The mass migration from broadcast TV to on-demand – and from big-screen to mobile – started a decade ago. Lockdown moved it to a new level, with app-based video streaming up 40% in a year.

In January 2020, Ben and Jerry’s launched an ice cream called Netflix and Chilll’d. It was an astute move. Staying in to binge on snacks and a series would be ‘the new going out’ for most of us in 2020. The video streaming market was already on a sharp uptick pre-pandemic, but in 2020 it soared to new highs.

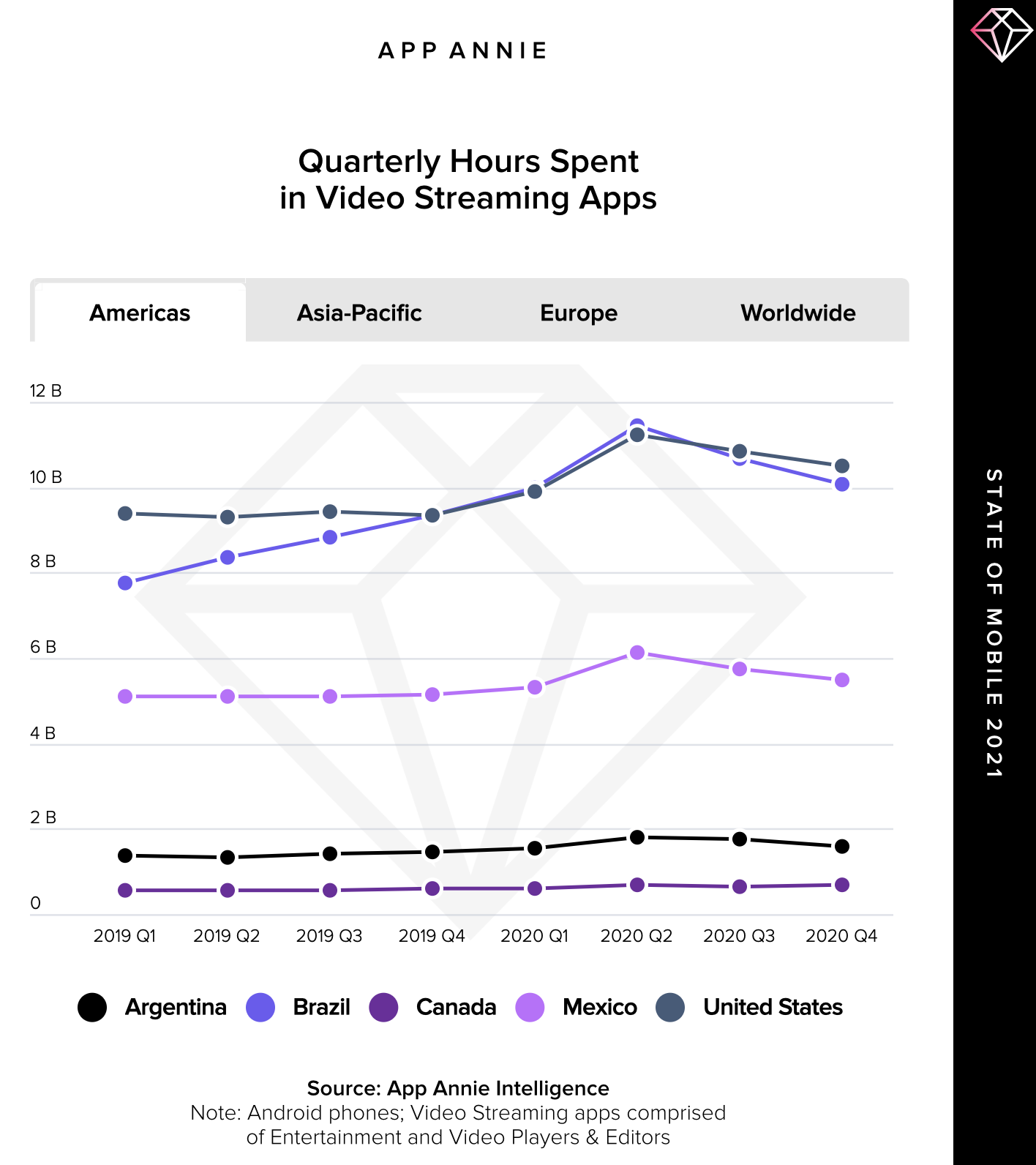

According to our State of Mobile 2021 report, global mobile consumers streamed 146 billion hours on mobile devices in Q1 2019. By Q4 2020 they were streaming around 240 billion hours — a rise of nearly 65% in 2 years. The increase for 2020 alone was 40% to 935 billion hours.

It’s important to note where people are consuming video content – both on wall-mounted TVs and increasingly on mobile devices — but also that consumers are turning to mobile for all content and activities throughout the day, including second-screening while watching on a larger screen. In fact, across 2020 Americans spent 8% more time on mobile than watching live TV per day.

Then there is the staggering change in the film and TV business model itself. People have accelerated their migration away from scheduled broadcast TV to on-demand subscription services. The proliferation of network-based streaming apps in 2020 and in the first 2 months of 2021 indicates even heavyweight media companies are recognizing the power of mobile streaming. Discovery+ debuted on Jan 3, 2021 and NBCUniversals’s Peacock TV generated over 10 million downloads in the two weeks following its July 2020 expansion.

Global Giants Tighten Their Grip on Long-Form Video Consumption

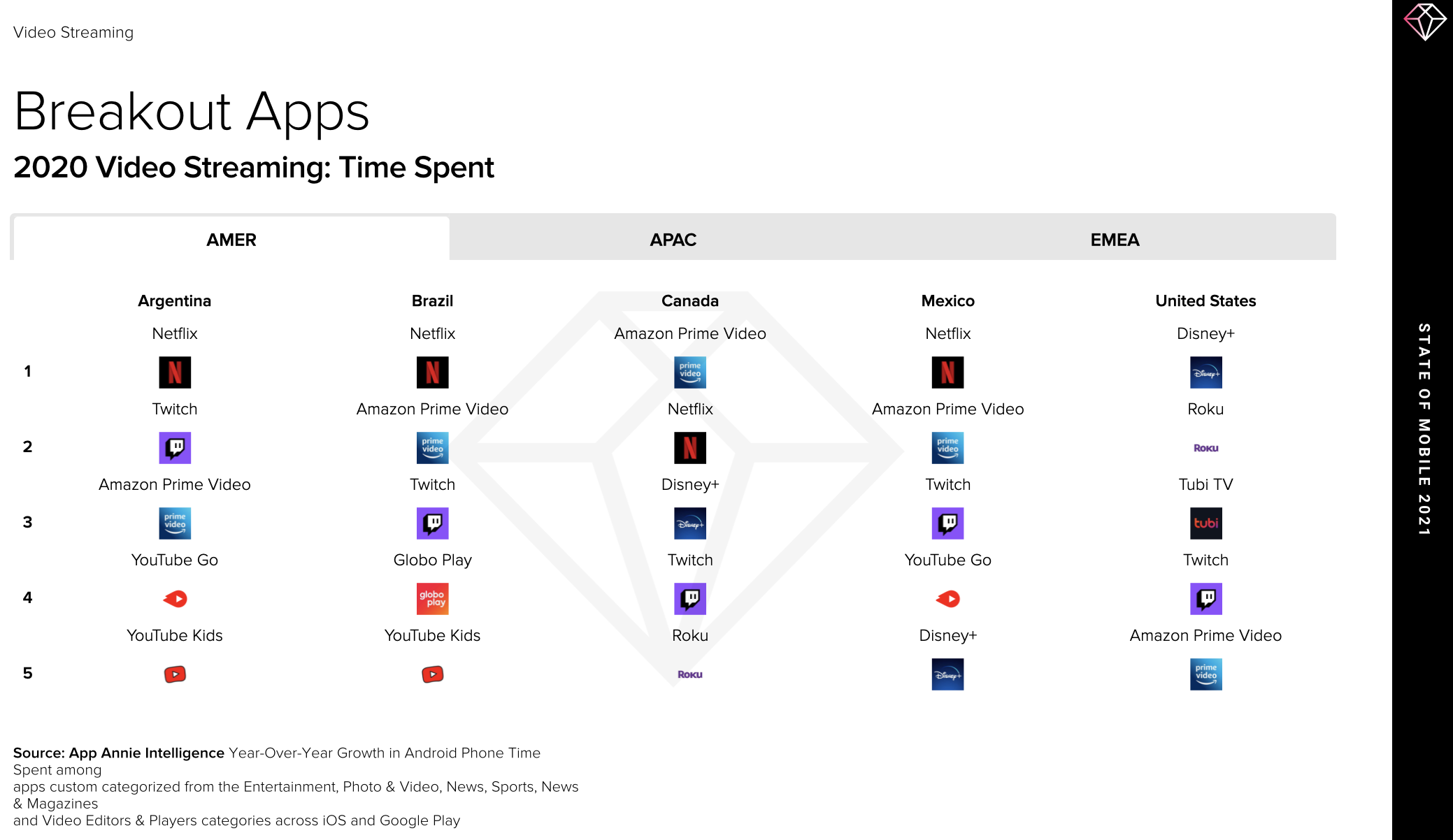

Netflix was, predictably perhaps, one of 2020’s biggest winners. The State of Mobile 2021 report revealed the Netflix app to be the fastest-growing entertainment product (in terms of time spent) in the following markets: Argentina, Brazil, Mexico, Australia, Indonesia, South Korea, France, Germany, Turkey, and the UK. The company’s own numbers support this —Netflix ended 2020 with 203.66 million paid subscribers (up 21.9% from 2019).

Disney+ had a similarly impressive year, having launched in November 2019. It was the #1 ‘breakout’ entertainment app in the US for 2020, and the second in UK, Germany and Australia. Disney reported 87 million paid subscribers in December 2020 and believes it can reach 260 million by the end of fiscal 2024.

YouTube Relegates Rivals Into a Distant Second Place

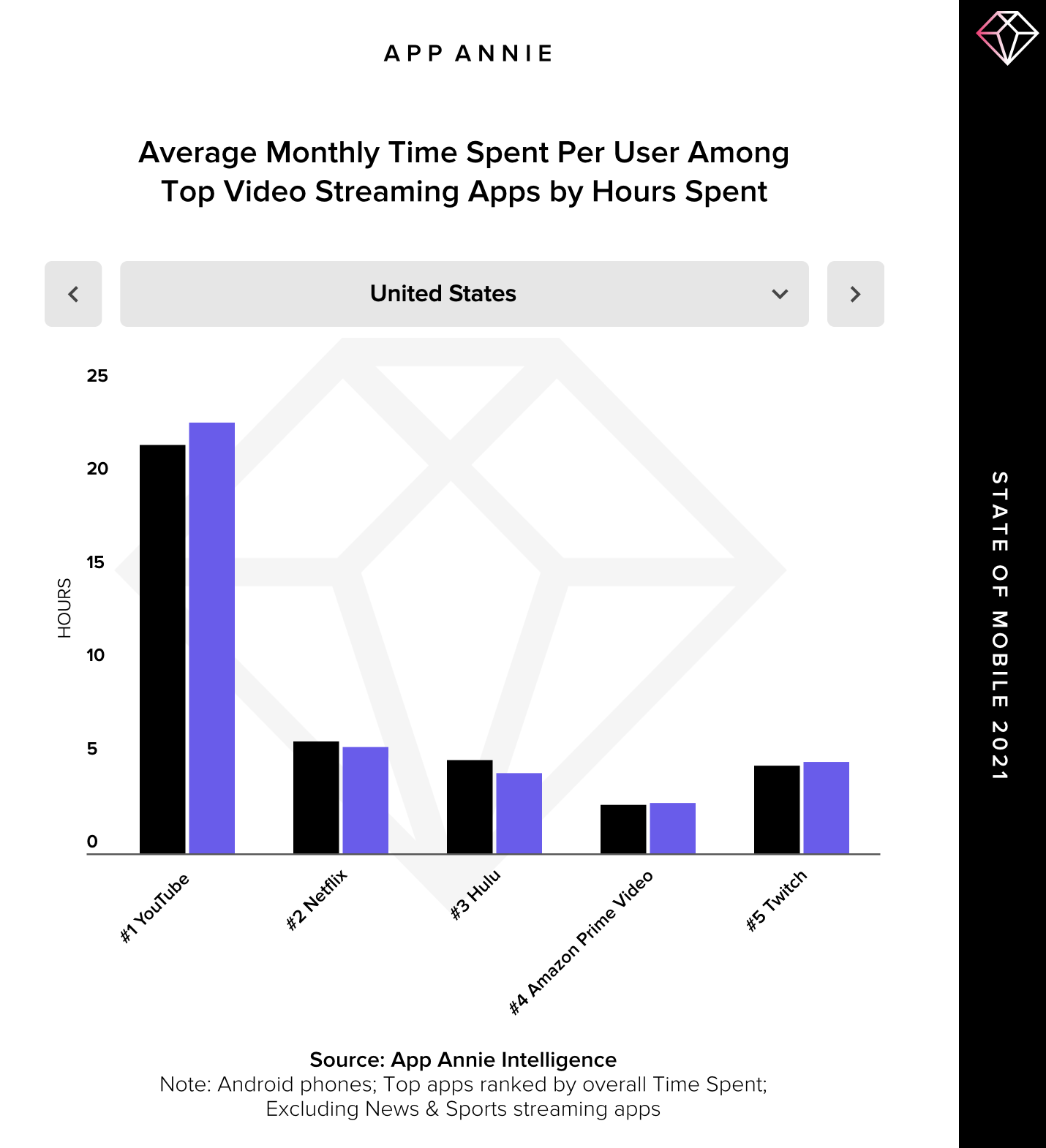

However, for all the success of the long-form video giants, it was ‘snackable’ video that claimed the most viewing time overall. YouTube was the #1 video streaming app by time spent on Android phones in all markets analyzed, except China.

In some cases, the margin to the #2 app was huge. Take Russia, for example. Russians streamed an average 30.4 hours of YouTube a month. Next up was MX Player at 5.1 hours a month. Meanwhile, consumers in South Korea streamed 37.9 hours of YouTube a month compared with 8.4 hours of Netflix.

Twitch and TikTok Encroach on the Video Streaming Landscape

Another interesting participant in the streaming wars is Twitch. Amazon’s video gaming spectator channel is primarily long form, but also contains short form content. It’s an outlier of sorts. But it too benefited from the stay-at-home mandate. Twitch was a top 5 ‘break out’ video streaming app in the US, the UK, Germany, France, Mexico, Brazil, Argentina, Canada, Russia, South Korea and Turkey.

TikTok was another major contender in the streaming content space — indicating a shift in consumption. Consumers are looking for both polished TV shows as well as spending hours consuming short user-generated content. In the US, consumers spent 21.5 hours per month in TikTok during 2020, up 70% from 12.8 hours per month in 2019 — putting TikTok in striking distance of YouTube at 23.1 hours per month, and sizably ahead of the next largest video streaming app — Netflix at 5.7 hours per month in the US. TikTok has also seen strong overlap in user bases. In the US, the percentage of Netflix iPhone app users who also use TikTok more than doubled from 21% in 2019 to 49% in 2020. The lines are blurring. Marketers, advertisers and video streaming publishers need to take note of this shift and the potential it has to further shake up the industry into 2021 and beyond.

Mobile Video Streaming to Maintain its Growth Post-Pandemic

While the pandemic undoubtedly sped up the migration to on-demand video consumption, most observers expect streaming to maintain its growth even when lives return to normal. In its 2020 Mobility Report, Ericsson stated that the average mobile user consumes 9.4GB of mobile data a month – and that video accounts for 60% of this traffic. It projects that the monthly total will rise to 21GB by 2024, with video comprising 74% of data consumed.

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.