Mainland China hotel performance is steaming, while occupancy in the Asia Pacific region (excluding Mainland China) presents low occupancy levels overall. U.S. occupancy has remained mostly flat in recent weeks even with a lift from post-natural disaster demand. Recovery in Europe, Australia and New Zealand is also flattening.

Brazil, like many nations, has lifted COVID-19-related entry restrictions for travelers and provided an additional flow of demand for reopening hotels. However, reopening measures are determined on a state level. How has this affected Brazil’s recovery?

How does Europe compare to other regions in the recovery cycle? China hit a 69.4% occupancy level on 18 August, the highest level during the time of the pandemic. Since that date, however, China has started to fall back a bit. During the first weekend of September (4-6 September), the market posted 57.6%, 57.5% and 57.9% occupancy levels, respectively.

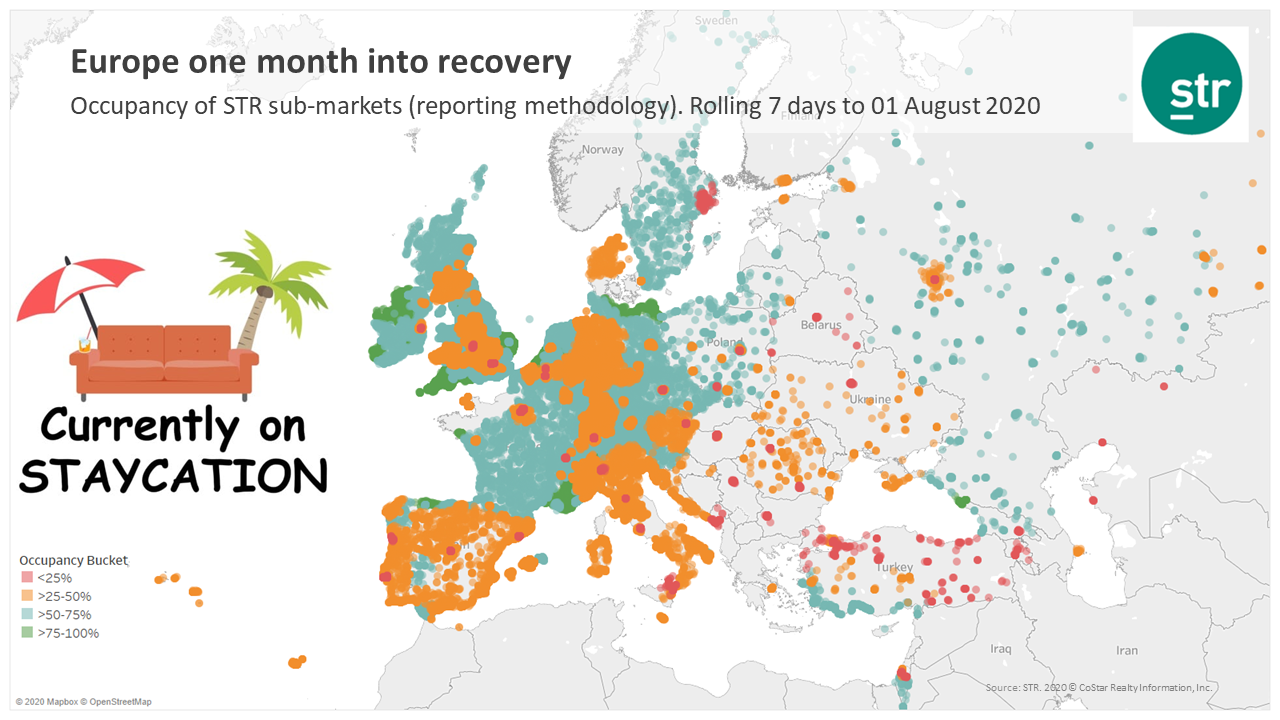

While Germany boasts the most open hotels in Europe, U.K. hotels are opening the fastest having started July with 70% of hotels closed and ending the month at just 20% hotels closed. European hotel occupancy is significantly healthier moving into August, with coastal markets in many countries experiencing the strongest recovery.

July and August are two of Europe’s most important months for hotels with travellers spread across the continent on summer holidays. However, it is no secret that summer looks much different this time around for Europe due to the global impact of the COVID-19 pandemic. Occupancy (for reporting hotels) for the week ending with 18 July shows that most European countries are somewhere between 20-40% in occupancy.

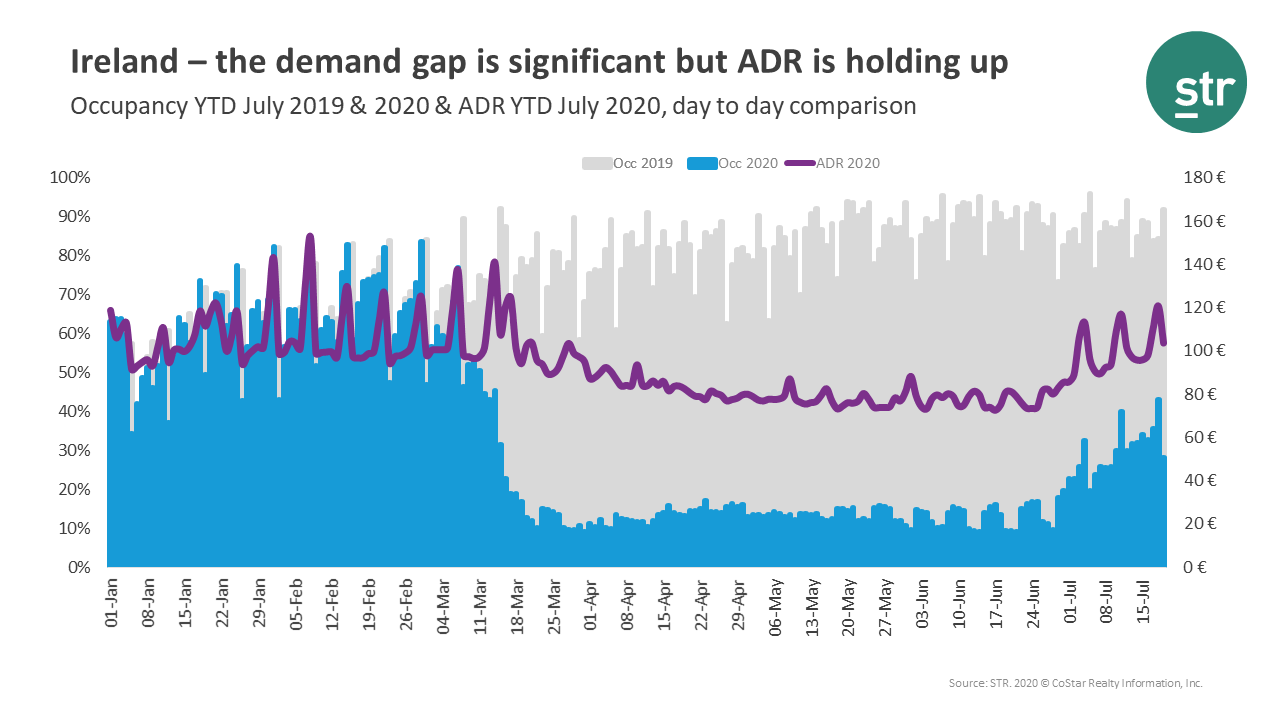

While ADR has declined since the end of 2019, the decline is modest compared to Ireland’s significant demand loss over the same period. Peaks in rate over the past few weeks indicate healthy weekend leisure travel.

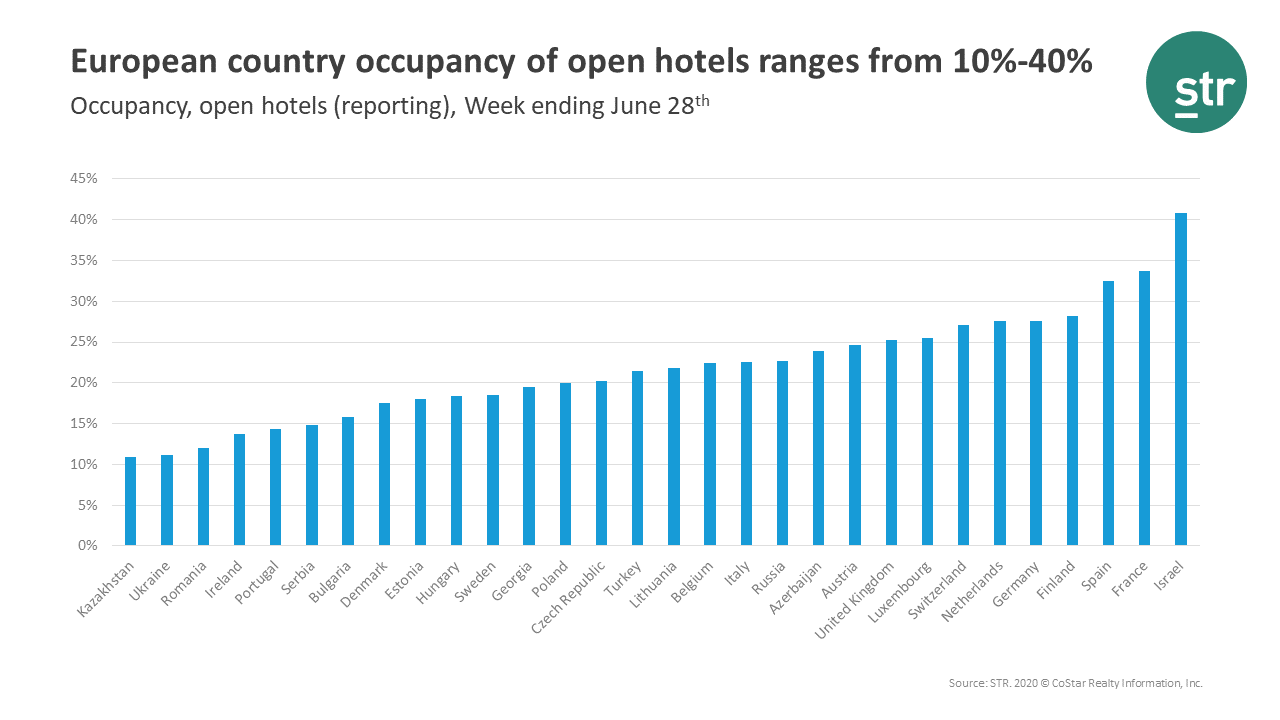

For the week ending 28 June, occupancy of open hotels in European countries ranged from 10%-40%. Among those countries, Israel posted the highest occupancy level (41%), followed closely by France (34%) and Spain (32%). Regional markets in Europe are leading the recovery while main cities have lagged. For example, Finland Provincial posted the country’s highest occupancy level (66%), while Helsinki occupancy was 23% for the week ending 28 June.

The COVID-19 pandemic has caused unprecedented challenges for global hospitality, with travel restrictions and lockdown measures forcing hotel closures and performance declines that exceed the levels witnessed during the global financial crisis and other challenging times for the industry. An area of the industry where the impact continues to evolve is business on the books, or reservations booked for future dates.

Although COVID-19 accelerated declines in occupancy since the beginning of March in Australia and Oceania, the region has started to see a progressive occupancy increase. Australia and New Zealand have seen spikes in occupancy during the weekends. New Zealand posted its highest occupancy level during the last weekend of March, while Australia reached its highest occupancy level during the first weekend of June.

Three months ago, China hit a 15% occupancy level, however, on 30 May, the market posted 47% occupancy followed by U.S (38%) and Middle East (38%). Europe occupancy, however, was just 15% on that same day.

STR data ending with 23 May showed another small rise from previous weeks in U.S. hotel performance. Year-over-year declines remained significant although not as severe as the levels recorded in April.

The majority of STR participating hotels are closed across Europe. As of 30 April, Barcelona showed the largest percentage of closures (96%), followed closely by Madrid (95%) and Athens (92%). Moscow and Saint Petersburg closures, however, were the lowest in Europe, at 15% and 19%, respectively.

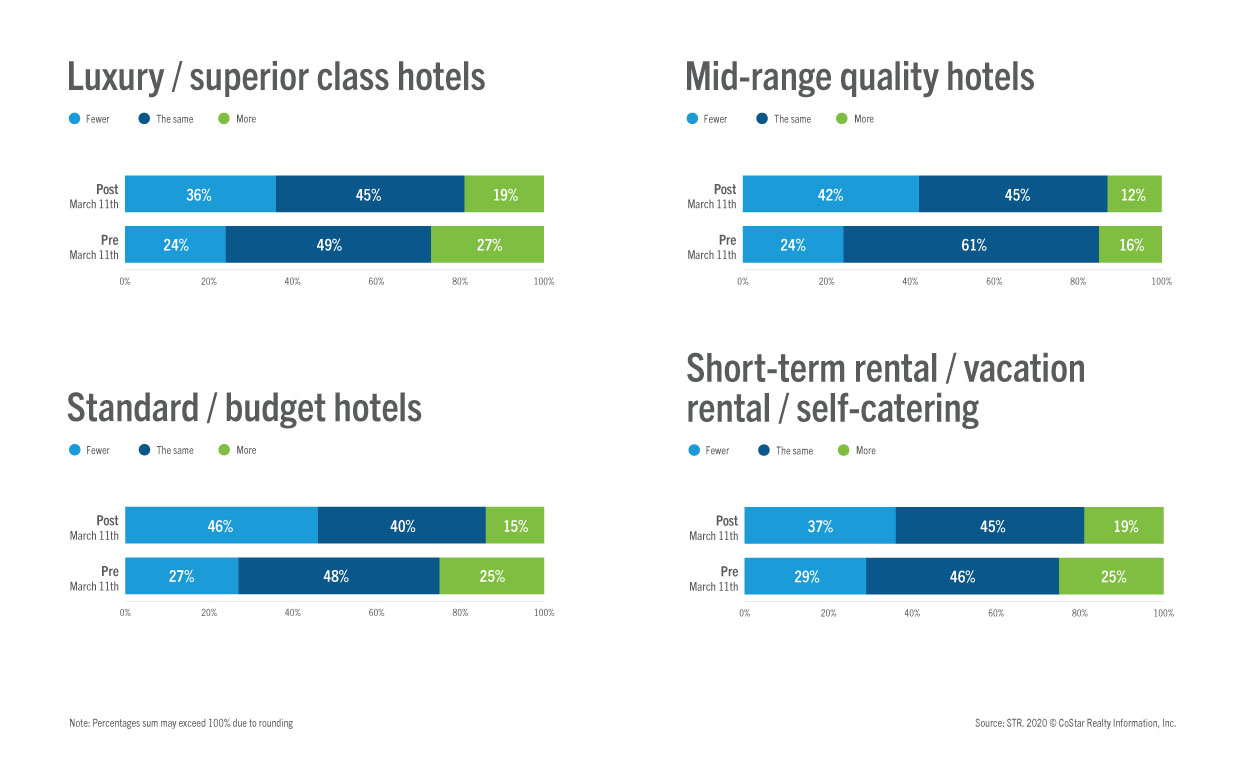

As the COVID-19 pandemic reshapes the world of travel, we investigated the impact on accommodation choices among international travellers. This piece builds on our analysis of propensity to travel in key English-speaking countries, in which we learned that desire for travel has declined but remains strong overall.

STR data for 3-9 May 2020 showed continued modest gains in U.S. hotel occupancy compared with previous weeks, but a similar level of year-over-year decline in the three key performance metrics.