Key Takeaways

A Quick Review

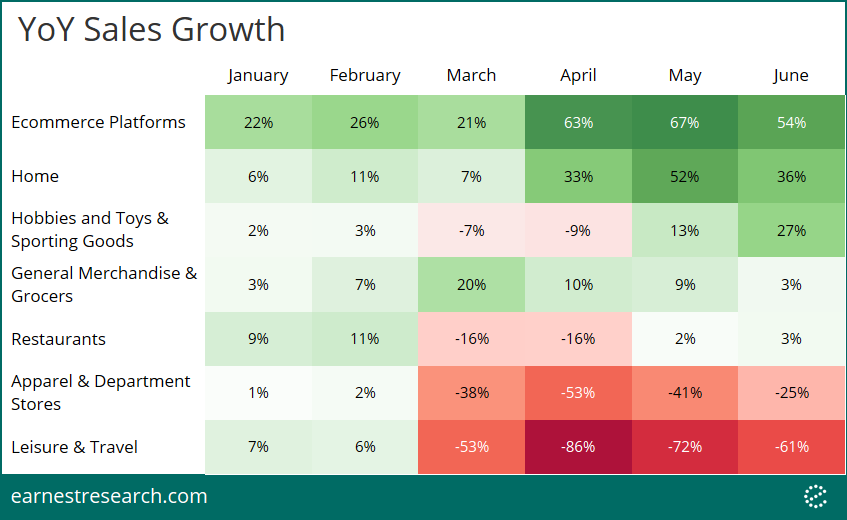

It’s been a wild ride of consumer spending through the first half of 2020. The story can be summed up as follows: Ecommerce Platforms flew high, ‘essential’ General Merchandise and Grocers spiked and sustained growth, stay-at-home, Hobby and Toy companies outperformed, while ‘non-essential’ Restaurants, Apparel, and Department Stores struggled and high-risk Leisure and Travel sectors halted.

By June, with stay-at-home orders mostly expired, spending started along the road to recovery, mostly manifested in Restaurants, General Merchandise, and Grocers returning to relatively normal growth profiles of low single-digits.

Now, with the virus resurging across parts of the US at rates that exceed the March onset, will consumers return to lockdown behavior or continue on the path toward normalization?

A Tale of Two Peaks

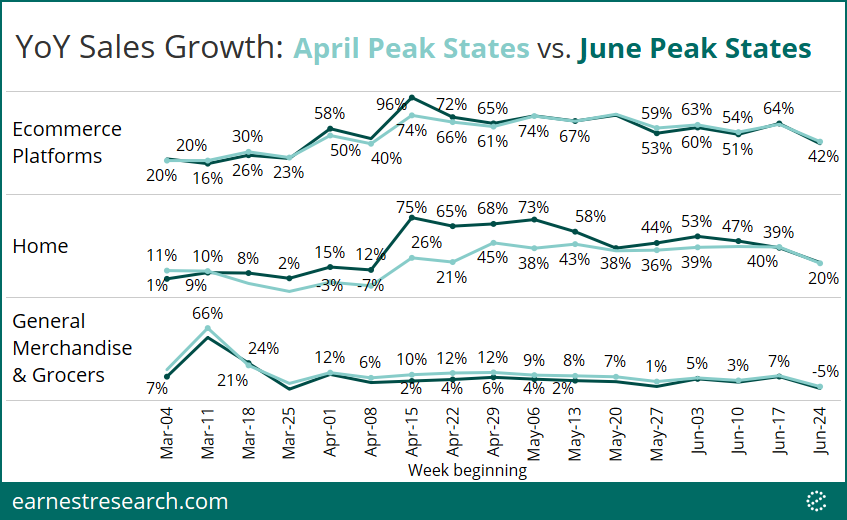

Spending has materially slowed in the last week of June, particularly in the sectors most associated with lockdown-driven spending. Ecommerce and Home categories slowed 20 points WoW, and General Merchandise/Grocers slowed 10 points to a 5% YoY decline.

Is this slowdown happening even in states that are experiencing an uptick in Covid cases? We’ve isolated eight states that experienced the highest coronavirus cases per capita into two groups: those that saw daily new reported cases peak in June vs. those that peaked in April. Arizona, Florida, South Carolina, and Texas saw their cases peak in the last week of June (data* as of June 30); April peak states include New York, New Jersey, Massachusetts, and Connecticut.

Despite increased Covid cases in the June peak states, we don’t currently see increased spending compared to the April peak states in the sectors most associated with lockdown spending behavior: Ecommerce, Home, General Merchandise, and Grocers.

April peak states include: New York, New Jersey, Massachusetts, and Connecticut

June peak states include: Arizona, Florida, South Carolina, and Texas

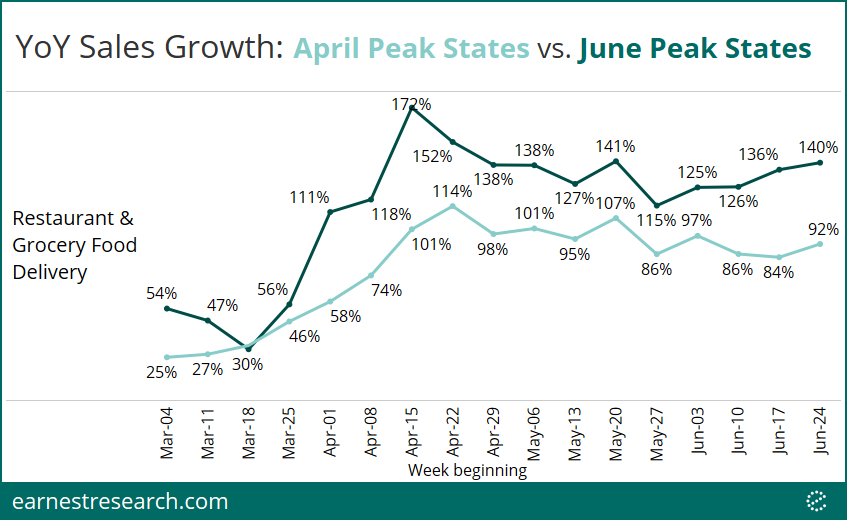

Food Delivery’s outperformance in the June peak states is an exception, however; while associated with lockdown behavior, this appears to be a continuation of prior weeks, and is therefore perhaps more regional rather than rising Covid related outperformance.

April peak states include: New York, New Jersey, Massachusetts, and Connecticut

June peak states include: Arizona, Florida, South Carolina, and Texas

Additionally, with stay-at-home orders expired by 5/15 in the June peak states (vs. 6/5 for the April peak states), the Apparel, Department Store, and Restaurant (excl. delivery) sectors saw a relatively quick return to just under their normal growth levels by early June. However, while the April peak states continue to climb, the June peak ones have paused or reversed course in the last two weeks. We anticipate this reversal to continue considering the recently announced state-required restaurant closures in many of these states.

April peak states include: New York, New Jersey, Massachusetts, and Connecticut

June peak states include: Arizona, Florida, South Carolina, and Texas

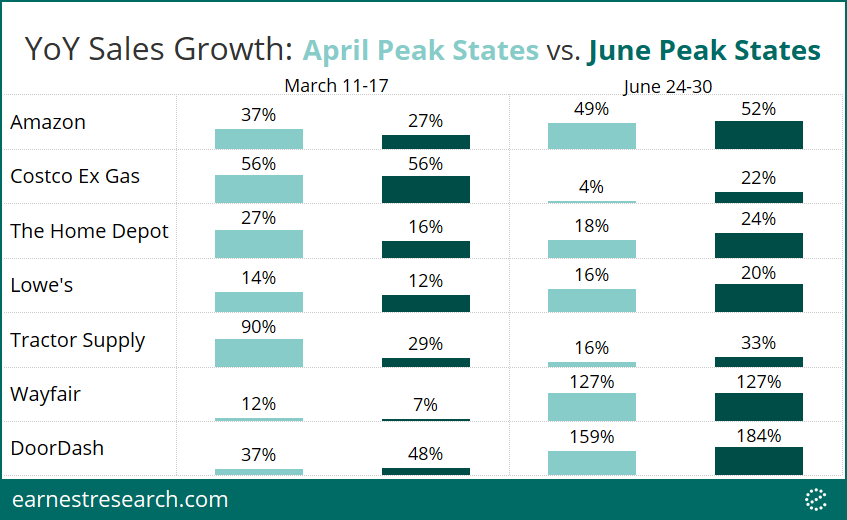

Lockdown Mirrors

There are hints of a lockdown spending behavior occurring in the June peak states.

A handful of large merchants experienced late June consumer behavior that mirror lockdown spending patterns in mid-March. Amazon and Costco saw outperformance back in March and it appears this trend is recurring in late June in the affected states. Home Depot and Lowe’s saw the June peak states outperform, as did Tractor Supply, mirroring the outperformance that the April peak states saw in mid-March. Wayfair and Doordash saw significant growth in the last week of June as well.

April peak states include: New York, New Jersey, Massachusetts, and Connecticut

June peak states include: Arizona, Florida, South Carolina, and Texas

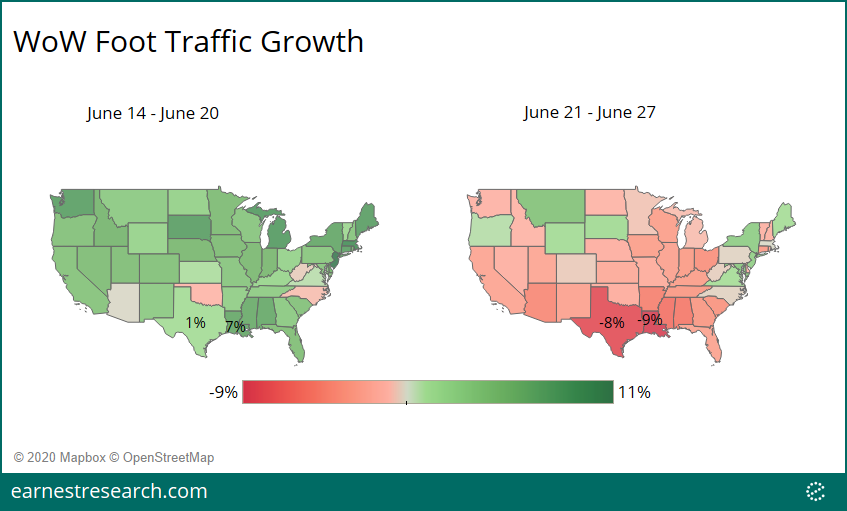

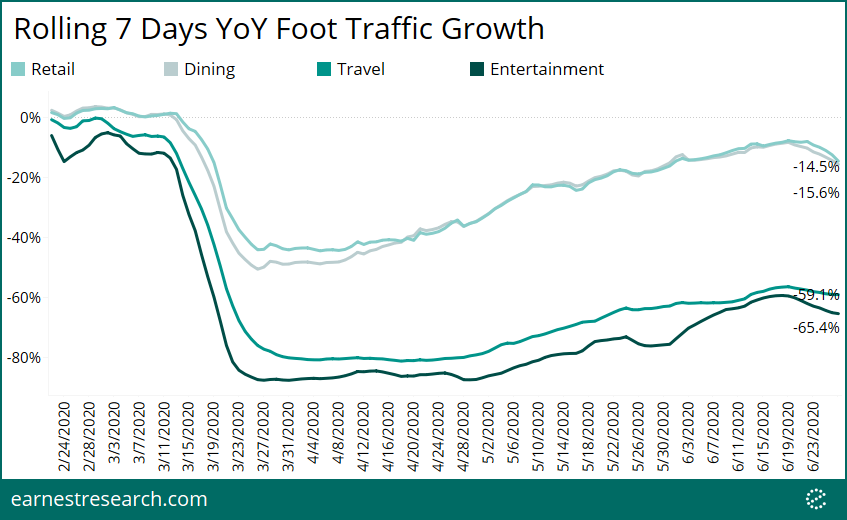

Foot Traffic Indicates Consumer Hesitancy in New Hot Spots

For a broad measure of in-person consumer activity, we analyzed foot traffic patterns across sectors including dining, retail, entertainment, and travel. The week ending June 27th saw the first WoW decline in thirteen weeks and the first fall back in YoY growth in ten weeks. The drops were led by Louisiana and Texas, but were largely seen across much of the South and Midwest. On a YoY basis, Texas fell from -14% in the week ending June 20th, to -22% in the week ending June 27th, and Louisiana saw a similar drop.

In the states seeing the largest declines (TX, FL, AL, LA), all sectors were impacted, but retail and dining saw the most acute drops on a rolling 7 day YoY basis, falling from a recent peak of roughly -8% to -16% as of June 27.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.