WW International (formerly Weight Watchers) reports its Q4 and full year earnings on Feb. 25 after markets close.

Ahead of the print, WW shares are flat on a three-month basis. Last quarter, the global wellness company reported mixed results with a revenue miss. WW cited declines in workshop fees and overall product sales as a result of COVID-19 pressures. Investors are also anxious about up-and-coming players like weight-loss app Noom and food-tracking monitor Lifesum.

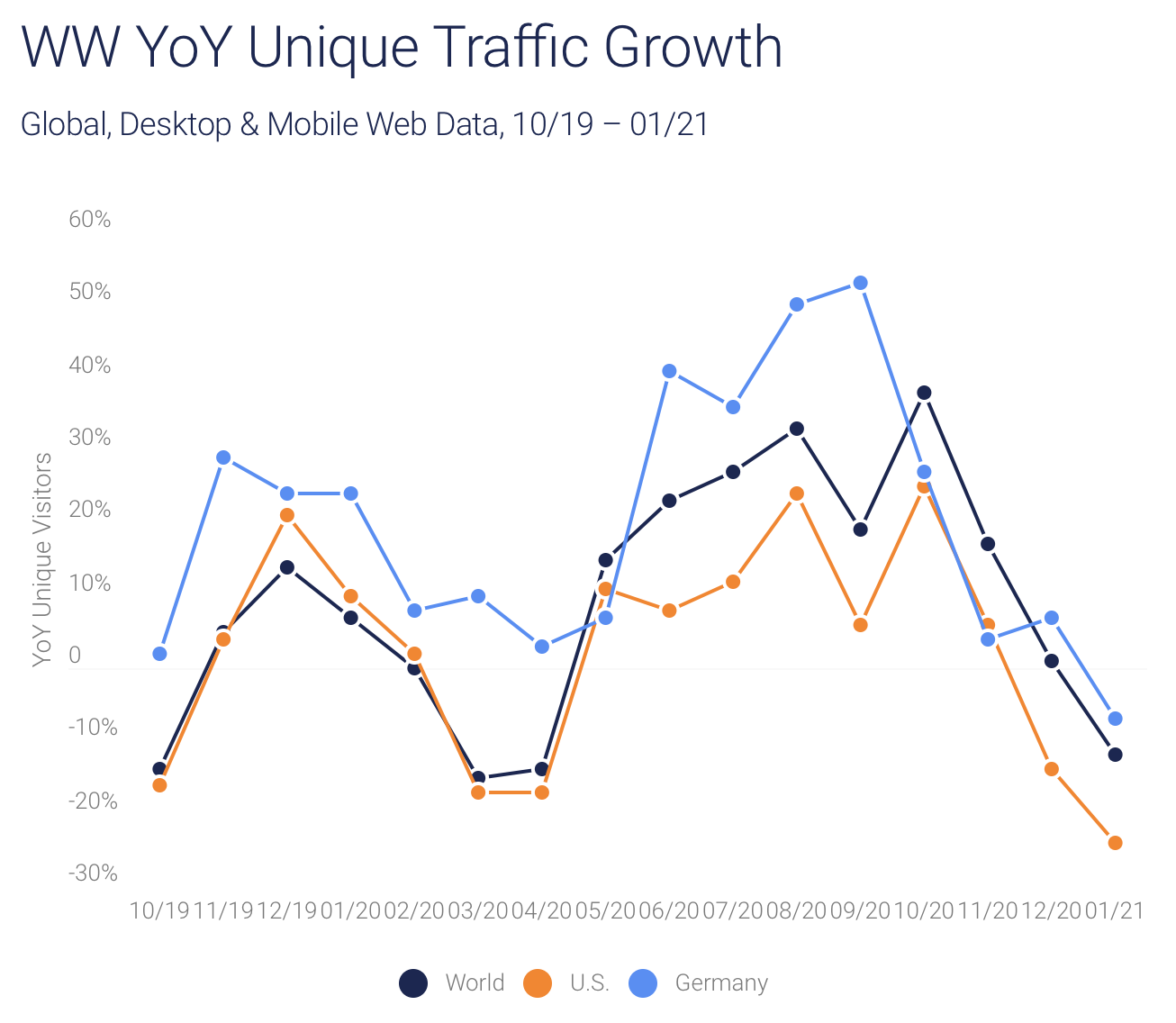

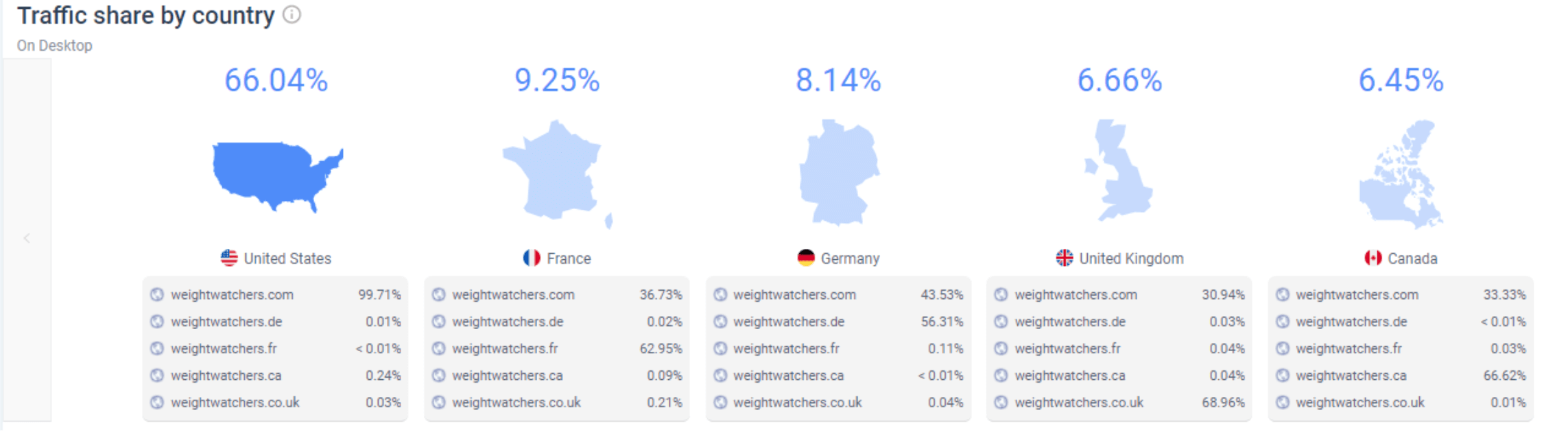

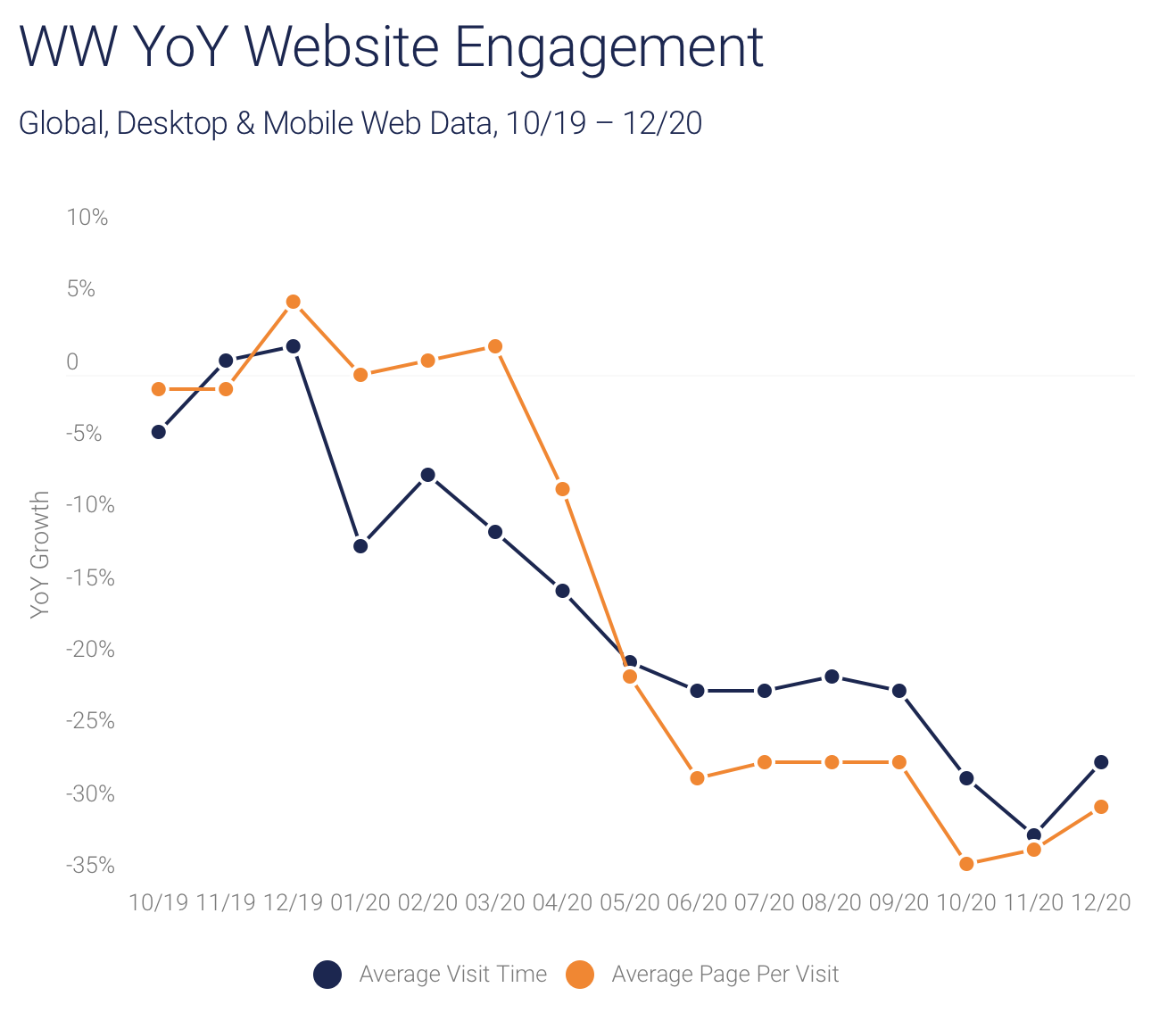

But despite the revenue shortfall, analysts praised WW’s pivot to a digital-first world. That included WW shutting down studios and ramping up digital health and wellness services (which boast higher profit margins). Plus WW’s total subscribers rose 5% in Q3 to a record 4.7M. Most impressively, digital subscribers soared 23.5% year-over-year (YoY), with eCommerce sales rising 300%.

According to CEO Mindy Grossman, “All of WW’s 4.7 million members utilize our digital platforms, with over 80% of our members being digital-only and 20% having both digital and workshop, whether virtual or physical access.” So did this strategy continue to pay off in the fourth quarter?

Using SimilarWeb’s powerful investment analysis we can track WW’s key digital data trends. Let’s take a closer look now.

Key Takeaways

Our data suggests that:

Net-net Q4 was not an easy quarter for WW, but could this create an opportunity ahead of a potential post-pandemic boom? According to Grossman, COVID has really prompted people to carry out ‘an overall reappraisal of their health.” She believes WW’s new app-based membership plan Digital 360, launched in January, will help WW boost its subscriber numbers going forward – so watch this space.

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.