Cross-border flows into Australian commercial real estate sank in 2020, but the magnitude of the drop was moderated by a European champion: German institutional investment. Spending by groups headquartered in Germany alleviated fears that overseas investors would desert Australia, as occurred in the last global downturn.

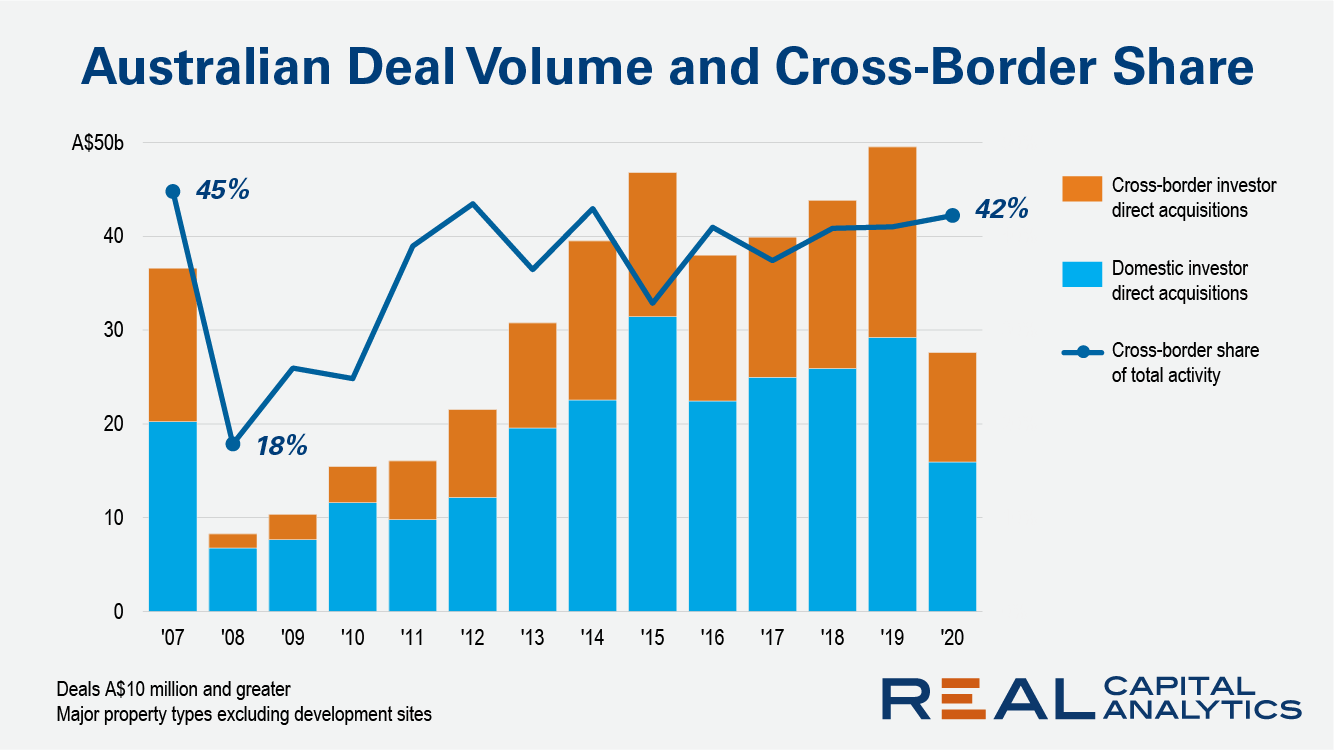

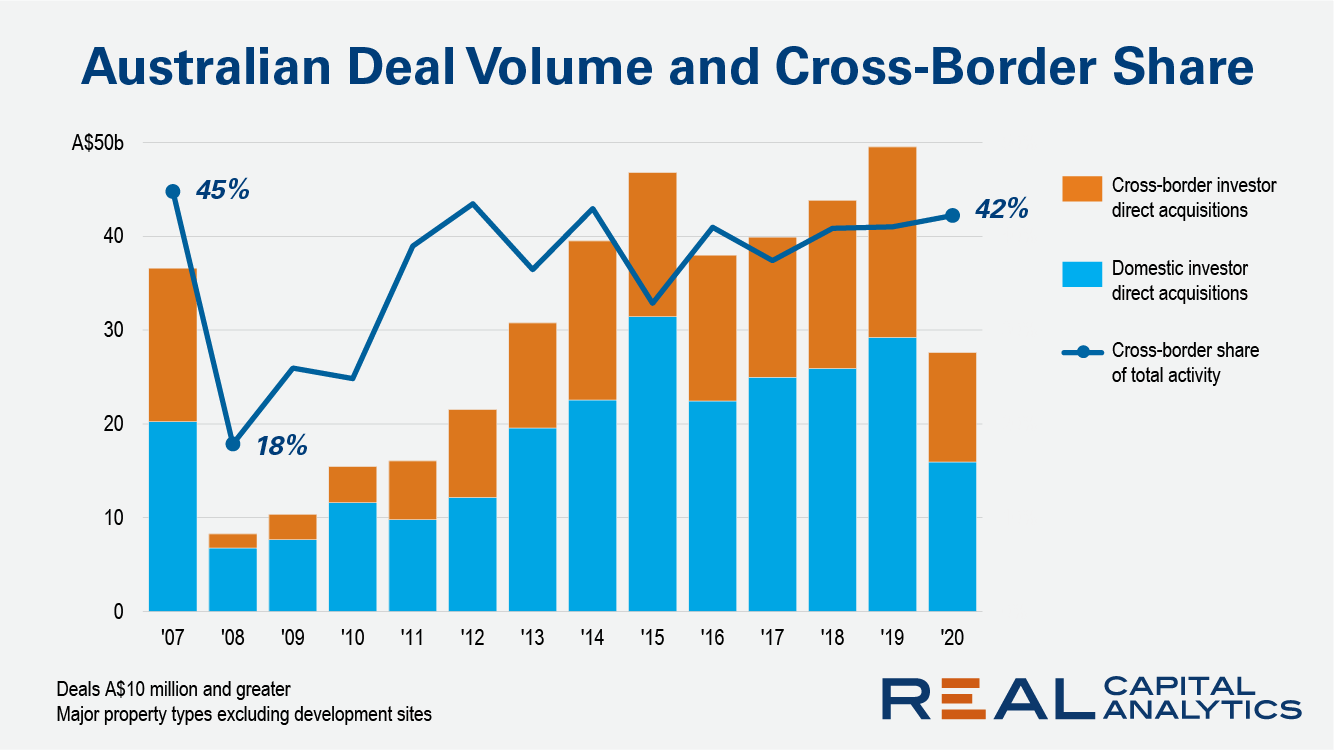

During the Global Financial Crisis (GFC), investors across the world retreated to the sanctuary of their home territories. As a market with a high proportion of cross-border investment, capital flows into Australia nosedived, falling from A$16.4 billion ($12.6 billion) in 2007 to A$1.5 billion in 2008. After breaking the A$20 billion mark in 2019, overseas investment looked to be heading for a déjà vu in 2020, with the pandemic shutting down business travel and stringent lockdowns enforced.

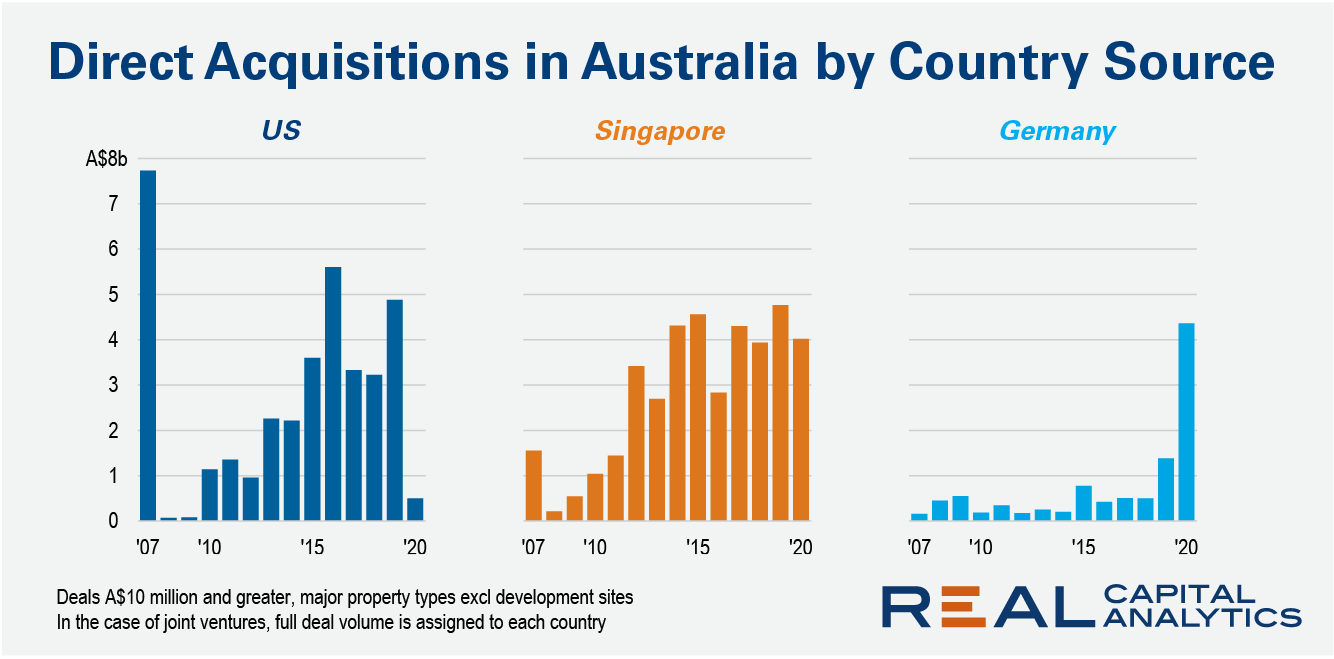

Germany-headquartered investment groups persevered as other cross-border investors struggled or were unwilling to do deals. Record investment by German investors of over A$4 billion in 2020 helped keep the overall share of cross-border investment in Australia steady at over 40%, in contrast to 2008 when it plunged to 18%.

The continued spending of German investor groups during the most uncertain times contrasts with other major sources of capital. During the depths of the GFC in 2008-09, Real IS purchased two office buildings in Canberra, both let on long leases to government tenants at yields of 7.3% and 8.0%. In the same period, Deka Immobilien ventured into Melbourne and Perth for the first time, while German insurer Allianz purchased a shopping center in Brisbane.

Twelve years on, with another collapse in overall Australian investment activity, the investor trio have replicated the feat. Deka and Real IS each made a pair of office purchases, while Allianz has forayed into the student housing and logistics sectors.

This proclivity for going against the grain has set these German investors apart from Australia’s two largest sources of inbound capital. Singaporean groups largely view Australia as an extension of Singapore’s domestic market, and have been a patient, consistent source of capital throughout both the highs and lows. In 2019 they were the second largest source of capital behind the U.S., while in 2020 they ranked just behind the Germans, with nine different groups that deployed over A$100 million.

By contrast, investors from the U.S. retreat from Australia during times of market volatility. While they were the biggest buyers during both peaks in 2007 and 2019, they also subsequently cut their purchasing activity significantly. Moreover, U.S. groups have been actively selling properties, with LaSalle’s disposition of an office block on behalf of the CalSTRS pension fund one of Melbourne’s biggest single property deals of the year. Meanwhile, Blackstone completed almost A$1 billion worth of sales during 2020 and plans to place a multibillion dollar logistics portfolio on the market.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.