In late August and early September 2020, STR conducted quantitative research using STR’s Traveler Panel. We set out to examine attitudes to travel in this ‘new COVID world’ and to evaluate early experiences among travelers at a time when many economies were reopening and the industry was seeking to capitalize on pent up demand.

So far in this blog series we’ve taken the ‘pulse’ of travel and evaluated how accommodation preferences have shifted due to COVID-19. Now, we look at how travelers view and have interacted with other tourism sectors such as attractions and restaurants. So, how has COVID-19 influenced our preferences for visiting attractions?

Outdoor attractions see surging interest levels

For most of us, 2020 has been a year of restricted travel choices, so local visitor attractions have played an important role in providing leisure experiences and helping to improve wellbeing.

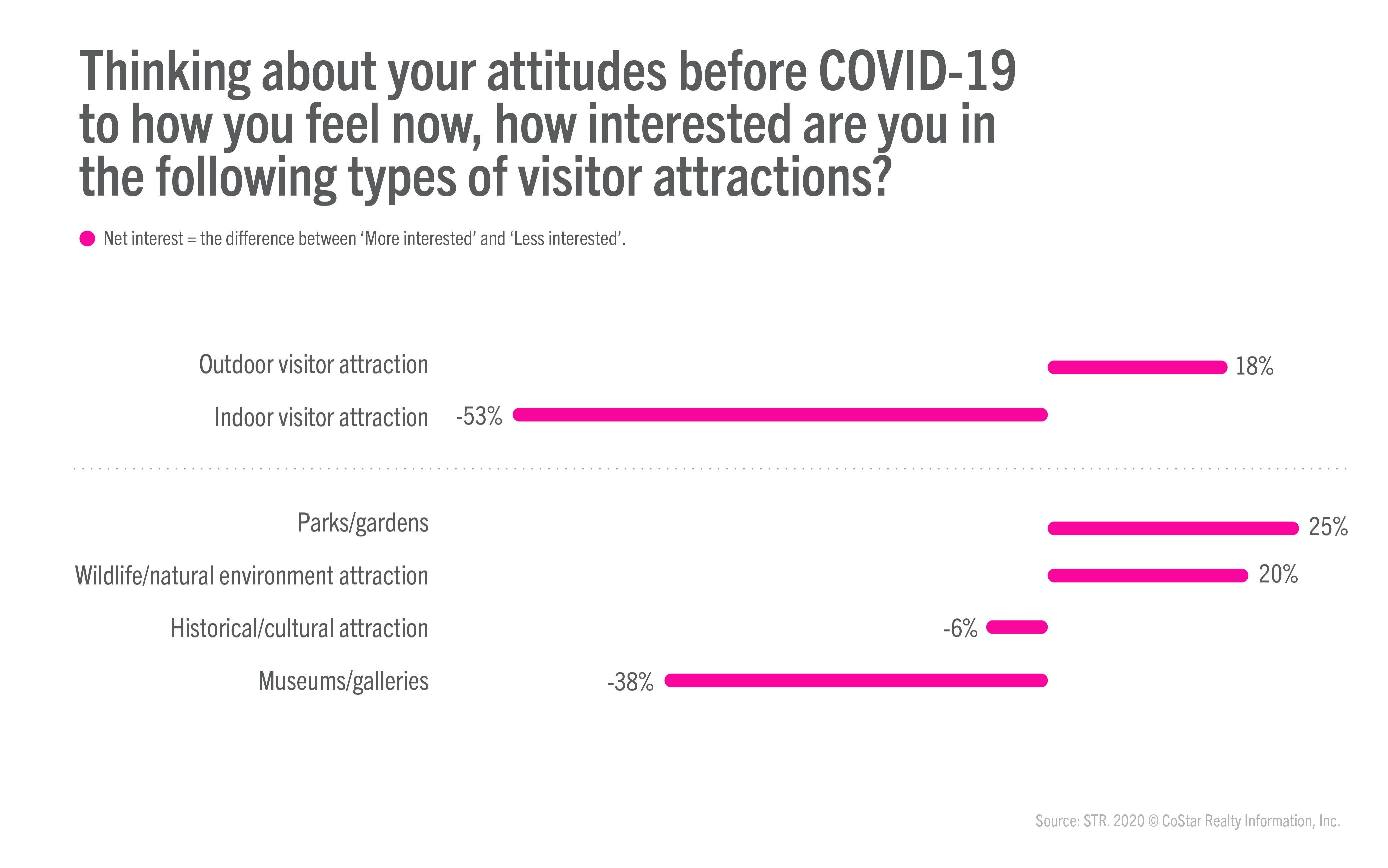

However, as shown below, travelers demonstrate varied levels of interest in different types of attractions during this uncertain time.

Unsurprisingly, given the increased risk of COVID transmission in crowded enclosed spaces, indoor attractions have seen an overall decrease in interest (-53% net interest) whilst outdoor attractions have become more attractive (+18% net interest).

Open air locations such as parks and gardens as well as wildlife and natural environment attractions have become more appealing. Conversely, museums and galleries—being typically indoor-based— have suffered from the greatest fall in appeal.

Meanwhile, likely due to encompassing both indoor and outdoor spaces, historical and cultural attractions showed a small overall decline in interest. Nostalgia and, by extension, an interest in history, is known to rise during times of hardship as people look to the past for comfort. Public health concerns will continue to influence the appeal of indoor attractions. Nonetheless, it will be interesting to monitor the plight of heritage attractions in the coming months to compare against the trend of previous downturns.

Eat and be merry

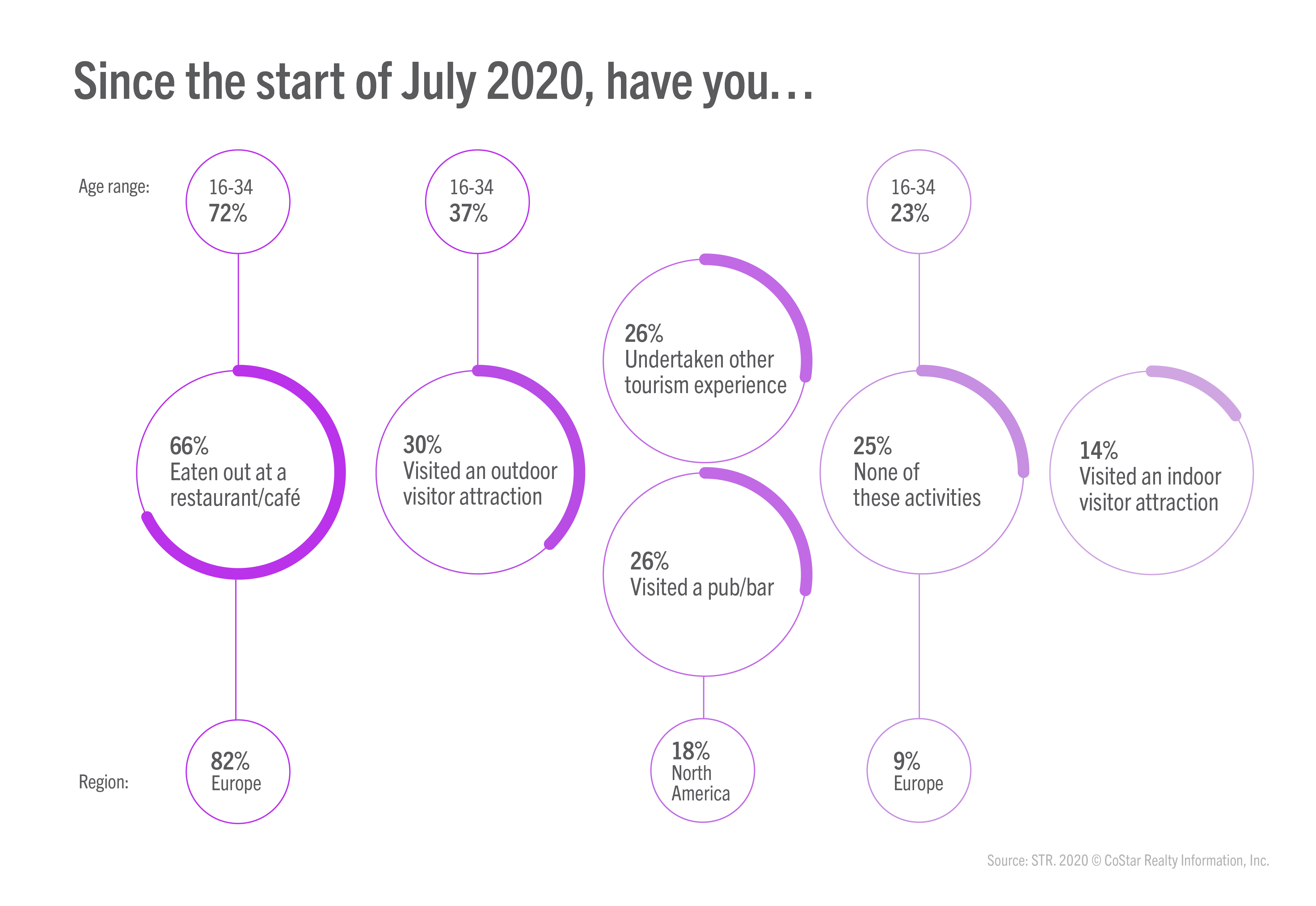

Overall, 75% of respondents had undertaken a leisure activity such as eating or drinking out, visiting an attraction or undertaking another tourism experience between early July and early September.

Highlighting the importance and scale of other tourism sectors in the visitor economy, this figure of 75% was significantly above the proportion (30%) who had undertaken an overnight trip during the same window.

As shown above, eating out was the main leisure activity as 66% went to a restaurant or café during the period. Eating out was popular among the key markets of U.K., North American and European travelers included in the survey. However, interestingly, Europeans demonstrated higher levels of engagement with restaurants and cafés (82%) compared to U.K. and North American travelers. This trend was also seen for other tourism experiences, which highlights that European travelers were more active in destinations than Brits and North Americans in recent months.

Meanwhile, pubs and bars achieved a much lower engagement level: 26% among all travelers and only 18% among North Americans.

Visiting outdoor attractions was the second most popular activity whilst visiting indoor attractions was least popular.

The behavior of different age groups has been a topical issue during this pandemic. Unsurprisingly, our data shows that younger consumers, aged 16-34, have been more active undertaking leisure experiences than older cohorts. That said, there is still a sizeable proportion (23%) in this younger group that had not undertaken any activities. This finding highlights that for some, even in the lowest risk group, there is underlying reluctance and hesitancy to interact with the industry.

Attractions impress visitors with their COVID efforts

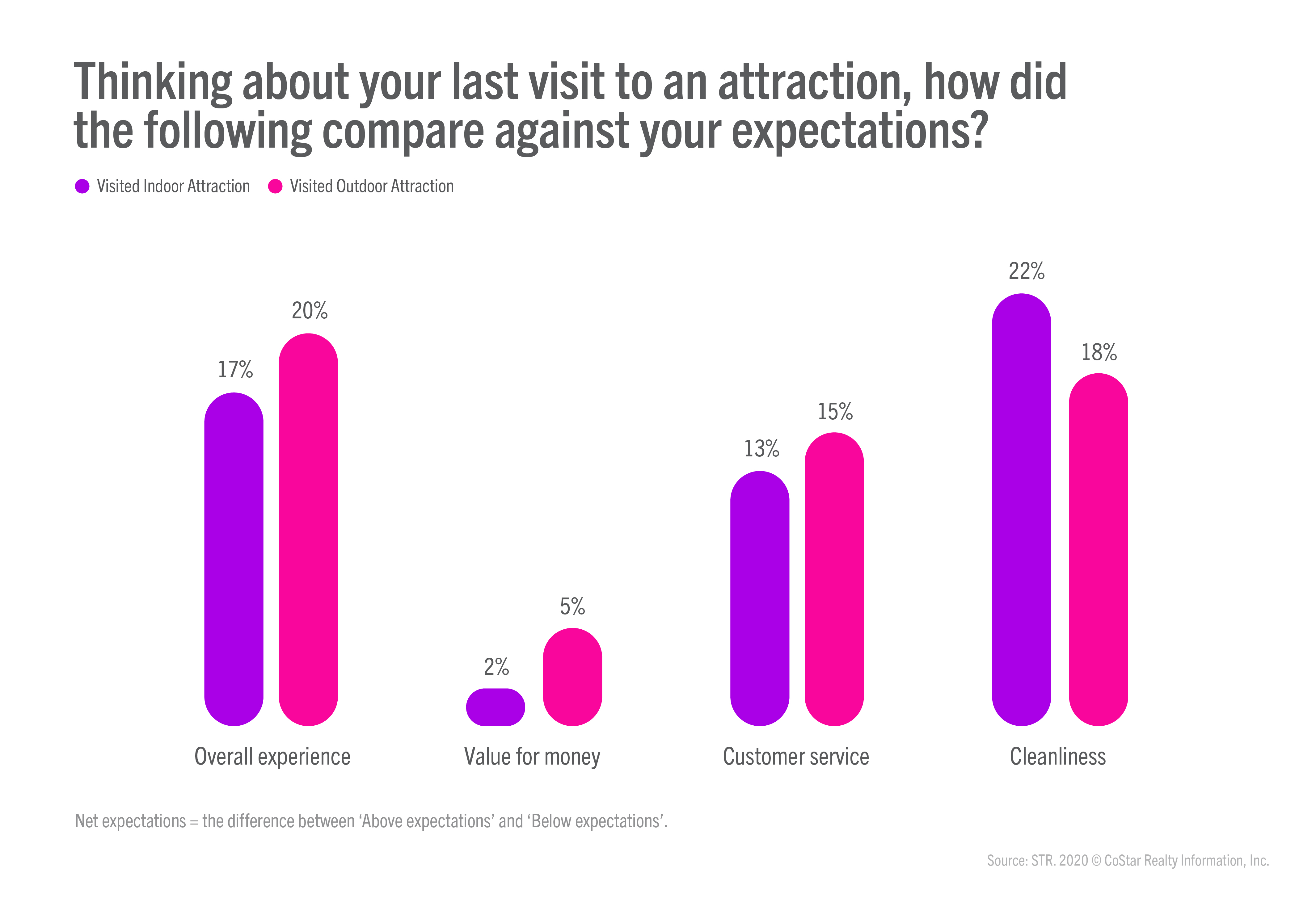

For those who visited an attraction, their experience was generally positive.

Further highlighting that visitors have largely endorsed the efforts of the sector to provide a COVID-safe experience and environment, perceptions of cleanliness were rated positively, achieving a net expectation score of 19% overall and slightly higher (22%) for indoor attractions.

It’s also pleasing to see high customer service satisfaction for a sector that has had to pivot drastically to suit social distancing requirements. New booking practices and approaches to manage the movement of visitors are two aspects which have fundamentally changed the way that many attractions operate. Positive customer service recognition indicates that front line staff have largely risen to the challenge, which coupled with effective COVID-safe measures, have contributed to high visitor satisfaction. But, how well has the sector responded in following government guidelines on the need for social distancing?

Social distancing measures received well

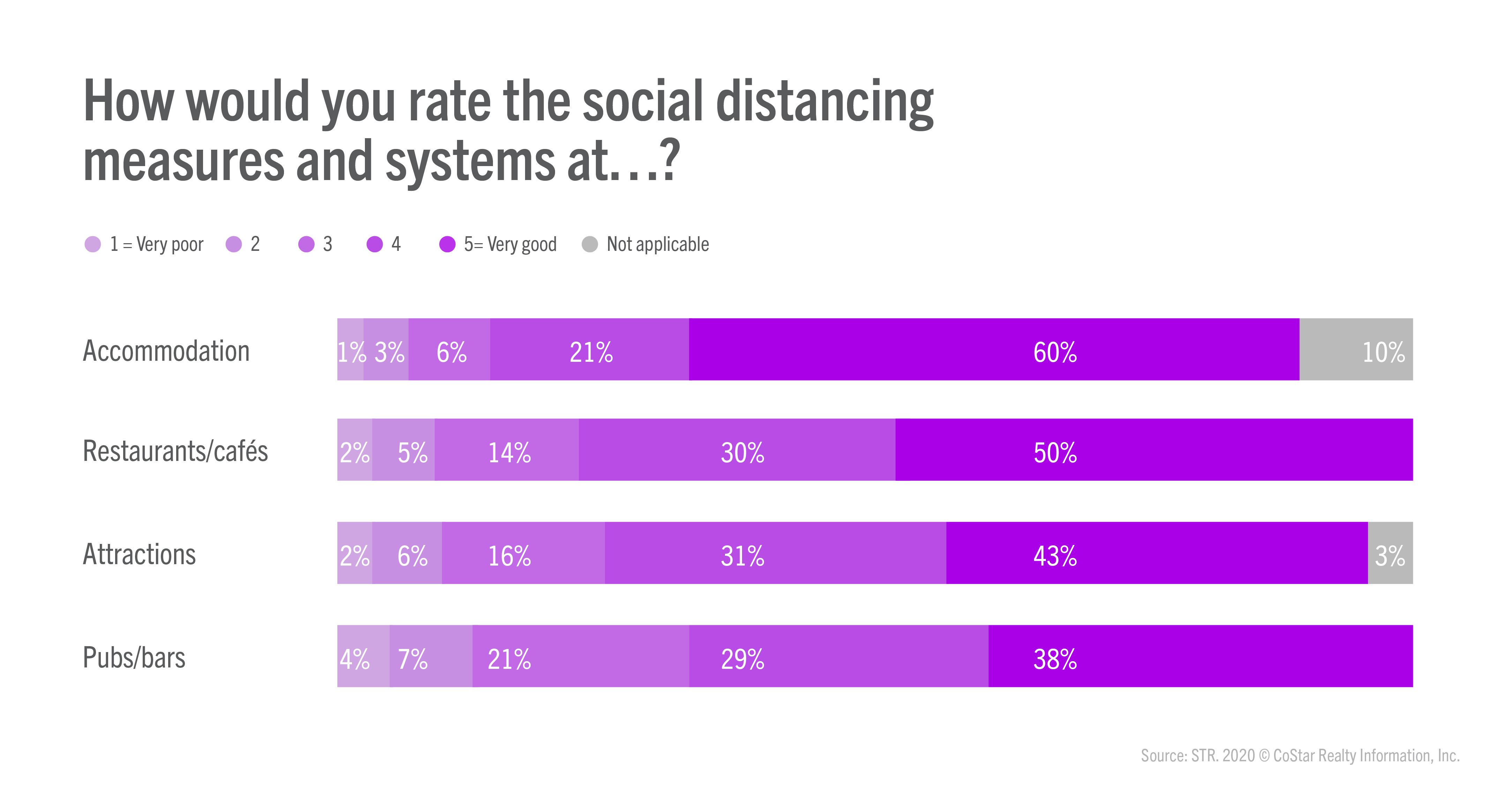

We asked those who had interacted with different parts of the visitor economy between early July and early September to rate the social distancing measures and systems in place.

As shown below, the efforts to enable social distancing by accommodation providers were rated most positively as 60% considered these efforts to be very good. Restaurants and cafés achieved the next highest rating (50% rating social distancing measures as ‘very good’) followed by attractions (43%). Meanwhile, pubs and bars achieved the lowest rating for their social distancing measures. This latter finding seems consistent with many governments’ stance to reduce the spread of the virus through more restrictive measures on licensed establishments.

Data shows that as economies have reopened and adapted following travel restrictions and lockdown measures to minimize the spread of the virus, consumers too have reemerged and reengaged with the tourism industry.

As reported earlier in this blog series, demand for international travel has fallen, but, on the upside, some consumers are sampling more of what their local area has to offer. As a result, restaurants, cafés and attractions have, for many, been an important outlet for leisure experiences in recent months.

Evidence suggests that tourism businesses have adapted well to maintain appeal and build confidence and trust. Additional efforts to drive up positive perceptions of cleanliness and safety will help to entice more visitors during these challenging and uncertain times.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.