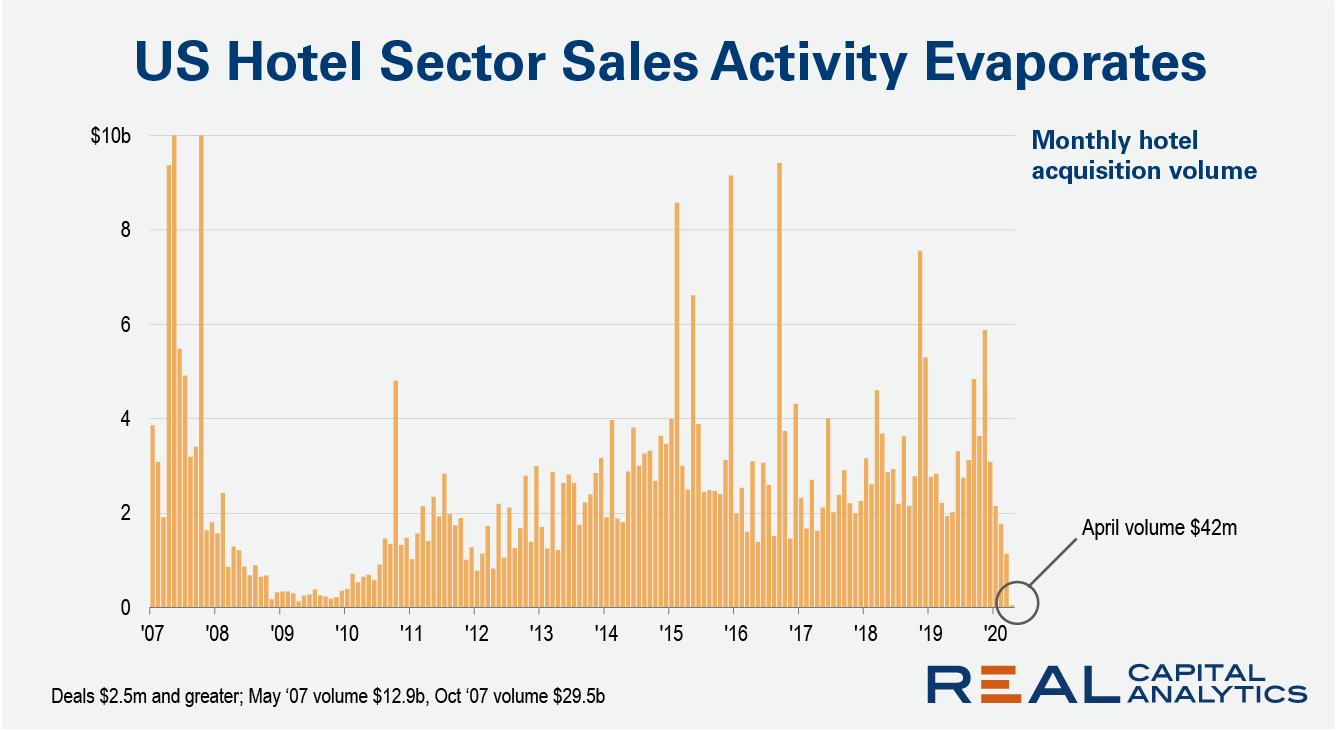

In the month of April fewer than 10 hotel properties changed hands across the entire U.S. We have never seen this level of illiquidity in the hotel market. It is effectively a frozen marketplace.

Hotel sector investment activity was already spinning downward even before the economic crisis wrought by Covid-19. A construction glut in key markets and challenges from upstarts such as Airbnb had put the sector under pressure.

The hotel market was more liquid even in the worst parts of the Global Financial Crisis. The previous low-water mark for sales volume was in April 2009, when deal activity fell to $127 million with 21 properties transacting. That slowdown came on the heels of months of slow, steady declines in the market. The current downturn is more striking because of the speed by which the market got there.

Deals that closed in April were focused on smaller assets. Six out of the eight hotels that traded had fewer than 100 rooms and only one full-service hotel transacted in the month.

Cap rates averaged 8.6% in April, flat from a year earlier. The small, eclectic sample of sales transactions for the month do not drive this figure; rather, the continuation of refinancing activity is providing some evidence of market pricing.

The refinancing data shows that lenders will still work with owners, with many more refinancing deals than purchases. Buyers and sellers are simply too far apart on their expectations of value and the market will remain frozen until both sides move.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.