With the COVID-19 pandemic leaving most shoppers sheltered in place, many Americans have turned to crafting to pass the time. JOANN is taking advantage of this fad to launch an IPO, but will the glitter of crafting stay glued once consumers are able to leave the house? In today’s Insight Flash, we examine JOANN’s prospects vs. other craft destinations based on overall growth, new customer acquisition, and demographics.

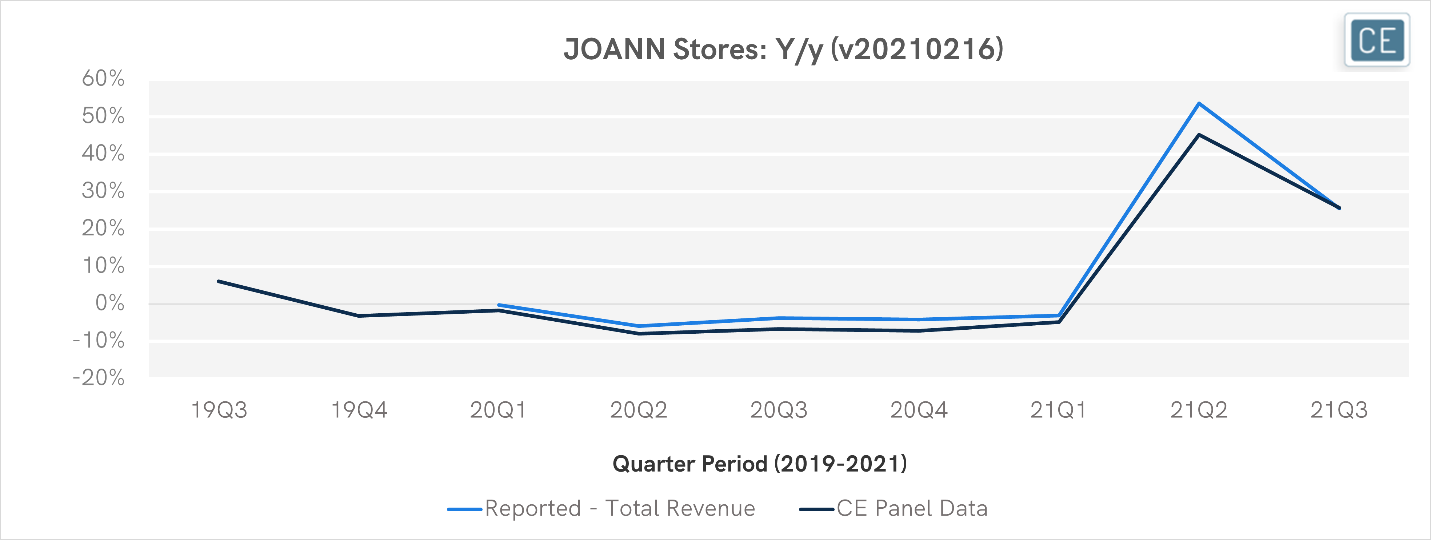

CE Capture of JOANN Sales:

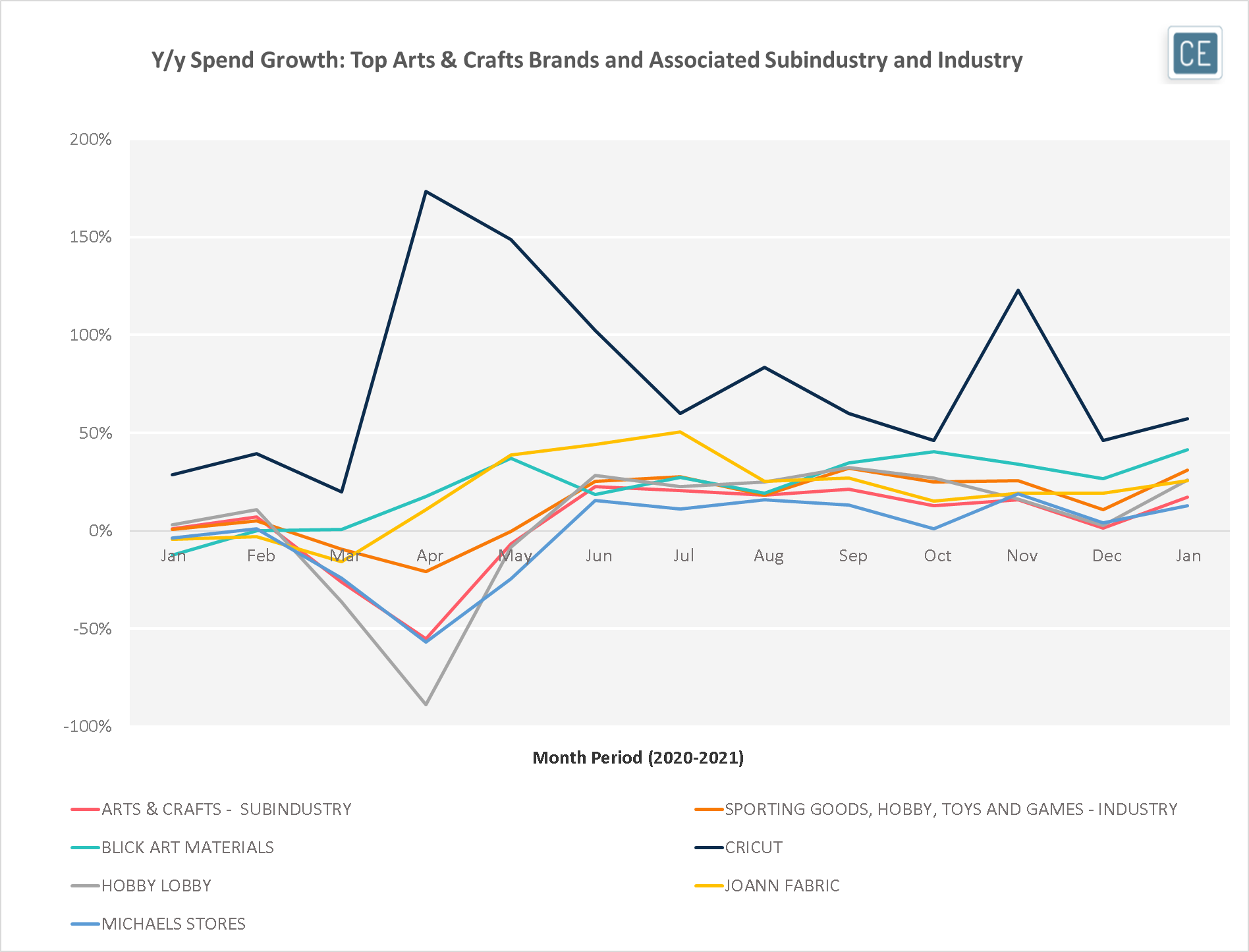

In general, Arts & Crafts spend growth has lagged the broader Sporting Goods, Hobby, Toys and Games industry since the beginning of last year as pandemic trends have driven shoppers towards more outdoor pursuits. Yet, JOANN spend growth, negative at the beginning of 2019, began to outpace overall Arts & Crafts at the beginning of the pandemic. In April, spend was up 11% y/y for JOANN and down -55% for the Arts & Crafts subindustry overall. Growth peaked for JOANN in July at 51%, but has stayed strongly in the 15-25% range for the balance of the year. Competitors such as Michaels and Hobby Lobby didn’t see as strong of an initial bump, but did manage to accelerate to double-digit spend growth for much of the second half of 2020. Blick started slower but has since begun to outpace JOANN in growth, while DTC Cricut leads the subindustry with growth that has accelerated from already strong pre-pandemic levels.

Arts & Crafts Spend Growth

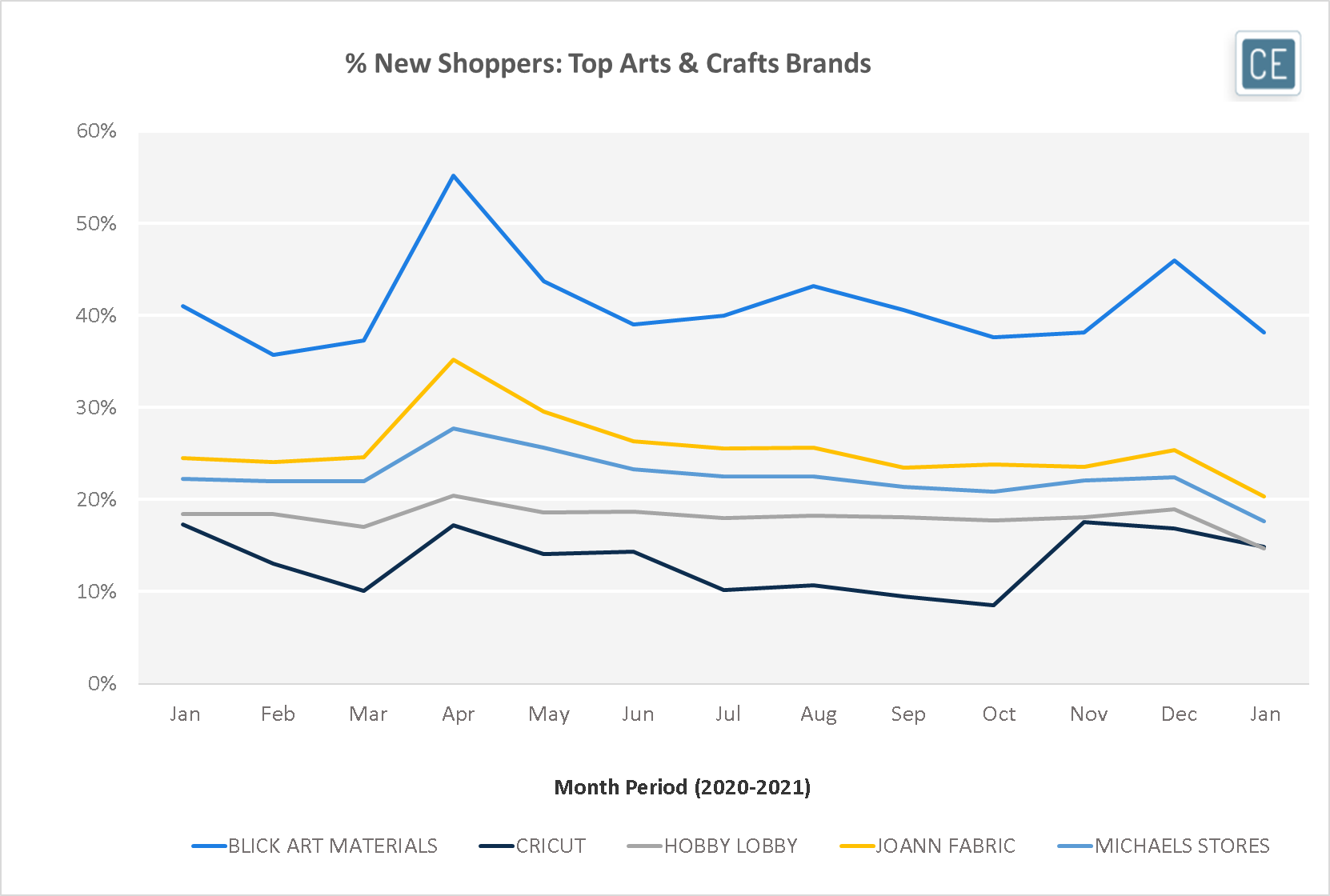

All of the top Arts & Crafts brands saw an influx of new pandemic shoppers in April, with new shopper percentages rising from the first three months of the year. Blick has led the group in capturing new shoppers. JOANN is in second place though, with a strong ability to drive new spend and at least 20% of sales coming from new shoppers in every month of 2020.

New Shopper Mix

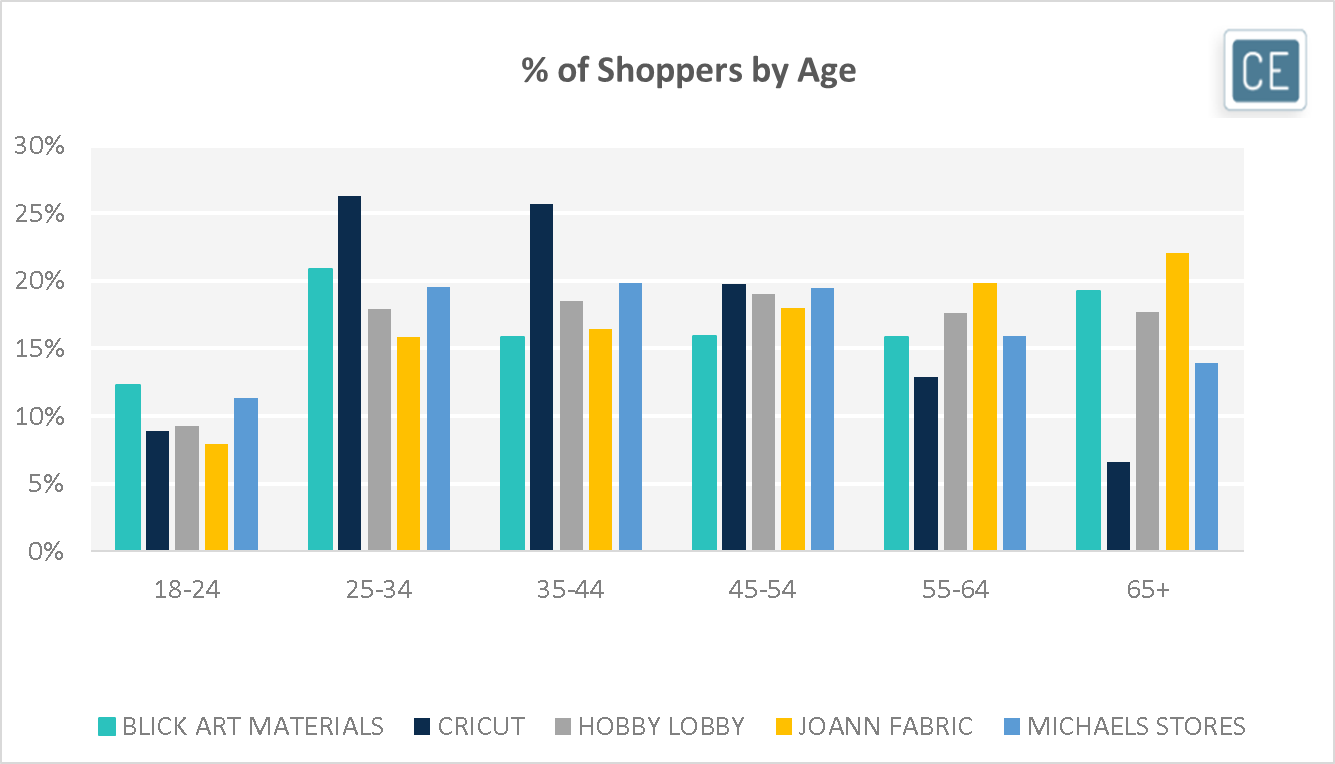

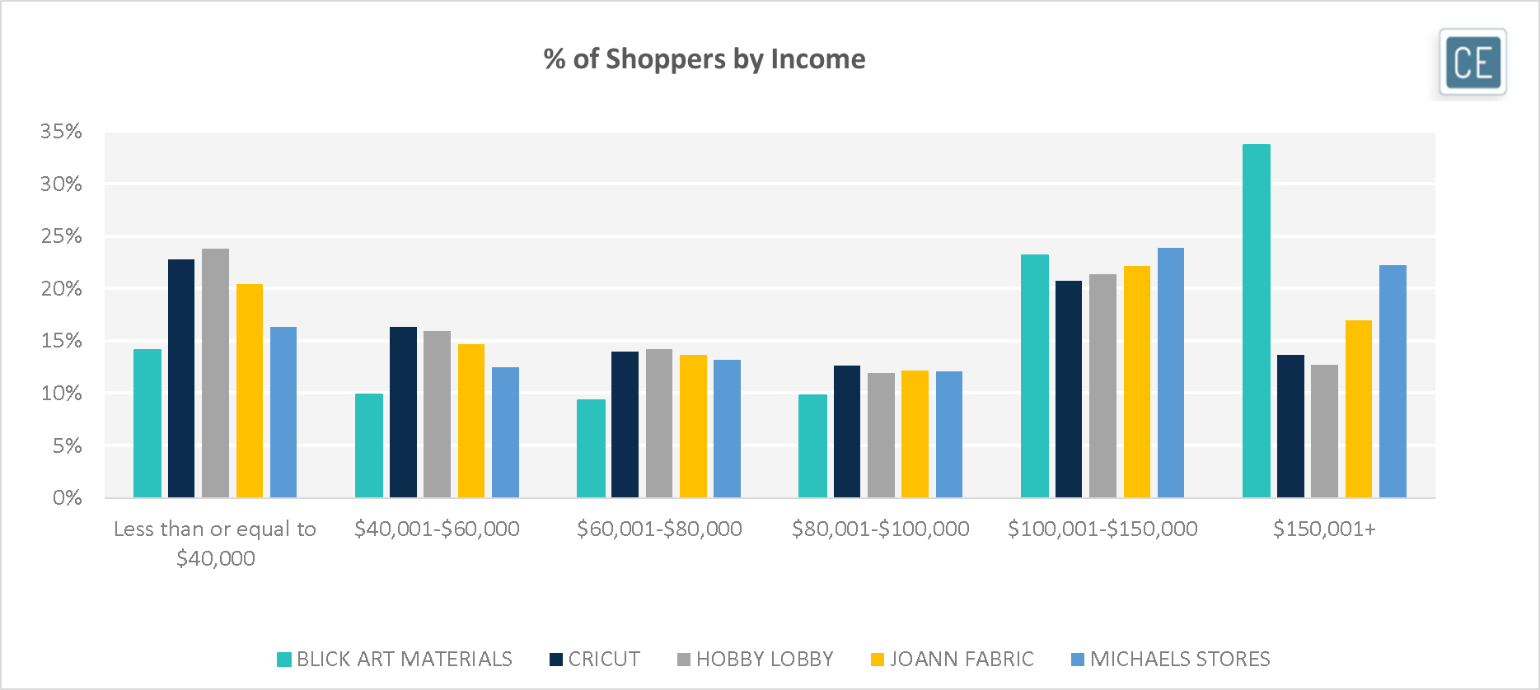

JOANN holds a unique demographic positioning among its competitive set. Its shoppers skew older than other Arts & Crafts brands, but also shoulder income levels with skews at both the low end and the high end of consumer income. Given the mix, the low-end spenders may be retirees relying on savings. Cricut and Hobby Lobby also skew lower income, although Cricut has a very strong age concentration in 25-44 year olds. Blick skews higher income and also younger, as does Michaels, although to a lesser extent.

Demographics

Note: Shoppers in each demographic who made at least one purchase 01/01/2020-01/31/2021.

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.