From the second week of February all four of the chains we analyzed saw a steep and prolonged fall in stock price through to the first week of April, when they began to rebound. Extended Stay America in particular has experienced a healthy share price recovery, with its stock back to only 10% below where it was in February, which is worse than S&P’s 0.9% gain but better than its competitors; Marriott’s share price is still 40% lower than it was pre-COVID and Hilton’s hovering around -30%.

The US faces a deep coronavirus crisis as new cases are surging to record highs in many states. Texas was one of the first states to reopen in May with restaurants, retail stores, malls and even theaters to allow to reopen at limited capacity. Looking at the mid-May data, the foot traffic in Texas at Advan’s consumer discretionary index was down about 35% compared to the pre-COVID era and kept increasing through mid-June, adding a 15% increase to -20%.

The RV market in the US looks like it may have found a new client base during the pandemic. As reported by the New York Times, companies like Cruise America, the largest RV rental company in the US, typically count on overseas visitors for about 40% of their bookings.

With COVID cases rising again in Southern and Western states, the Washington Post reported that many hospitals are under renewed strain, with beds being filled to capacity. In order to measure the true number of hospital admissions, we have developed an algorithm that can track overnight stays for any period of time (by excluding staff and visitors).

Big box stores such as CostCo and Sam's Club were early winners in the pandemic era as many of us stocked up in preparation for an anticipated period of lock-down. One clear winner during this period has been Amazon. Shelter in place orders have driven a spike in online shopping and the massive growth in employees at Amazon warehouses confirms the extent to which the retailer has benefited.

Measuring foot traffic at consumer discretionary businesses helps us understand the extent to which people are back to shopping for non-essentials - an indicator for increasing flexibility of movement and confidence in the outlook. During April and May there was a massive year-over-year drop in visits to non-essential locations. This make sense given most stores were closed. As you would expect, this trend was most pronounced in states such as Nevada and New York.

With restrictions lifted early in the state, and given its popularity as a vacation destination, hotel traffic has seen a steady rise since mid-April. As of the third week of June, traffic in Florida hotels was 43% below the start of the year. Though with case numbers rising again over the past several days we may see a reversal of the trend as we head into July.

Since Europe was locked down earlier than North America, it has also started opening up sooner. As a comparison, we looked first at foot traffic in European airports to see whether there are any early signs of a pick-up in visitors coming into the peak holiday period. Overall traffic remains fairly depressed, but there are some signs of growth, particularly in Greece, which depends heavily on tourism income.

Reviewing the data we can see that admissions in Texas and Florida are up on a year-over-year basis, indicating that state openings have had a material impact. Hospitals are feeling the strain, with admissions higher than they normally handle. New York by comparison is still 12% down year-over-year.

As one of the sectors hit hardest by the pandemic, hotels, resorts and leisure facilities are hoping that the summer may offer a recovery in the form of reduced case numbers and fewer cancelled vacations. A critical period for the industry, a bounce back in July and August could help mitigate some of the losses from the past few months. Our analysis of foot traffic, using our Hotel, Resort and Leisure Index, shows a very mixed picture across different states.

The approaching summer holiday period in the northern hemisphere is a critical time for the travel and hospitality sectors. With travel restrictions still in place, however, there remains a lot of uncertainty about what this summer will bring for companies that rely on tourism during this peak travel season.

Building on previous posts from Advan Research and Eigen10 Advisors using anonymized cell phone movement over time to analyze the impact of Covid-19 on various real estate property segments, this week we explore the different experiences metro areas have had returning to the office. The market areas were chosen to represent a cross-section of the country, which had their own set of stay in place orders, and in turn, timing of a return to work. The markets analyzed are a section of Plano TX, part of Nashville CBD, a section of Phoenix near Scottsdale and the Seaport District in Boston MA.

With a decrease in social distancing measures across most states, and markets reaching record highs, the past couple of weeks had felt like a tentative breakthrough after months of lockdown and uncertainty. Yet news from the Fed today that they would hold rates steady for the foreseeable future and another heavy week for jobless claims led to a 5% drop in the Nasdaq.

Monday was the first day non-essential office workers could return to work in Boston. There was NO rush back to the office. Using mobile tracking data from Advan Research, overall foot traffic was up 7.3% in the Seaport waterfront last week compared to 2 weeks ago.

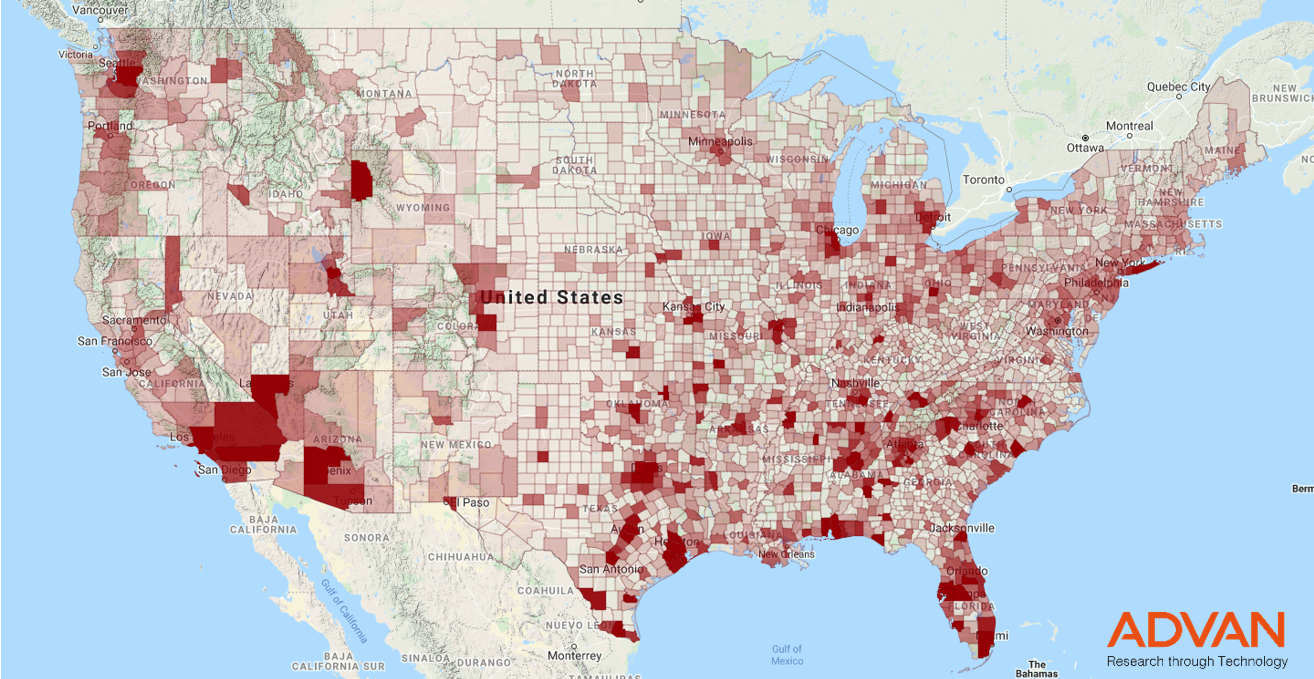

Geolocation data gives us an almost infinite number of ways to track and measure the extent and impact of relaxing social distancing measures, such as we are starting to witness in many states across the country.

Over the past several weeks, meat processing plants around the world have been receiving increased attention in the media. The high numbers of COVID-19 cases in these locations, where physical distancing can be difficult, has affected meat supply chains across the country.

Authorities around the world are working hard to understand how people are altering their behavior as rules around social distancing begin to change.

Gathering data on where people are congregating is a valuable measure for understanding risks and calculating the likelihood of a second wave of infections.

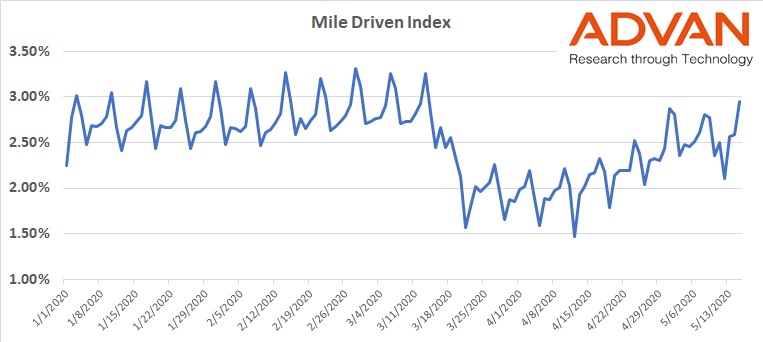

Based on foot traffic data from Advan Research, the last four weeks have shown a resurgence in visits to gas stations. It appears that people have quarantine fatigue after being locked in their homes for nearly two months.

Visits to gas stations reached a national low during the week ending April 5th. According to figures from Advan, traffic was down 38.1% from the yearly average and down 36.5% from the first week of April 2019.

Georgia is one of the first US States to reopen businesses after the nationwide shutdowns began in mid-March. After the first week we analyze different parts of the state’s economy to understand what this reopening says about life post quarantine in the country.