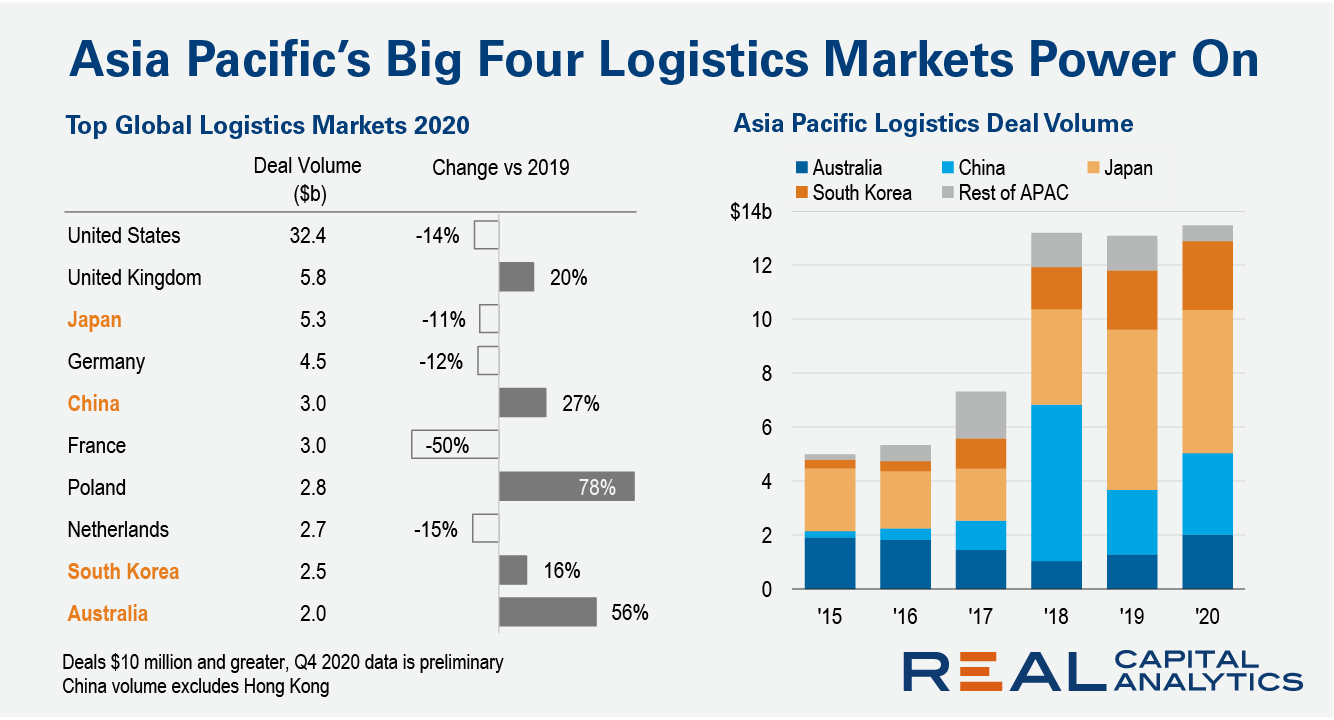

Investment in the logistics sector reached a record high in Asia Pacific in 2020, with four of the region’s markets ranking in the top 10 biggest logistics markets globally in the year. The e-commerce revolution was already well underway before 2020, and the Covid-19 pandemic served to reinforce investor appetites for warehouses even further.

Deal activity totaled $13.5 billion in 2020, according to preliminary Real Capital Analytics data, just eclipsing investment levels in 2018 and 2019. South Korea and Australia notched record years for investment in distribution facilities, while China and Japan both had their second most active years. Together, these four markets accounted for 96% of all logistics deal volume in APAC in 2020.

The logistics sector is still in expansion mode in most of the Asia Pacific region, with China and South Korea two of the fastest growing markets in the world. From 2015 to 2020, logistics investment grew at an annualized rate of 66% and 51%, respectively. The rapid development of prime warehouse facilities has underpinned this trajectory, with developers such as GLP, ESR, and Goodman racing to build sheds to keep up with the burgeoning investor appetite for the asset class.

In Japan, the region’s most mature market, 2020 logistics investment was just shy of the $6 billion in deals recorded in 2019. Trades of supersized logistics facilities are gaining traction: the acquisition of the 2.8 million sqft Logiport Kawasaki Bay in Yokohama was the biggest distribution facility traded in Japan across all of RCA history.

In Australia, deal activity for most sectors was muted last year, with office, retail, and hotel investment all plummeting by over a half. Not so for the logistics sector, which grew to become the 10th largest market of this type globally.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.