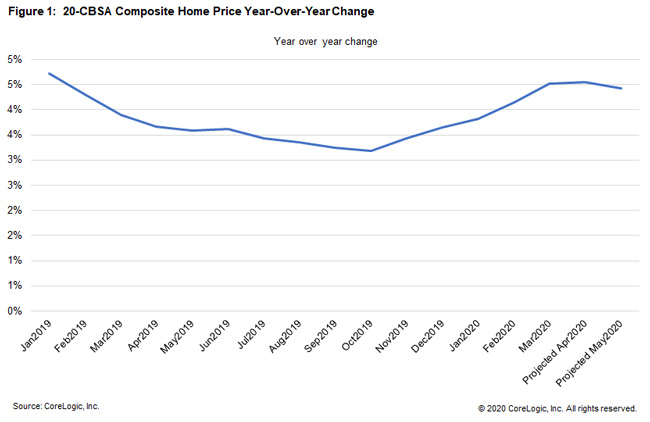

The newly released CoreLogic March Home Price Index (HPI) shows that prior to the COVID-19 outbreak home prices were starting to heat up in most places in the United States. However, home prices captured in the March report were from transactions negotiated prior to the implementation of shelter-in-place mandates, and there was a wide expectation that the growth may have decelerated in response to this interruption in demand.

CoreLogic has developed a Pending Price Index using MLS data. The index is built on the price recorded on the contract date rather than the price on the closing date. Since it generally takes 30-45 days to close a sale on average, contracts negotiated in April can be used to project May home prices, which will be the first time for us to see COVID-19’s full impact on the housing market as the April home prices will still have transactions negotiated in the first half of March prior to the implementation of shelter-in-place mandates. The latest CoreLogic Pending Index indicates that annual price growth began to slow in May. However, home prices held up surprisingly well in many metro areas.

The 20-CBSA composite Pending HPI year-over-year change came in at 4.4% in May, just slightly below what was reported by CoreLogic March HPI, 4.5%. It confirms the growth deceleration many analysts are expecting. It is also consistent with what CoreLogic HPI Forecast reported in March: HPI Forecast for U.S. goes from 4.5% in March to 4.4% in May.

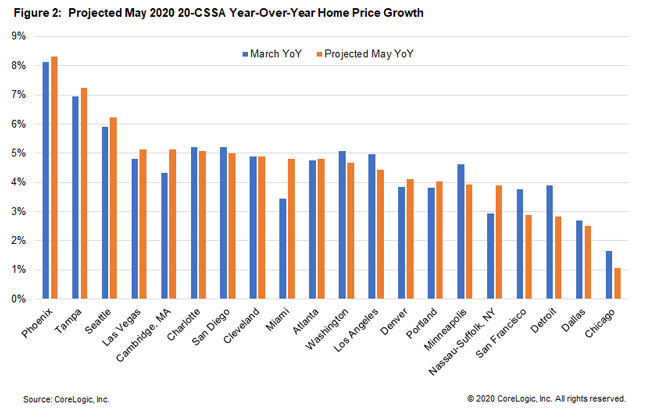

Among all 20 CBSAs included in the CoreLogic Pending Index, Phoenix leads the way with an 8.3% year-over-year growth in May, compared to a pre-Covid 8.1% year-over-year growth in March. The other two CBSAs from the Mountain region also show a 0.3% growth acceleration in May compared to March: Las Vegas has a projected 5.1% year-over-year growth in May and Denver has a projected year-over-year 4.1% growth in May. Home prices also hold up well in Seattle (6.2%), Portland (4.0%), Tampa (7.3%), and Miami (4.8%), all of which are projected continuous acceleration in the year-over-year change.

On the other hand, home prices in California were picking up pace and expected to have the best month in one year prior to COVID-19. However, the acceleration was interrupted in May by the pandemic and shelter-in-place orders. Los Angeles (4.4%), San Diego (5.0%) and San Francisco (3.8%) are all expected to have slightly slower home price growth in May. Home prices in the Midwest had plateaued since the second half of 2019 and were further softened by COVID-19 in May. Among all 20 CBSAs, Detroit is projected to have the largest home price deceleration in May (2.8% in May vs 3.9% in March). Evidently, it was hit hard by both COVID-19 and job loss in the auto industry.

The Northeast is the epicenter of COVID-19 in the United States. Yet both the Nassau-Suffolk, NY and Cambridge, MA metropolitan areas are expected to have a pickup in their annual home price gain in May. CoreLogic MLS data suggests higher-priced homes have been temporarily removed from listings. It may be that the Pending sales we observed in April had a higher proportion of lower-priced homes. Since lower-priced homes have been appreciating more rapidly than higher priced homes that may help account for some of the increase observed in some Northeast locales.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.