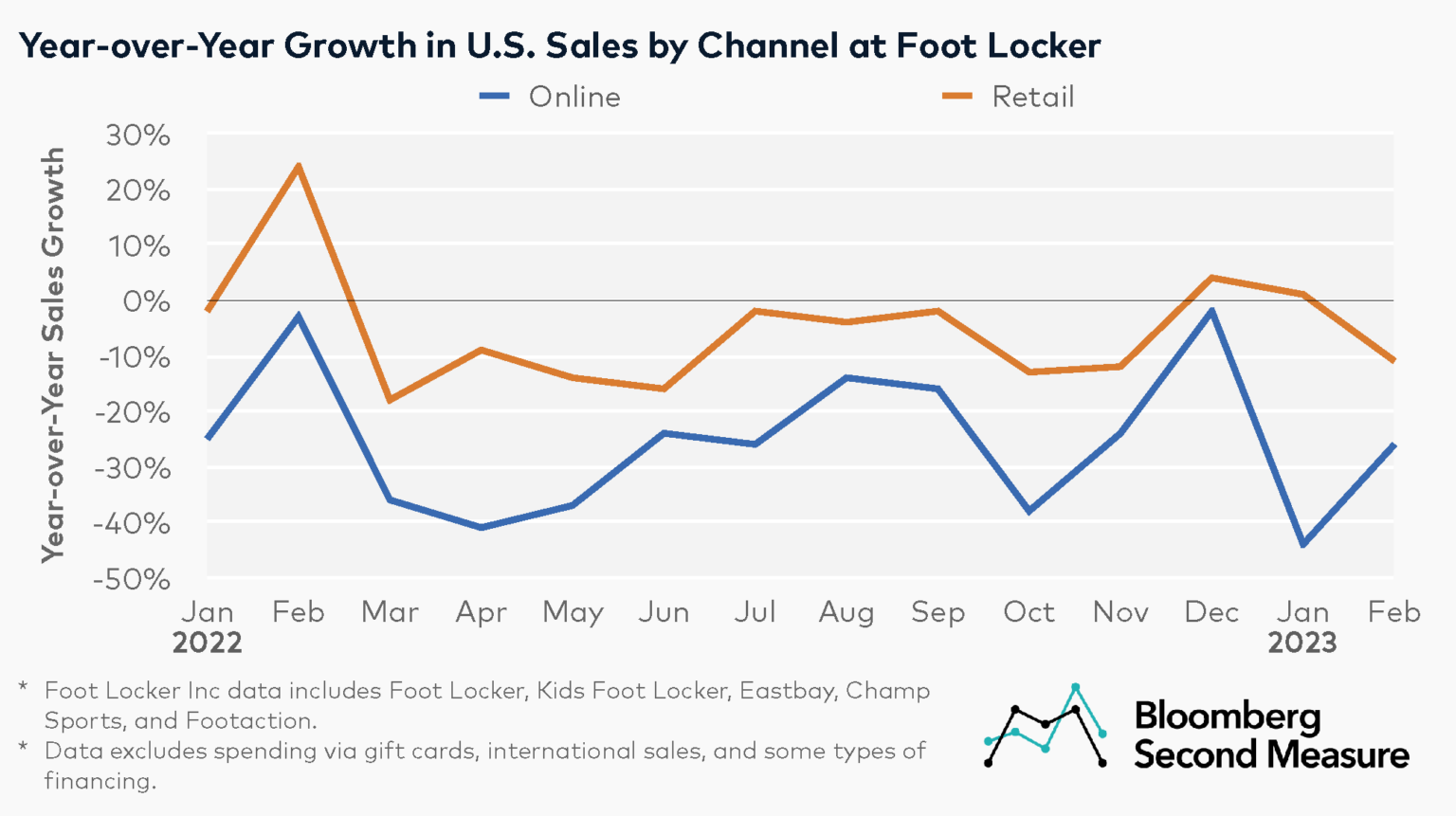

During its Investor Day call, Foot Locker also unveiled its “Lace Up” plan, which features renewed focus on its core banner brands and a revamped store strategy. Consumer transaction data reveals that in terms of year-over-year growth, Foot Locker’s in-store sales outperformed its ecommerce sales in the U.S. over the past year. In 2022, Foot Locker’s average monthly year-over-year growth rate for online sales in the U.S. was -24 percent, compared to -5 percent for in-store sales. In February 2023, the first full month of the new fiscal quarter, Foot Locker’s online U.S. sales decreased 26 percent year-over-year, while retail sales decreased 11 percent.

Foot Locker also announced that it will close about 400 underperforming mall stores. Part of its “Lace Up” strategy will also include opening 300 stores through one of its new formats, which include community stores for sneaker enthusiasts, power stores aimed at higher income shoppers, and “House of Play” concept stores that showcase kids’ products.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.