According to ATTOM Data Solutions’ just released Q2 2020 U.S. Residential Property Mortgage Origination Report, there were 1.69 million refinance mortgages secured by residential properties (1 to 4 units) in Q2 2020. The report revealed that number is up almost 50 percent from Q1 2020 and more than 100 percent from Q2 2019, to the highest level in seven years.

ATTOM’s most recent residential mortgage origination analysis reported that with interest rates hovering at historic lows of around 3 percent for a 30-year fixed-rate loan, refinance mortgages originated Q2 2020 represented an estimated $513 billion in total dollar volume. That number was up 130 percent Q2 2019, to the highest point in almost 17 years.

The report noted that refinance loans helped drive the total number of home loans in Q2 2020 up to 2.72 million, an 11-year high. Homeowners rolling over old mortgages into new ones accounted for 62 percent of all lending activity in Q2 2020, up from 54.5 percent of loans in Q1 2020 and from 39.6 percent in Q2 2019.

ATTOM’s Q2 2020 mortgage origination analysis also revealed that residential refinance mortgage originations increased from Q2 2019 to Q2 2020 in all but one of the 211 metro areas that had a population greater than 200,000 and at least 1,000 total loans. The number at least doubled in 158, or 74.9 percent, of those metro areas, led by Madison, WI (up 403.7 percent); Hilton Head, SC (up 358.7 percent); Charleston, SC (up 322.4 percent); Greenville, SC (up 321.8 percent) and Lincoln, NE (up 269.2 percent).

The Q2 2020 analysis noted that metro areas with at least 1 million people that saw refinance activity at least doubled, year over year, in Q2 2020 included Washington, DC (up 219.9 percent); Milwaukee, WI (up 213.1 percent); Austin, TX (up 211.9 percent); Raleigh, NC (up 205.3 percent) and Birmingham, AL (up 198.4 percent).

The report stated that Pittsburgh, PA was the only metro area where refinance mortgages decreased in Q2, measured year over year (down 5.7 percent), while those with the smallest annual increases were Lexington, KY (up 7.5 percent); Myrtle Beach, SC (up 8.6 percent); Syracuse, NY (up 22 percent) and Gulfport, MS (up 25.4 percent).

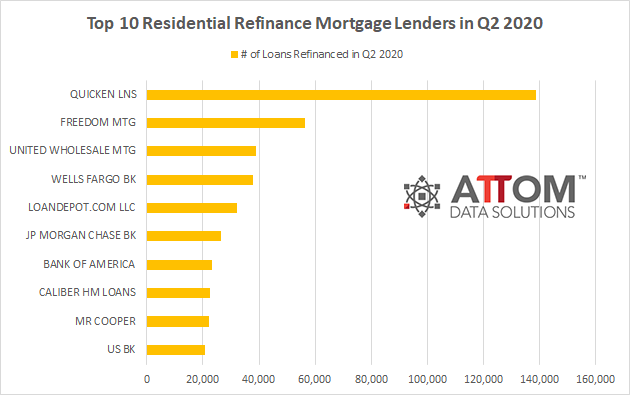

In this post, we take a deep dive into the data behind ATTOM’s Q2 2020 U.S. Residential Property Mortgage Origination Report to uncover the top 10 refinance mortgage lenders in the second quarter of 2020. Those lenders include: QUICKEN LNS (138,790 loans refinanced); FREEDOM MTG (56,413 loans refinanced); UNITED WHOLESALE MTG (39,024 loans refinanced); WELLS FARGO BK (37,877 loans refinanced); LOANDEPOT.COM LLC (32,110 loans refinanced); JP MORGAN CHASE BK (26,423 loans refinanced); BANK OF AMERICA (23,389 loans refinanced); CALIBER HM LOANS (22,371 loans refinanced); MR COOPER (22,305 loans refinanced); and US BK (20,847 loans refinanced).

ATTOM’s most recent residential property mortgage origination analysis also reported that while refinancing activity soared, purchase mortgage activity dropped to just 28.8 percent of all home loans in Q2 2020 and home equity lending or HELOCs declined to only 9.2 percent – the lowest levels in seven years.

The Q2 2020 analysis also mentioned that mortgages backed by the Federal Housing Administration (FHA) accounted for 248,544, or 9.1 percent of all residential property loans originated Q2 2020, down from 12.6 percent of all loans in Q1 2020 and 13.4 percent in Q2 2019, to the lowest level since the first quarter of 2008. While residential loans backed by the U.S. Department of Veterans Affairs (VA) accounted for 230,808 or 8.5 percent of all residential property loans originated in Q2 2020, down from 9.9 percent in Q1 2020, but up from 7.5 percent in Q2 2019.

The report noted that Q2 2020 U.S. property mortgage origination activity occurred as the worldwide Coronavirus pandemic swept across the U.S., stifling consumer spending and prompting untold numbers of potential home seekers abiding by social distancing recommendations to stay out of the housing market.

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.