Consumers look for contactless mobile alternatives as COVID-19 further limits physical banking, raises safety fears around cash and interest in stock market movement

It is no surprise that consumers have quickly adopted app banking over the last 10 years, which is available 24 hours a day with no waits. However, the retail banking app is just one facet of a wider revolution in mobile finance. Investing, payments, loans – all are being upended by agile new digital replacements.

In 2020 – powered by COVID-19 stay-at-home orders – consumers embraced these new alternatives in record numbers. Our State Of Mobile 2021 report shows time spent in finance apps during 2020 leapt by 45% worldwide outside of China year over year. As early as 2018, we had seen that consumers were accessing their banking apps on average once a day — creating an entirely new behavior. The average consumer would likely not walk into a bank branch once a day, but on mobile, they were now engaging with the bank virtually once a day.

Even when they did venture outside, consumers still used finance apps. The ability to pay by mobile in physical locations has been growing steadily for years. In 2020 it jumped again thanks to an unexpected factor: not convenience, but safety. The pandemic made many fearful of cash. As a result consumers switched to contactless or QR code payments. Retailers too. A Visa study found 39% of SMES now accept new digital forms of payments – and 74% expect consumers to continue with contactless payments even after a vaccine. Particularly for markets like the US that were slow to adopt contactless payments, this is a major shift in the industry.

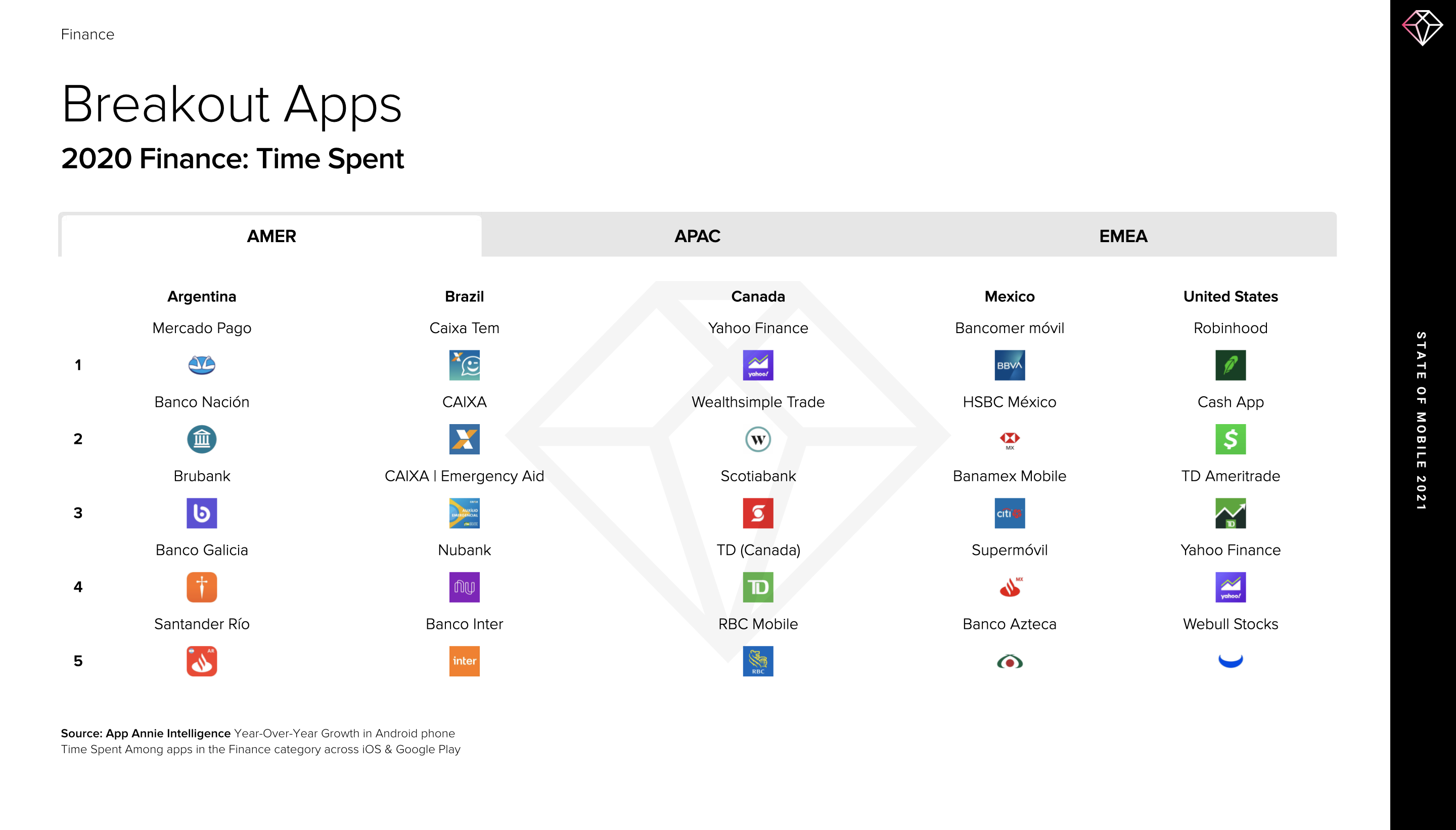

Confirming this, State Of Mobile 2021 revealed many payment apps among its breakout finance products of the last year. Notable among them are Tez and PhonePe in India, and PayPay in Japan by growth in time spent on Android phones.

Argentina and Brazil Among the World’s Fastest Growing Countries for Mobile Finance

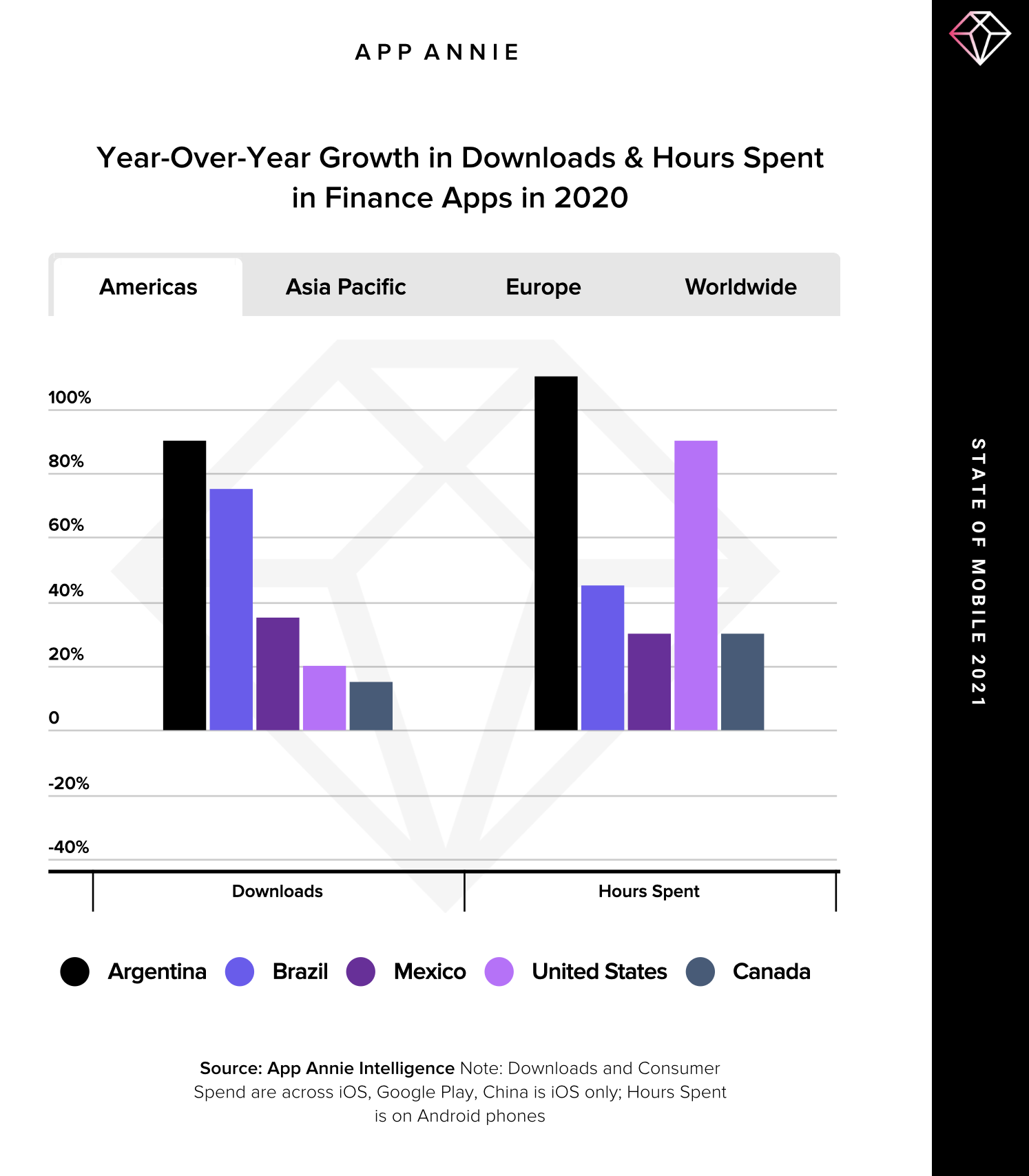

While all regions showed significant uplift in mobile finance activity, LATAM was the standout performer among the 16 countries analyzed in the State of Mobile 2021 report.

Argentina and Brazil are especially ripe for finance innovation. Each is home to many millions of unbanked consumers, who must make purchases in cash, or pay for expensive pre-loaded debit cards or money orders.

These consumers want solutions that cost less and are easy to use. The pandemic merely speeded up the adoption of these products. For example, Argentina’s top app by growth in time spent year over year was Mercado Pago. This is a payment product that was originally designed for the Mercado Libre e-commerce auction site but expanded to be a generic payment instrument. In Q3 2020, Mercado Pago processed 559.7 million transactions, up 146.6% year-over-year.

Brazil’s top breakout finance app, Caixa Tem, illustrated another facet of the COVID era. The state-owned bank Caixa Econômica Federal used the app to distribute emergency funds to citizens. It says 105 million users opened accounts for this purpose.

Disruptive Investment and Trading Apps Dominate the US Market

The popularity of the mobile app has sped up the ‘unbundling’ of the financial ecosystem. There used to be one destination – a bank – for everything: savings, loans, mortgages, investments etc. Now, there are specialists each offering competitive rates and a more friendly user experience.

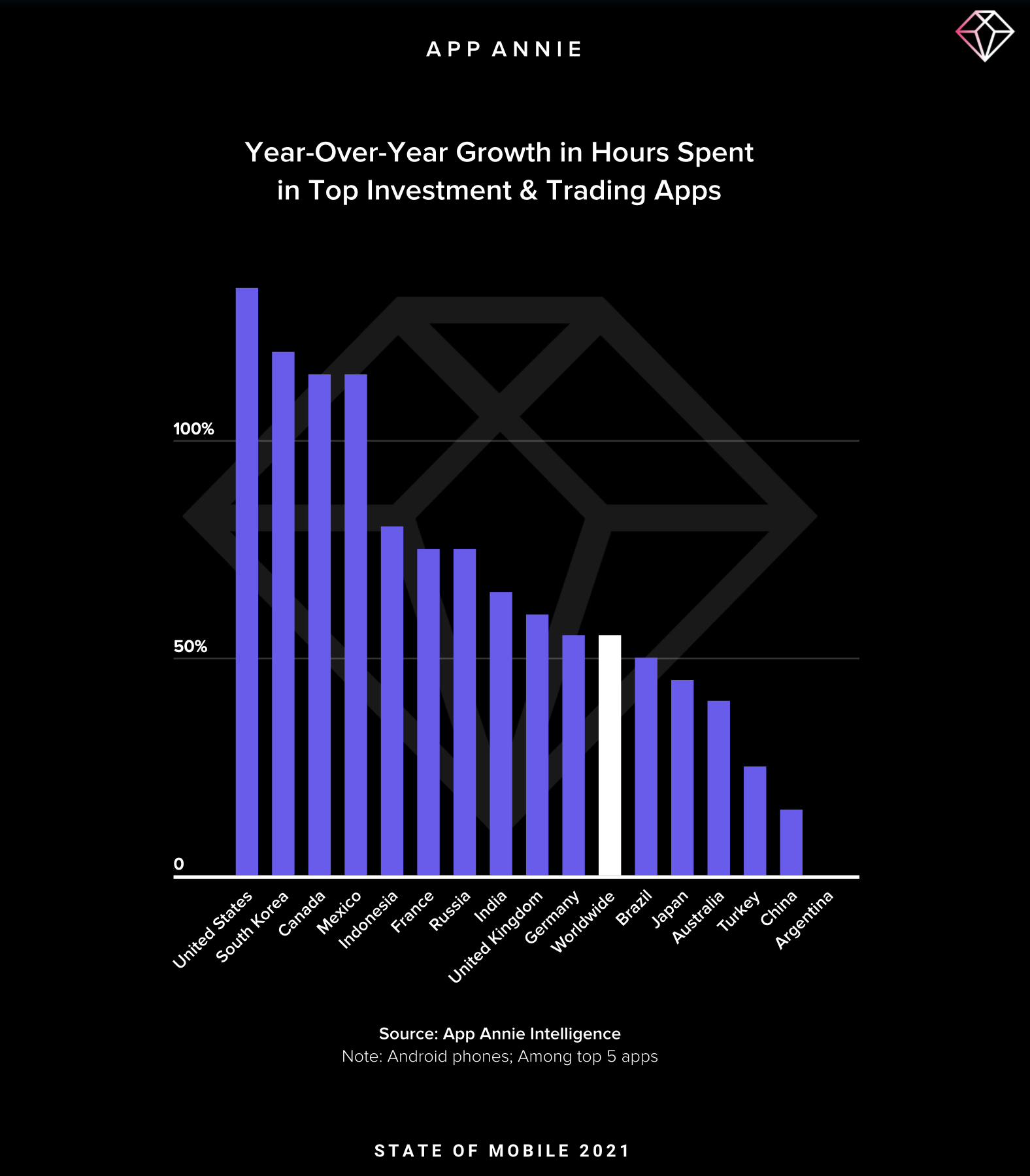

Of all these sub-sectors, investment and trading apps performed especially well in 2020. Time spent in these products grew by 55% worldwide. In the US, the rate was up 135%.

Outside of the US there were other notable successes. For example, trading app Kite Serodha ended the year as India’s biggest finance app by time spent. It increased its cumulative hours on Android phones by 140%.

It should also be noted that State Of Mobile 2021 also revealed a sharp rise in crypto-investing apps. In a year of mass state borrowing, many consumers saw cryptocurrency as an attractive store of value to fiat money. This helps to explain the rise of apps such as Binance (#1 investment app by time spent in Argentina in 2020 on Android phones, #3 in Russia) and Bitso (#1 in Mexico).

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.