Footfall across the UK’s biggest supermarkets has fallen by 51 percent in the last year despite their essential retailer status and booming food sales. The big chains reported record sales during the Coronavirus pandemic and festive season claiming consumers treated themselves to luxury items to get them through the lockdowns and to compensate for the closed hospitality industries.

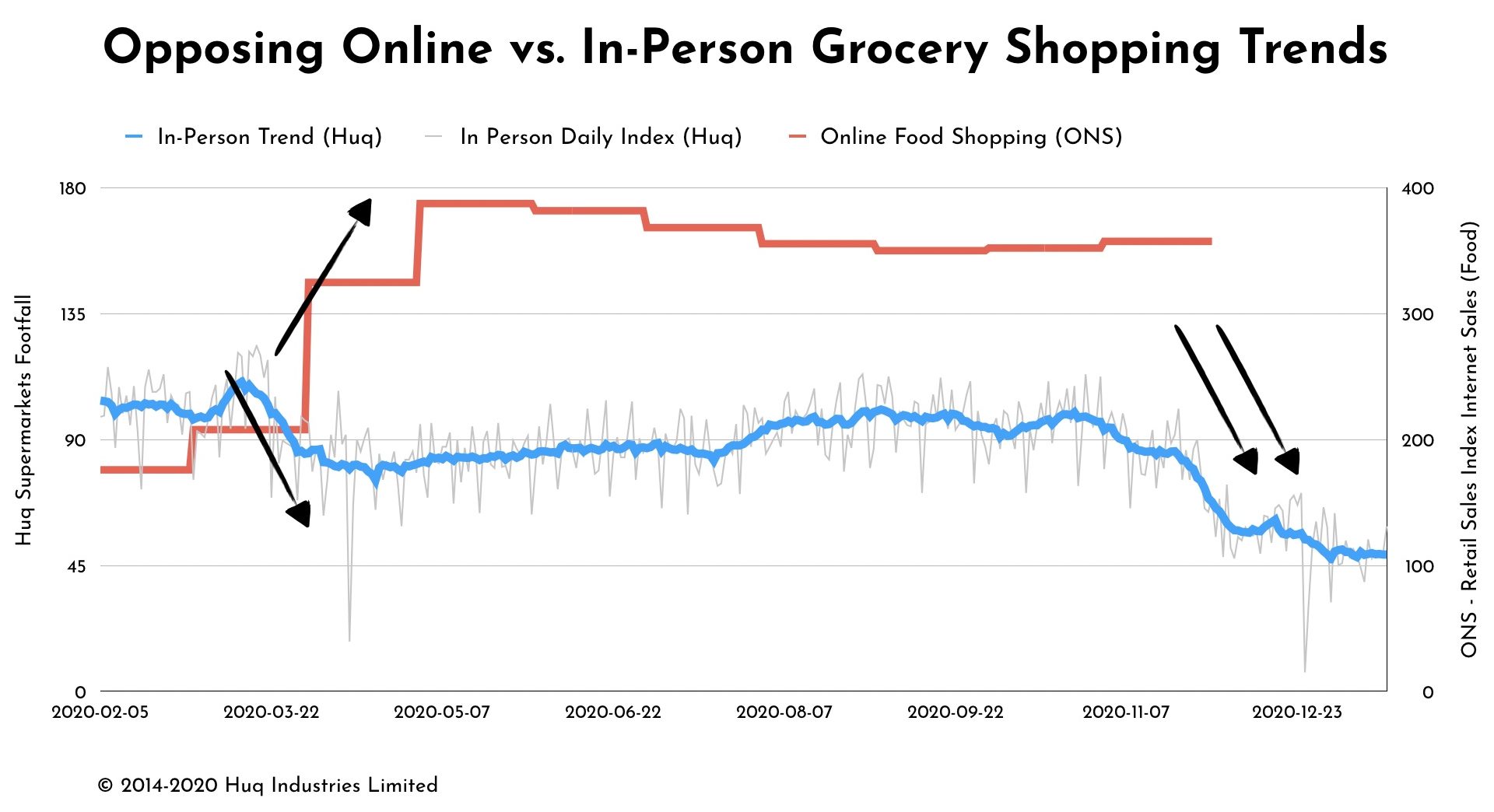

But, at the same time, data from Huq Industries suggests that fewer of those trips where made in person. Actual journeys to the aisles and checkouts have shown a steady decline during 2020, with a 25 percent drop during the first lockdown and a further 25 percent fall to coincide with the second wave from September.

UK Supermarkets: Larger sales but fewer in-person visits

At the same time, the Retail Sales Index for Internet Sales (Food) shows that the fall in physical store visits is counterbalanced by a huge (200%) rise – demonstrating that shoppers are buying online and making fewer trips to stores – and all with fuller baskets.

Recently the big four – Tesco, Sainsbury’s, Asda and Morrisons – along with Lidl, all reported total sales up by more than seven per cent for the crucial six week festive period compared to last year, and of this the online component – delivery and click and collect – has more than doubled.

Future updates from the ONS will confirm whether the strong (-0.65) inverse correlation between in-person shops and online sales continued during the autumn / winter of 2020, and the big question for industry watchers of course is whether this change becomes structural?

To learn more about the data behind this article and what Huq has to offer, visit https://huq.io/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.