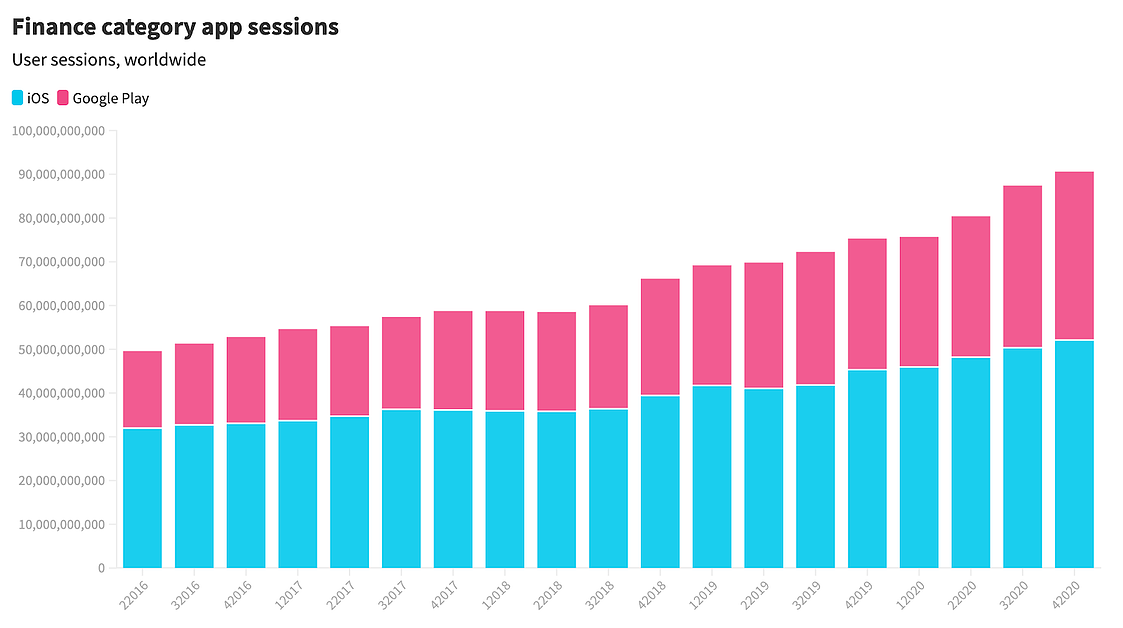

Let’s be clear. The digitization of money and banking was inevitable. The pandemic merely accelerated its adoption. 2020 forced us to finally download our bank’s app (if we hadn’t already) and take all of our transactions online. As a result, finance apps hit record highs for both downloads and user sessions in Q4.

To unpack the recent growth of the fintech space, we sat down with mobile and banking experts from Adjust, MoEngage, Visa, Current and Kredivo. Together, we identified the key trends and success strategies of the past year. Click the “Watch it here” button below to watch the full virtual session.

“It’s a fascinating time to be in fintech”

—AJ Shanley, Head of North America Fintech, VISA

If you’re still here, I assume you’d prefer to read about the key trends and takeaways. As mentioned, finance apps hit record highs for both downloads and user sessions in Q4. Downloads increased 15.2% YoY, sessions increased 20% YoY. Plus, time spent in-app rose about 9% YoY.

While some of the overall growth stats may appear to be in line with the market’s previous trajectory, the gains we saw per finance vertical, and per region, were beyond the norm. Visa’s AJ Shanley validated this finding, sharing that Visa saw payment flows increase by 20x.

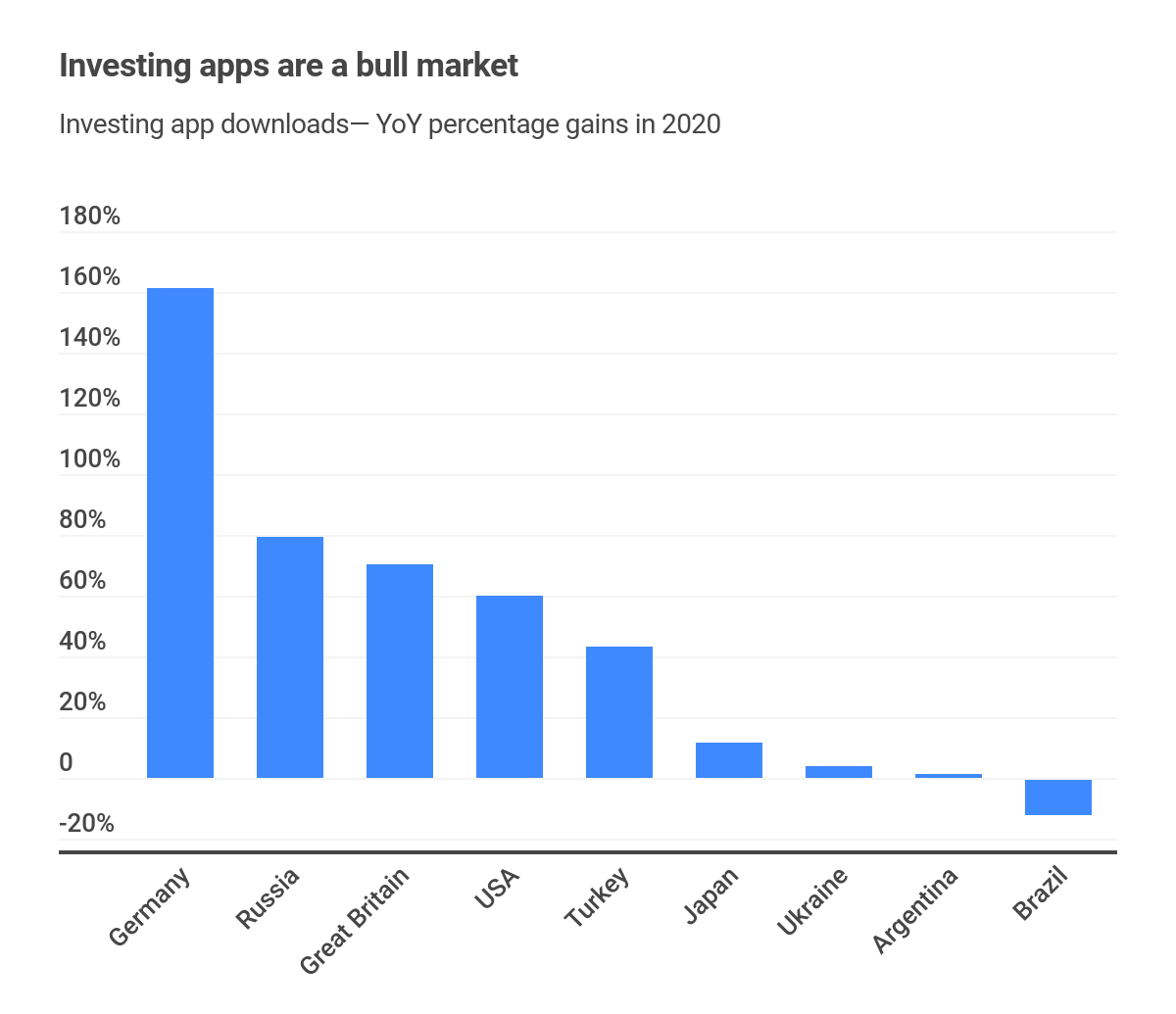

Investment apps, similarly, are booming. In fact, according to both Adjust’s data and ours, investing apps are the fastest growing vertical across all finance apps. Plus, these apps are seeing spikes in key markets, like Germany, Russia, UK, and the US.

“About half of our customers— we’re their first bank account”

—Adam Hadi, VP of Marketing, Current

For those who are not yet at the investment stage of their finance journey, full-service banking apps, payment apps, and alternative lending apps were the go-to downloads. Overwhelmingly, those who were not banked at all prior to 2020 opted for these online banking services instead of in-person ones. This speaks to the accessibility and convenience that digital banking solutions offer.

In emerging markets that have larger populations of unbanked people, fintech is not seen as a disruptor, but a helpful solution. As such, these countries drove the global growth of banking apps. Of the countries analyzed, Argentina leads the pack in new user growth, having seen an increase of 138% in banking app downloads YoY.

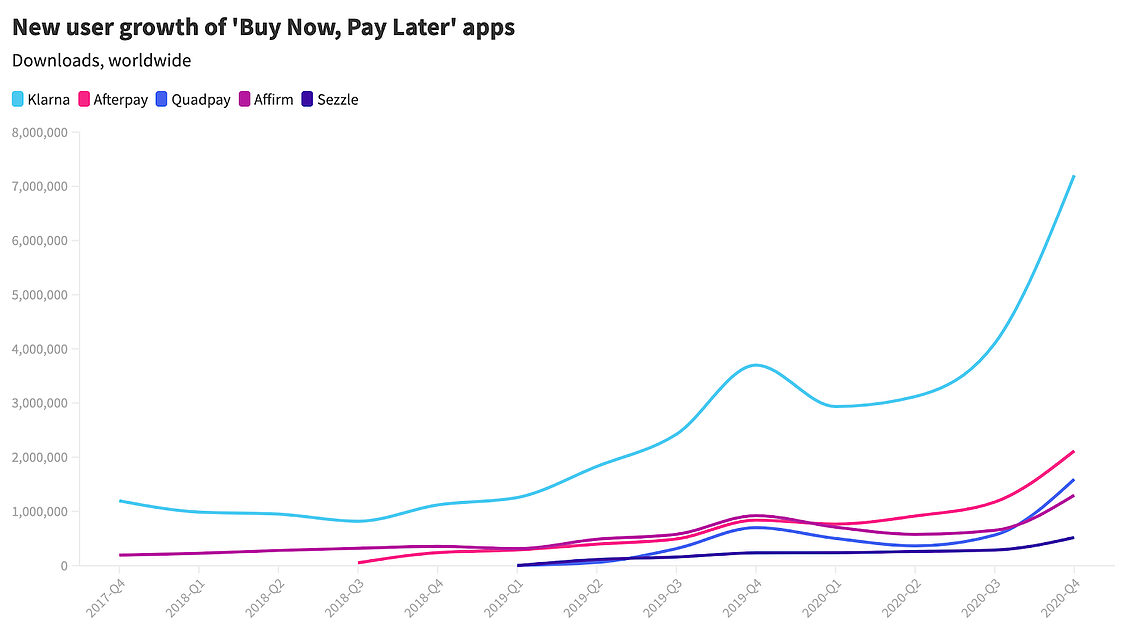

In the spirit of accessibility, we also saw ‘Buy Now, Pay Later’ (BNPL) apps take off in Q4. BNPL apps offer a way for consumers to pay in installments, and better stay within their budget.

**“The lines between fintech and traditional banks will continue to blur”

**—AJ Shanley, Head of North America Fintech, VISA

If it’s not clear to you already: consumers desire accessibility and flexibility. Best way to deliver this? Through mobile solutions. This is true in emerging markets, where fintech fills a critical gap, and true in more mature markets, where fintech is the preferred choice for Gen Z, Millenials, and Gen X.

But what makes for a successful mobile strategy? A combination of factors, according to our panelists…

Visa’s AJ Shanley emphasized the need to “unbundle and bundle." This is the process by which a business looks at all banking services, then selects one to be their niche or focus. After establishing their core product, they can begin to add/layer other services back into their offerings.

Unbundling and bundling is key to succeeding in the crowded fintech space because it ensures differentiation. It also makes it easier to define the product’s target audience. Knowing your audience, Current’s Adam Hadi argues, is critical for both acquisition and retention. It can be tempting, he says, “to make a product for everybody,” but you can’t let yourself get distracted from your core offering.

Finally, Kredivo’s Alethia Tan said she expects we’re going to see more collaboration and more experimentation—across the industry and within companies, with the main goal of offering new innovations and features to users. If traditional financiers partner with mobile-first folks, and vice versa, innovative solutions can reach more people, faster. And if there’s data backing these efforts, all the better.

“The power of data analytics & insights will become so much more important”

—Alethia Tan, Head of Growth Operations, Kredivo

To learn more about the data behind this article and what Apptopia has to offer, please reach out to Connor Emmel at cemmel@apptopia.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.