Starbucks and Dunkin’ Donuts are two of the most well-known and well-loved brands in the country. And while they were hit hard by the pandemic, recovery is underway for both.

Starbucks & Dunkin’ Rounding Into Form

The shutdown meant more than closed stores and work from home, it represented a fundamental shift in the normal patterns of behavior for most people in the country. And few brands witnessed the impact of this change more than Starbucks and Dunkin’ Donuts. With a clear orientation to coffee and breakfast, the breakdown of normal morning routines, whether work commutes, trips to or from school, all impacted the performance of these brands. And this combined with the more acute impact on major cities alongside closed locations clearly limited reach during the period.

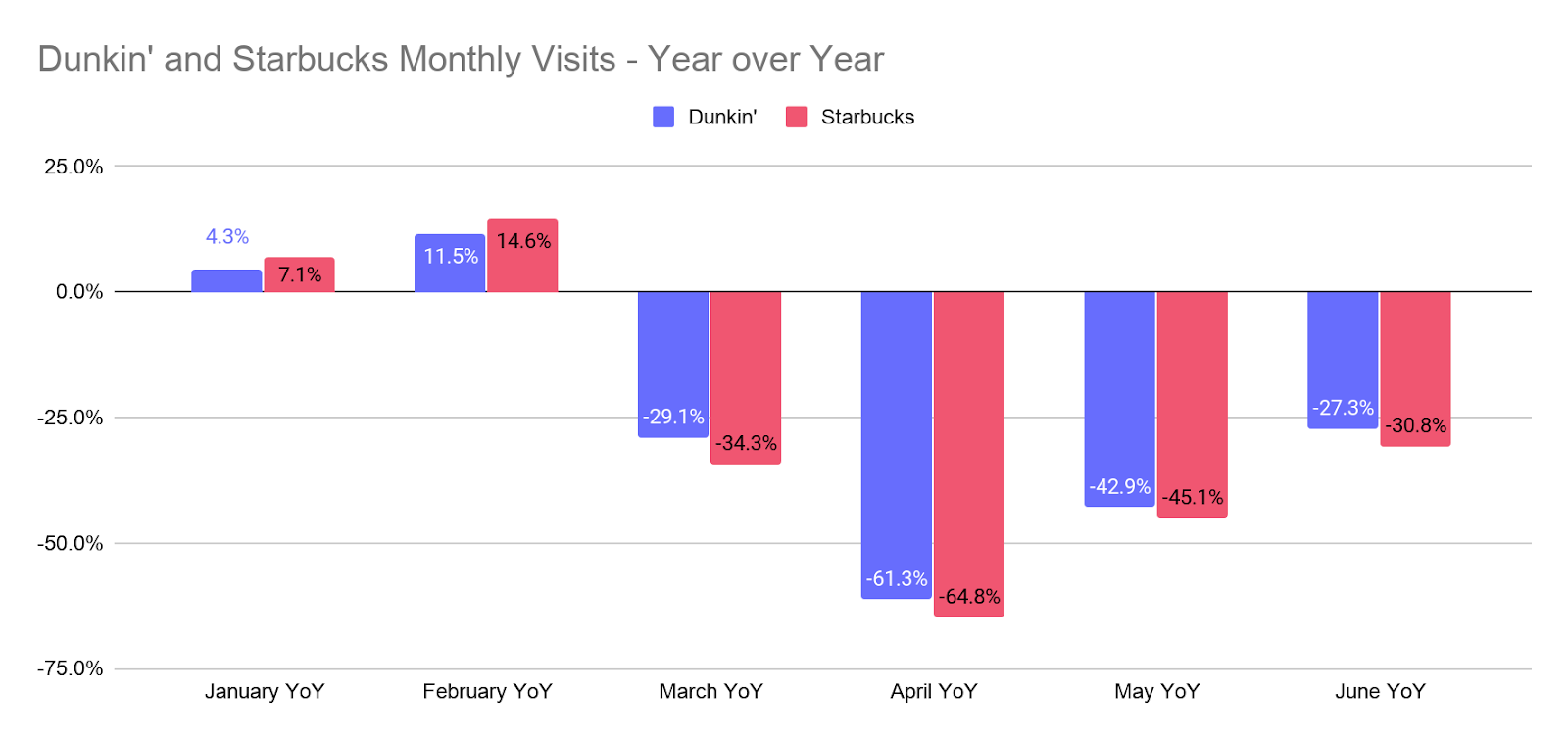

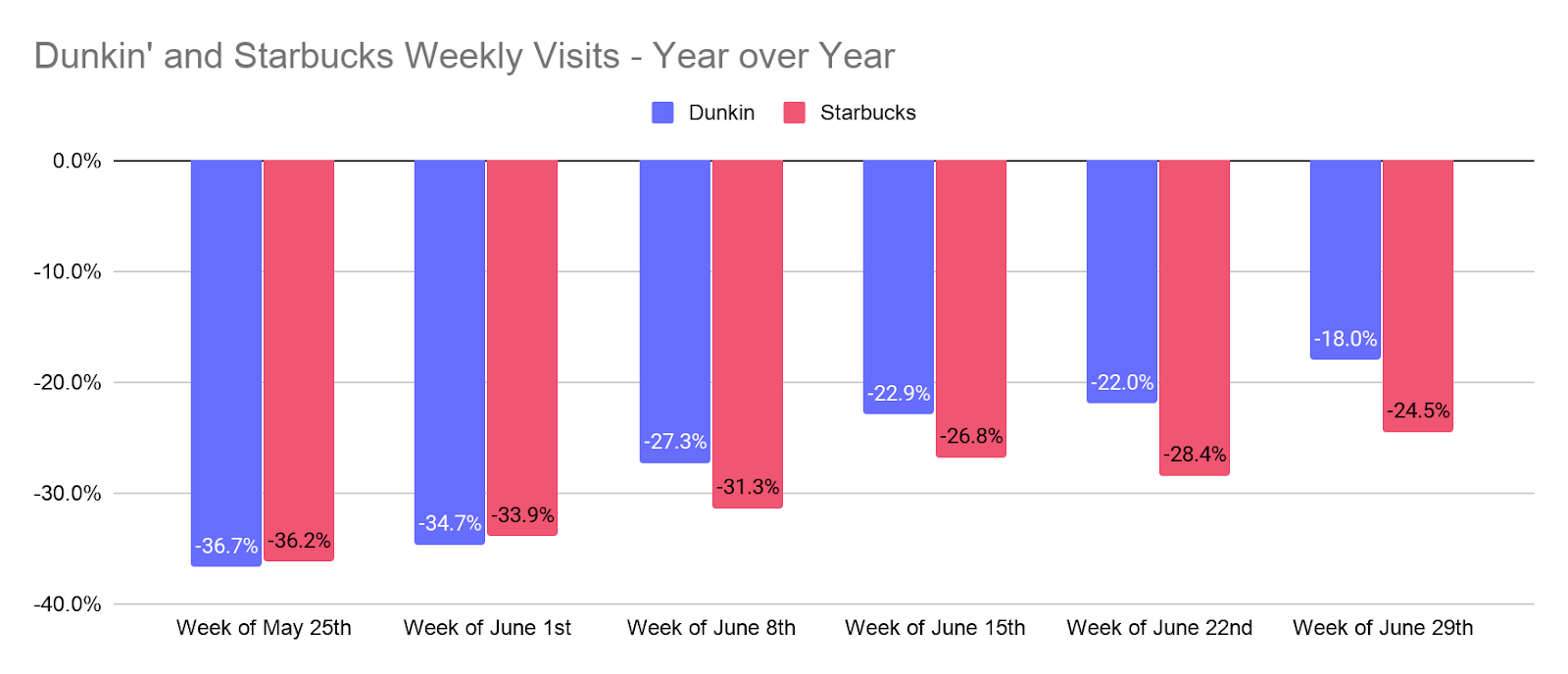

Yet, the recovery does seem to be kicking in for both. Visits in June were down 27.3% for Dunkin’ and 30.8% for Starbucks year over year, a massive leap forward from May when visits were down 42.9% and 45.1% year over year respectively.

And critically, the pace of return has been picking up. The week of June 29th was the best week for in-store visits for either brand since COVID began impacting retail in March, and this was during a week where July 4th clearly suppressed weekend traffic.

Shifts in Behavior

And while lockdowns certainly mattered, the ramifications do seem to center around this break from the daily routines. In May and June 2019, 9.2% of Starbucks visitors came straight from work, while 9.1% went to work directly after a Starbucks visit. These numbers dropped to 5.0% and 5.8% respectively in May and June 2020. For Dunkin’, the shift was equally dramatic with 7.8% of May and June visitors in 2019 coming from work and 10.1% going to work immediately after a visit. These numbers dropped to 4.8% and 6.2% respectively in the same months in 2020. These patterns also held true for visits after a school visit, indicating likely post-drop off declines.

The Magic Metric – Morning Visits?

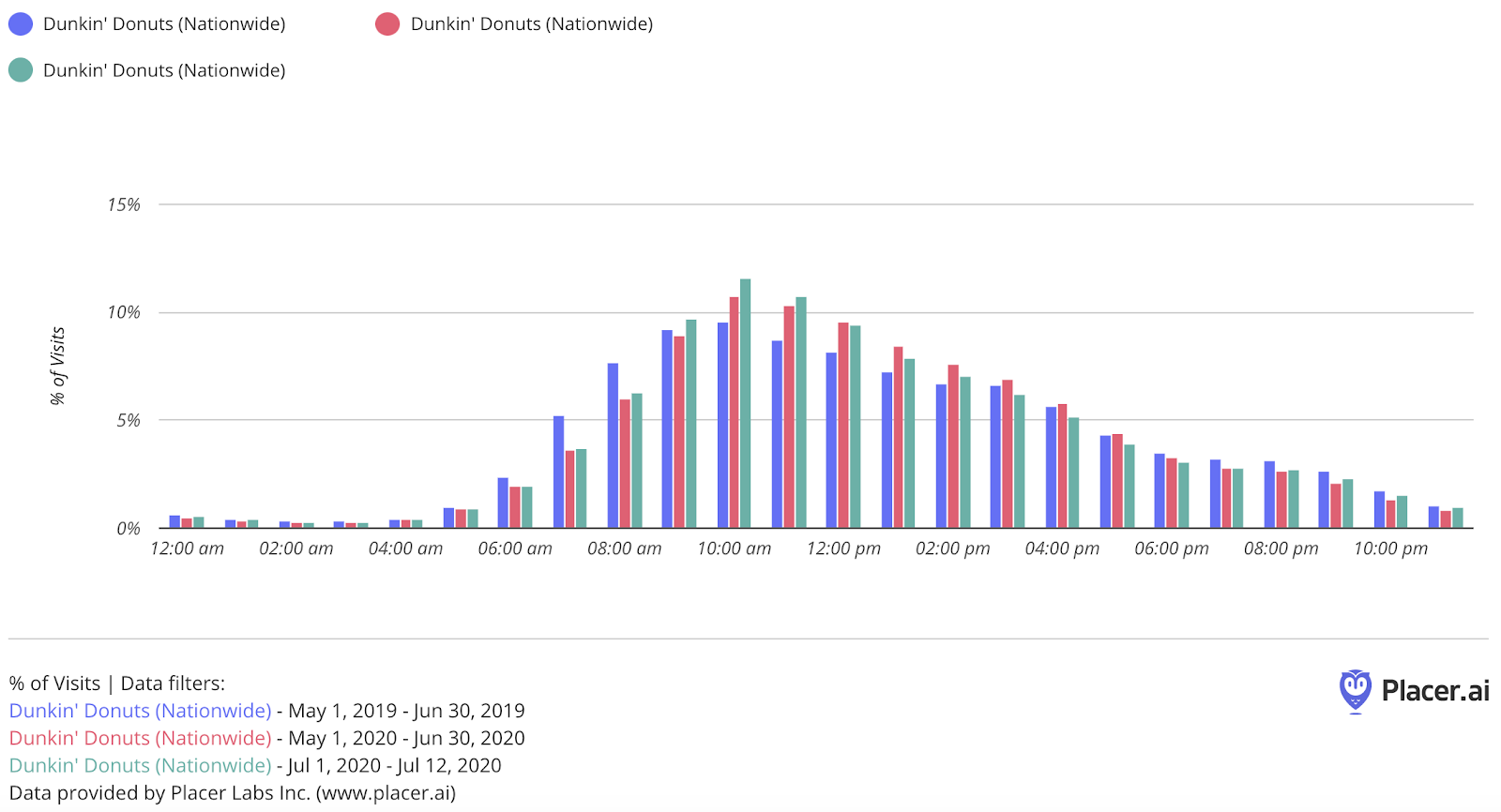

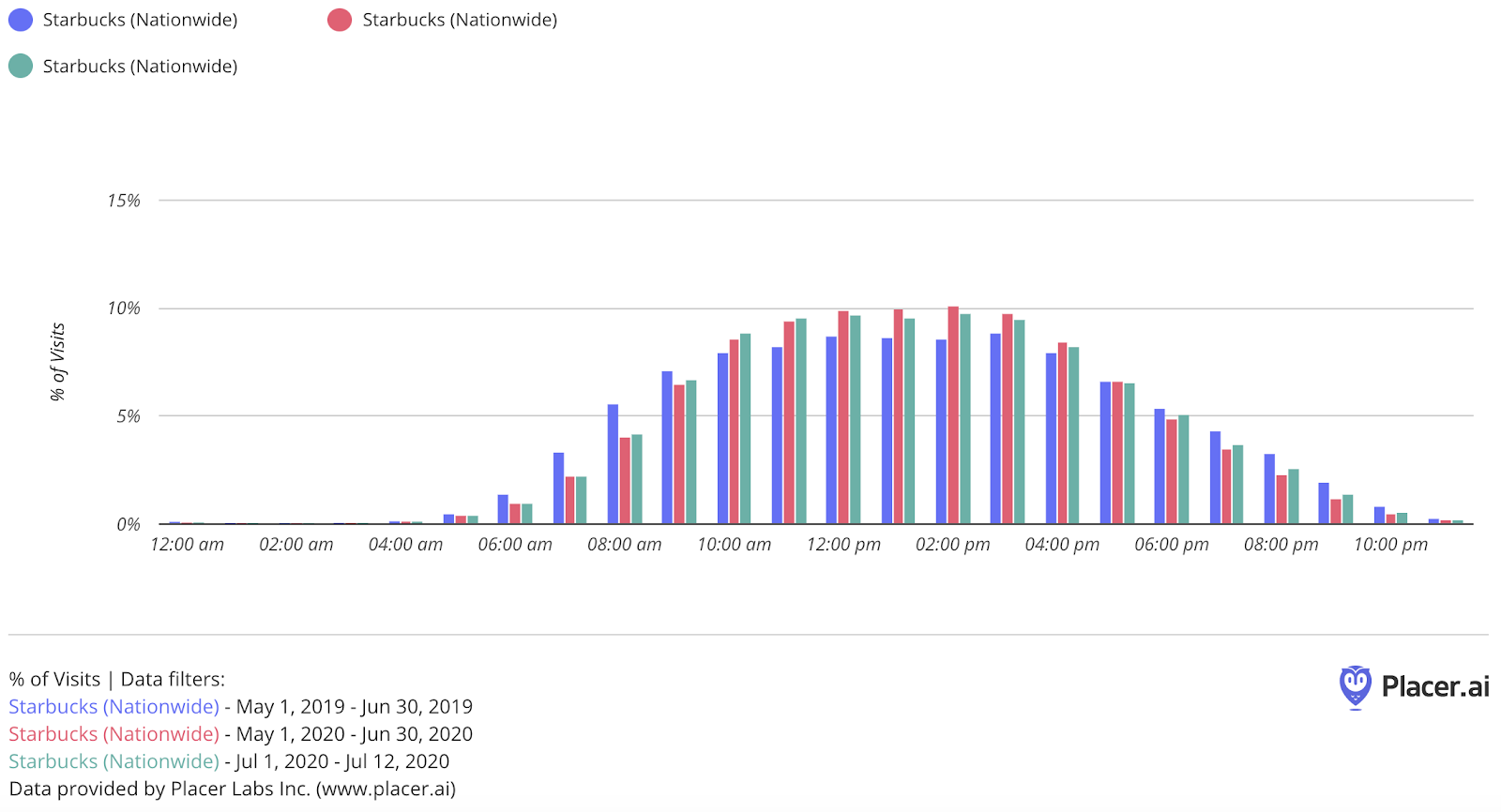

Measuring this return to ‘normal’ behavior, therefore, becomes all the more important. To give some context for this, we dove into the time of visit for May and June 2019 compared to the same months in 2020 and as well as the early numbers from July 2020. Analyzing both brands, there was a massive shift away from early morning and evening traffic during the pandemic with early afternoon visits picking up when comparing May and June visits in 2020 to the same months in 2019. But here too, the data shows indications of a return to normalcy.

For Dunkin’, 7.6% of 2019 visits in May and June came between 6 am and 8 am, numbers that dropped to 5.7%, and 5.6% in May and June 2020 and July 2020 thus far respectively. Yet, the 8 am to 10 am time period is returning to normal with 16.0% of July 2020 visits coming in this window compared to 16.8% in 2019, rising from 14.9% in May and June 2020.

This same return was evident for Starbucks where the percentage of July visits between 8 am and 10 am moved closer to “normal” while visits for the brand have shifted away from the early afternoon back to other core periods.

What’s Next?

Both brands seemed on a clear path to recovery, but the current resurgence of COVID in states like Florida, California, and Texas should be very worrying. While delivery and pick-up is clearly an important part of the business, the daily routines that brought people in contact with their favorite barista brand could be disrupted once again.

On the bright side, the summer is not the strongest period for either brand with their peaks coming later in the year during fall and winter. However, both are clearly hoping for a quick return, as such normalcy in work and school routines would clearly provide a significant uplift.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.