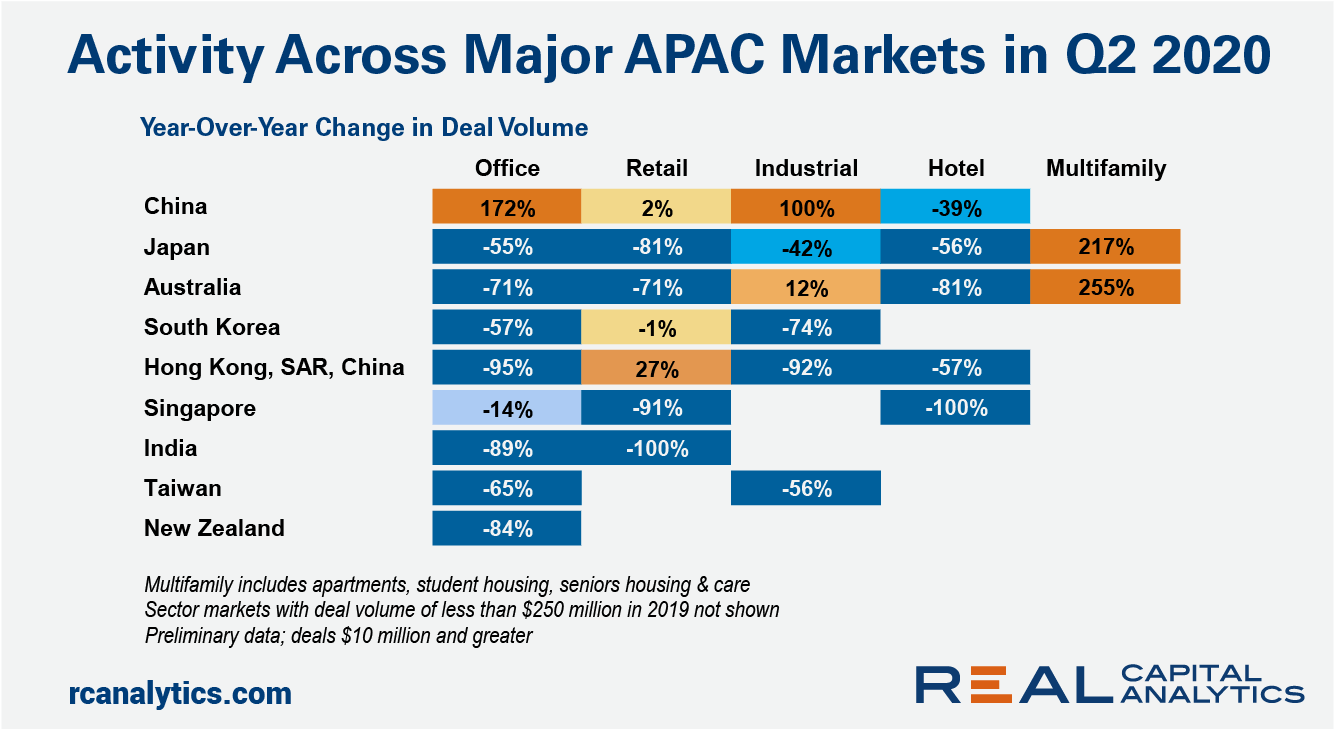

China’s commercial real estate market rebounded in the second quarter of 2020, while the worsening economic outlook took its toll on investment sentiment across the majority of sector-markets in the region.

The demand for Chinese office skyscrapers leaped, with nine buildings priced over $250 million changing hands in the quarter. Logistics facilities and data centers also remained in vogue, helping China’s investment volume to double the tally of Q2 2019, according to preliminary Real Capital Analytics data.

Investors have stayed away from retail investments in markets with extended lockdowns and resurgent Covid-19 case counts. With income streams under siege, a key question is how long sellers of retail assets can hold out before giving way on pricing. Hong Kong affords us a glimpse of what the road ahead might be like. Over 12 months since the political unrest began, retail yields have risen almost 100 bps above their trough and volume in the market is finally starting to recover.

After a record year of hotel investment in 2019, the sector slumped across the region this year. In contrast, interest in multifamily assets surged in the region’s two primary markets of Japan and Australia. Blackstone’s purchase of a $2.8 billion portfolio of residential apartments in Japan and Scape Australia’s $1.4 billion buyout of Urbanest student dormitories were the two big deals that closed in the second quarter.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.