2020 was a whirlwind of a year for the CMBS and commercial real estate segments measured by unprecedented changes dictating how we live and do business, unlike any other economic disruption we’ve seen before.

As a follow-up to our popular Decade in Review blog highlighting the twists and turns in the industry for the 2010-2019 decade, we are pleased to bring our readers the CMBS superlatives for 2020 – which few can contest – has been a year for the history books like none other.

Read on for the winners, biggest surprise trades, biggest rebounds, bright spots among the distress, the “unknowns,” and more.

Close, But No Cigar

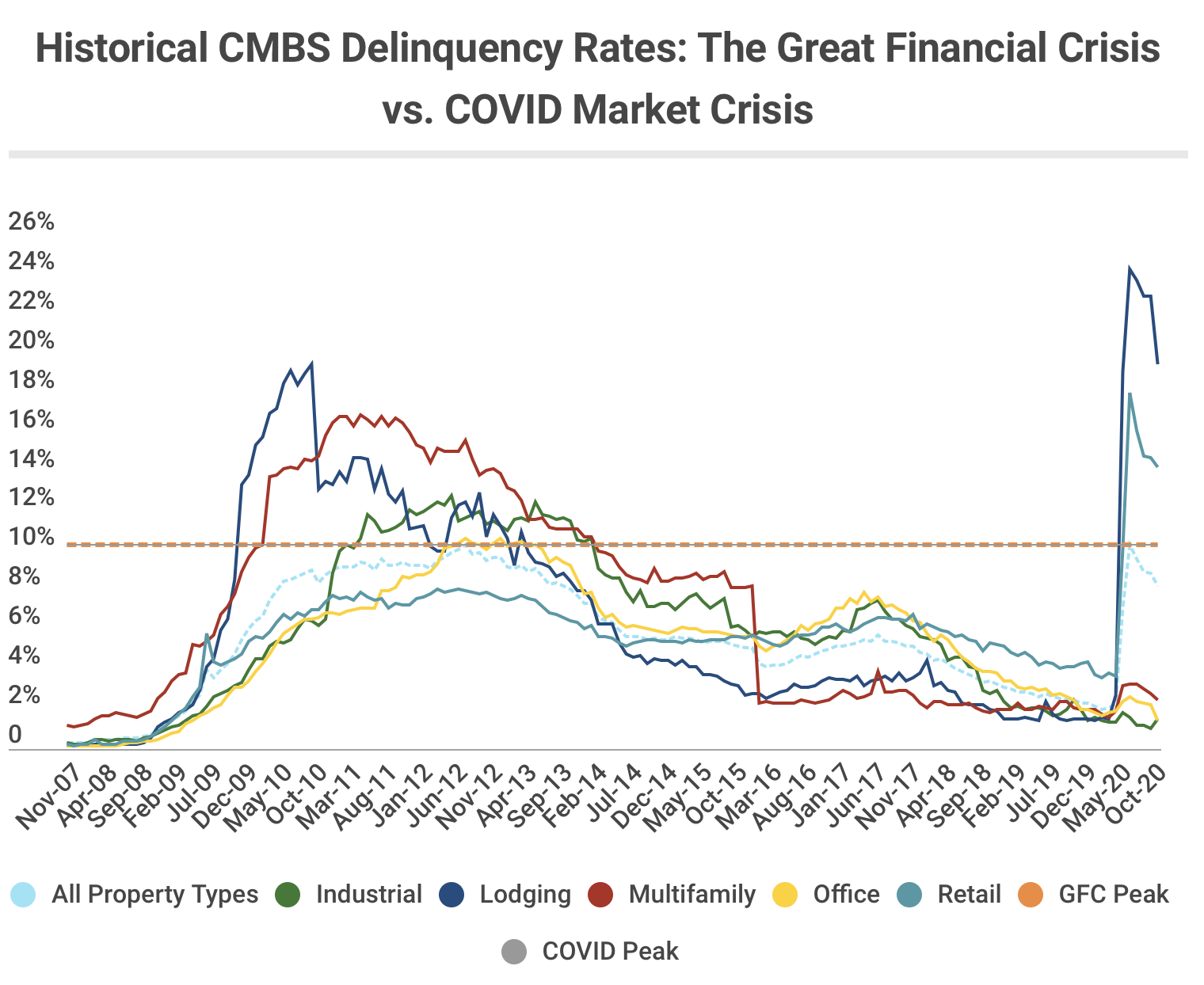

With lockdown policies resulting in the fastest rise in delinquency rates in CMBS history, all eyes were peeled to see whether the reading would surpass the GFC-high of 10.34%. The overall CMBS delinquency rate rose to 10.32% in June, albeit in a much shorter time frame, just 2 basis points shy of the previous record. Fortunately, rates have since retreated to 7.81% in December thanks to forbearance agreements and the partial reopening of the economy.

Retail Headlines Get Uglier

Even before the pandemic, it was hardly a secret that traditional retailers struggled to remain relevant in a rapidly changing landscape that was made more challenging by shifting consumer habits and the rise of e-commerce. Add into the mix social unrest, federally mandated closures, and continued consumer caution during a global pandemic to make for a difficult 2020 holiday season. 2020 saw the liquidation of iconic department store chains Century 21 and Lord and Taylor. JCPenney, Neiman Marcus, J. Crew, Brooks Brothers, Pier 1, GNC, New York & Co (and the list goes on…) were among those that sought Chapter 11 bankruptcy to restructure existing debt and shore up capital to keep their operations afloat. Manhattan street-level retail landlords remain under pressure while several troubled retailers had ceased making rent payments. Several CMBS borrowers indicated they would turn back the keys on certain properties and mall valuations fell by 75% in some cases.

Biggest Surprise Trade of the Year #I

Who knew a pandemic would accelerate the demise of brick-and-mortar retail and generate huge profits for CMBX 6 and 7 BBB- shorts, the two indexes with the heaviest retail concentrations.

Biggest Surprise Trade of the Year #II

With no one seeing COVID-19 coming until March 2020, those that had been short the CMBX indexes heavily tilted toward hotels stumbled into big gains.

Rise of Skywalker, Fall of 10-Year Yield (Take II or III or IV)

The yield on the 10-year Treasury ended at 1.92% in 2019 and declined to an all-time low of 0.52% in early August. The yield ended in 2020 at 0.93% and continued to rise in early 2021.

Biggest Rebound of the Year

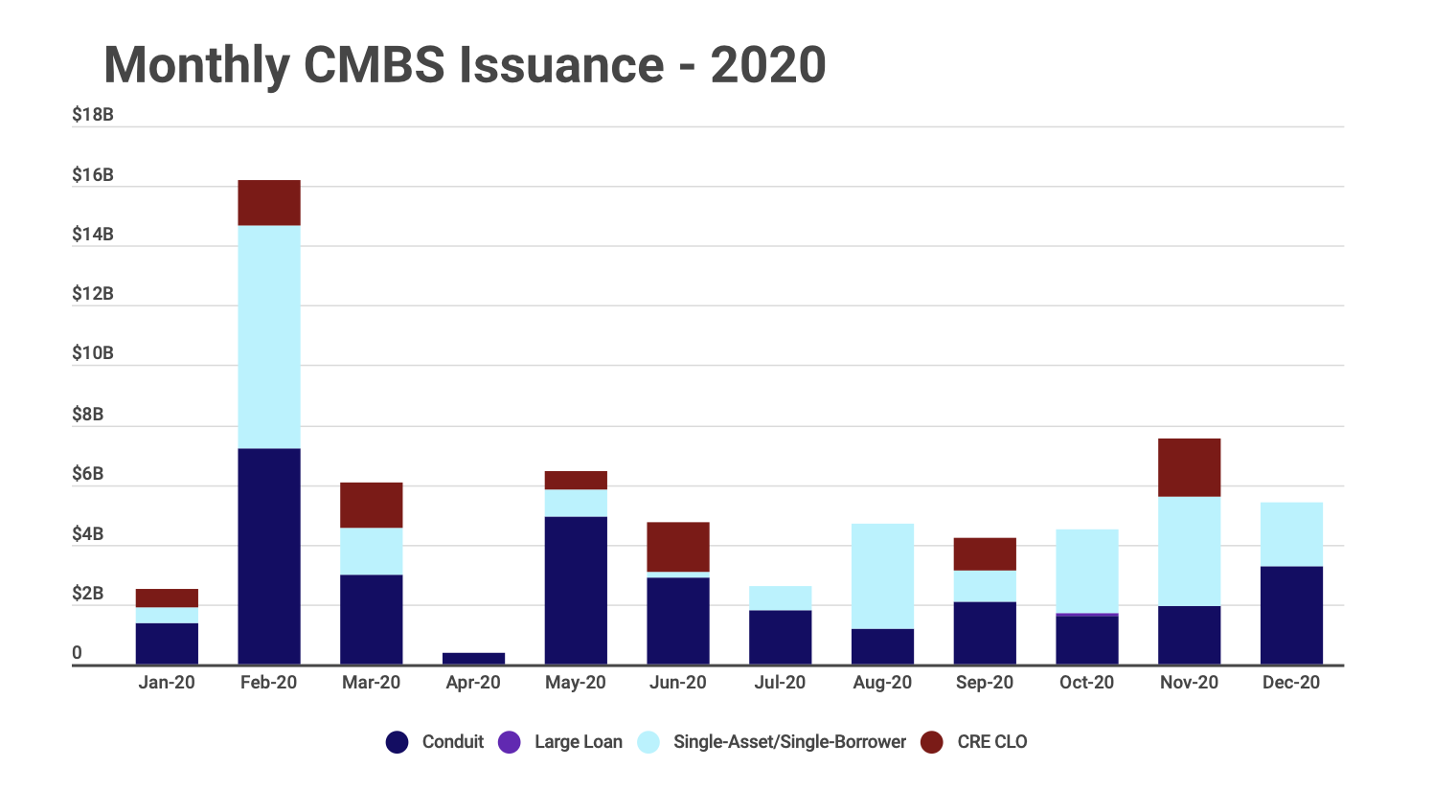

CMBS spreads blew out in March and April – 10-year AAA spreads rose from 79 basis points to 350 basis points while BBB- widened to 1,150 basis points over swaps at the height of the coronavirus market volatility – spreads have since tightened to pre-pandemic levels. As a result of strong demand and the introduction of the Term Asset-Backed Securities loan program by the Fed, issuers resumed bringing new deals to market by the summer after a brief standstill in issuance activity. By comparison, the CMBS market logged 21 months of no-issuance volume during the Global Financial Crisis.

Property Types that Just Can’t Seem to Catch a Break

Retail and lodging were the hardest hit industries during the coronavirus dislocation. Delinquency rates (30+ days) for the two property sectors surged to 24.30% and 18.07% respectively in June - the highest on record for the CMBS industry.

Bright Spot Among the Distress

The industrial segment continues to outperform as the demand and needs for warehousing and logistics space has never been more potent. In fact, CMBS delinquency rates had fallen from 1.35% in March to 1.14% in December, making it the only major property type to have its delinquency reading fall during this period. Self-storage and single-family rentals also benefitted from social and economic changes brought upon by the pandemic.

Tailwinds That Kept Things From Being Worse

The large volume of CMBS loans that would require forbearance, modifications, extensions, or other forms of relief. The US government stepped in quickly to pass fiscal support measures while the industry rallied together to provide workout strategies and other financial assistance to weather this difficult time.

The “Unknowns”

AKA Segments We’re Watching Closely / Biggest Topics Still Under Contention: With remote working and flexible working options so widespread, it remains to be seen the impact on the office market, even after we return to normalcy. Multifamily – especially student housing – is also on our radar, as recent servicer data has indicated that several large loans have reported occupancy for 2020 that was considerably lower than that of 2019 levels.

To learn more about the data behind this article and what Trepp has to offer, visit www.trepp.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.