Source: https://www.similarweb.com/corp/blog/petco-ipo-share-price-has-stabilized-is-now-the-time-to-buy/

Petco re-entered the public markets on 14 January, raising $864M, and its stock price was up 55% in the moments after its third IPO.

The company is now trading on the ticker WOOF, and the share price has stabilized following its initial surge. Whether you participated in Petco IPO or not, we used alternative data to gain insight into the online health and performance of the company.

Key Takeaways:

The company has started to invest more in paid advertising since April, but maintains strong brand strength

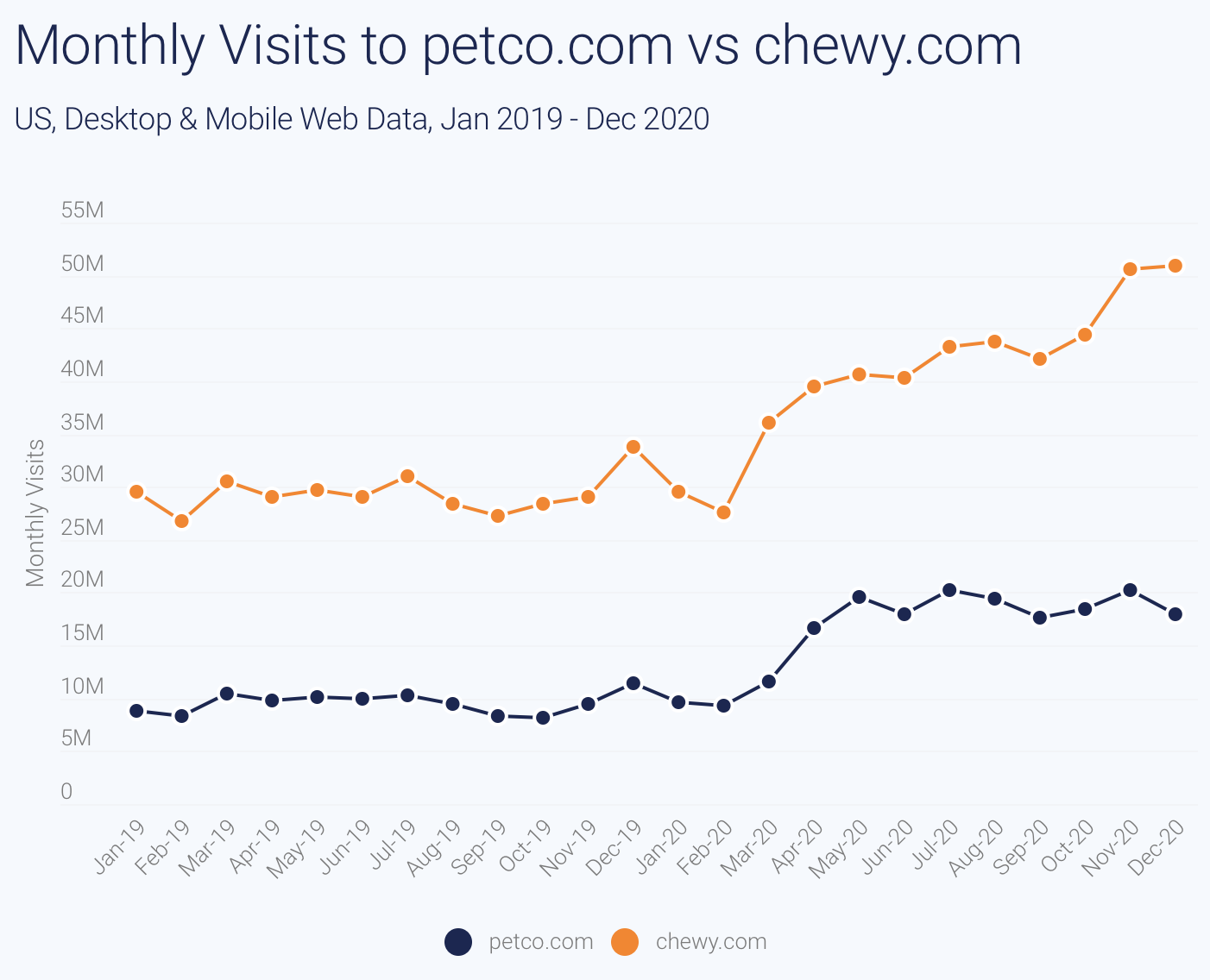

Monthly visits

Monthly visits to petco.com in the U.S. are significantly lower than competitor chewy.com, however year-over-year (YoY) growth is higher for petco.com. In Q4 20, petco.com experienced 95% YoY growth in monthly visits compared to chewy.com that experienced 60% YoY growth.

In Q2 20 Petco.com saw a huge jump in YoY growth of monthly visits, which set the tone for the rest of the year.

So, where is this growth coming from?

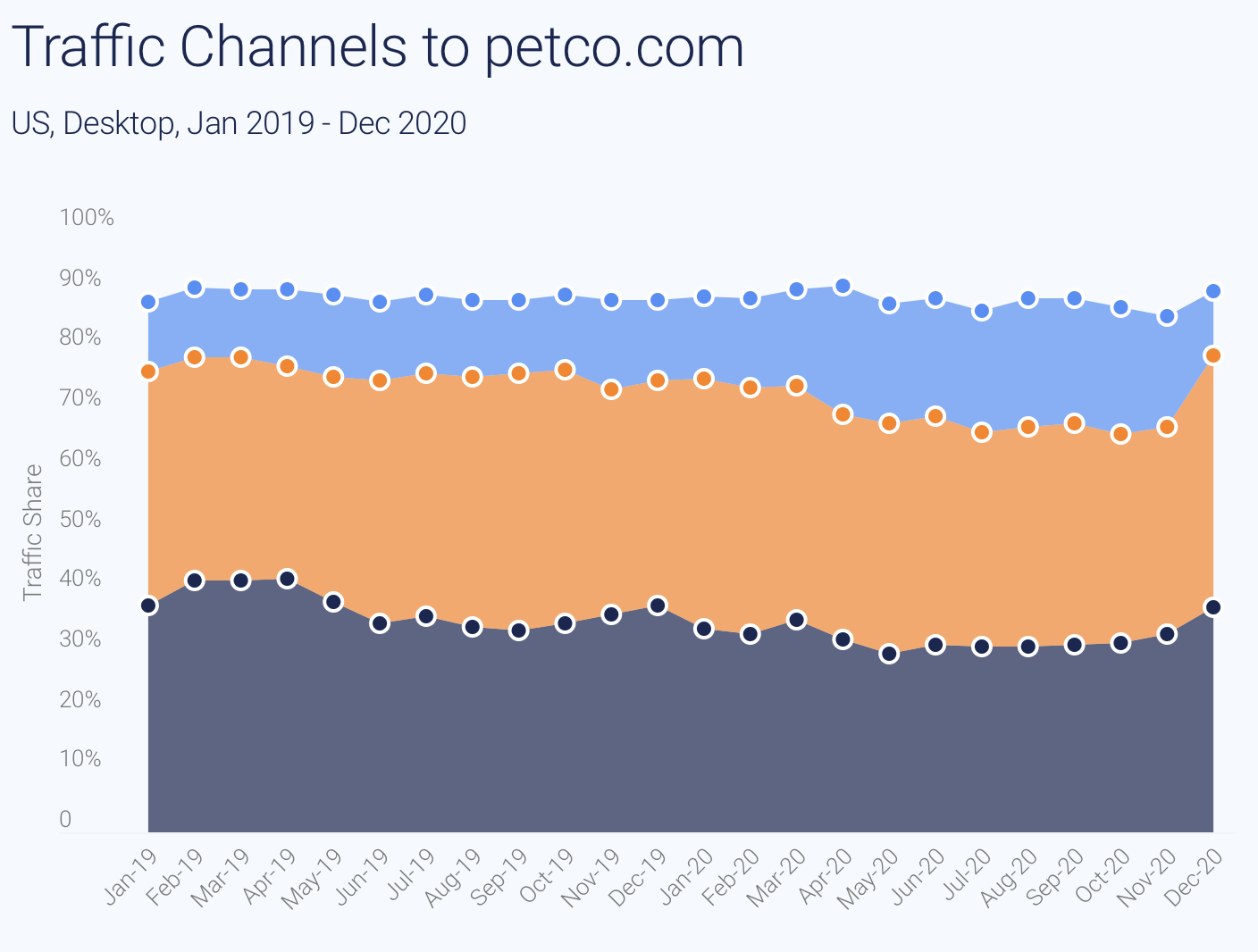

Petco’s brand awareness

Petco has strong brand awareness, displayed by ~75% traffic coming directly and organically. However the company has started to invest more in paid advertising since April, likely contributing to the strong growth in site visits.

An increase in site visits is one thing, but what we really want to know is whether Petco is making a good return on its investment in paid search.

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.