The State of Mobile Gaming 2021 data proves that, yet again, games dominate the mobile app business. This is especially true when it comes to revenue. Consumers spent $143 billion on apps in 2020. Of that, $100 billion went on games. In other words, for every dollar spent on iOS and Google Play, games took 70 cents. Gaming also dominated the market in terms of downloads, although not to the same extent. 36% of all mobile app downloads in 2020 were games – that's 80 billion downloads out of 218 billion overall.

In 2018, investment bank UBS published an 82-page report titled “Is the kitchen dead?” It made a strong case for the rise of online food ordering. It estimated the market to be worth $35 Billion, but said it could grow 20% a year to $365 billion by 2030. It even made the dramatic statement: “There could be a scenario whereby 2030 most meals currently cooked at home are instead ordered online and delivered from either restaurants or central kitchens.”

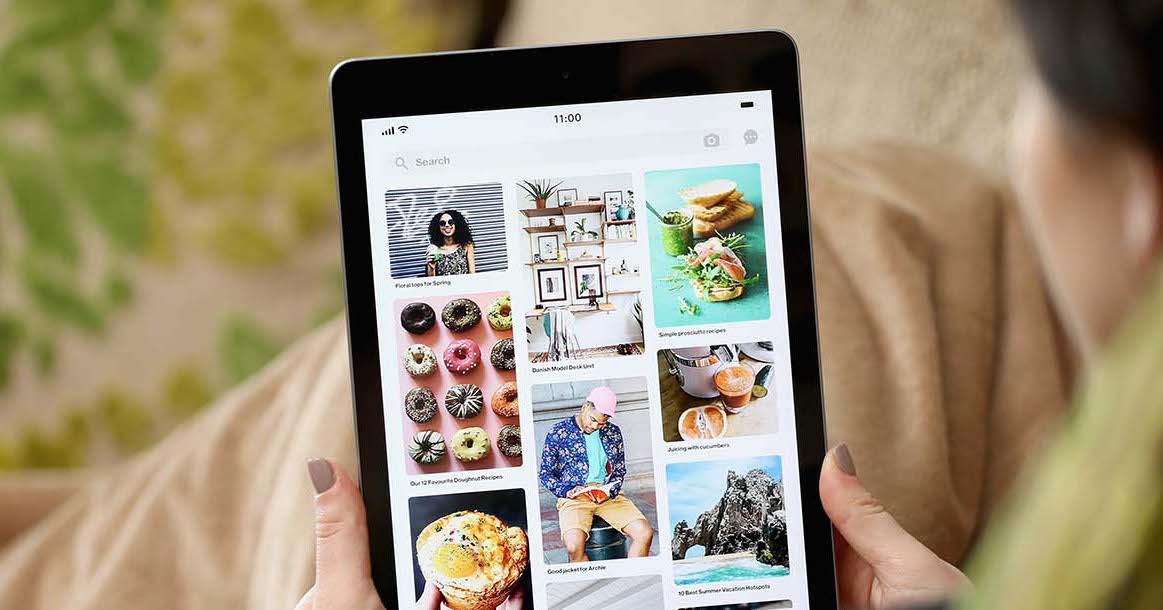

The retail industry during the pandemic has undergone a huge shift in its offerings, fulfillment and prominent shopping channels. E-commerce-focused brands, like Amazon, have done extremely well, given that many consumers are choosing to forgo entering physical stores. Some big-box retailers have adapted to the need for fast, free shipping, using their physical presence as an advantage for more same-day delivery options. Pinterest saw significant growth with 193 million global downloads in 2020, up 50% year over year — driven by an acceleration of consumers leveraging the platform for product discovery, design inspiration and shopping.

With 2020 in the rear-view mirror, we can gauge the true impact of COVID-19 on the Business & Productivity app space, and it was truly remarkable. Our State of Mobile Report reveals that consumers across the world installed Business and Productivity apps 7.1 billion times in 2020 – up 35% from 2019. Predictably, the biggest surge began in mid-March 2020 when shelter-in-place became the norm across many regions. At this time, millions of employees were restricted from visiting their offices and had to find new ways of collaborating from home. While there was a surge in the spring, Business & Productivity app downloads remained high, as they were a consistent area of focus for the rest of the year and beyond.

The mass migration from broadcast TV to on-demand – and from big-screen to mobile – started a decade ago. Lockdown moved it to a new level, with app-based video streaming up 40% in a year. According to our State of Mobile 2021 report, global mobile consumers streamed 146 billion hours on mobile devices in Q1 2019. By Q4 2020 they were streaming around 240 billion hours — a rise of nearly 65% in 2 years. The increase for 2020 alone was 40% to 935 billion hours.

Mobile retail scales new heights in 2020 as COVID closes physical stores. Consumers also begin experimenting with next-gen smartphone shopping habits: social commerce and livestream shopping. It's become a cliche to talk about how 2020 accelerated consumers towards a new (digital) normal. But this was never more true than in retail. In our State of Mobile 2021 report, we showcase how 2020 came to be the biggest mobile shopping year to date. Global time spent in shopping apps (outside of China) grew 45% year over year.

It is no surprise that consumers have quickly adopted app banking over the last 10 years, which is available 24 hours a day with no waits. However, the retail banking app is just one facet of a wider revolution in mobile finance. Investing, payments, loans – all are being upended by agile new digital replacements. In 2020 – powered by COVID-19 stay-at-home orders – consumers embraced these new alternatives in record numbers.

Whether it’s a strained pandemic relationship coming to an end or individuals looking for companionship after a long year alone, dating app usage and spend have increased significantly in the past year. Consumers spent over $3 billion on dating apps in 2020, up 15% YoY globally, seeing a total of 560 million dating app downloads. Going into Valentine’s Day, we can expect this trend to continue with the most popular dating apps encouraging users to put themselves out there.

If you can guarantee one thing about the Health and Fitness app market it is this: downloads will explode in January, then taper during the rest of the year. Why January? Simple. It's when holiday excess and New Year resolutions inspire millions of people to get fit. But, as we know, last year was different. In 2020 it was April, not January, that saw the biggest spike in downloads of Health and Fitness apps globally at 276 million, up 80% year over year.

While COVID-19 impacted so many industries last year, real estate fared quite well. In the United States, home prices hit a record high in 2020 — just above $320,000, while the UK saw their average house price rise 7.6% compared to 2019. By forcing employees across the globe to work from home and students to learn from their bedrooms, many consumers began to flock away from cities and into the suburbs for more space.

As we look back on 2020, we can reflect on a year that felt more like three than one. 2020 ripped up all previous forecasts. Thanks to Covid-enforced lockdowns, all the emerging mobile behaviors that had been bubbling away suddenly exploded. Niche mobile habits went mainstream. Three years of projected changes were squeezed into one.

Mobile device usage has significantly accelerated over the last year with daily time spent per user reaching 4.2 hours (a 20% year-over-year increase). While Gen Z has never known a world without smartphones, the ongoing pandemic has made all generations increasingly more reliant on mobile over the last year. Our recent 2021 State of Mobile report uncovered that in 2020, Baby Boomers in the United States spent 30% more time year over year in their most-used apps.