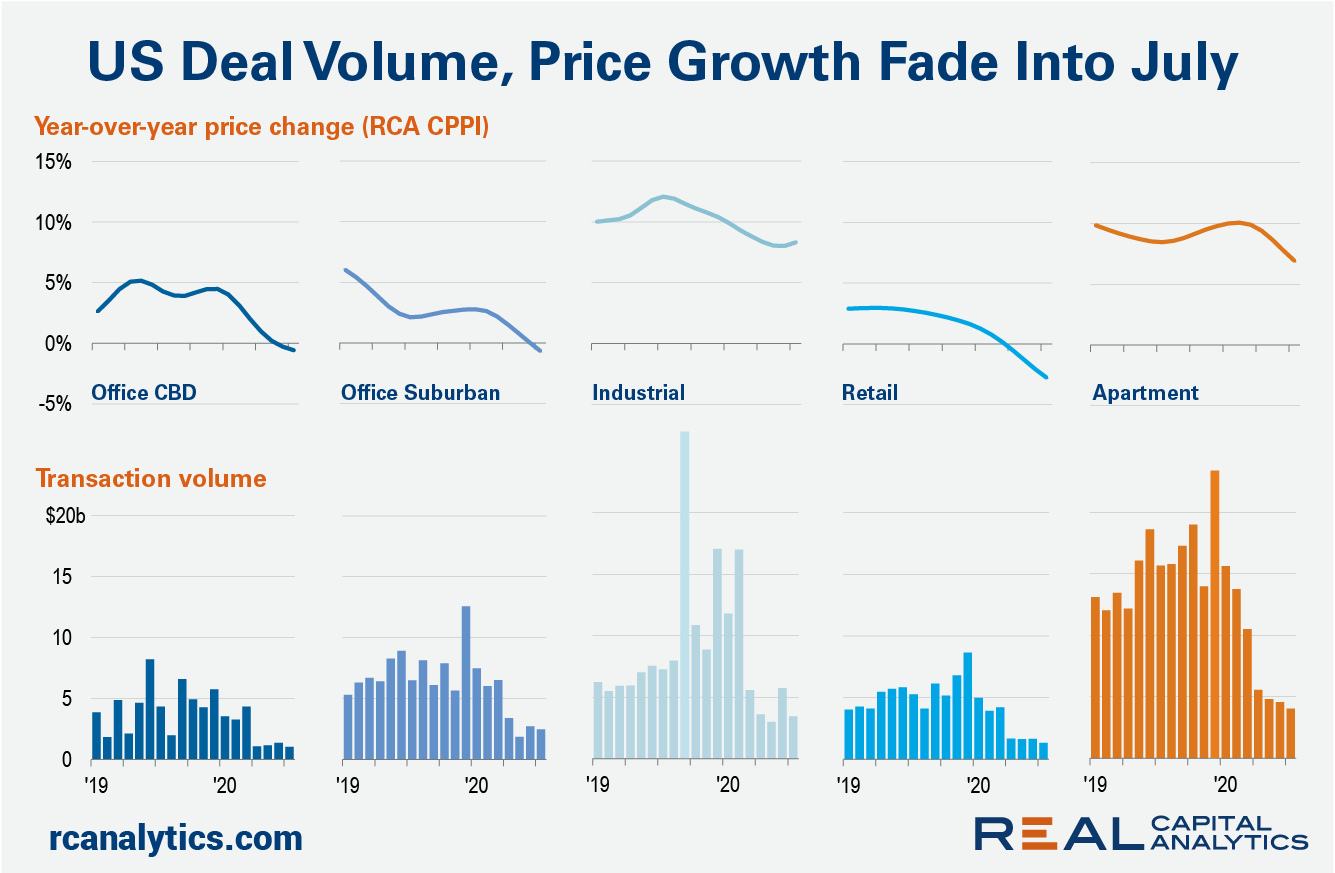

Illiquidity continued to plague the U.S. commercial real estate market in July, with volume across the property types falling at high double-digit rates, the latest edition of US Capital Trends shows.

Total U.S. sales activity fell 69% versus July 2019, the fourth month in a row that the Covid-19 crisis has scuttled dealmaking. However, the monthly sales level is still trending above the lows set in 2009 during the Global Financial Crisis.

The health and economic crisis is also blunting price growth, with the main gauge of U.S. commercial property prices easing further in July. The RCA CPPI US National All-Property Index dipped 0.2% from June and gained just 1.5% from a year earlier, dragged on by declines in suburban and CBD office prices, as well as retail prices.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.