The Stop Hate For Profit campaign sent shockwaves through the social media advertising communities in late June. Brand-name companies such as Unilever, Coca-Cola, Patagonia, Adidas, Verizon, and hundreds of others announced they would halt all Facebook advertising for at least the month of July to protest hate speech, misinformation, and derogatory content across the platform.

As the news broke, Pathmatics was the only data source to bring much-needed transparency and visibility to which brands were staying true to their promise of staying off Facebook. Three months later, we’re looking back at several top-performing digital advertisers to see how they’ve reinvested their digital ad budgets.

1. P&G

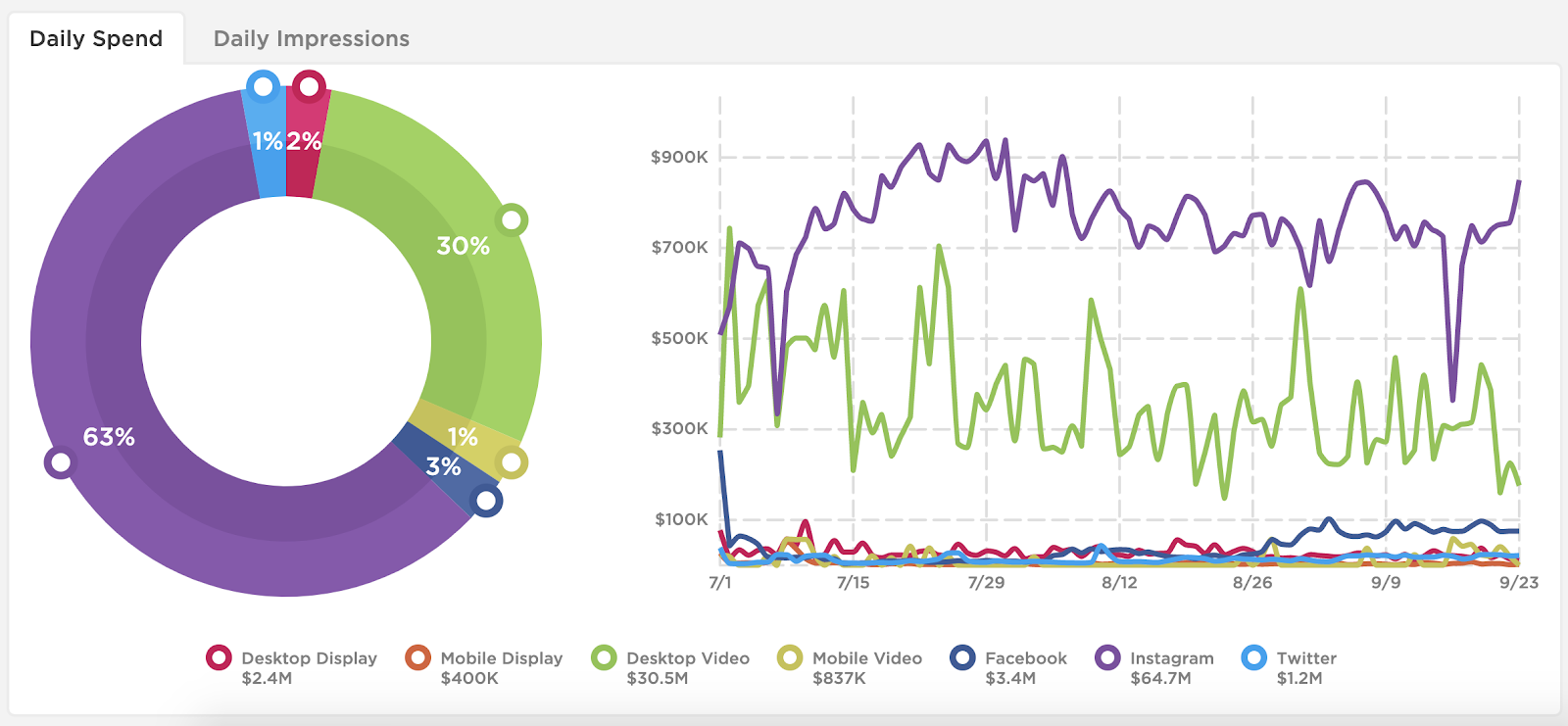

Although it didn’t publicly announce it would join the Stop Hate For Profit campaign, P&G quietly and quickly slowed ad spend on Facebook in early July. Per Pathmatics Explorer, P&G spent $83.3M on Facebook from January to June, and only $3.4M on the platform from July 1 to September 23.

Though P&G did not completely eliminate Facebook spend, its daily average spend on the platform went from nearly $14M per day, to under $40K per day. This was a vast shift in ad strategy for P&G, which was the top-spending advertiser on Facebook in the first half of the year. P&G continued to invest roughly the same amount across other digital channels — such as mobile and desktop display — though we are beginning to see an uptick in Facebook spend once again in September.

2. Starbucks

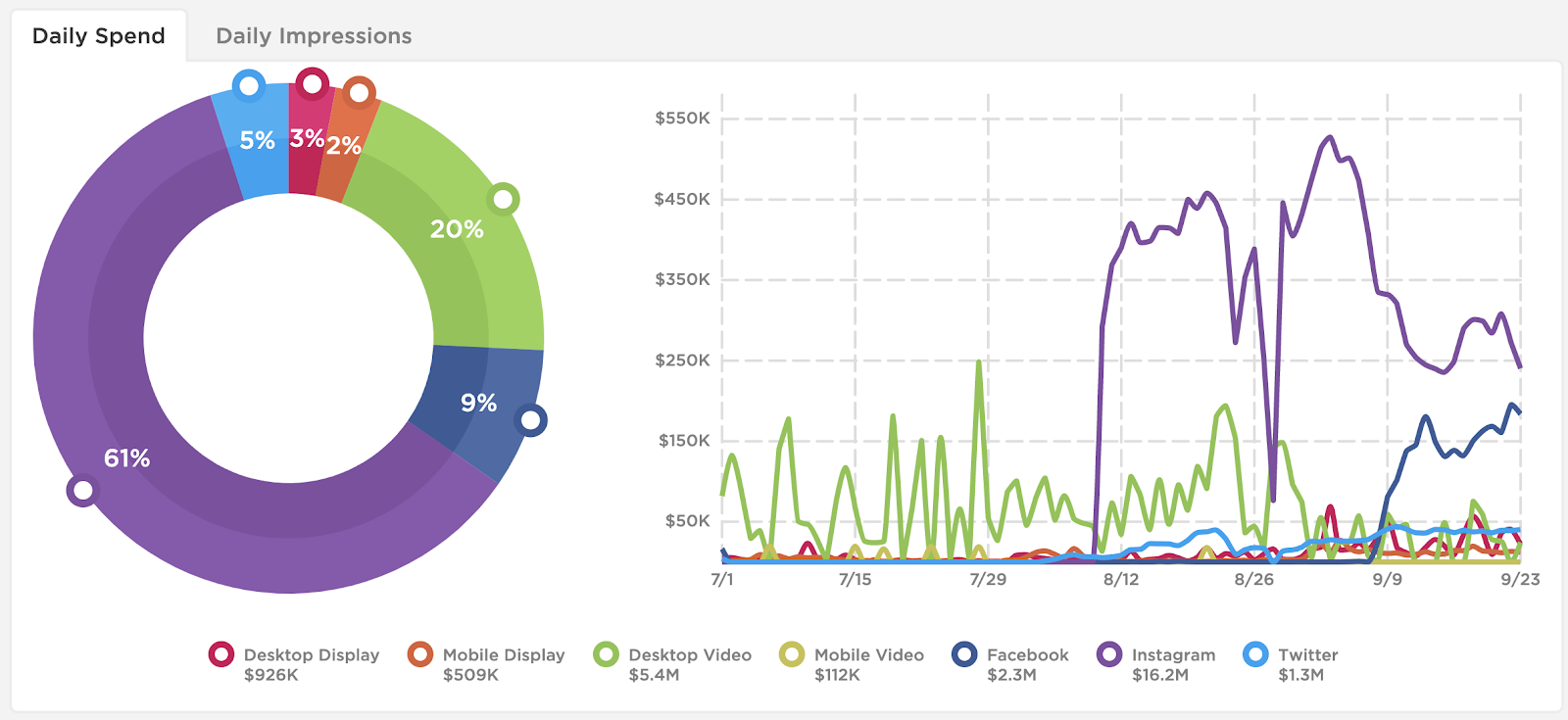

For the most part, Starbucks has done well on its promise to stop hate for profit, though Pathmatics saw the coffee giant pick up Facebook spending in late August. ‘Tis the season for pumpkin spice, and Starbucks wasted no time promoting its pumpkin cold brew drink, and Uber Eats delivery.

In lieu of Facebook investment, Starbucks spent $5.4M on desktop video and a staggering $16.2M on Instagram ads in July, August, and September. Roughly one-fifth of that desktop video spend went to promoting brightly colored dragon fruit and frappuccino drinks in equally bright YouTube pre-roll ads. Additionally, Starbucks didn’t start spending on Instagram until August 1, running ads for its Teavana brand, further promoting Uber Eats delivery, and introducing a new refresher drink.

3. Target

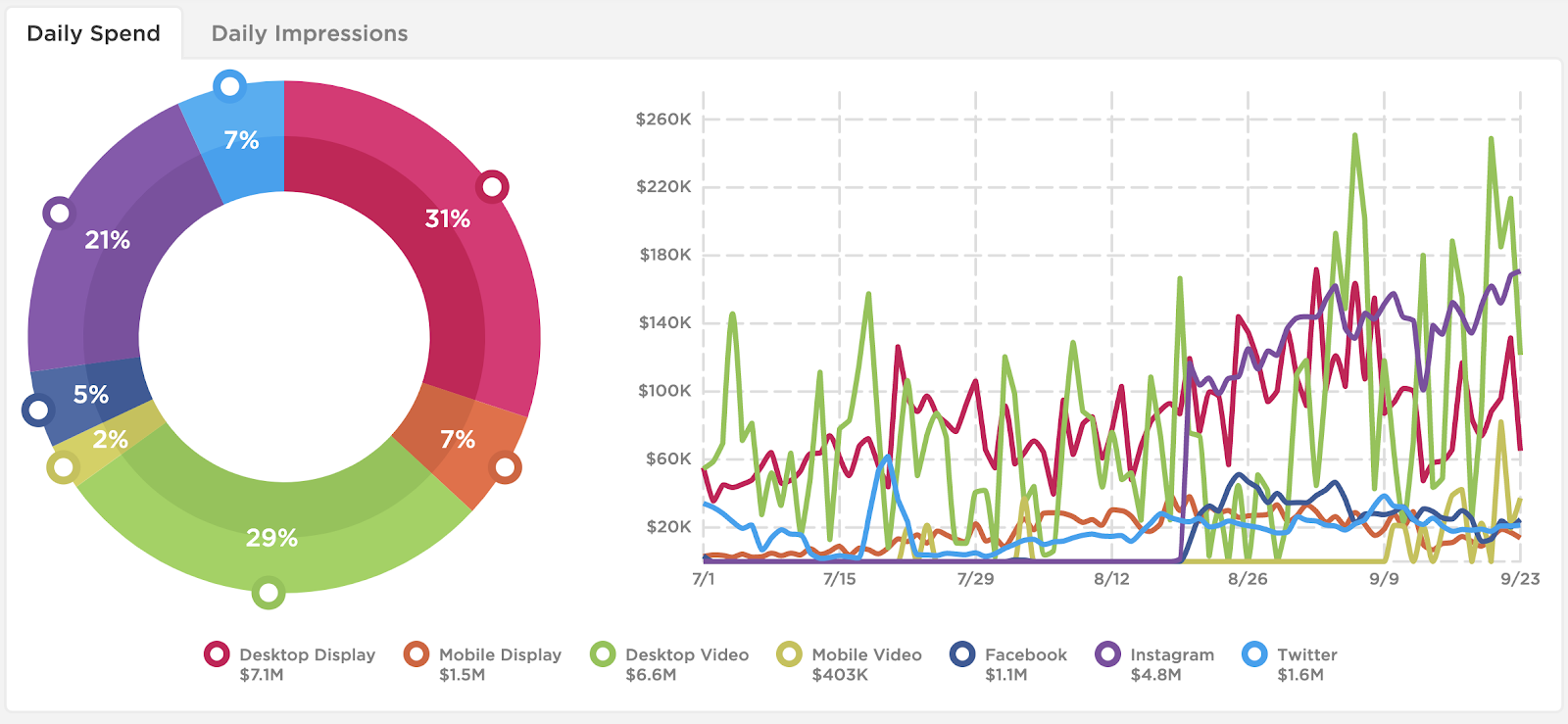

Target has only spent 5% of its total ad budget on Facebook in the last three months, and Pathmatics didn’t start picking up Facebook ads from the company until August 20. The bullseye brand has dabbled in a few different ad channels since July, with varying ad investment across desktop and mobile video and display.

Target invests roughly 60% of advertising dollars into desktop advertising, which makes sense given 20% of the company’s ads are placed through a DSP or ad network such as Display & Video 360, or Google AdX and AdSense. The company spent over $1.2M indirectly on fandom.com, promoting a Target Circle video, as well as several banner ads promoting home deals and “college-ready” cleaning supplies.

4. Samsung

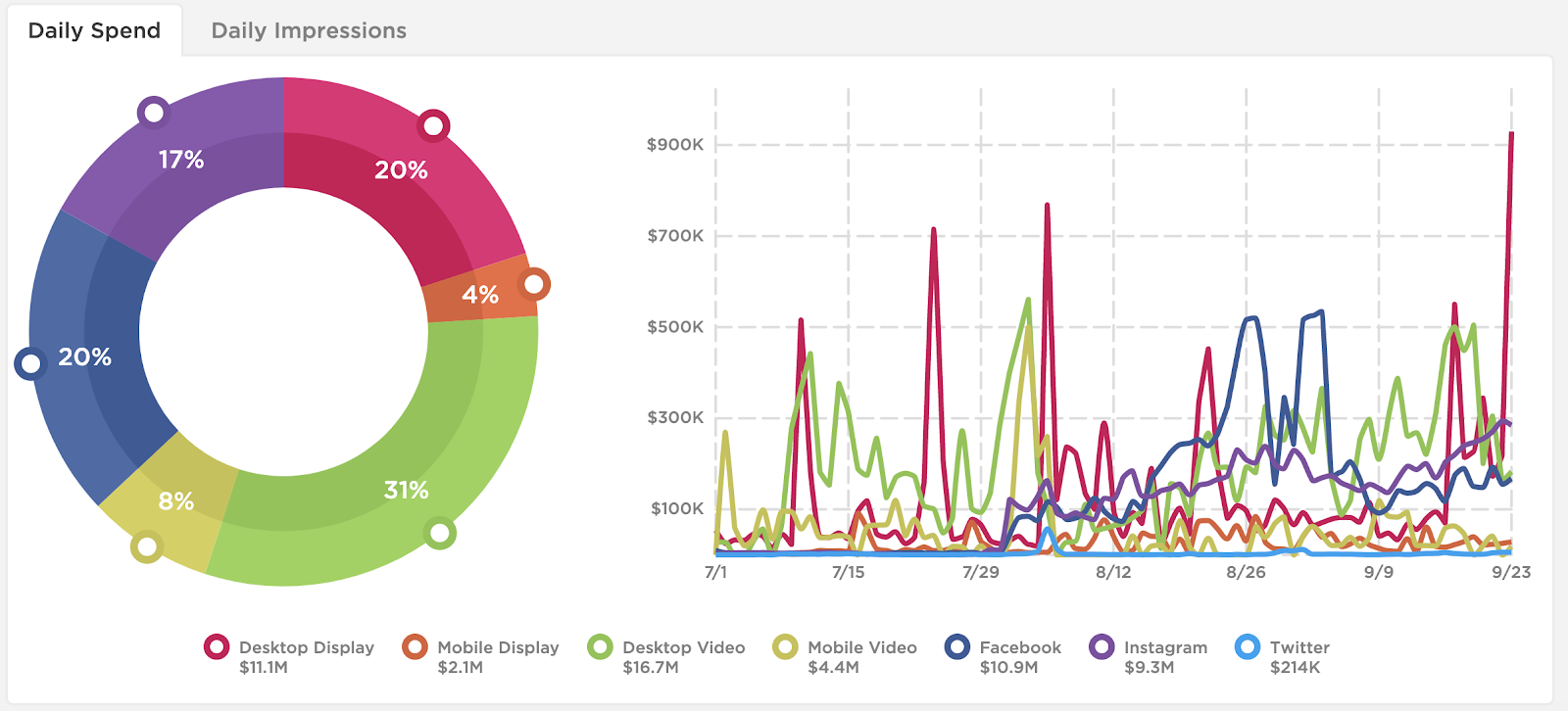

Although Samsung remained quiet on Facebook with $0 ad spend on the platform in July, the tech company almost immediately began to buy Facebook ads once again when August 1 rolled around. Samsung gradually spent more on Facebook ads throughout the month, peaking at nearly $520K on August 27, as it promoted Samsung’s Education Discount Program for students and educators.

When it’s not posting on Facebook, however, Samsung has been investing in a desktop display strategy with peaks of high spend at least a couple times per month. In July, Samsung had several high-spend days promoting pre-roll ads on YouTube for its new Galaxy Note 20. Samsung also directly spend over $1.3M on Reddit.com display ads, promoting the same product.

5. Disney

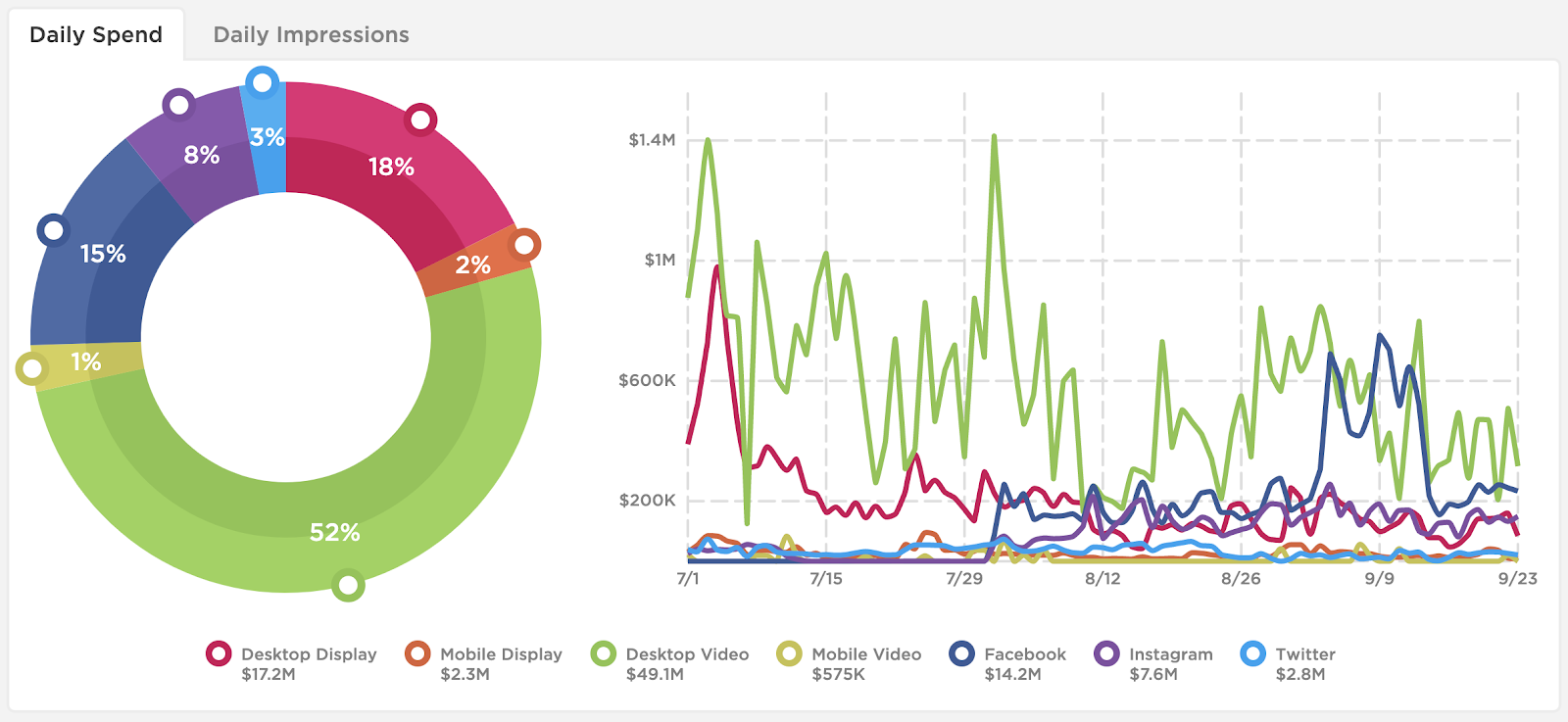

Disney only came second to P&G in Facebook advertising for the first half of 2020. After the Wall Street Journal reported that Disney slashed its ad spending on the platform amid the growing boycott, supported by Pathmatics data, we saw a surge in the company’s use of desktop video display and video ads.

In fact, in July and August, Disney invested nearly 70% ($54M) of its digital ad budget into desktop ads. Disney only invested a portion of that ($4M) advertising on its own subsidiaries, including espn.com, Hulu.com, disney.com, and babble.com. The company spent over $36M on YouTube pre-roll ads promoting Disney+ shows and partnerships.

However, Disney picked back up on Facebook advertising in early August, spending $14M to heavily promote a Hulu, ESPN+, and Disney+ package deal, its Mulan reboot, and other Disney+ TV shows.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.