Antitrust has returned to the limelight with the rise of tech giants after enforcement fell during the Reagan administration. While public focus and congressional hearings have centered around market power among FAANGs, the potential for stronger antitrust regulation contained in proposals like that of Senator Amy Klobuchar would also have implications for large retailers and CPG brands. Viscacha Data’s store-level price and sales data helps to produce nuanced insights into antitrust risk that could result from changes in pricing strategy, mergers and acquisitions, and exclusive distribution agreements. Here, we break down which categories sold at Target may face the highest antitrust scrutiny based on a popular measure of market concentration, the HHI index [1].

The degree of market concentration varies substantially by product category, from gift bags and baskets where over 90 percent of sales come from Target-owned brands, to alcoholic beverages where the largest market share for any company is just 9 percent.

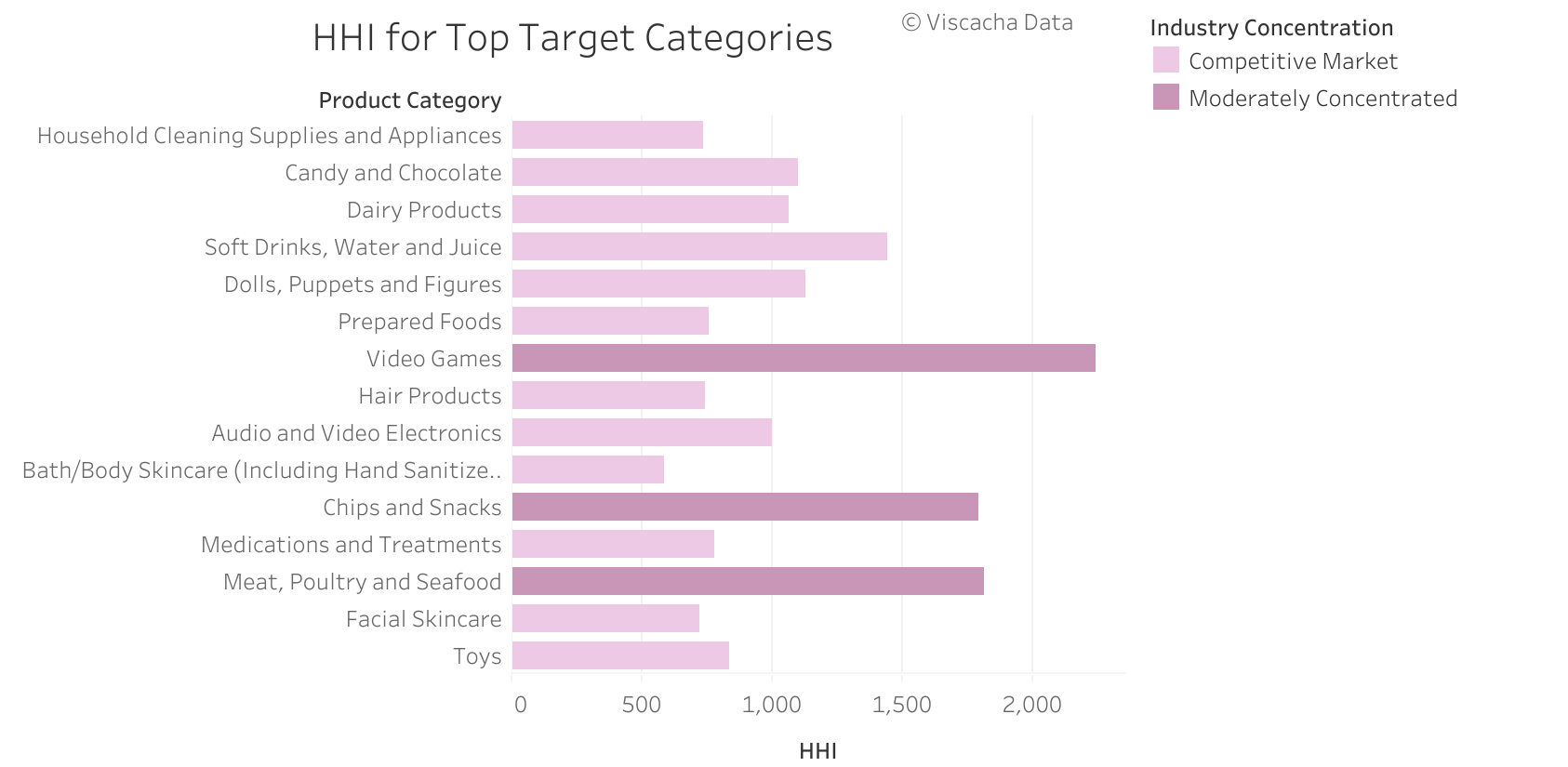

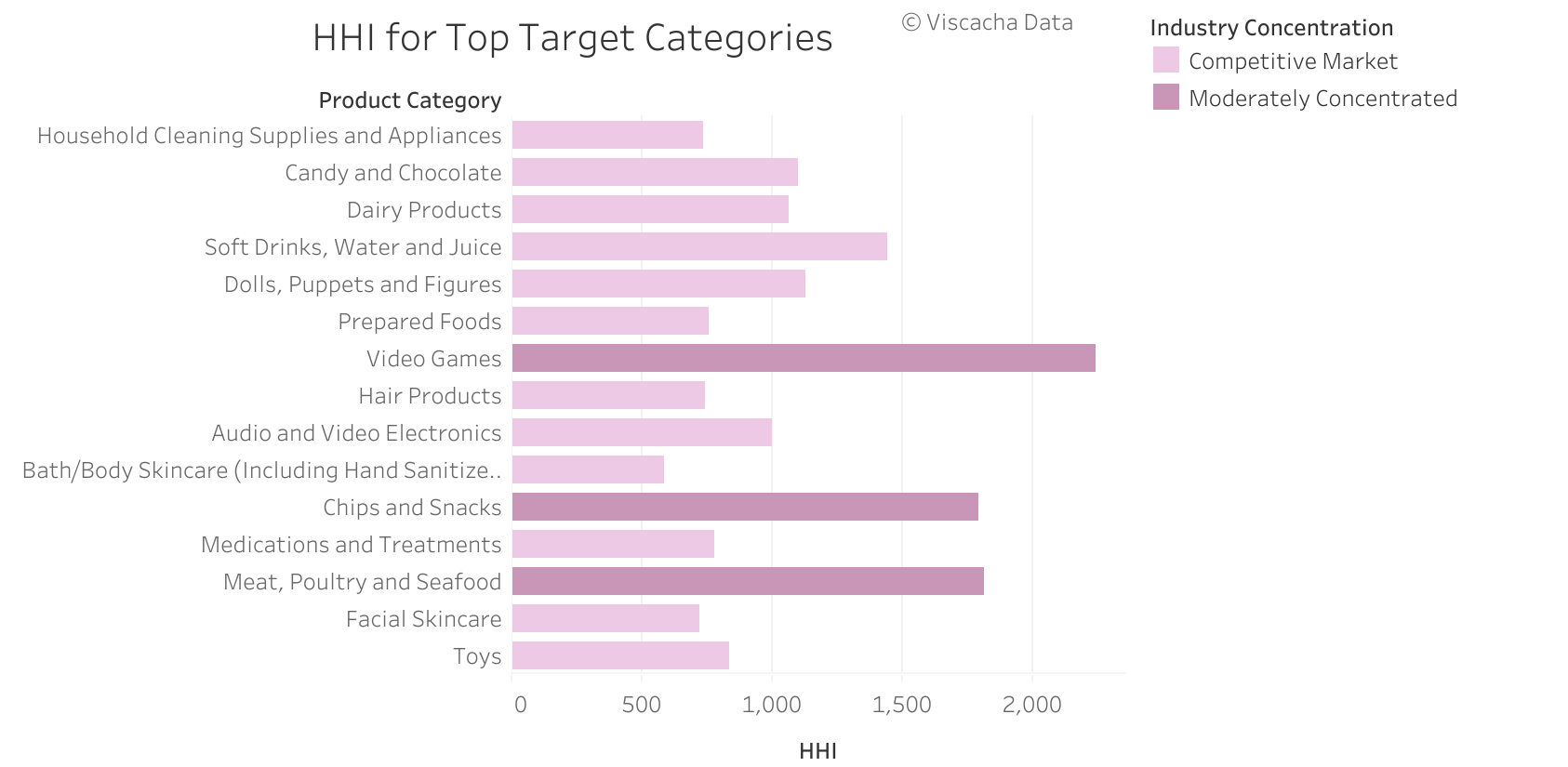

However, when focusing on just the top fifteen categories, the distribution of competitiveness looks a bit different. Of the leading categories, only three of fifteen meet the standard threshold for moderate concentration, and the rest are fairly competitive. This means acquisitions and mergers between large players will likely face little scrutiny. Other than video games, the most concentrated leading categories are food and beverage-focused: meat/poultry/seafood, chips/snacks, and non-alcoholic beverages.

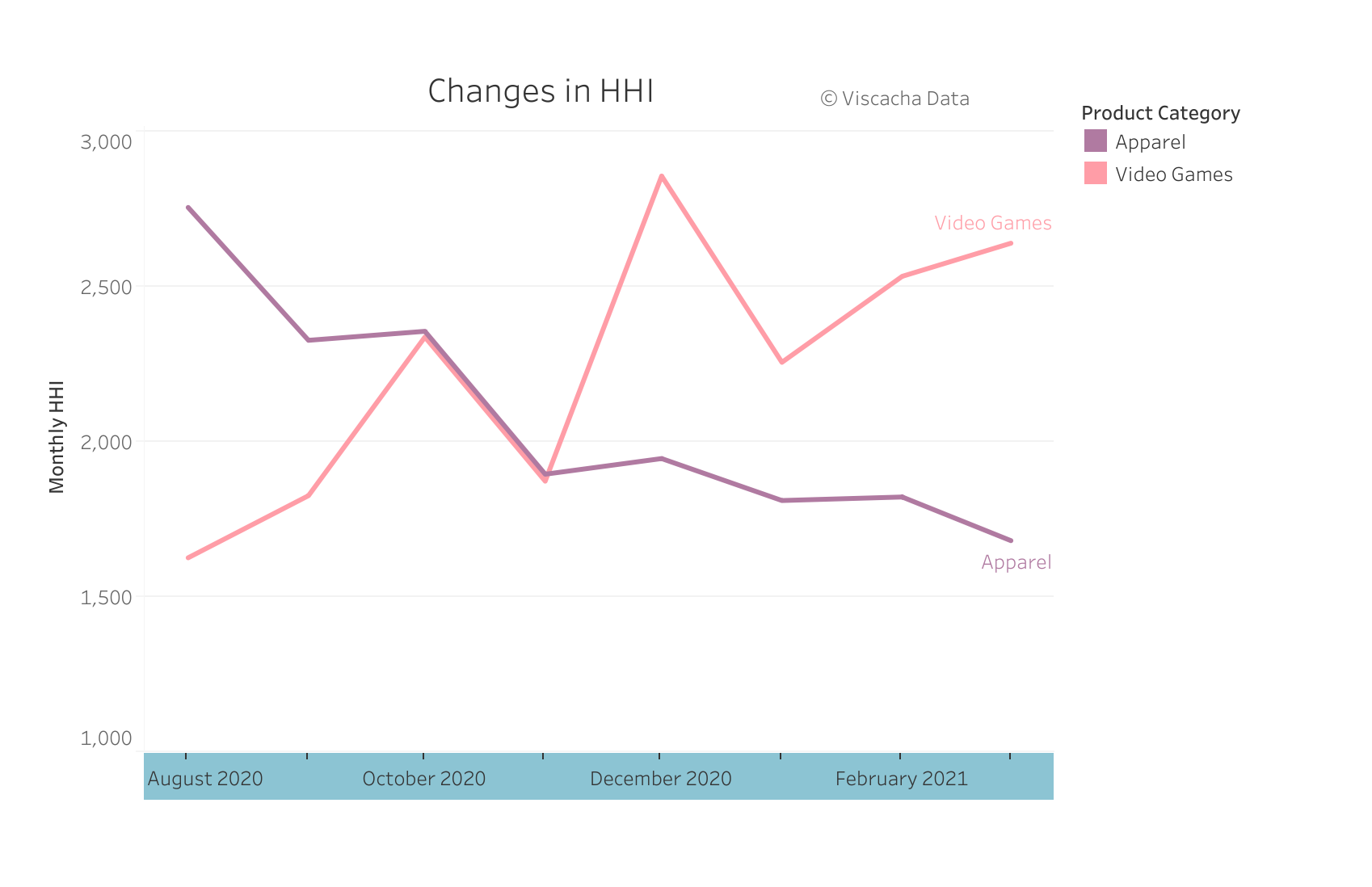

Although concentration is generally relatively constant over the past six months, several categories have seen notable shifts. Since August, the HHI for video games has increased 62 percent due in large part to Nintendo’s growth, pushing the category into the “highly concentrated” group. On the other hand, apparel’s HHI has fallen almost 40 percent as an increasing number of companies have entered the space and Target’s own market share in the category has fallen.

Acquisitions that increase a market’s HHI by over 250 points are significantly more likely to draw scrutiny from the DOJ or FTC that can result in costly, drawn out legal battles [2]. Viscacha can help companies perform more in-depth analyses in the due diligence process to better address market concentration risks. For example, detailed product-, store-level sales data can be used to measure cross-price elasticities of demand to more accurately define the relevant market. For more info, take a look at our public data dashboards and get in touch to learn more.

Footnotes

[1]. HHI measures market share by summing the squared shares of each company in a given market.

[2]. DOJ Horizontal Merger Guidelines

To learn more about the data behind this article and what Viscacha Data has to offer, please reach out to at loften@viscachadata.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.