The drivers of the current downturn in the economy and commercial property markets are distinct from those which led to the Global Financial Crisis (GFC). This Covid-19 downturn came on suddenly, while warning bells were ringing a number of years ahead of the collapse of the housing market in the last recession. The variation in drivers could lead to a faster race to the bottom for market prices this cycle.

The founder of Real Capital Analytics noted recently that market cycles are usually defined by duration and magnitude. Duration, though, is a big unknown. Until the medical issues are addressed, nobody knows how long the weakness in property income will last nor how bad the long-term damage will be. Still, the magnitude of this downturn is becoming clearer given the pullback in market liquidity.

Sale prices are a function of the depth of the market. The more easily one can bring an asset to market and engage in a competitive bidding process, all other factors equal, one can achieve a higher sale price. The striking feature of this downturn is how quickly this depth has eroded.

There are a number of indicators one can use to measure liquidity and Real Capital Analytics combines these indicators into a composite score of liquidity for markets worldwide. One high-frequency indicator employed in this scoring system is the number of unique buyers active in the market and this metric for the U.S. is collapsing faster in this downturn than the last.

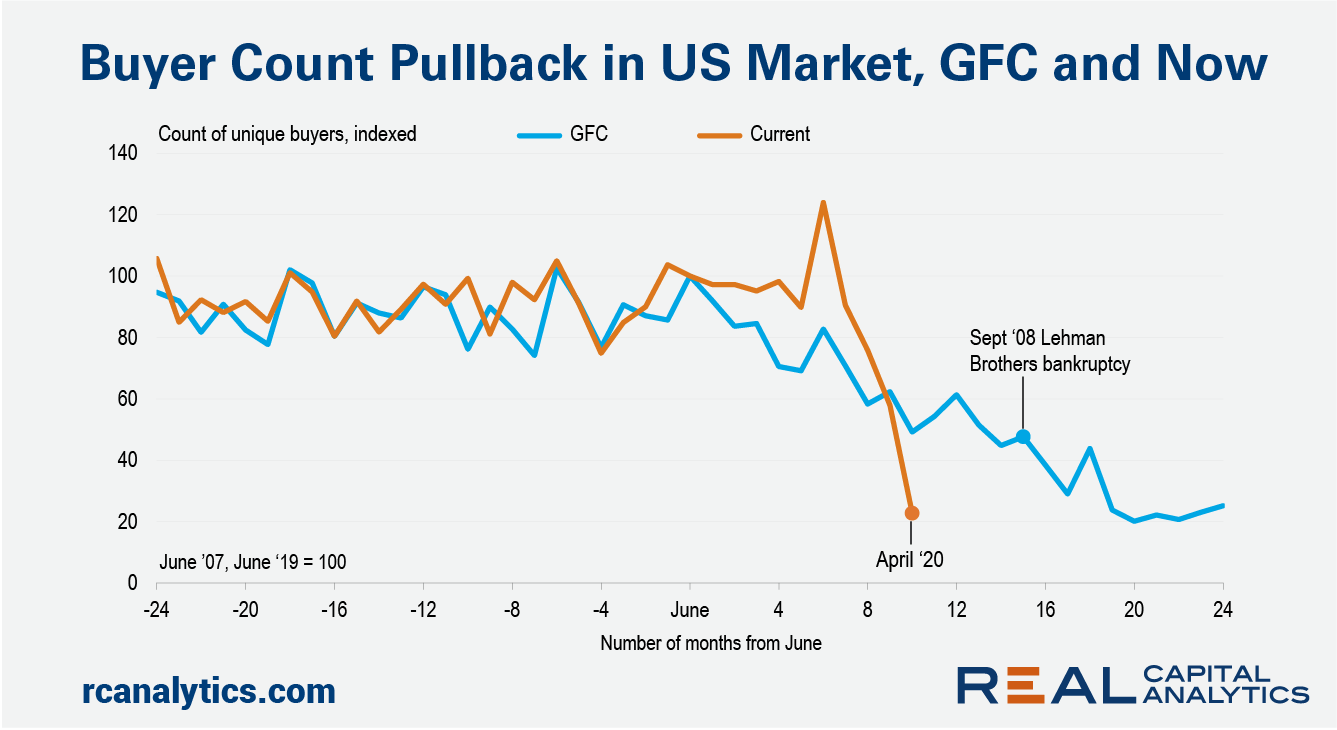

There are seasonal patterns in the number of unique buyers in the market just as there are seasonal patterns in sale activity. More transaction volume comes through in December of every year for instance. Accounting for these seasonal patterns by lining up the counts of the unique number of buyers in June 2007 vs. those for June 2019, we see that for each period, the two preceding years saw consistent moves in buyer depth.

In the following months, however, the buyer pool thinned slowly. Ten months on from June 2007, in April 2008, the buyer pool was 51% smaller. It was clear to many investors by mid-2007 that something was wrong with the market and a sense of caution built slowly. In April 2020, by contrast, the buyer pool was 77% smaller than it had been in mid-2019.

The September 2008 collapse of Lehman Brothers was a signature turning point for the GFC but the market hit a low point for the unique number of buyers five months later. The speed of the decline has been so intense this time that the market is at nearly the same level for the unique number of buyers as seen at the worst parts of the GFC. A drop in the size of the buyer pool that took nearly 20 months in the last cycle has been nearly achieved in 10 months in this downturn.

The buyer pool thus is shrinking faster in this downturn, with most of that decline seen in the last two months, but it does not mean that prices will fall more. Economic fundamentals, the status of property income and investor perceptions of risk will drive the ultimate floor for prices. Additionally, some aspect of the shrinking buyer pool is undoubtedly a feature of the fact that acquisition professionals cannot get on planes to visit with brokers and tour properties. Once travel and social distancing restrictions are lifted, some suppressed level of activity may rebound.

Still, when those buyers are back on the road they are not likely to be as optimistic as a year ago. The speed of the pullback in liquidity is likely to help investors find a floor for prices faster this cycle.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.