Lending Shoots Up Another 17 Percent in Third Quarter of 2020 As U.S. Braces for More Impacts from Coronavirus Pandemic; Dollar Amount of Home-Purchase Loans Spikes 35 Percent Over Second Quarter; Down payments and Mortgage Amounts Rise To New Highs in Third Quarter

ATTOM Data Solutions’ just released Q3 2020 U.S. Home Equity and Underwater Report reveals that 16.7 million residential properties in the U.S. were considered equity-rich in the third quarter of 2020, while just 3.5 million mortgaged homes were considered seriously underwater.

Equity-Rich Properties Now Outnumber Those Seriously Underwater by Almost Five-to-One Margin; Portion of U.S. Homes Considered Equity-Rich Grows to 28 Percent; Share of Seriously Underwater Properties Stay at 6 Percent

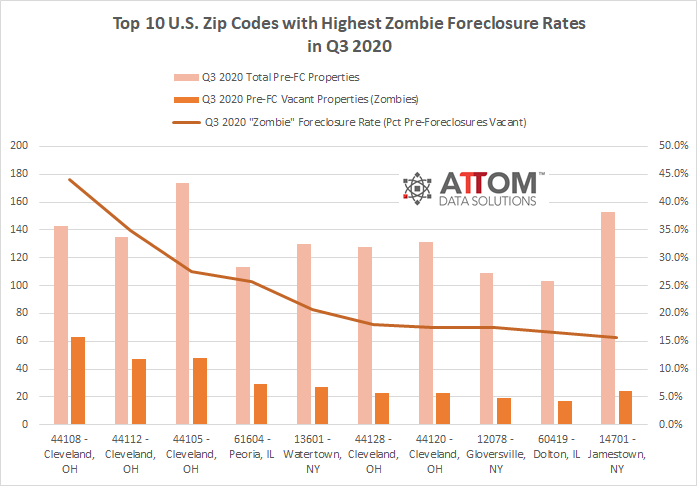

Number of Zombie Foreclosures Drops 4 percent From Last Quarter; Percentage of Foreclosure Properties Sitting Empty Stays About the Same; Among All Residential Properties, Zombie Foreclosures Represent Just One of Every 13,100

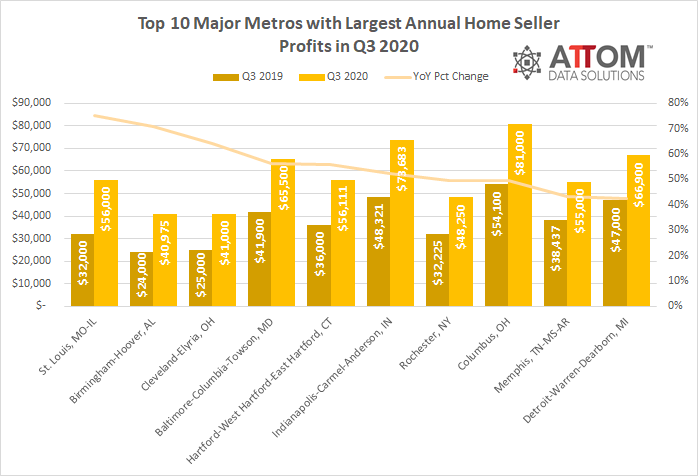

ATTOM Data Solutions’ just released Q3 2020 U.S. Home Sales Report reveals that both the raw-profit and return-on-investment figures recorded from the typical home sale in the U.S. in third quarter of 2020, stand at the highest points since the U.S. economy began recovering from the Great Recession in 2012.

ATTOM Data Solutions, curator of the nation’s premier property database and first property data provider of Data-as-a-Service (DaaS), today released its third-quarter 2020 U.S. Home Sales Report, which shows that profits for home sellers nationwide continue to hit high points despite the economic distress caused by the worldwide Coronavirus pandemic.

According to ATTOM Data Solutions’ newly released September and Q3 2020 U.S. Foreclosure Market Report, foreclosure filings are down 12 percent from Q2 2020 and down 81 percent from Q3 2019, to the lowest level since ATTOM began tracking quarterly filings in Q1 2008. The reports shows there were a total of 27,016 U.S. properties with foreclosure filings in the third quarter of 2020.

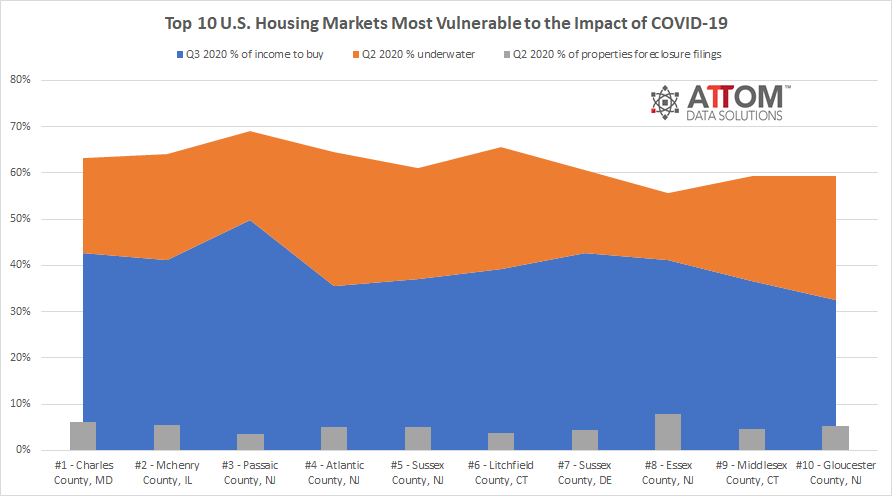

ATTOM Data Solutions’ just released Q3 2020 Special Report, spotlighting the U.S. housing markets more or less at risk of an economic impact related to the Coronavirus pandemic, shows that pockets of the Northeast and Mid-Atlantic regions were most vulnerable in Q3 2020, while the West and now Midwest fared less at risk.

Most Vulnerable Counties in Third Quarter of 2020 Concentrated in States Running from Connecticut through Maryland; New York City, Baltimore, Washington, D.C. and Now Philadelphia Among Areas with Clusters of High-Risk Counties; Midwest Joins the West as Regions Less at Risk of Housing-Market Problems

ATTOM Data Solutions’ most recent U.S. Home Sales Report shows that homeowners who sold in the second quarter of 2020 had owned their homes an average of 7.95 years. According to the report, that number is up slightly from 7.85 years in Q1 2020, and nearly the same as the peak of 7.96 years in Q4 2019.

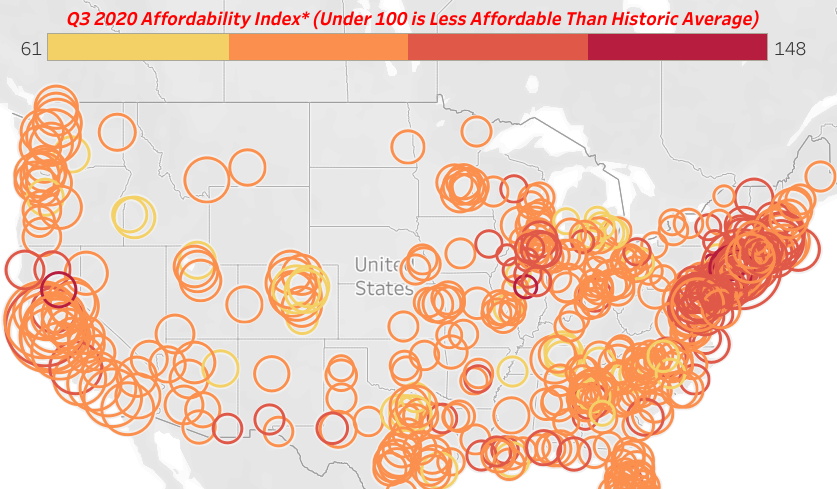

Median home prices of single-family homes and condos in the third quarter of 2020 are less affordable than historical averages in 63 percent of counties with enough data to analyze, up from 54 percent a year ago.

53,621 single-family homes and condominiums in the United States were flipped in the second quarter. Those transactions represented 6.7 percent of all home sales in the second quarter of 2020, or one in 15 transactions. That figure was down from 7.5 percent of all home sales in the nation during the prior quarter, or one in 13, but up from 6.1 percent, or one in 17 sales, in the second quarter of last year.

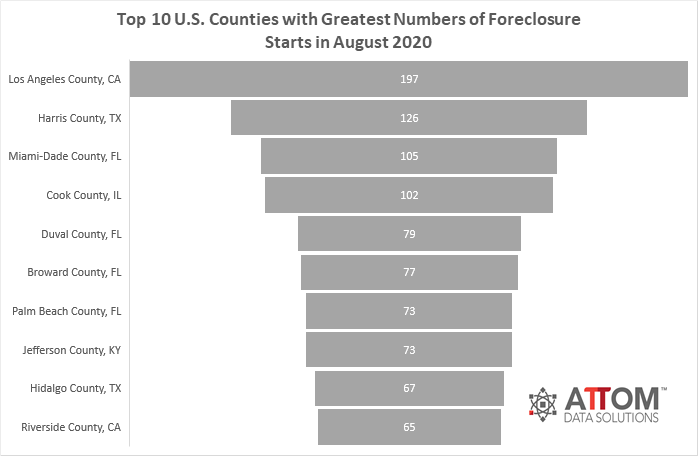

U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — saw a slight uptick in August 2020 from July 2020, with 9,889 filings reported. That number increased monthly by 11 percent, but is still down 81 percent from last year.

There were a total of 9,889 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in August 2020, up 11 percent from a month ago but down 81 percent from a year ago. “While foreclosure activity remains over 80% below 2019 totals, there was a significant increase in foreclosure starts in August compared to July,” said Rick Sharga, Executive Vice President at RealtyTrac.

ATTOM Data Solutions’ newly released Q3 2020 Vacant Property and Zombie Foreclosure Report reveals that 1.6 percent of all homes in the U.S. are vacant, numbering 1,570,265 residential properties, with 7,960 or 3.7 percent of those vacant properties in the process of foreclosure, otherwise known as ‘zombie foreclosures.’

1\.5 million (1,570,265) residential properties in the United States are vacant, representing 1.6 percent of all homes. The third quarter analysis shows that about 216,000 homes are in the process of foreclosure, with about 7,960, or 3.7 percent, sitting empty as so-called ‘zombie foreclosures.’. The count of properties in the process of foreclosure (215,886) in the third quarter of 2020 is down 16 percent from the second quarter of 2020 (258,024).

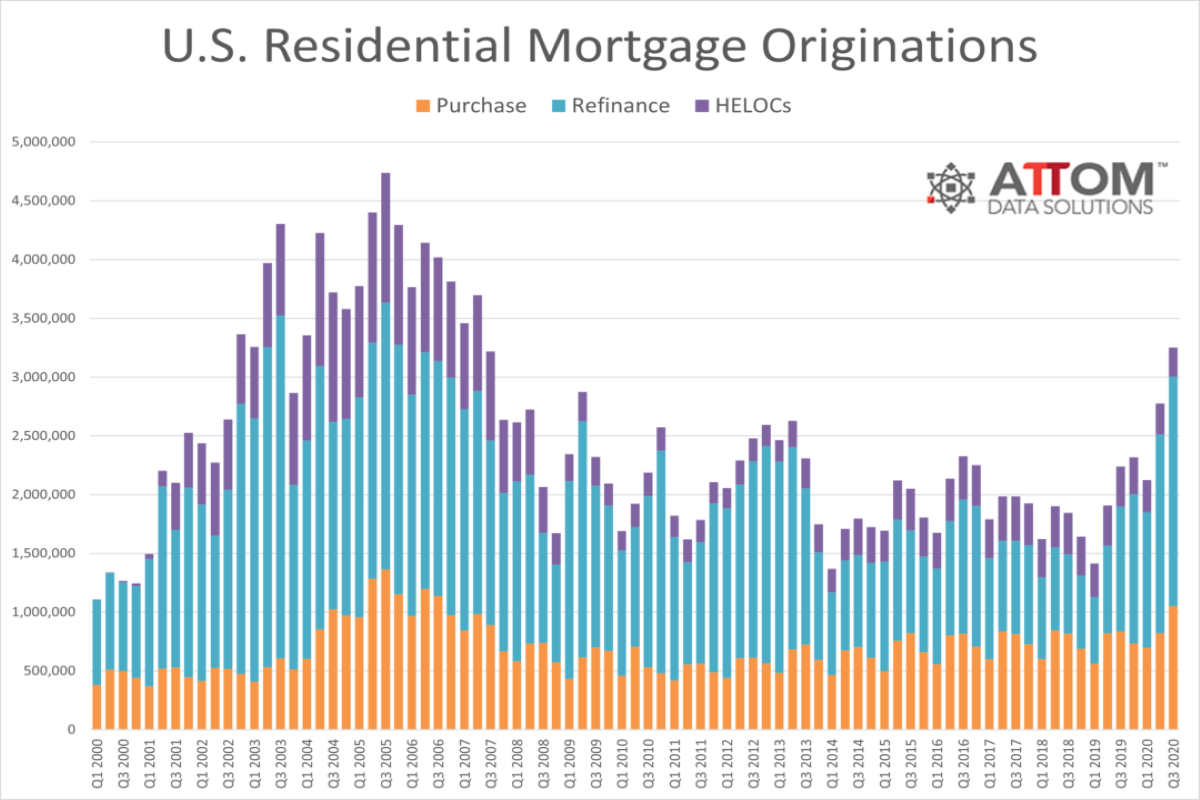

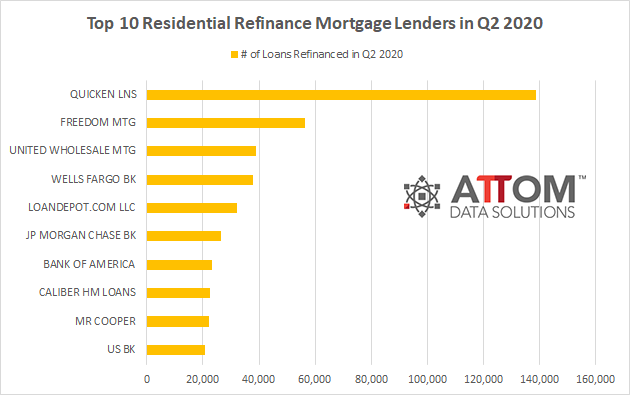

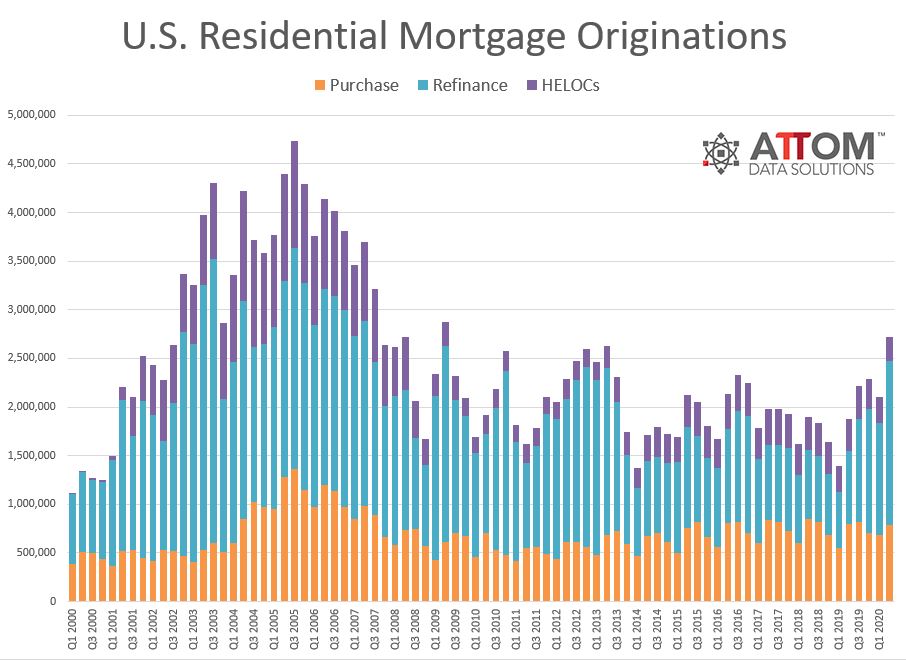

There were 1.69 million refinance mortgages secured by residential properties (1 to 4 units) in Q2 2020. That number is up almost 50 percent from Q1 2020 and more than 100 percent from Q2 2019, to the highest level in seven years. With interest rates hovering at historic lows of around 3 percent for a 30-year fixed-rate loan, refinance mortgages originated Q2 2020 represented an estimated $513 billion in total dollar volume.

1\.69 million refinance mortgages secured by residential properties (1 to 4 units) were originated in the second quarter of 2020 in the United States. That figure was up almost 50 percent from the prior quarter and more than 100 percent from the same period in 2019, to the highest level in seven years.

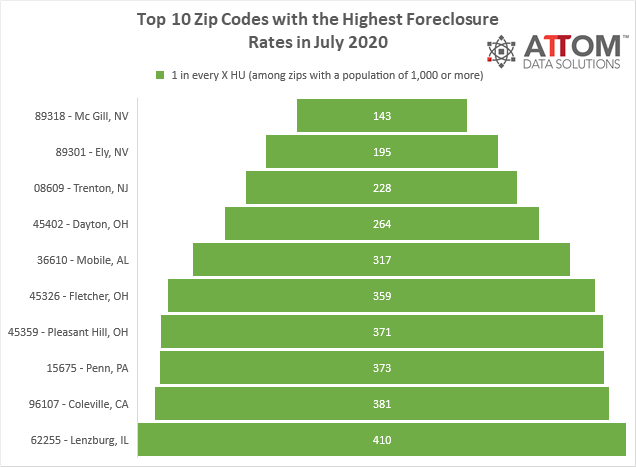

ATTOM Data Solutions’ newly released July 2020 U.S. Foreclosure Market Report shows that U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — are continuing a downward trend amid the Coronavirus pandemic, with 8,892 filings reported in July 2020. According to ATTOM’s latest foreclosure activity report, foreclosure filings in July 2020 are down four percent from June 2020 and 83 percent from July 2019.

There were a total of 8,892 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in July 2020, down four percent from a month ago and 83 percent from a year ago. “Even as mortgage delinquency rates climb, foreclosure activity continues to be artificially low due to moratoria put in place by the Federal and State governments,”