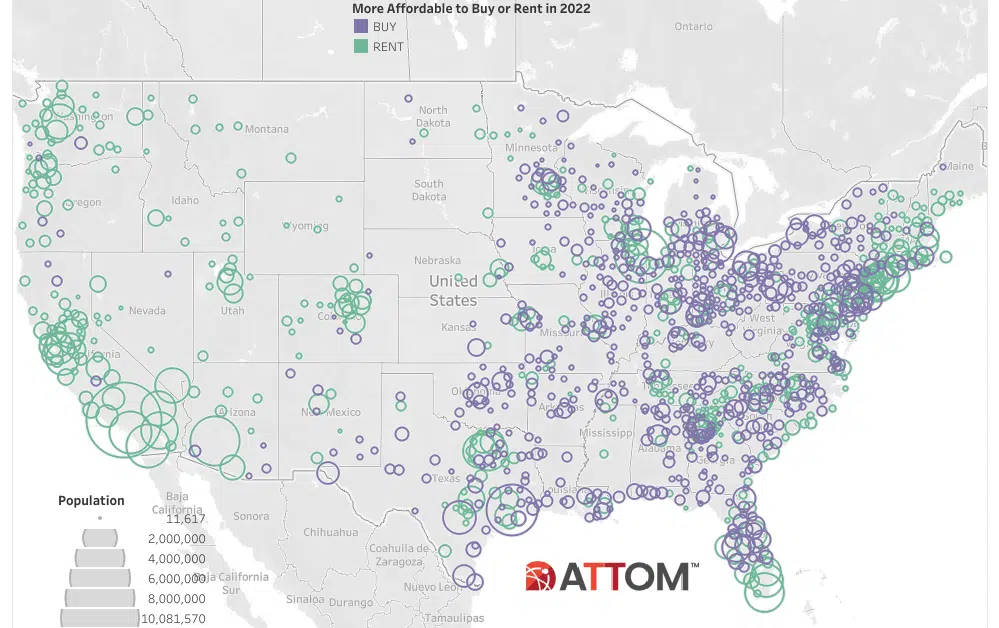

ATTOM, curator of the nation’s premier property database, today released its 2022 Rental Affordability Report, which shows that owning a median-priced home is more affordable than the average rent on a three-bedroom property in 666, or 58 percent, of the 1,154 U.S. counties analyzed for the report. That means major home ownership expenses consume a smaller portion of average local wages than renting. Home ownership remains more affordable even though median home prices have increased more than average rents and more than averages wages in in 88 percent of the counties analyzed.

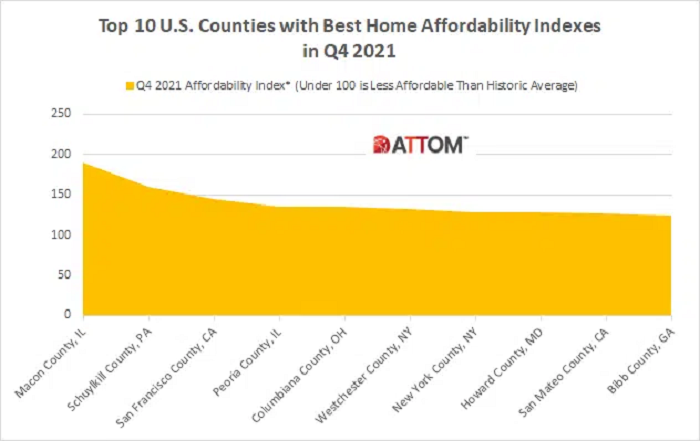

ATTOM’s just released Q4 2021 U.S. Home Affordability Report shows the latest pattern in home affordability – home prices still manageable, but getting less affordable – has resulted in major ownership costs on the typical home consuming 25.2 percent of the average national wage of $65,546. According to ATTOM’s latest home affordability analysis, the percent of wages needed to buy a median-priced single-family home is up from 24.4 percent in Q3 2021 and 21.5 percent in Q4 2020.

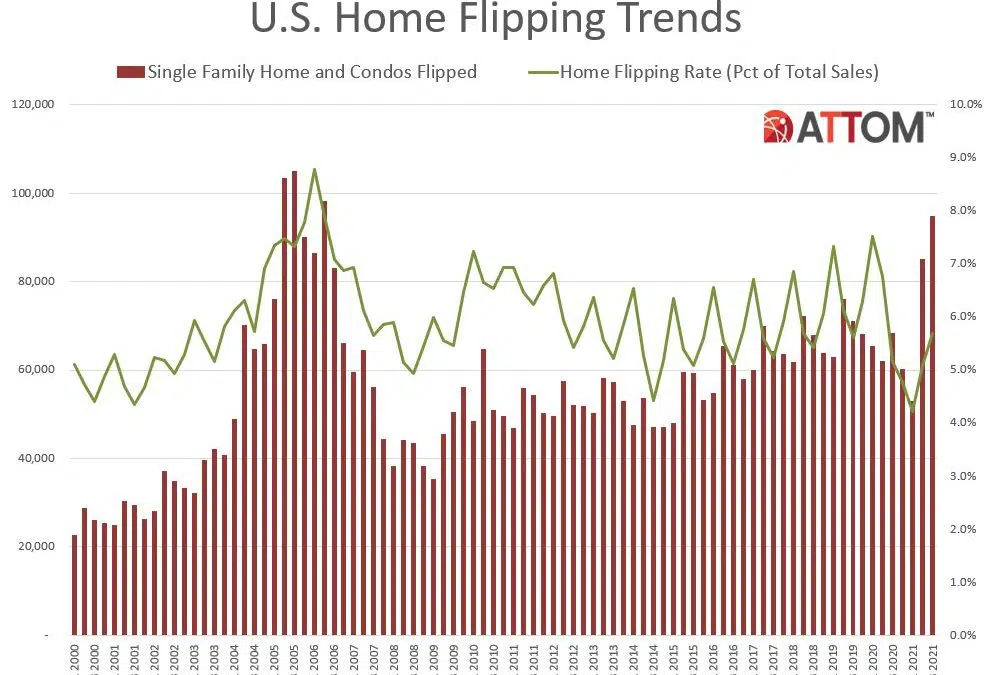

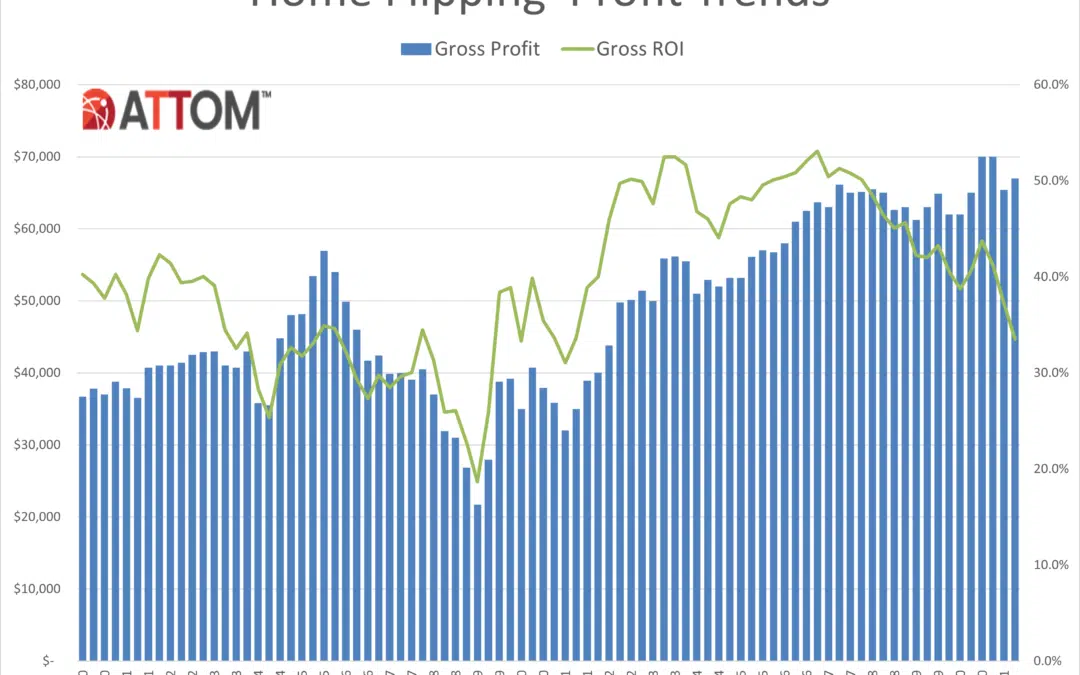

ATTOM, curator of the nation’s premier property database, today released its third-quarter 2021 U.S. Home Flipping Report showing that 94,766 single-family houses and condominiums in the United States were flipped in the third quarter. Those transactions represented 5.7 percent of all home sales in the third quarter of 2021, or one in 18 transactions, a figure that was up for the second quarter in a row after a year of declines.

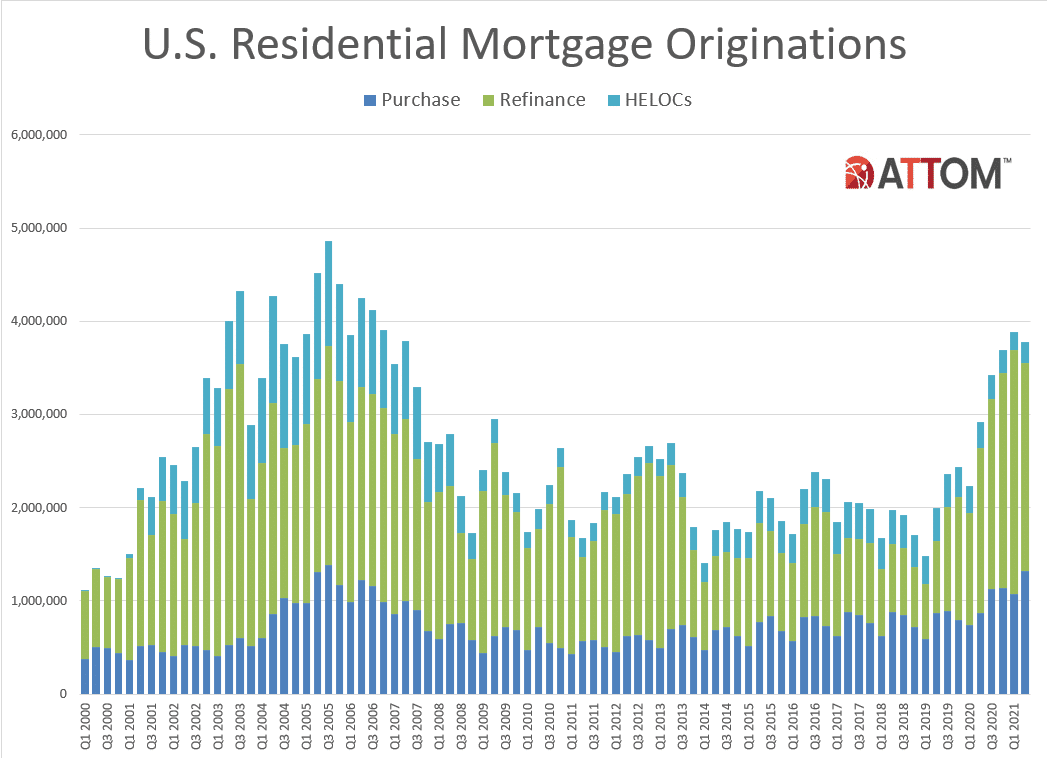

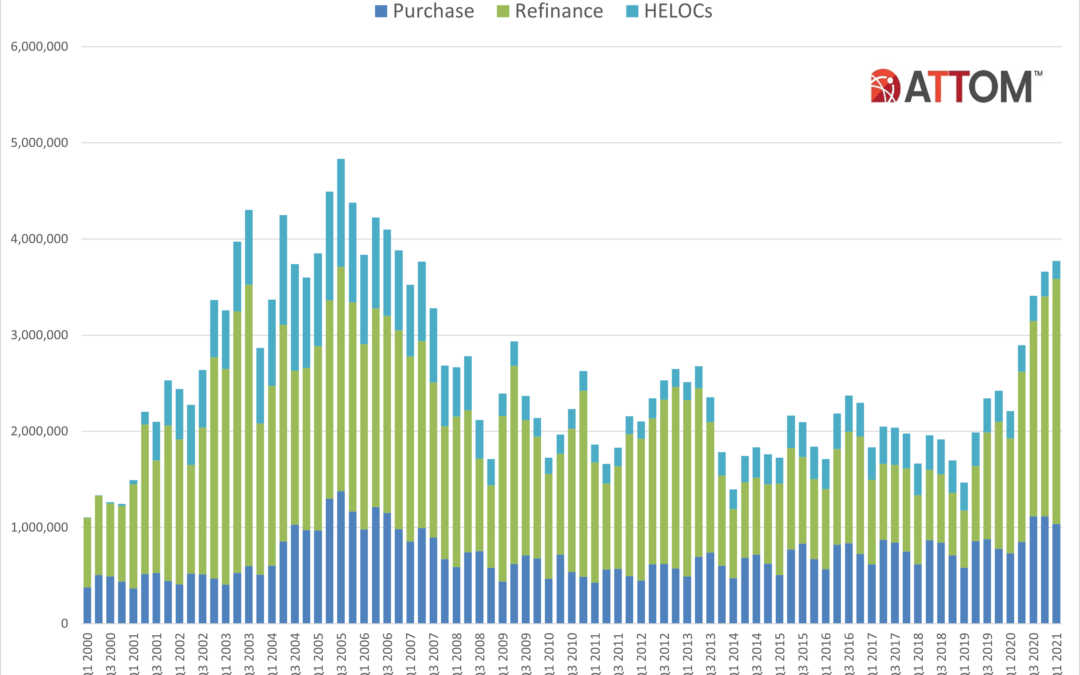

ATTOM’s just released Q3 2021 U.S. Residential Property Mortgage Origination Report shows that overall mortgage lending was down 8 percent in Q3 2021, marking the second straight quarterly decline and the first time in more than two years that total lending decreased in two consecutive quarters. The Q3 2021 loan origination analysis conducted by ATTOM noted the quarterly decrease in mortgage lending was the first time in any year since at least 2000 that lending activity declined in both the second and third quarters, typically peak buying seasons.

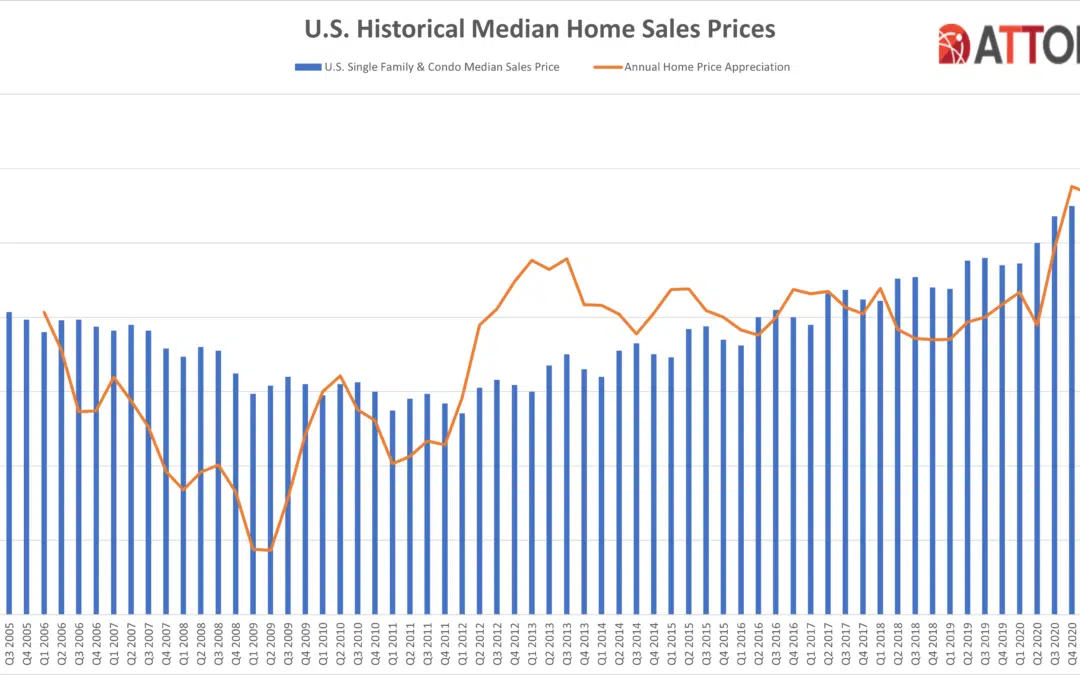

ATTOM, curator of the nation’s premier property database, today released its third-quarter 2021 U.S. Home Sales Report, which shows that profit margins on median-priced single-family home and condo sales across the United States jumped to 47.6 percent – the highest level since the end of the Great Recession a decade ago. In yet another sign of how strong the U.S. housing market remains, the report reveals that the typical home sale across the country during the third quarter of 2021 generated a profit of $100,178 as the national median home price hit a record of $310,500.

ATTOM’s just released Q3 2021 Special Report, spotlighting county-level housing markets around the U.S. that are more or less vulnerable to the impact of the coronavirus pandemic, stated that New Jersey, Illinois and Delaware had the highest concentrations of the most at-risk markets in Q3 2021. The latest Coronavirus housing impact analysis, conducted by ATTOM, reported that the biggest clusters were in the New York City and Chicago areas, while the West remained far less exposed.

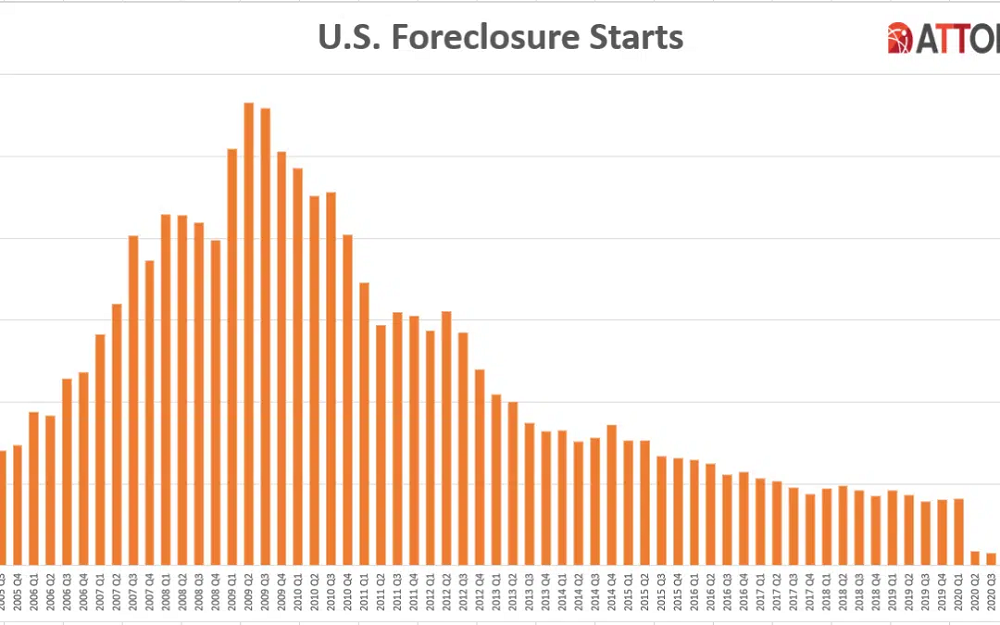

ATTOM, licensor of the nation’s most comprehensive foreclosure data and parent company to RealtyTrac (www.realtytrac.com), the largest online marketplace for foreclosure and distressed properties, released its Q3 2021 U.S. Foreclosure Market Report, which shows there were a total of 45,517 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — up 34 percent from the previous quarter and 68 percent from a year ago.

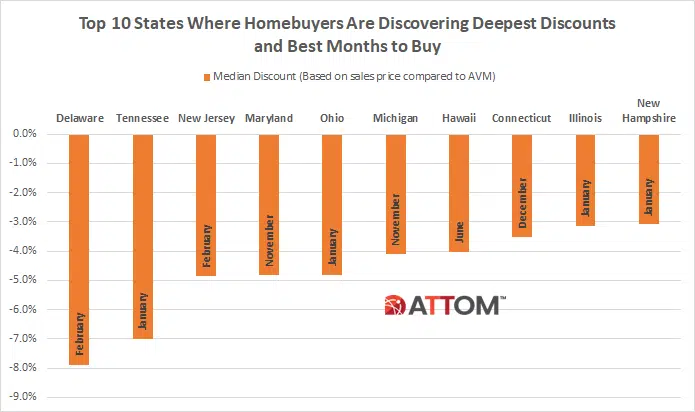

ATTOM’s newly released 2021 analysis of the best time of the year to buy a home reveals that homebuyers are fetching lower premiums during the month of October, as well as the winter months, compared to the spring buying season. The study of more than 33 million single family home and condo sales over the past eight years found that while the premium is still above market value, homebuyers that close in October are only dealing with a 2.9% premium, compared to the month of May, when homebuyers are experiencing an 11.5% premium.

ATTOM, curator of the nation’s premier property database, today released its second-quarter 2021 U.S. Home Flipping Report showing that 79,733 single-family homes and condominiums in the United States were flipped in the second quarter. Those transactions represented 4.9 percent of all home sales in the second quarter of 2021, or one in 20 transactions – the first increase in more than a year. The second quarter home flipping rate was up from 3.5 percent, or one in every 29 home sales in the nation, during the first quarter of 2021.

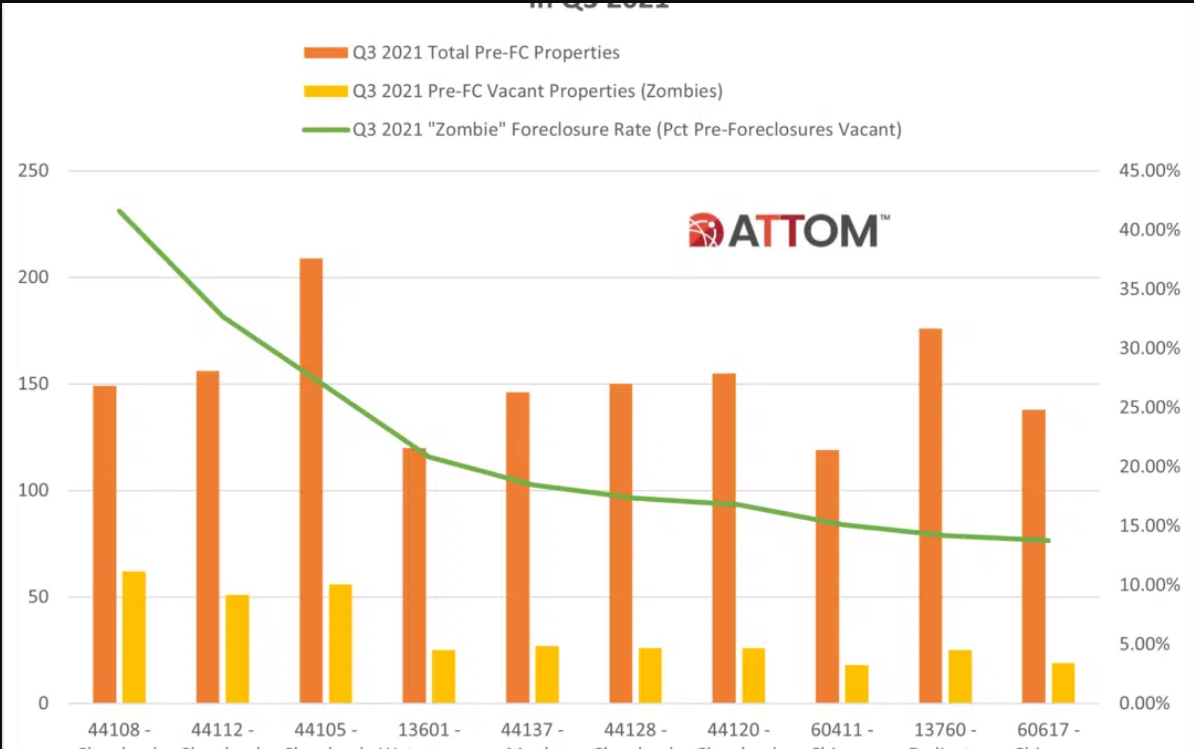

ATTOM’s newly released Q3 2021 Vacant Property and Zombie Foreclosure Report found that 1.3 million residential properties in the U.S. sit vacant, representing 1.4 percent, or one in 74 homes, across the nation. According to ATTOM’s latest vacant properties analysis, while the number of properties in the process of foreclosure in Q3 2021, is down 3.7 percent from Q2 2021 and down 0.2 percent from Q3 2020, among those pre-foreclosure properties, the number of those sitting vacant in Q3 2021 is down quarterly by 6.7 percent and annually by 5.3 percent.

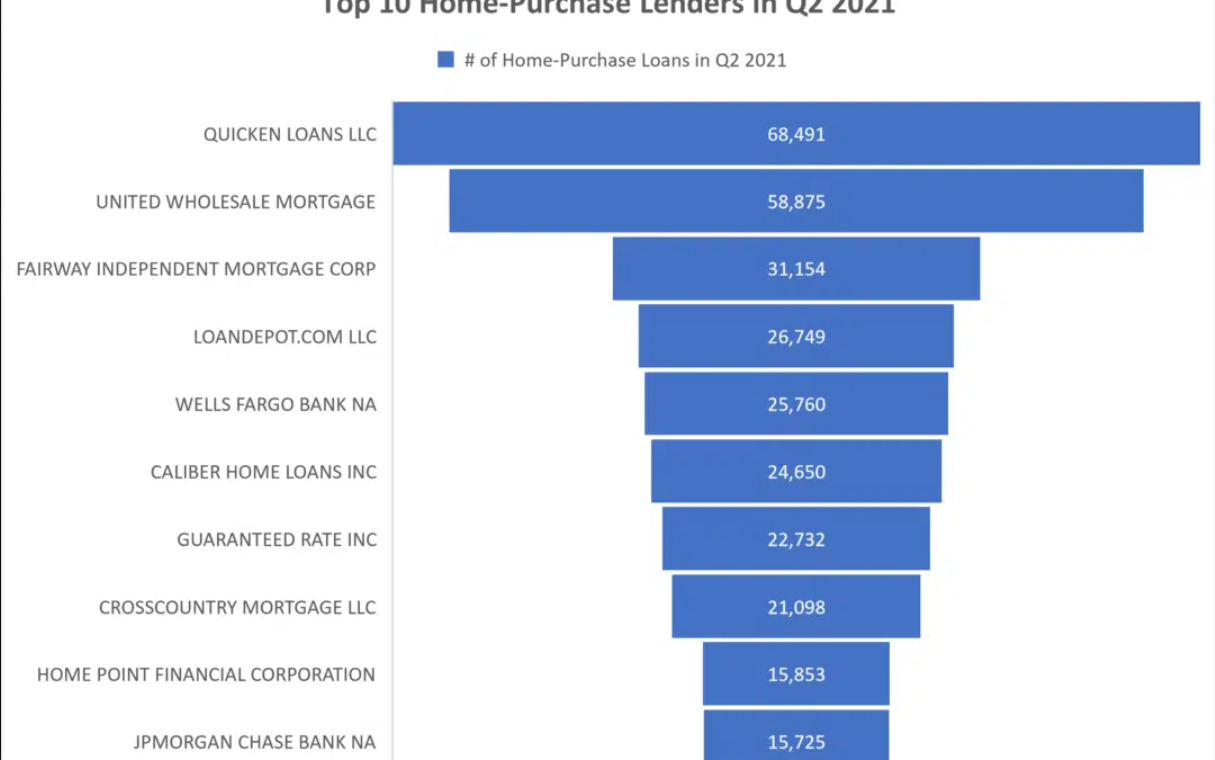

ATTOM’s newly released Q2 2021 U.S. Residential Property Mortgage Origination Report revealed that the number of mortgages secured by residential property originated in Q2 2021 in the U.S. was up 29 percent from Q2 2020, but down 3 percent from Q1 2021. According to ATTOM’s latest residential property mortgage origination analysis, the quarterly decline in overall mortgage lending in the U.S. marked the first decrease since early in 2020, as well as the first time that happened from a Q1 to a Q2 period since 2011.

ATTOM, curator of the nation’s premier property database, today released its second-quarter 2021 U.S. Residential Property Mortgage Origination Report, which shows that 3.78 million mortgages secured by residential property (1 to 4 units) were originated in the second quarter of 2021 in the United States. That figure was up 29 percent from the second quarter of 2020, but down 3 percent from the first quarter of this year.

ATTOM, curator of the nation’s premier property database, today released its second-quarter 2021 U.S. Home Equity & Underwater Report, which shows that 34.4 percent of mortgaged residential properties in the United States were considered equity-rich in the second quarter, meaning that the combined estimated amount of loans secured by those properties was no more than 50 percent of their estimated market value. The portion of mortgaged homes that were equity-rich in the second quarter of 2021

Chicago Area and East Coast States Remain More Exposed to Pandemic’s Impact During Second Quarter of 2021; Most Vulnerable Areas Are More Scattered Around Nation Than in Prior Quarter; Western States Continue to Have Most Favorable Market Conditions. ATTOM, curator of the nation’s premier property database, today released its second-quarter 2021 Coronavirus Report spotlighting county-level housing markets around the United States

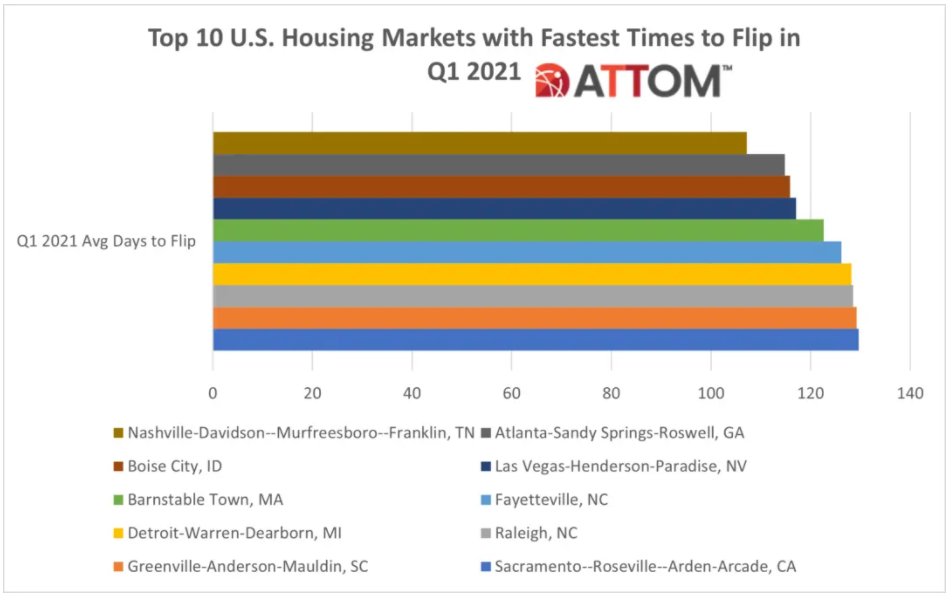

According to ATTOM’s recently released Q1 2021 U.S. Home Flipping Report, both the home flipping rate and gross profits declined nationwide in the first quarter of 2021. With home flips representing just 2.7 percent of all home sales in Q1 2021, the home flipping rate fell to the lowest level since 2000. ATTOM’s latest home flipping market analysis found that the gross profit on the typical U.S. home flip declined in Q1 2021 to $63,500, translating into a 37.8 percent ROI compared to the original acquisition price.

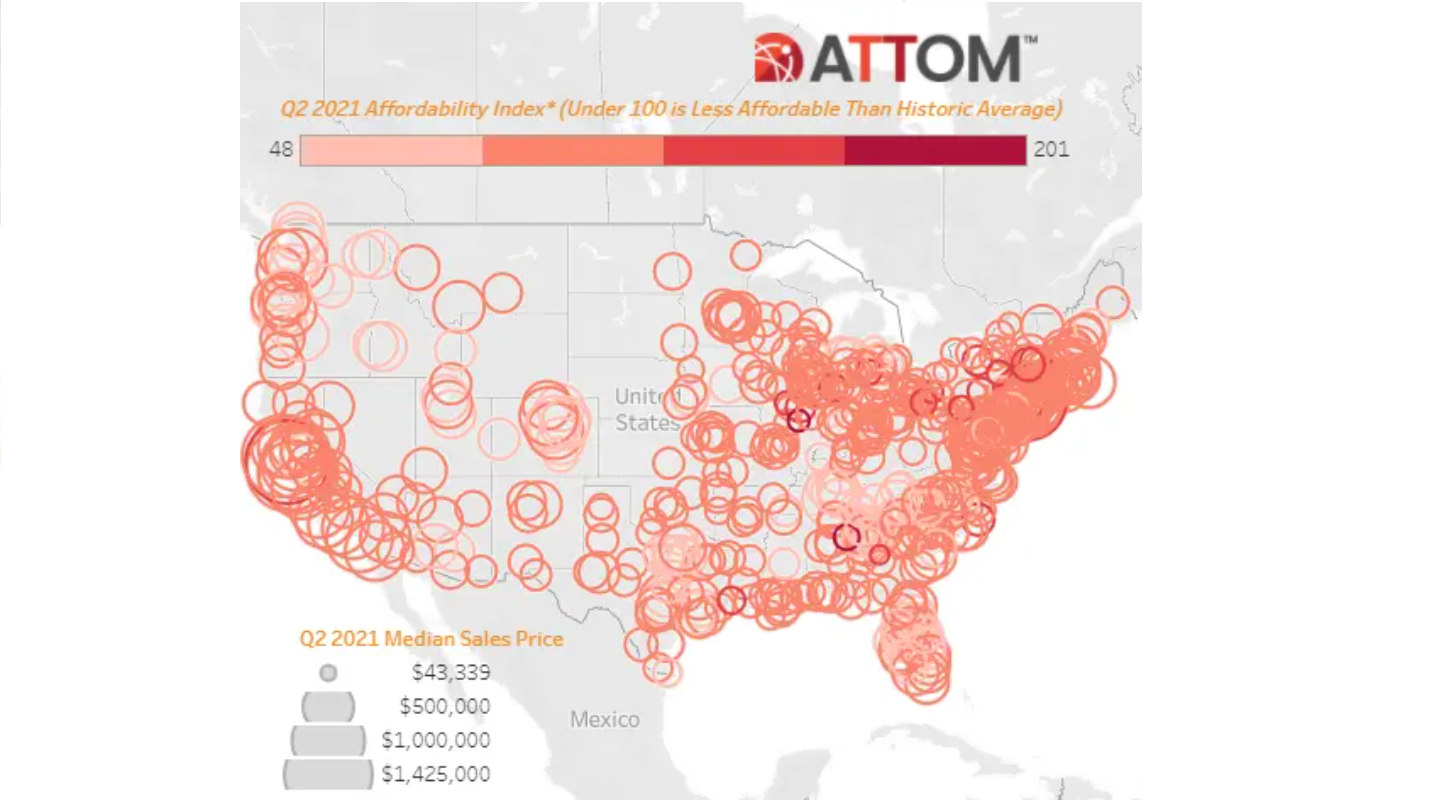

ATTOM, curator of the nation’s premier property database, today released its second-quarter 2021 U.S. Home Affordability Report, showing that median home prices of single-family homes and condos in the second quarter of this year are less affordable than historical averages in 61 percent of counties across the nation with enough data to analyze. That was up from 48 percent of counties in the second quarter of 2020, to the highest point in two years, as home prices have increased faster than wages in much of the country.

ATTOM, licensor of the nation’s most comprehensive foreclosure data and parent company to RealtyTrac (www.realtytrac.com), the largest online marketplace for foreclosure and distressed properties, released its May 2021 U.S. Foreclosure Market Report, which shows there were a total of 10,821 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — down 8 percent from a month ago but up 23 percent from a year ago. Foreclosure starts, which represent the initial notice of default, grew by 36 percent year-over-year.

ATTOM Data Solutions, curator of the nation’s premier property database, today released its first-quarter 2021 U.S. Residential Property Mortgage Origination Report, which shows that 3.77 million mortgages secured by residential property (1 to 4 units) were originated in the first quarter of 2021 in the United States. That figure was up 3 percent from the previous quarter and 71 percent from the first quarter of 2020 – to the highest level in more than 14 years.

ATTOM Data Solutions’ newly released Q1 2020 U.S. Home Sales Report reveals that the typical Q1 2021 home sale in the U.S. generated a profit of $70,050, down from $75,750 in Q4 2020, but still up 26 percent from $55,750 in Q1 2020.

ATTOM Data Solutions, curator of the nation’s premier property database, today released its first-quarter 2021 U.S. Home Sales Report, which shows that profits for home sellers nationwide were again up on an annual basis in yet another sign of how the housing market is fending off economic damage caused by the Coronavirus pandemic. The report reveals that the typical first-quarter 2021 home sale in the United States generated a profit of $70,050. That was down from $75,750 in the fourth quarter of 2020 but still up 26 percent from $55,750 in the first quarter of 2020.