With snow covering much of the U.S. and wreaking havoc in many southern states, we looked at consumer behavior in Texas, where the cold snap triggered widespread power outages and acute hardship.

Key Takeaways

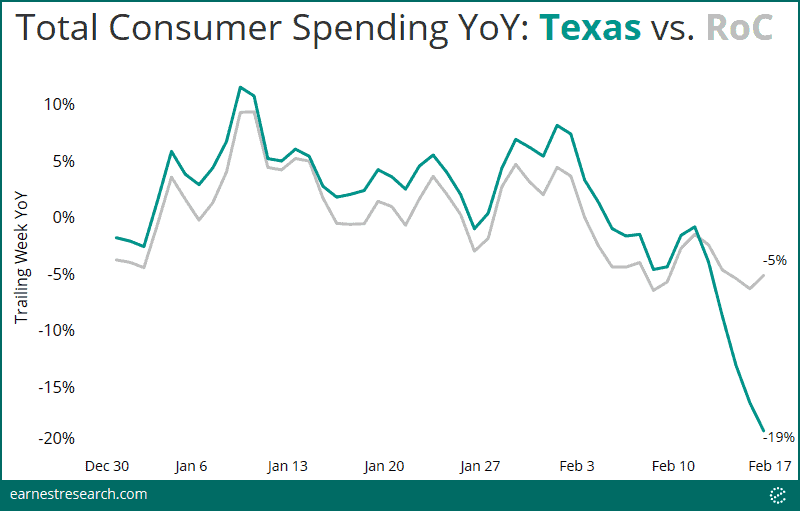

A Double-Digit Storm

In the first few weeks of the year, spending growth in Texas outperformed the rest of the country, peaking over the second stimulus-driven ~10% uptick in early January. However, concurrent with the drop in temperature, the most recent data shows growth for Texas dropping by almost 20% YoY, a full 14 points lower than the rest of the country.

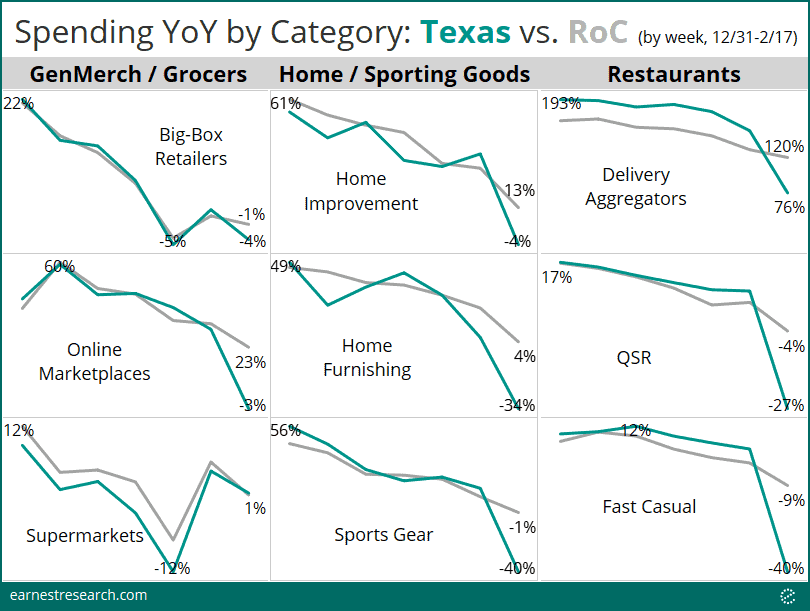

Few Categories Safe, Including Online

Looking at consumer categories, spending amongst Texans in February diverged from the rest of the country in interesting ways. Big-Box retailers (Walmart, Target, etc.) and Supermarkets in Texas saw minimally down to equal performance relative to the rest of the country, likely in preparation for the storm. All other sectors saw drastic levels of underperformance, including Home Improvement and Furnishing, Sports Gear, and Restaurants. Interestingly, the storm was equally disruptive to online channels such as Online Marketplaces (Amazon, Etsy, etc.) and Food Delivery Aggregators, both of whom saw over 25 points of underperformance as well.

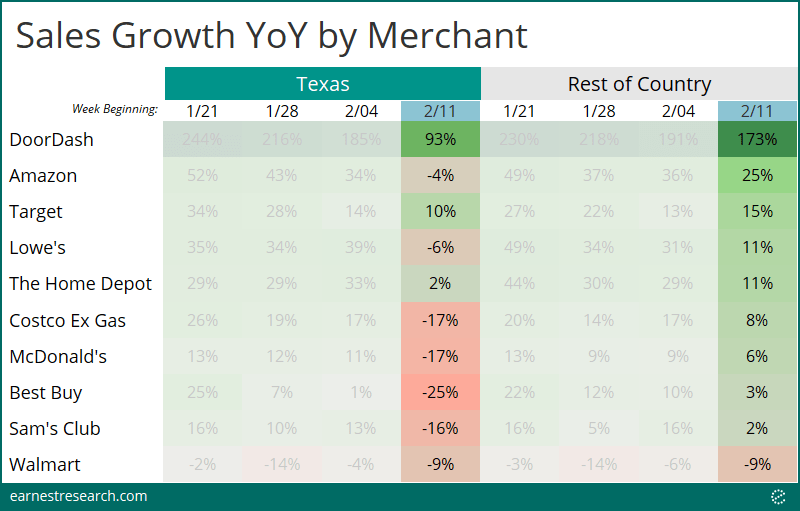

A Cost of 20+ Points

Drilling down into some of the ten largest retailers across a variety of sectors, spending growth in Texas underperformed by over ~20 points across most large retailers in the most recent week, relative to the rest of the country. Fast-growing DoorDash saw 80 points less growth, Amazon and Best Buy saw just under 30 points, Lowe’s, Costco (ex Gas), McDonald’s, and Sam’s Club each underperformed by roughly 20 points. Target and Walmart saw the least impact among this list; only a 5 point delta for Target, while Walmart saw equal performance in the most recent week.

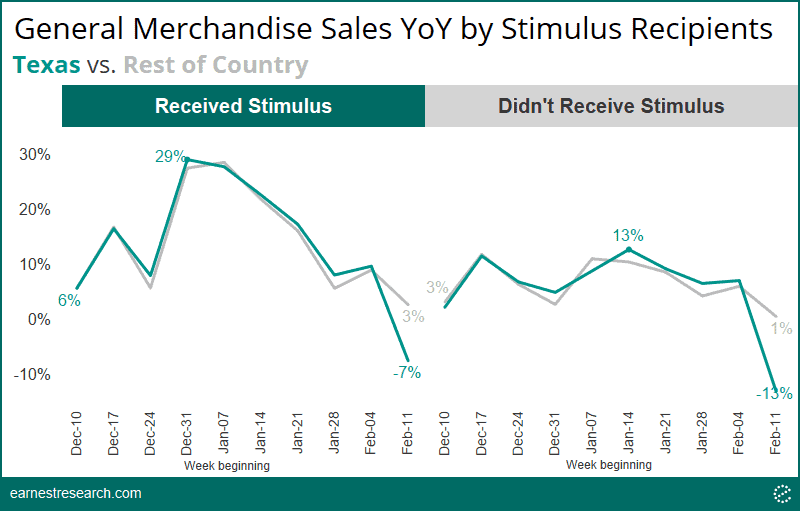

Some Small Stimulus Help

Lastly, we took a look at how the second round of stimulus checks may or may not have had an impact among Texans throughout this storm. Focusing on core General Merchandise spending (Walmart, Target, Amazon, etc.), Texans who received the stimulus underperformed the rest of the country by 10 points during the week of the storm: their spending declined 7% YoY vs. the RoC’s +3%. This is notably slightly smaller of an impact relative to the 14 points of underperformance among Texans who didn’t receive the stimulus (Texans’ -13% vs. RoC’s +1%), suggesting that the stimulus round – along with its ongoing weekly UI benefits – continue to provide some residual benefit, however minor, during this moment of need.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.