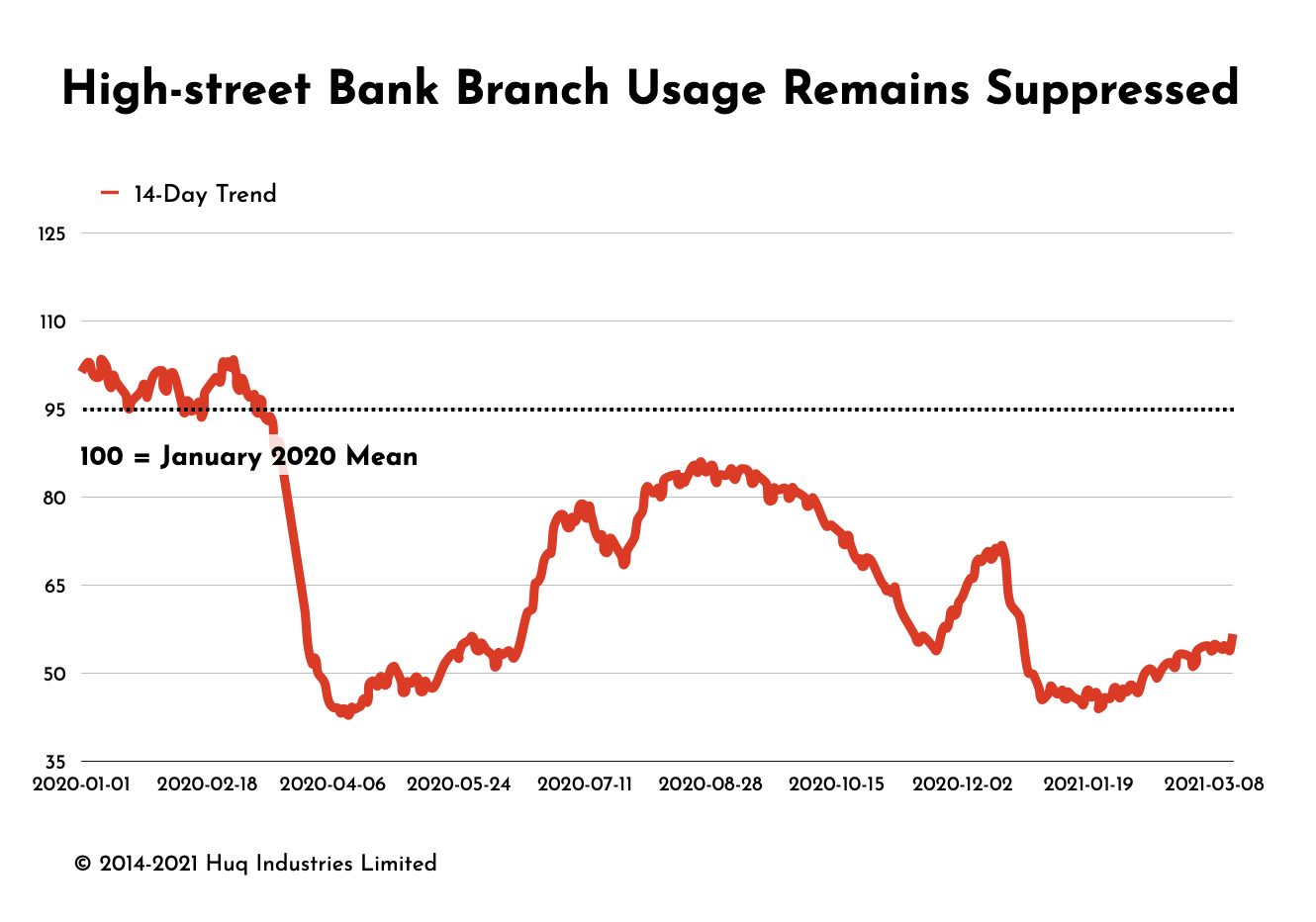

In-person visits to UK high street banks has remained static at around 50% of pre-pandemic levels since the start of 2020, with the number of visits climbing just 6pts during February despite the end of the financial year approaching. Bank visits dropped to around 40% of the January 2020 average during the first national lockdown before recovering to 85pts over the summer. However, despite a brief peak to 70% of ‘usual’ levels in the run up to Christmas, activity remains largely flat.

Although banks have reported that as much as 90 per cent of customer service is now conducted online or over the phone, research suggests that many will continue to rely on a local branches. However, with usage remaining low despite it traditionally being a busy time of year for banking, Huq’s high-frequency geo-location data suggests that if this Covid-formed habit persists, more branches may be withdrawn from the high street or be destined for transformation.

To learn more about the data behind this article and what Huq has to offer, visit https://huq.io/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.