Key Takeaways

Recently, Quick Service Restaurants (QSRs) like Starbucks and Burger King made headlines following announcements that new protein-based meat items will be added to their breakfast menus—the latest moves in the ongoing QSR breakfast wars that Edison Trends previously reported on. The popularity of plant-based meat has quietly established itself as a mainstay across the restaurant and grocery industry—in fact, the plant-based meat industry is projected to reach $85 billion by 2030. Increased adoption of veganism stemming from environmental and health concerns is expected to further escalate the demand for plant-based products. And in the wake of the COVID-19 pandemic, consumers may also be hungry for more sustainable meat options for fears over any potential meat supply chain issues amidst Covid-19.

To understand how online consumer spending on plant-based meat foods at restaurants has changed during the COVID-19 pandemic, Edison Trends analyzed over 10,000 transactions.

How did online spend on plant-based meat alternative foods at restaurants change during the COVID-19 pandemic?

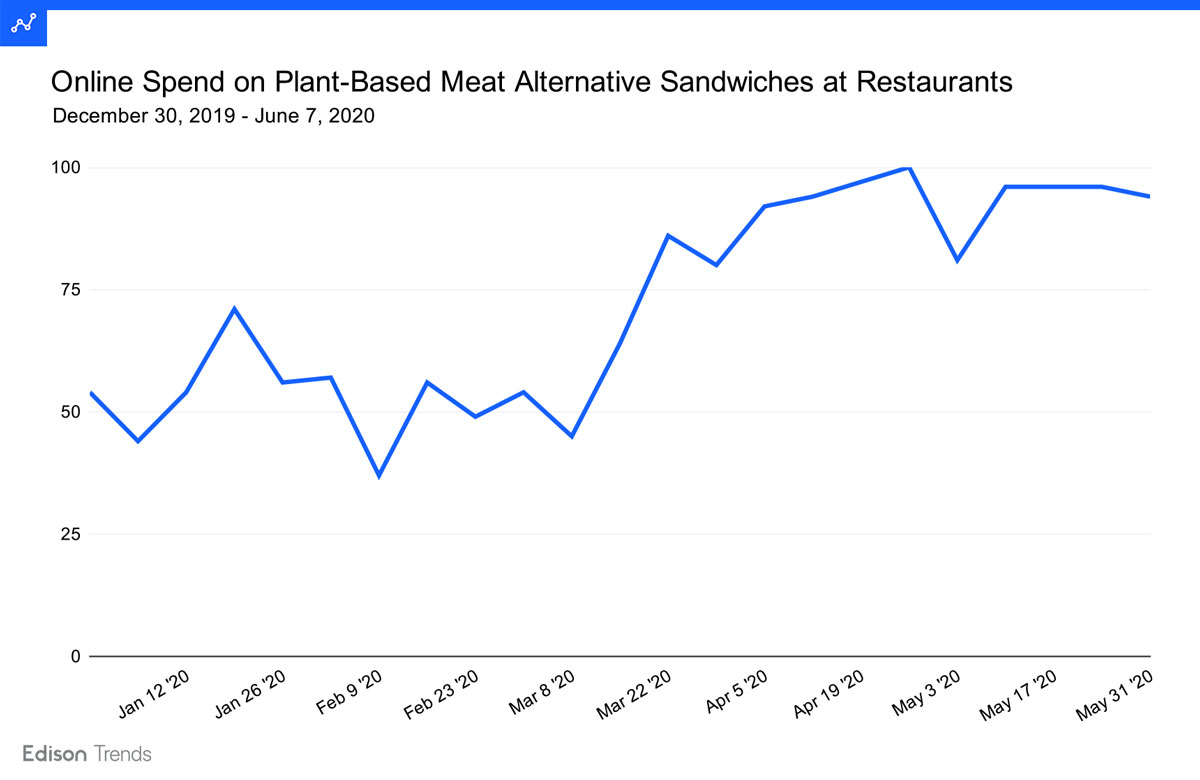

Figure 1: Chart shows estimated online spend on plant-based meat alternative sandwiches at restaurants, between December 30, 2019 and June 7, 2020, according to Edison Trends. This analysis was performed on over 4700 transactions from UberEats, Doordash (including Caviar), and Grubhub (including Seamless, Eat24, Yep, Order Up, and Tapingo), as well as restaurant ordering platforms such as OLO and transactions through websites such as Subway.com. The analysis examined products from Beyond Meat, Impossible Foods, Boca, Yves Veggie Cuisine, Field Roast, Gardein, Lightlife, MorningStar Farms, Quorn, Sweet Earth, Tofurky, Raised & Rooted, Uptons Naturals, Oumph, Abbot’s Butcher, and VBites/VegiDeli.

Online spending on plant-based meat alternative sandwiches has climbed in recent months, jumping 64% between the week of March 9 and that of March 23. In the 11 weeks since then, spending on such products has remained, on average, 72% higher than it was during the previous 11 weeks.

Which restaurants lead in selling plant-based meat-alternative food online?

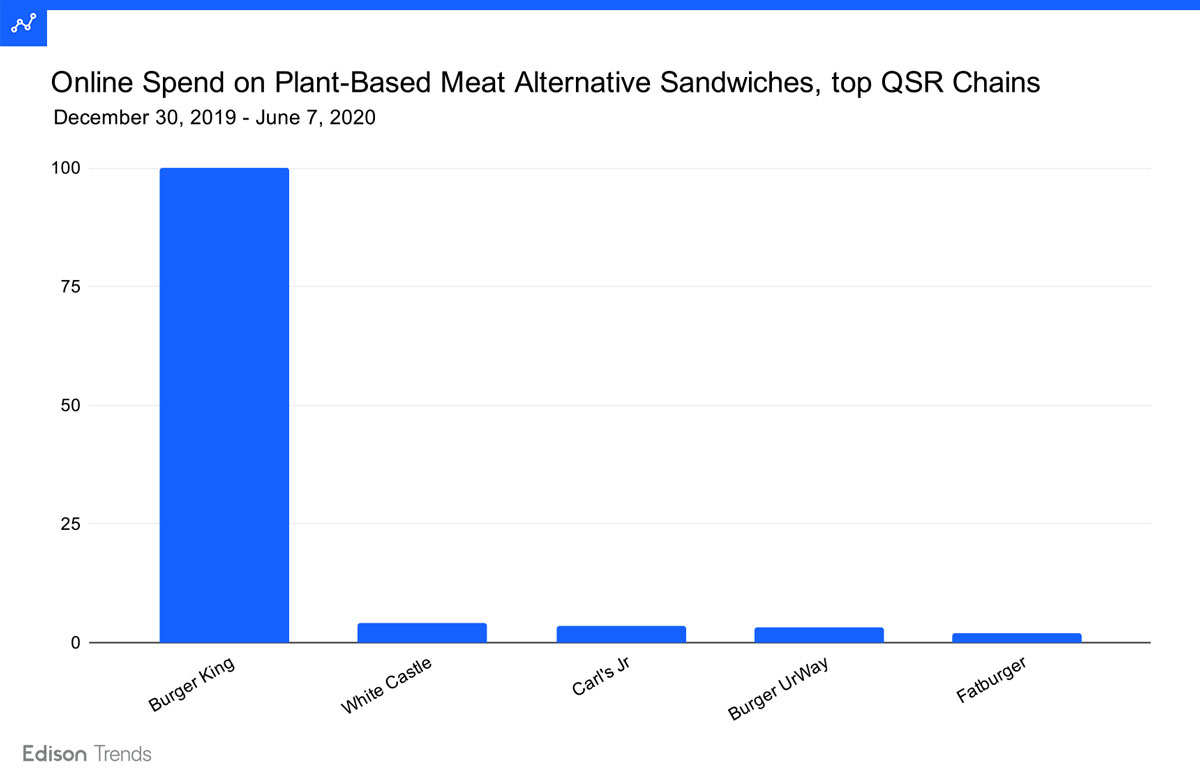

Figure 2: Chart shows estimated online spend on plant-based meat alternative sandwiches at top QSR chains, between December 30, 2019 - June 7, 2020, according to Edison Trends. This analysis was performed on over 3700 transactions from UberEats, Doordash (including Caviar), and Grubhub (including Seamless, Eat24, Yep, Order Up, and Tapingo), as well as restaurant ordering platforms such as OLO and transactions through websites such as Subway.com. The analysis examined products from Beyond Meat, Impossible Foods, Boca, Yves Veggie Cuisine, Field Roast, Gardein, Lightlife, MorningStar Farms, Quorn, Sweet Earth, Tofurky, Raised & Rooted, Uptons Naturals, Oumph, Abbot’s Butcher, and VBites/VegiDeli.

Looking at the top QSR restaurants for plant-based meat sandwich spending in online orders, Burger King takes a clear lead, vastly outselling any other QSR chain. White Castle and Carl’s Jr are next, each with about 4% of Burger King’s customer spending on such sandwiches; then come Burger UrWay and Fatburger, with 3% and 2% of Burger King’s figure, respectively.

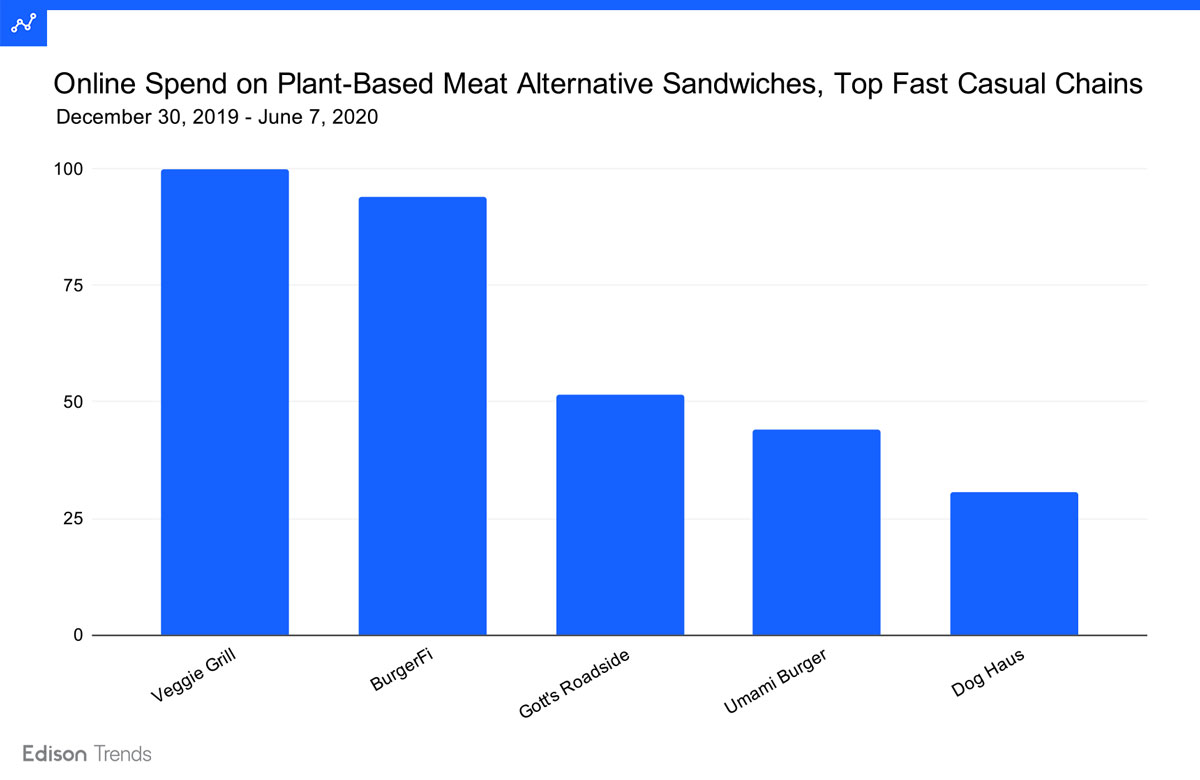

Figure 3: Chart shows estimated online spend on plant-based meat alternative sandwiches at top fast casual restaurant chains, between December 30, 2019 - June 7, 2020, according to Edison Trends. This analysis was performed on over 800 transactions from UberEats, Doordash (including Caviar), and Grubhub (including Seamless, Eat24, Yep, Order Up, and Tapingo), as well as restaurant ordering platforms such as OLO and transactions through websites such as Subway.com. The analysis examined products from Beyond Meat, Impossible Foods, Boca, Yves Veggie Cuisine, Field Roast, Gardein, Lightlife, MorningStar Farms, Quorn, Sweet Earth, Tofurky, Raised & Rooted, Uptons Naturals, Oumph, Abbot’s Butcher, and VBites/VegiDeli.

Veggie Grill is the top fast casual restaurant when it comes to customer spending on plant-based meat sandwiches through online orders. At Burger Fi, their next-nearest competitor, customers spent 94% of what Veggie Grill customers spent on such items. Gott’s Roadside was third, with 52% of Veggie Grill’s figure, and then Umami Burger at 44% and Dog Haus at 31%

To learn more about the data behind this article and what Edison Trends has to offer, visit https://trends.edison.tech/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.