Introduction

The COVID-19 pandemic made housing affordability a persistent concern throughout 2020. And as we enter the new year, rent payments remain a financial obstacle for many families. According to our latest survey, 30 percent of renters did not make their January payment on-time at the start of the year. This is down just slightly from the mid-summer peak when unemployment was at its worst, but up significantly from historic baseline levels.

For minority renters, the missed payment crisis has been even more damaging. In the fall of 2020, the missed payment rate for non-white renters was nearly 50 percent higher than that of white renters. This is just one of many ways that minority groups are burdened with an outsize share of the pandemic’s economic fallout; beyond housing, people of color have disproportionately experienced loss of employment, loss of health insurance, loss of food security, and more severe health impacts.

As we did throughout much of 2020, our team collected data on housing, race, and financial outcomes using a nationally-representative survey of over 4,000 respondents taken during the first week of January 2021. The findings below highlight how the persistent and unequal effects of 2020’s housing crisis are spilling over into the new year.

Rent Debt Disproportionately Burdens Vulnerable Groups

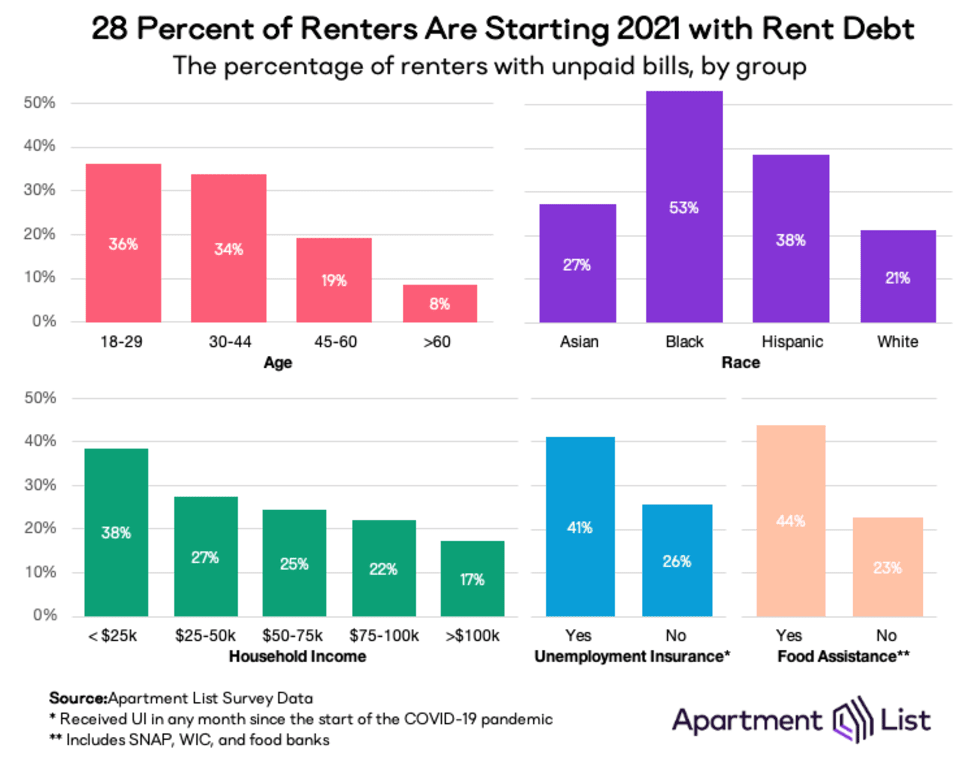

Last year, the percentage of renters unable to make a full on-time rent payment rose above 30 percent in May and has remained elevated ever since. Eviction moratoria have kept families housed but have not eliminated their past-due rent obligations, meaning millions are starting 2021 with “rent debt.” In total, our survey finds that 28 percent of renters carry rent debt, and of those, 42 percent owe over $1,000 to their landlords. Per the chart below, these debts are not evenly distributed across the nation. As we enter the new year, rent debt disproportionately burdens younger and poorer renters, renters of color, and renters receiving government benefits in the form of unemployment insurance and food assistance.

It is worth noting that rent debt has improved marginally since we last surveyed renters in October 2020; then, 33 percent reported having unpaid rent obligations, compared to 28 percent today. But for Black renters specifically, the problem has been worsening even as it improves for other racial groups. The percentage of Black renters with rent debt has grown from 47 to 53 percent since October, while it has dropped from 56 to 38 percent of Hispanic renters, from 39 to 27 percent of Asian renters, and from 23 to 21 percent of white renters.3 Furthermore, rent debt improvements have been concentrated among just the wealthiest set of renters. Since October, the rate of rent debt has nearly halved for households making over $100,000, but fallen just a few percentage points for those earning less than $50,000.

Rent Debt Is Driving Concerns About Evictions

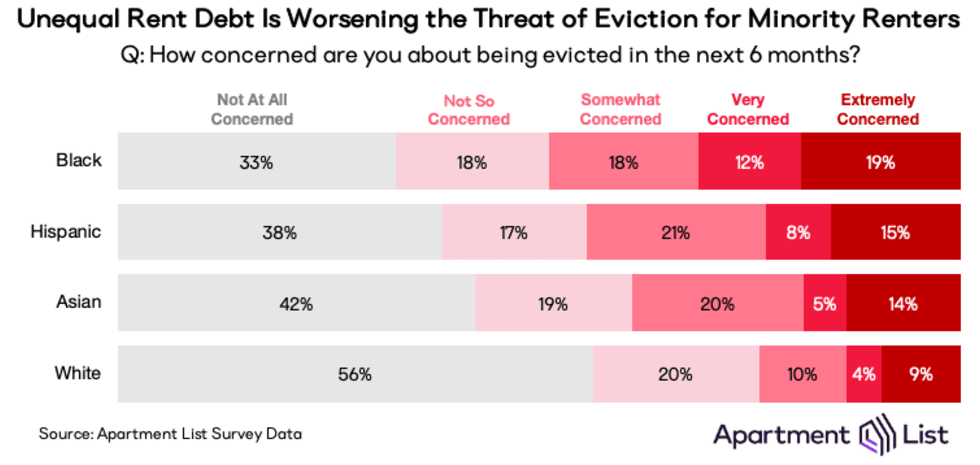

A national reduction in rent debt, coupled with federal and local eviction moratoriums, have allayed some broad concerns about renters being evicted from their homes. Today, 51 percent of renters say they are “not at all concerned” about an eviction, up from 39 percent six months ago.4 But eviction protection does not equal rent forgiveness, and unpaid debts will become due as soon as the federal moratorium expires, as it is scheduled to do in just a few weeks. This will expose the millions of renters with unpaid bills who aren’t protected by additional state or local laws. With that in mind, and considering what we now know about where rent debt is concentrated in America, it comes as little surprise that evictions pose a much greater threat to minority renters.

Eviction concern

Whereas 56 percent of white renters are “not at all concerned” about a looming eviction, only 33 percent of Black renters, 38 percent of Hispanic renters, and 42 percent of Asian renters said the same. Meanwhile, 31 percent of Black renters are “very” or “extremely concerned” about losing their homes, more than any other group and over twice the rate of white renters.

Unsurprisingly, rent debt and eviction concerns are highly correlated. Over 80 percent of renters who are extremely concerned about an eviction owe their landlords money, and on average, they owe much more than less-concerned groups; 45 percent owe more than $1,000, compared to just 3 percent of those who are not worried about losing housing. This highlights how eviction moratoriums may be short-term safety nets, but not sufficient solutions to deep inequalities. For renters coming into the new year with steep debts, these moratoriums may only be delaying the inevitable: a surge of evictions that will disproportionately displace already-vulnerable groups.

Unpaid Rent Causes Additional Downstream Financial Sacrifices

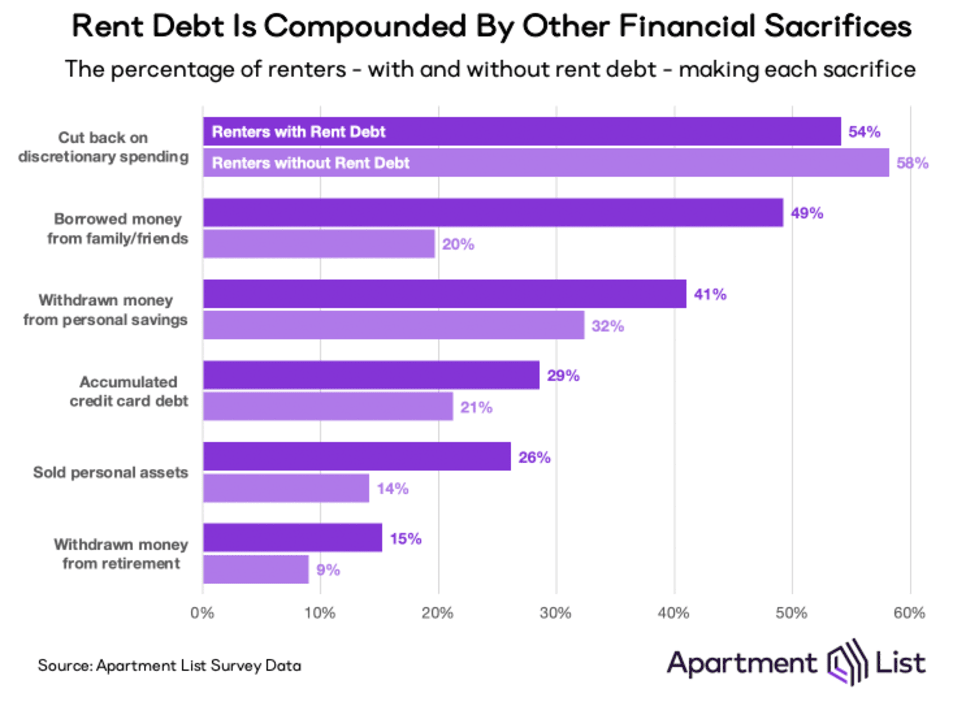

Rent debt - and the looming threat of eviction - are forcing many renters to change the way they spend and save their money, often exacerbating their financial troubles. Our survey asks renters what financial sacrifices they have made in response to the pandemic, and in the chart below we split the results by whether or not they have accumulated rent debt going into the new year. The discrepancies show that for debt-burdened renters, the financial hole can be much greater than just unpaid rent bills. By creating an immediate need for cash, rent debt leads to new forms of debt and limits short- and long-term savings.

Entering 2021, renters with unpaid bills are not only indebted to their landlords, they are more likely to be newly-indebted to friends and family (49 percent, versus just 20 percent of renters without rent debt) and more likely to be further-indebted to credit card companies (29 percent versus 21 percent). They are also withdrawing money from personal savings (41 percent) and retirement accounts (15 percent) at a faster rate than those who are free of rent debt, and are more likely to sell personal assets (26 percent) to acquire the cash needed for essential, immediate spending.

The only action that is less common among holders of rent debt is the least-disruptive: a reduction in non-essential, discretionary spending. Many debt-free renters can make this small change without resorting to more-substantial sacrifices. On the other hand, 85 percent of debt-burdened renters who cut back on discretionary spending also reported making one of the other changes on this list.

Conclusion

In 2021 the road to economic recovery will be a long one; slow but steady progress was made through much of 2020 until the year ended on a discouraging jobs report. This year the pandemic will remain a persistent threat to the health, finances, and housing security of our nation’s renters. And pre-existing economic inequality is compounding the problem for minority renters. People of color, who tend to work in occupations that are more prone to disease exposure and more susceptible to pandemic-related layoffs, are coming into 2021 with greater rent debt and more salient concerns about losing their housing once eviction protections expire.

A new presidential administration will be ushered in next week and has promised a number of lofty, long-term policy reforms aimed at curbing systemic inequalities in the housing market. But it also recognized the need for immediate aid to keep people housed, and is unveiling a new pandemic relief plan that will include larger direct payments and rent relief, among other initiatives. These efforts could be the difference-maker for vulnerable renter households currently on the precipice of eviction.

To learn more about the data behind this article and what Apartment List has to offer, visit https://www.apartmentlist.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.