As we prepare for a large swath of companies to report earnings in the next few weeks, LinkUp decided to take a look at jobs data to see if we could find an indication of what to expect. To start, we selected a handful of stocks whose 10 day average of active jobs have shown movement either up or down over the past 30 days.

Once regarded as one of the most highly valued unicorn companies, the last year has been a rough ride for co-working giant WeWork. In an interesting turn of events, Executive Chairman Marcelo Claure revealed in a recent interview that the long beleaguered company is on a faster track to profitability than once thought. Claure, the former Sprint CEO who joined WeWork’s parent company SoftBank in 2018, told the Financial Times that WeWork expects to be cash-flow positive in 2021, a first stop on the road to turning actual profits.

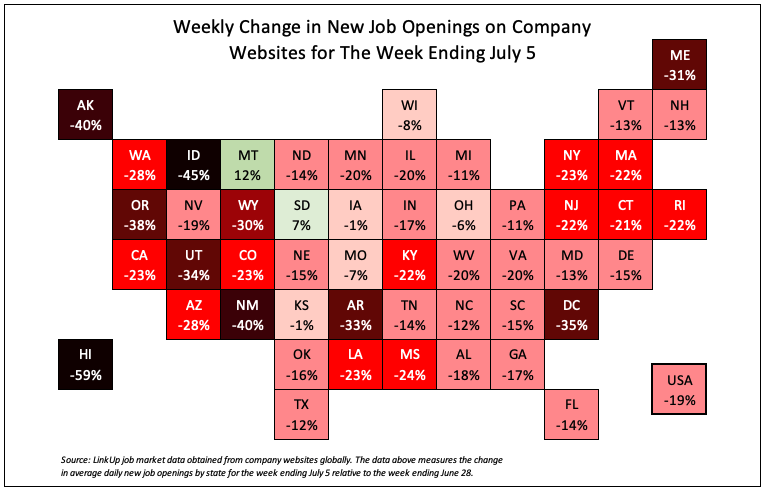

For the week ending July 5th, job openings on company websites dropped 19%, with declines in all but 2 states. It’s important to note that it was a holiday week and it’s not surprising that job openings would decline to some extent with people taking time off for the 4th. On the other hand, the horrific rise in COVID-19 cases in the U.S. in the past month or so, driven entirely by states that opened up way too fast without even the most basic, rational precautions like wearing masks, has resulted in states and businesses now closing things down.

What has returned to ‘normal’ in the U.S labor market is the fact that the trailing 30-day average of daily new and removed job listings on company websites throughout the country are now back in tandem with one another. And while the daily number of active job openings isn’t rising, new and removed jobs have risen steadily since May which provides some evidence that some portion of businesses have started or intend to start hiring again.

There has been a lot of recent news about large banks; the possibility of cutting dividends and generally not having the best looking balance sheets. As we near the end of June and the Federal Reserve’s annual stress tests on the biggest banks in the U.S. wrap up, investors are concerned about whether regulators will require dividend cuts. We decided to take a deeper look at this, hoping that recent job listings could shed some light on the direction large banks are heading.

Who needs cardio? Watching the trajectory of fitness companies since the advent of coronavirus is enough to get anyone’s heart rate up, no treadmill required. Unsurprisingly, the pandemic has been tough for the fitness business to navigate. On Monday, California-based 24 Hour Fitness filed for bankruptcy and announced plans to close 135 of its 445 locations.

It’s a powerful indication of the insanity plaguing the headlines these days that a global pandemic that has, so far, claimed over 100,000 lives in the U.S., put at least 40 million people out of work, driven unemployment to depression-era levels, decimated tens of thousands of businesses, and fundamentally transformed the world we live in could rightly drop from the front-pages.

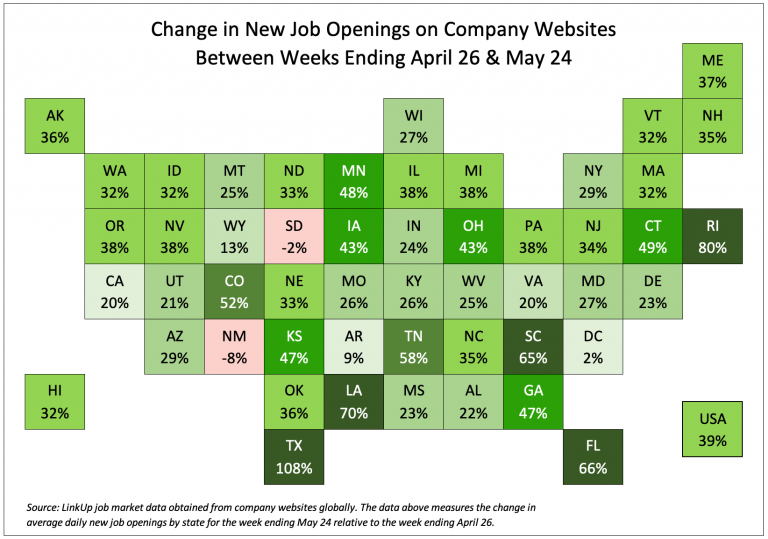

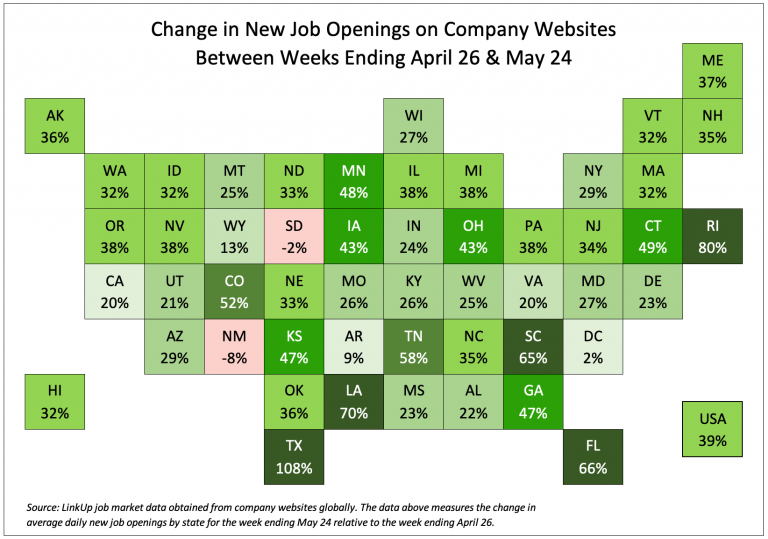

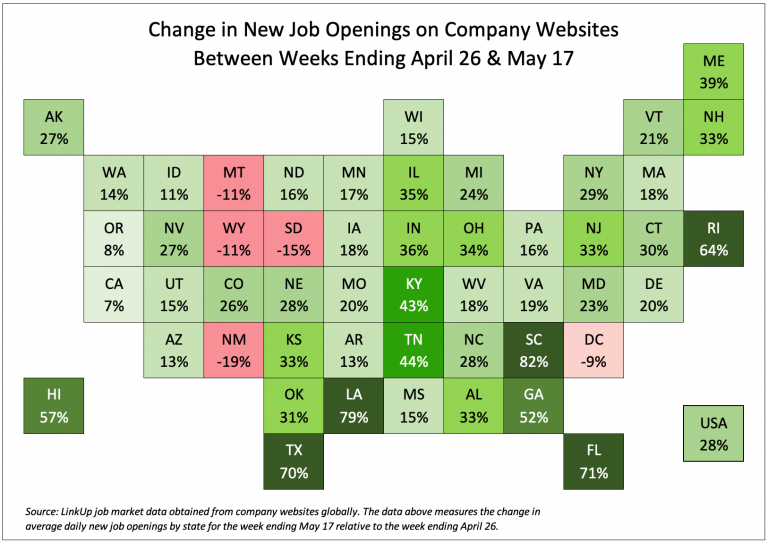

As we wrote last week, we’ve seen a relatively sharp increase in new job openings across most of the country since the end of April. Through May 17th, new job listings on company and employer websites throughout the country had risen 28% since the week ending April 26th with the largest increases in South Carolina, Louisiana, Florida, Texas, and Rhode Island.

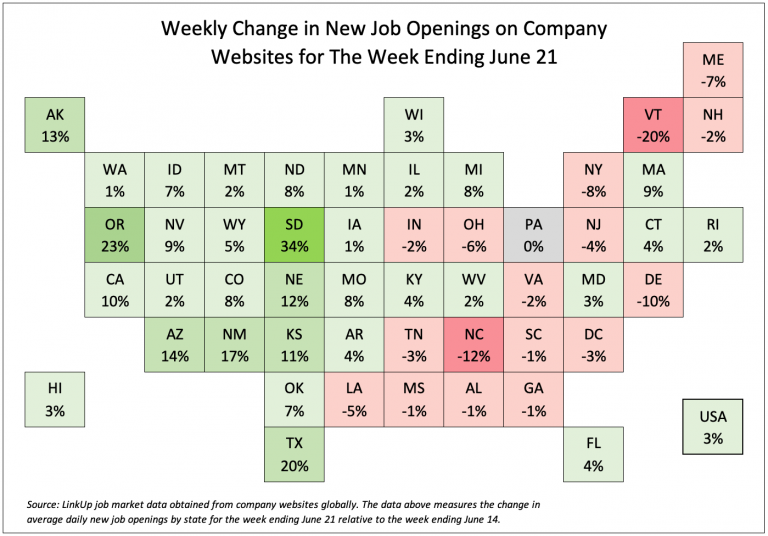

As states begin relaxing lockdown restrictions and opening up their economies, we are analyzing our job market data closely for indications of how quickly the labor market might recover at a local and national level.

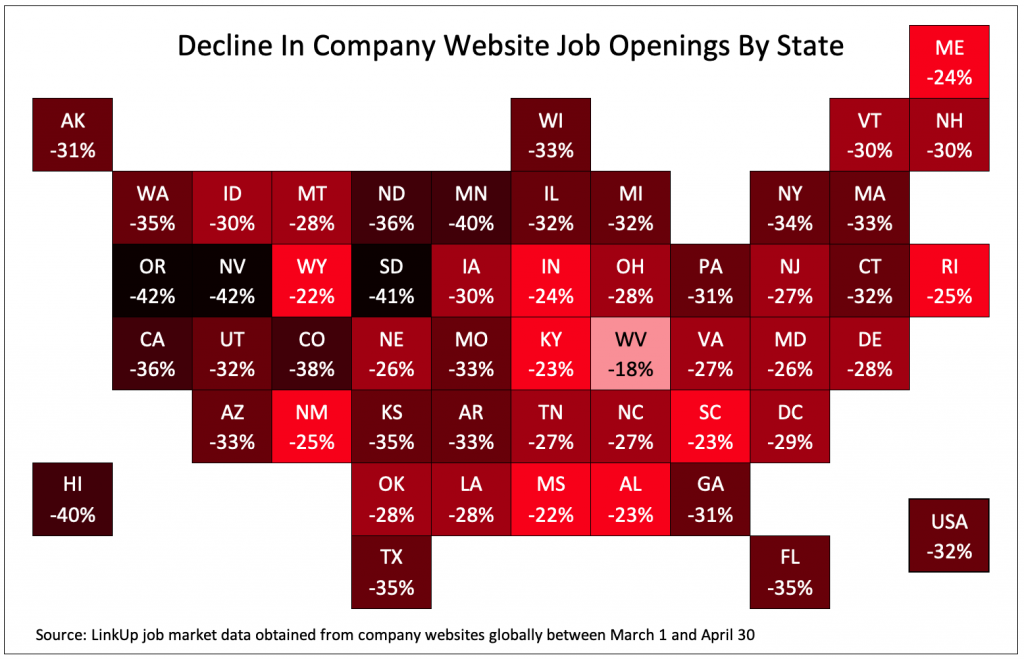

There are many data points that help to tell the story of the coronavirus pandemic. This week, we were particularly interested in what LinkUp data tells us about how states job counts are changing amid the pandemic, and whether there is a relationship between job counts at the state level and the number of confirmed COVID cases per county.

Looking at the monthly raw data in aggregate, total unique job listings in the U.S. fell 23% with new job openings falling 37% from March and removed job openings dropping 29%.