As consumer adoption of food delivery increases, the competition among food delivery companies on wallet share and loyalty continues.

If a restaurant is available on all delivery apps, users get to choose which app to order from. To lure more users to their own platforms, food delivery companies need to adjust their pricing strategies, optimize the service, run various promotion campaigns, and even offer alternative services such as grocery deliveries.

FoodPanda is winning in user loyalty in Hong Kong

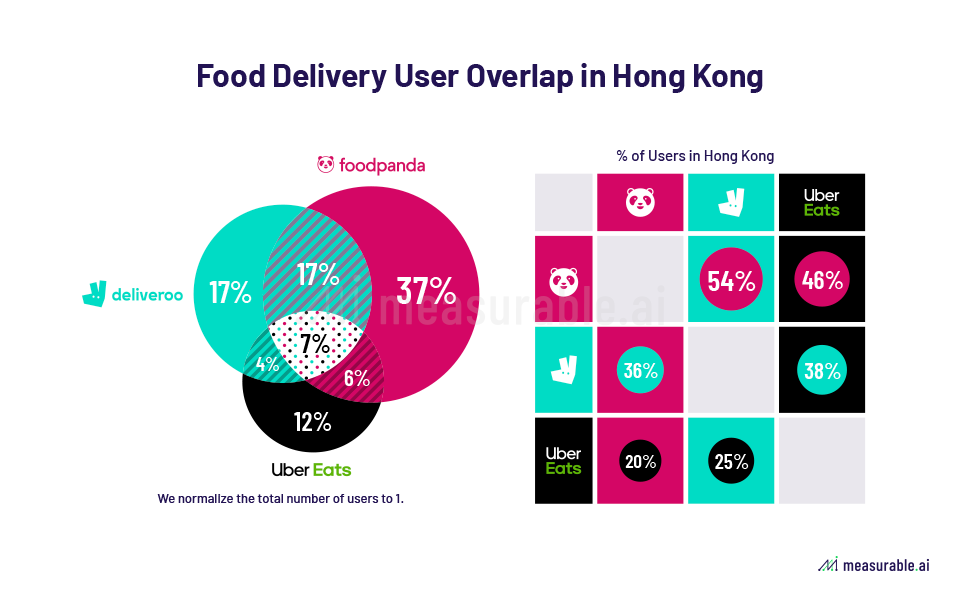

According to Measurable AI’s e-receipts data in 2020, Foodpanda, Deliveroo, and UberEats own 67%, 45%, and 29% of total users respectively in the Hong Kong market. Among all of them, 37% of users choose Foodpanda exclusively.

Among the rest of the users, 36% also ordered food through Deliveroo and 20% on UberEats. Compared with the other two players in Hong Kong, Foodpanda users stand out to be the most loyal ones.

Deliveroo Plus: VIP users make more orders with fewer items

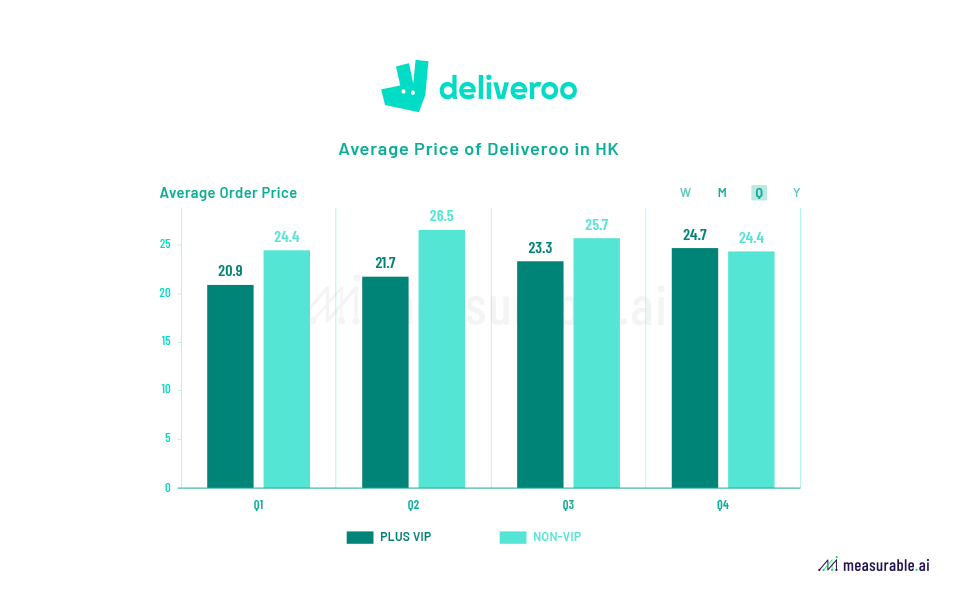

Deliveroo is the only platform that offers a premium membership to users which covers all delivery fees with a subscription fee.

In comparison between VIP and No-VIP users in Hong Kong, we find that the former group tends to order more frequently, probably for the convenience of zero delivery fee, thus the average price of the VIP orders is a bit lower than that of the non-VIP ones.

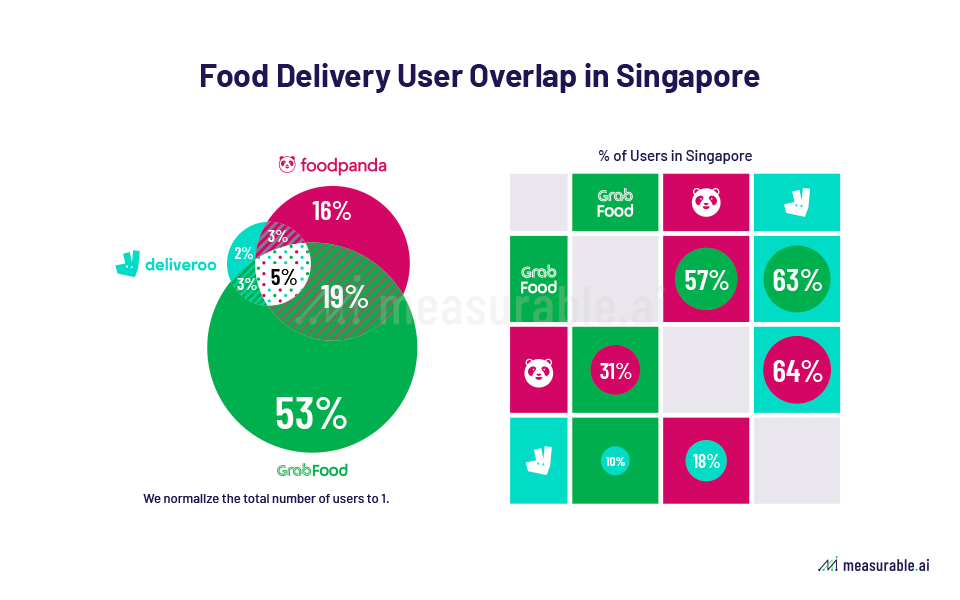

In Singapore, Grab is leading in both market share and loyal users. According to all e-receipts transactions in 2020 from Measurable AI, Grab, Foodpanda, and Deliveroo take the share of 80%, 43%, and 12% of total users respectively in the Singapore market.

A whopping 53% of users choose Grab exclusively in Singapore, while 16% of people use Foodpanda only and 2% on UberEats.

Foodpanda users in Singapore are not that loyal, among of which 57% also use Grab.

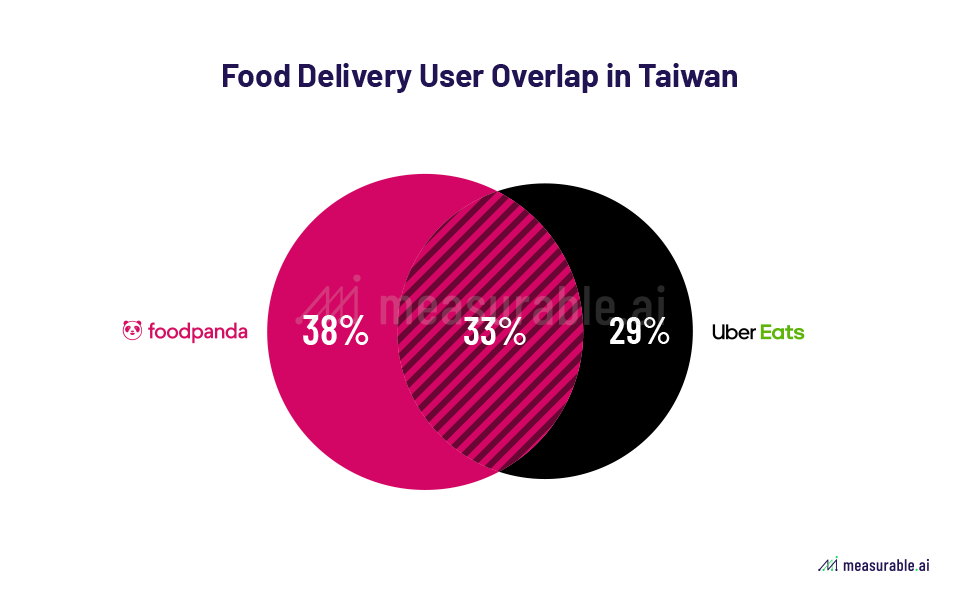

Weak advantage of Foodpanda in Taiwan

In 2020, there are mainly 2 players in Taiwan, for Deliveroo already quit the market in April. Foodpanda and UberEats share the market, 71% of users in Taiwan order their food only on Foodpanda, and 62% choose UberEats. In 2020, 33% of users in Taiwan have spent money on both platforms.

The customer overlap between the two platforms is high, 47% of Foodpanda users also use UberEats, and for the number of UberEats is 54%.

To learn more about the data behind this article and what Measurable AI has to offer, visit www.measurable.ai.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.