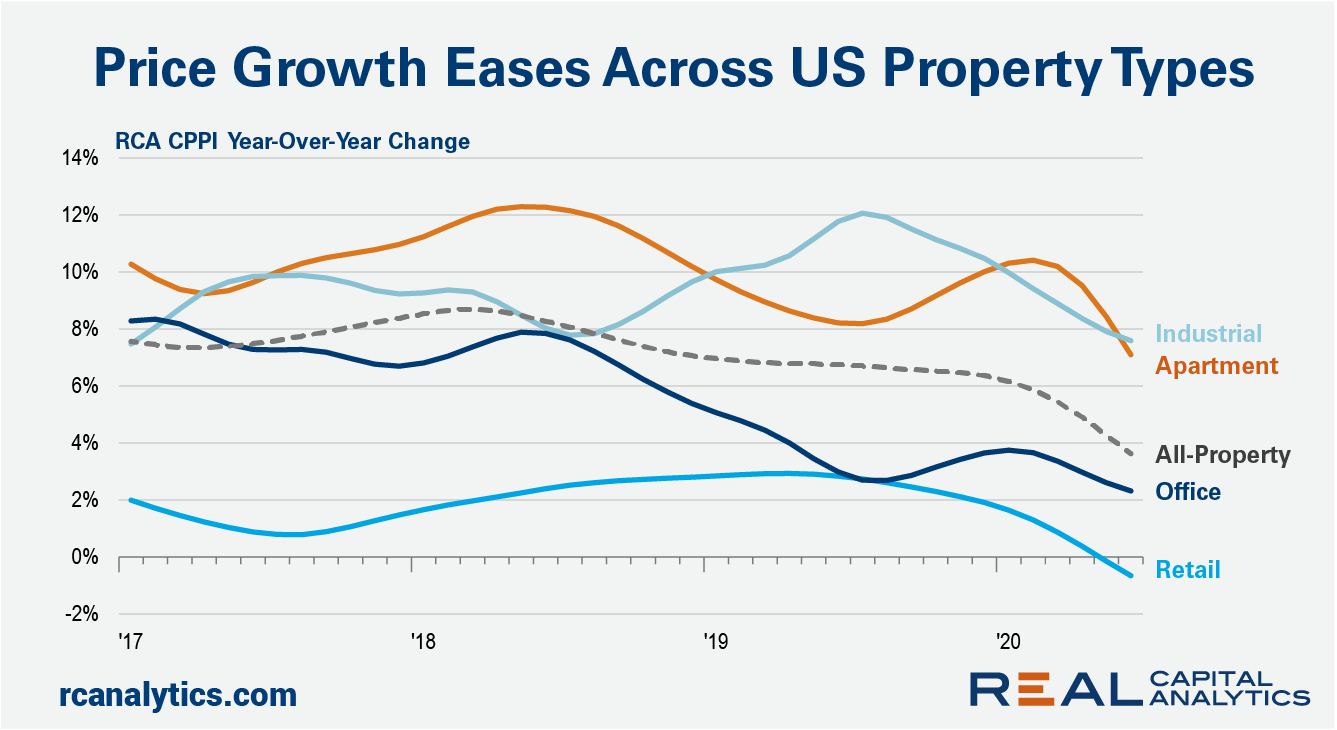

Commercial property price growth slowed in June across all U.S. property types, dragged down by the continued impact of the health and economic crisis. The US National All-Property Index was flat in June from May and gained just 3.6% year-over-year, the latest RCA CPPI summary report shows.

Retail prices fared the worst of the sectors, dipping 0.3% from May and down 0.7% over the past year. This is the first annual decline in prices seen for the beleaguered sector since 2011. Retail sector distress ballooned in the second quarter of 2020, which will likely speed price discovery for this asset class.

The office sector gained just 2.3% year-over-year and was flat on the month. CBD office was hit especially hard, with prices falling 0.8% from the first quarter and increasing just 0.8% from a year ago. Apartment price growth wound down to 7.1% year-over-year. Industrial prices eased to a 7.6% year-over-year increase.

Activity in the U.S. commercial real estate market plunged 68% in the second quarter of the year, as shown in the new edition of US Capital Trends, also released this week. Industrial sector sales volume was half that of a year earlier, and the other major property types fared worse.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.