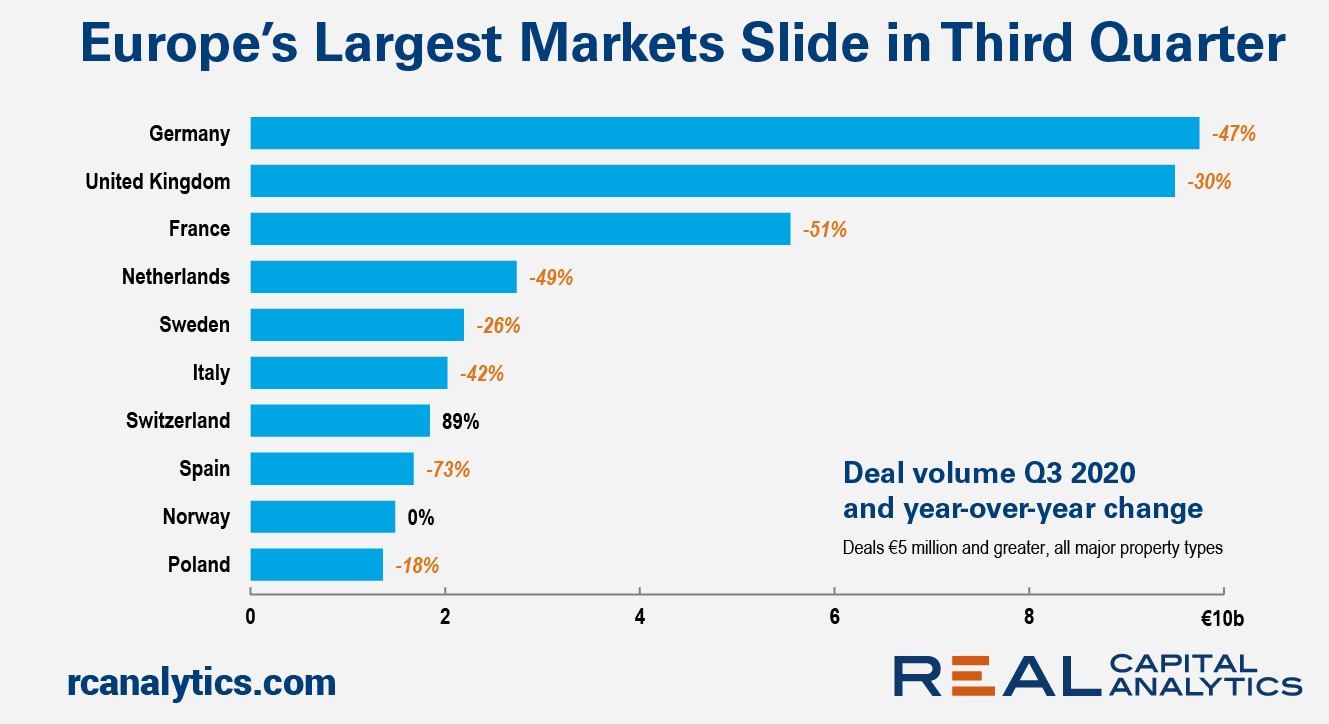

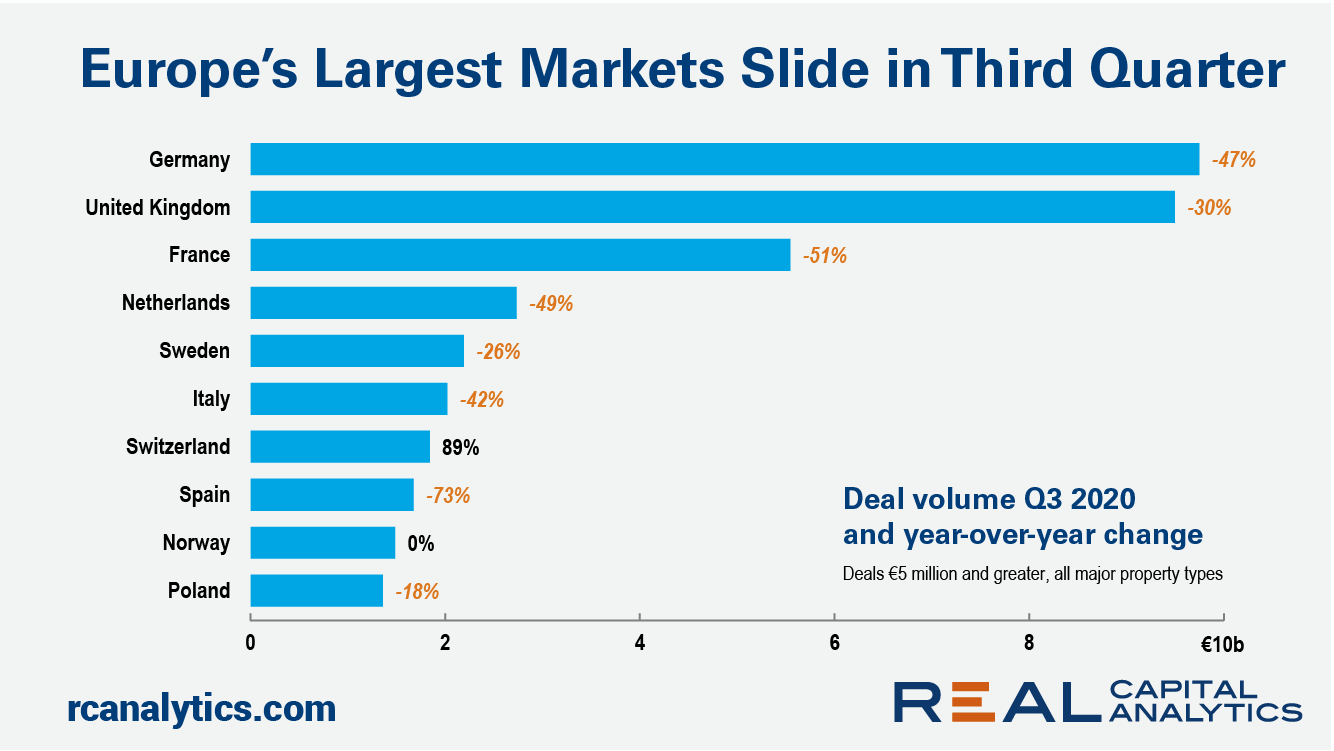

Commercial property deal activity in Europe slumped during the third quarter, rocked by the Covid-19 pandemic’s continued impact on dealmaking, economic growth and market prospects. The latest edition of Europe Capital Trends shows deal volume dropped 43% in the third quarter from a year ago, and was down from the levels seen in the second quarter of this year.

In Germany, quarterly deal activity fell 47% year-over-year to the lowest quarterly level since 2013. Deal volume in France dropped by 51%, though Paris retained its status as the most active market for the first nine months of 2020, closely followed by London. Apartment sector deals in London and regional industrial sector activity helped to stem the drop for the U.K. Deal volume in the U.K. fell 30% in the third quarter and is down 21% for the year so far.

Across the property types, only the industrial and development site sectors escaped the rout. Sales of industrial properties dipped by 9% year-over-year and for the year to date match 2019’s levels. The biggest industrial transaction of the quarter was the forward sale of a warehouse in southwest England, which at £201 million ($260 million) was the highest price on record for a single warehouse asset in Europe.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.