A common theme in the media for December was that we lived through a horrible year in 2020 and that 2021 would be better for us all. Perhaps this sentiment will hold by year-end but the start has been chaotic. Conditions might become more distressing for commercial real estate investors throughout the year, a turn of events that some players are hoping to see.

Distress has been the big word for capital-raising in recent periods, with investors planning to scoop up assets on the cheap as the economic turmoil of the Covid-19 pandemic translates through to asset sales. While some of these investors found success with this strategy in the last downturn, so far at least, the same initial conditions do not seem to hold.

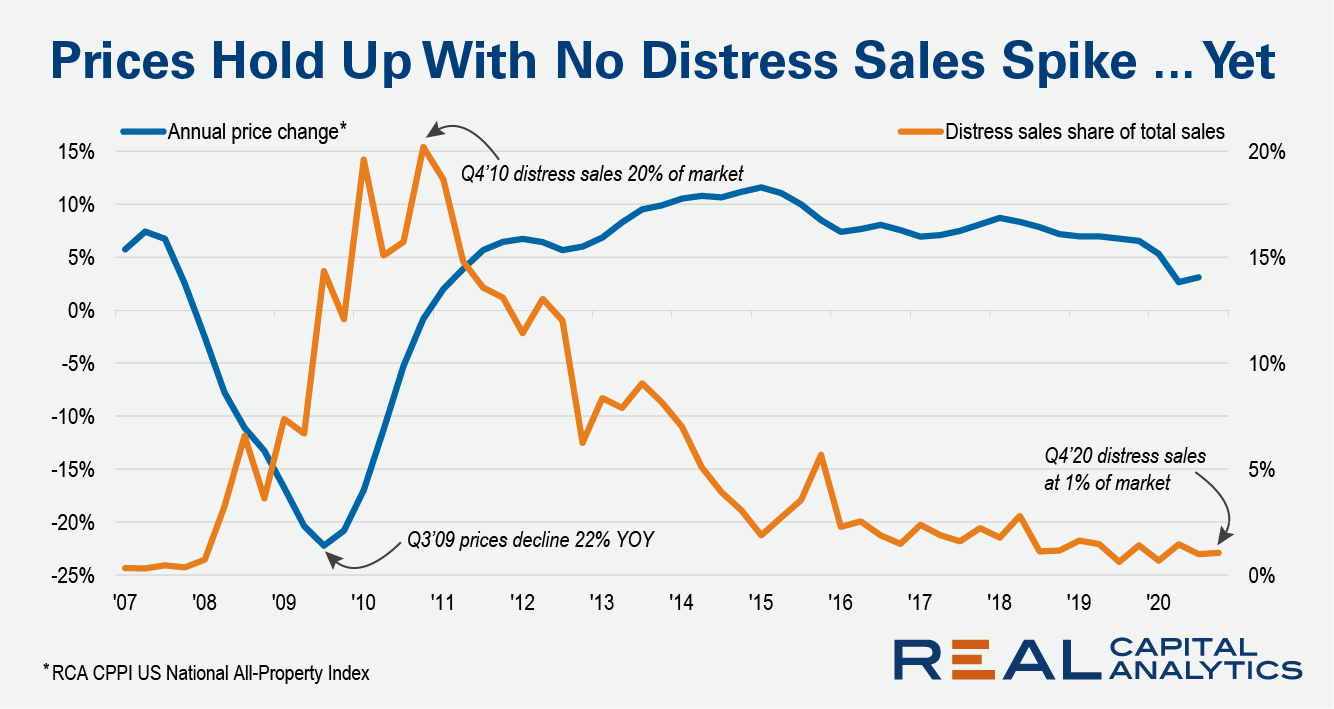

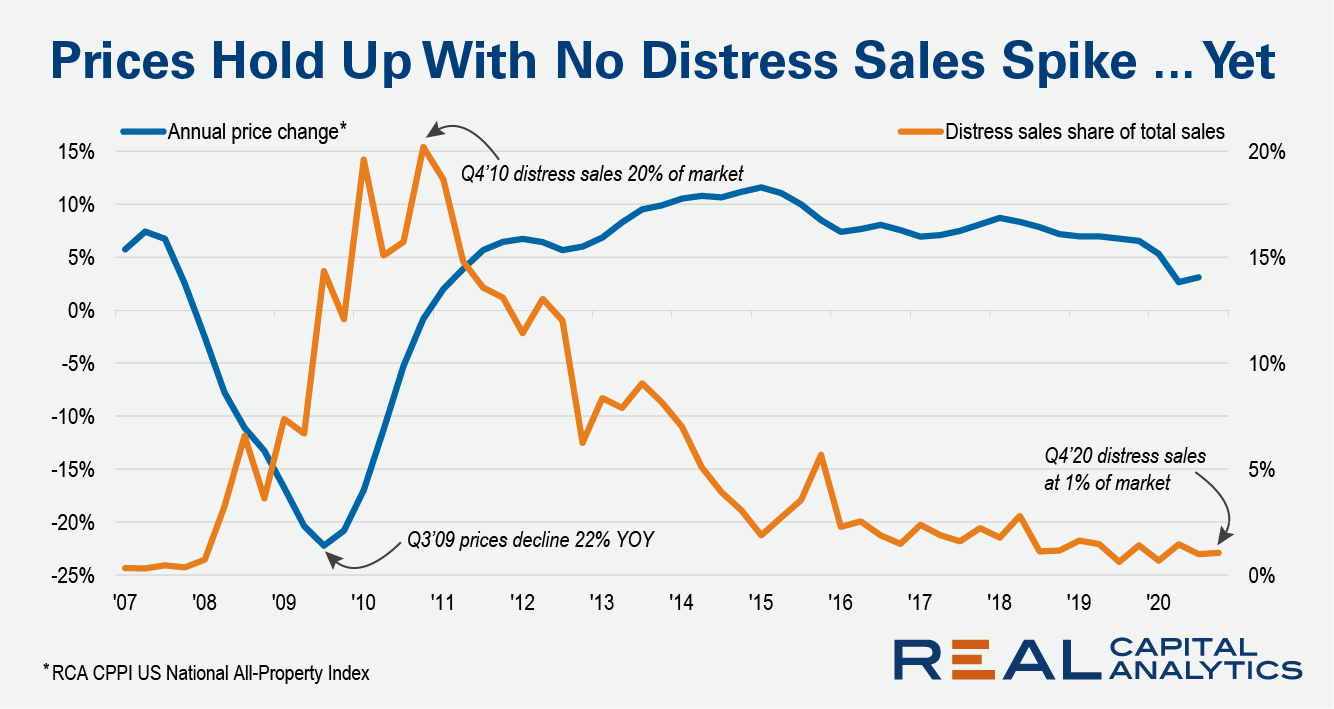

Commercial property prices were falling at a sharp rate into the Global Financial Crisis. That recession officially started in December 2007 and commercial property price growth turned negative in Q1 2008 as the RCA CPPI US National All-Property Index dropped 2.6% year-over-year. Bolstering that price decline was a jump in distressed asset sales.

Distressed asset sales rose from less than 0.5% of total commercial real estate volume early in 2007 to just under 1% by Q1 2008. By the end of 2010, such asset sales were one-fifth of the total sales market. The influx of distressed dispositions helped pull down overall pricing as investors reset their expectations for pricing on even the best-of-the-best cash-flowing assets.

Three business quarters into the current crisis, distressed asset sales are again at that 1% of the total market threshold which was the start of the price declines in the GFC. The pace of price increases has tempered, but there is still significant growth, with the latest reading of the All-Property Index showing a 5.7% year-over-year gain. Our Q4 2020 RCA CPPI figures will be released next week and initial signs indicate that we will not see the start of the same sort of price declines as at the beginning of the last downturn.

Nobody wants to take a loss on what is expected to be a temporary dislocation to income from the Covid-19 economic disruptions. Vaccines are here and many of us have friends and family in the medical sector who have already had their first shots. In Zoom cocktail hours we all talk about where we will travel first when we are vaccinated and quarantines are lifted later in the year. To the extent that they can, borrowers and lenders will continue to paper over problems in line with this optimism.

Still, even with anticipation of a temporary dislocation, some investors and lenders will not be able to hold on even with the finish line for the pandemic in sight. For the third quarter we reported that outstanding and potential distress arising in 2020 totaled around $130 billion, and in our US Capital Trends report to published next week we will show preliminary figures for the fourth quarter.

As these distressed loans move through the system, some are going to end up in workouts and foreclosure. The open question is whether there will be enough of these deals to lift that distress portion of total sales to a level that changes investor expectations on pricing overall.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.