As we head into the holiday season, the health of the newly acquired COVID shopper is top of mind. With the pandemic driving shoppers online, the retention and significance of this newly acquired cohort has become an increasingly important question. Utilizing spend data, we analyzed the overall health of new cohorts over the past six months for some of the largest retailers. Here’s what we found.

Key Takeaways

The New COVID Online Shopper

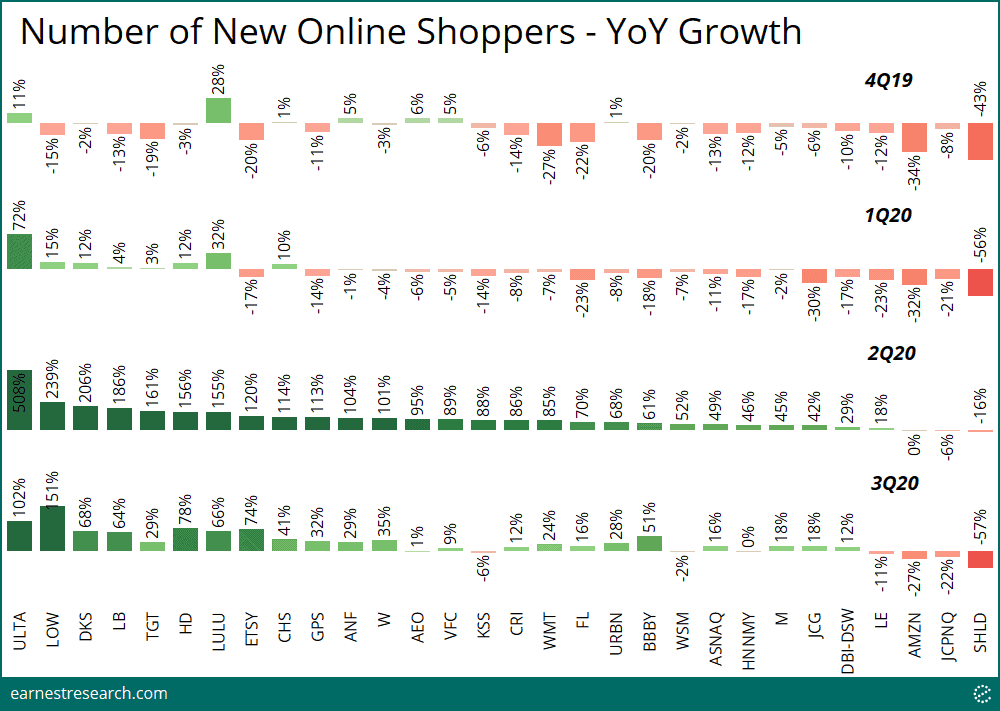

It’s no secret that there was a material spike in growth of new shoppers online in 2Q20 due to the pandemic. After all, it was the only way to purchase something in a brick-and-mortar-less retail environment. However, the uneven distribution of this online growth across retailers warrants a closer look.

Looking at the largest 30 retailers within broad retail categories, Ulta, Lowe’s, Dick’s, and L Brands saw the highest growth of new online shoppers in 2Q20, while Sears and JCPenney saw the least. (Amazon and Lands’ End, both effectively online-only retailers to begin with, would understandably not see many new online shoppers).

It is noteworthy though that many retailers with already mature online businesses saw material growth and continued growth into 3Q20 (J.Crew, Urban, William Sonoma, Lululemon, and Gap, for example, generated ~40%+ of sales online pre-COVID). Ulta and Lululemon stand out as having acquired new online cohorts at a double digit pace consistently over the past year.

But Are These Online Shoppers Sticky? Yes, They Are.

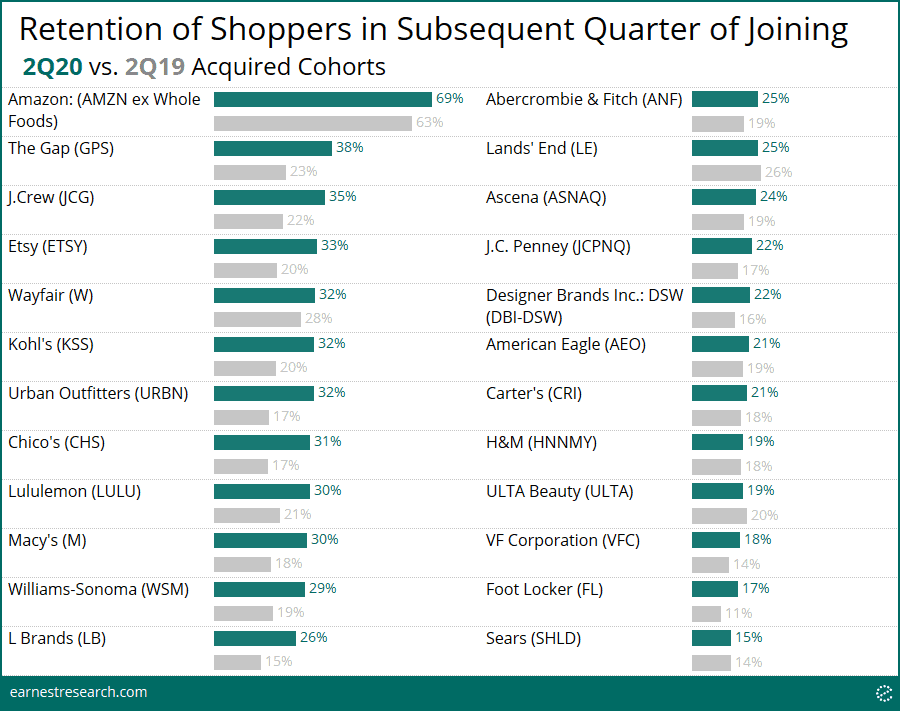

The big question is how sticky are these pandemic-driven acquired shoppers? To address this, we looked at the retention trends among the 2Q20 acquired cohorts, fully aware that this cohort was overwhelmingly—if not fully—acquired online. We compared their retention rates to the 2Q19 acquired cohort as a benchmark.

In all cases (except for Lands’ End, Ulta, and Sears), the 2Q20 cohort saw higher retention rates than the 2Q19 cohort. Additionally, a sizable number of retailers (9 out of 24 shown below) saw a 10+ point improvement in retention relative to last year: Gap, J.Crew, Etsy, Kohl’s, Urban, Chico’s, Macy’s, William Sonoma, and L Brands. It’s interesting to note that Ulta— despite substantially growing their online cohort this year—did not see improved retention relative to last year, remaining at [a healthy] ~20%.

How Much Do These New Cohorts Matter?

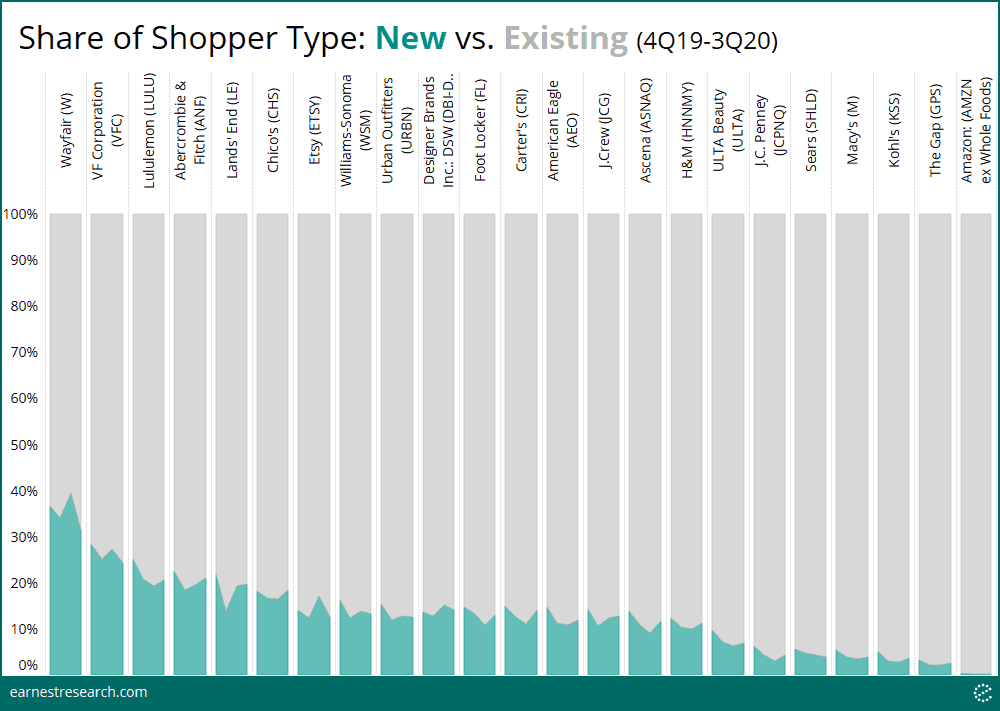

Retention of newly acquired shoppers is certainly important, but we wanted to understand how big—and therefore how crucial—acquiring new shoppers is for the retailers above. We therefore broke out the share of new vs. existing shoppers by retailer, and analyzed how this share trended over the past four quarters.

Wayfair, VF Corp, Lululemon, Abercrombie, Lands’ End, Chico’s, and Etsy, enjoy the highest share of newly acquired shoppers, accounting for ~15% to 40% of total. More mature retailers Amazon, Gap, Kohl’s, Macy’s, Sears, and JCPenney saw their share amount to ~6% or less. (Amazon’s share is understandably negligible as virtually all panelists have frequented the online giant by now).

Thus, despite Gap and Kohl’s, for example, seeing high retention of their newly acquired shoppers, the share that these new shoppers make up is small. On the other hand, 30%+ retention for Etsy, Wayfair, Chico’s, and Lululemon appears to be much more meaningful, considering a sizable piece (15%+) of their shopper base continues to be new.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.