One of the businesses that has seen sales slowest to come back from the COVID-19 pandemic is movie theatres. Adding to the pain of government-mandated closures, many studios delayed releases and have begun releasing films in theatres on the same day as key streaming services. In today’s Insight Flash, we look at the recent premiere of Raya and the Last Dragon, which launched on Disney+ for a $29.99 supplementary charge on the same day it was out in theatres. We compare the movie’s in-theatre success to that of Tom and Jerry the week before, analyze Disney+ purchases vs. the fall release of Mulan, and examine prior Netflix price hikes to see if Disney+ is offering enough content to retain subscribers after its own price increase later this month.

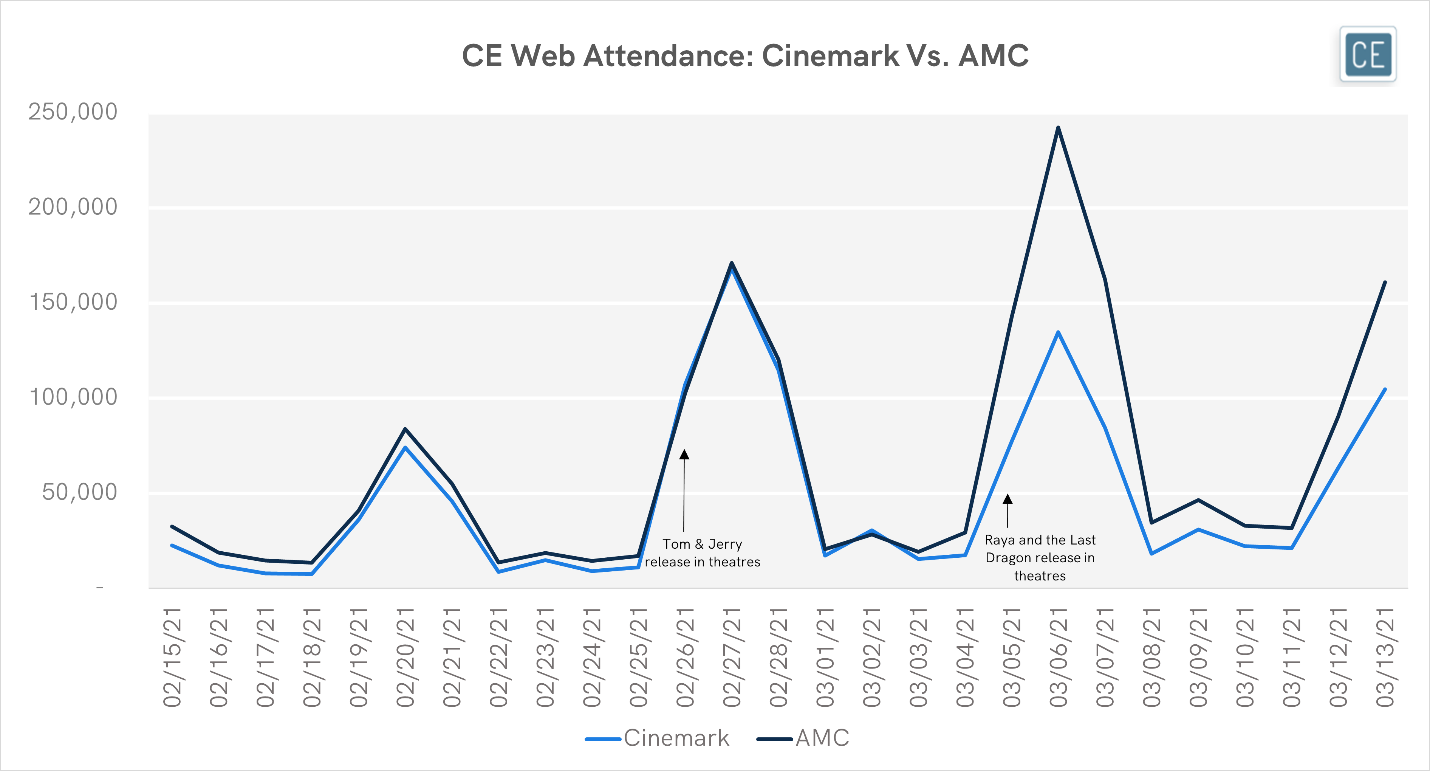

Both AMC and Cinemark saw spikes in attendance from the Tom and Jerry release in late February. Cinemark’s attendance that Friday was 3x what it had been the week before, and AMC’s was 2.5x. Both chains saw overall attendance more than double throughout the weekend. But Cinemark missed out in refusing to show Raya and the Last Dragon. AMC’s attendance on the release data was 40% higher than it had been for Tom and Jerry, 3.5 what it had been two weeks prior. Although Tom and Jerry premiered on HBO Max the same day it did in theatres and Raya and the Last Dragon was available on Disney+ the same day as in theatres, both movies still captured substantial in-person audiences, indicating that there might be hope for the theatre chains to survive the pandemic.

Theater Attendance

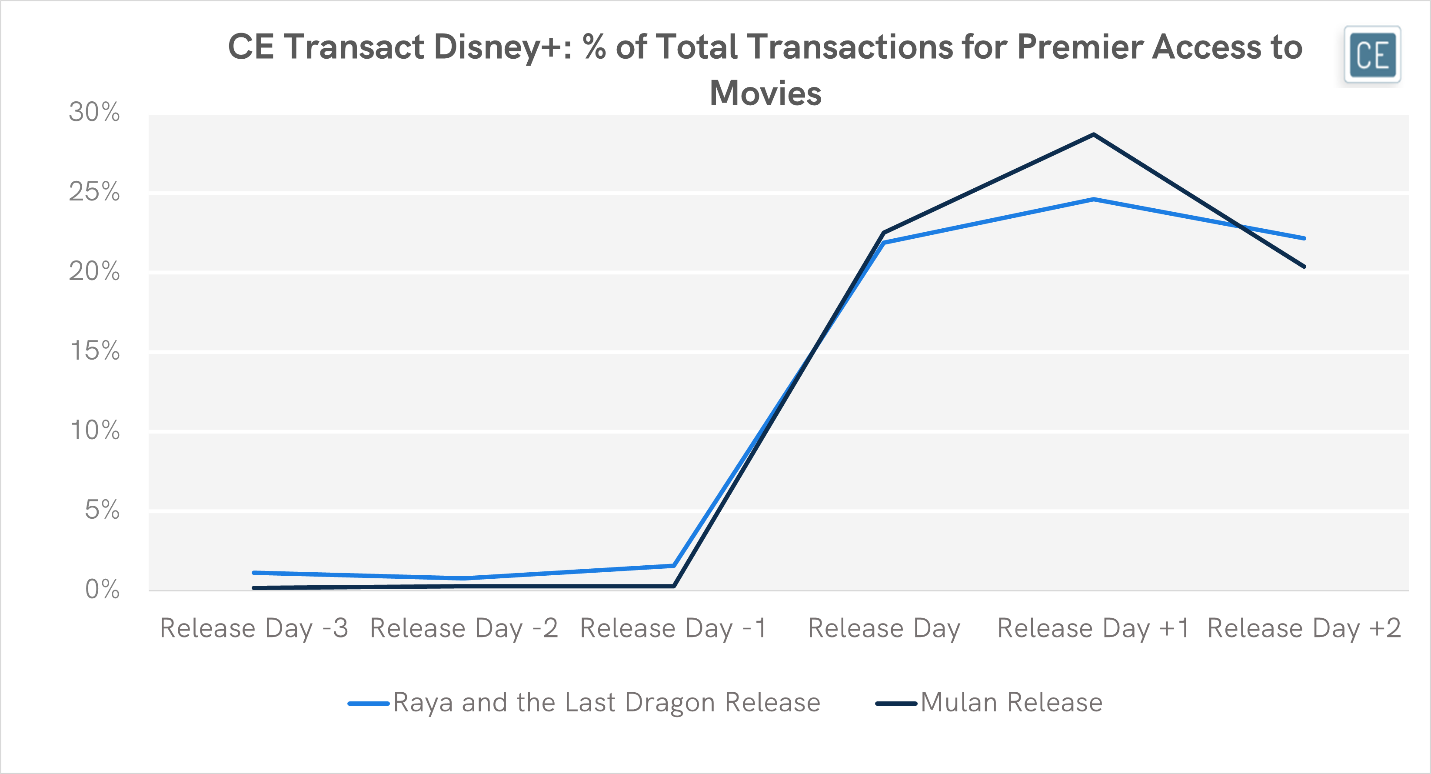

Even with more theatres reopened, Disney+ did see a high purchase conversion to its Premier Access for Raya and the Last Dragon. The Friday it was released, Disney saw over 20% of its transactions for the movie, jumping to 25% on Saturday. The release day percentage was on par with Mulan’s release, and while the day after was slightly lower, Raya and the Last Dragon saw a higher percentage two days later. These numbers indicate a consistent capture rate for premium streaming movie releases, with little impact from additional theatre openings.

Ticket Buckets

Note: Transactions between 29.99 and 69.99 assumed to be for movie releases

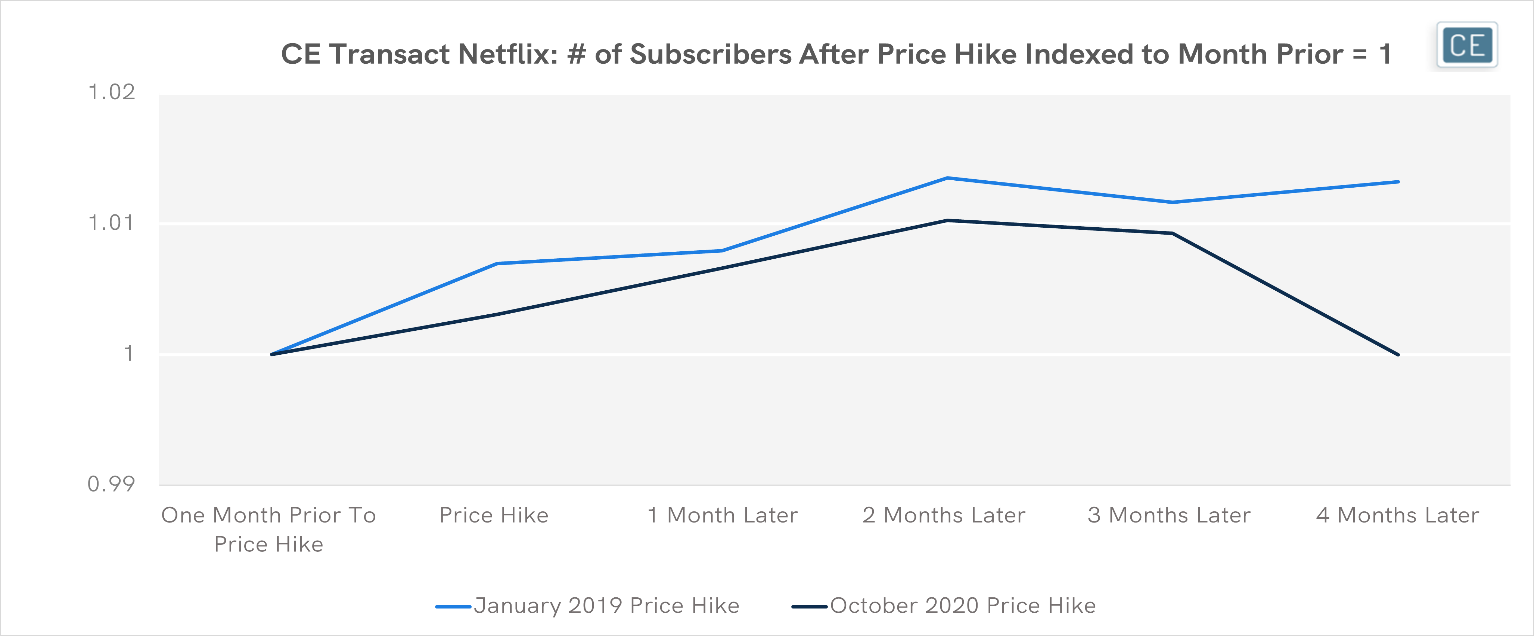

Will pricing changes jeopardize the model though? Disney+ is raising its annual subscription price from 69.99 to 79.99 and its monthly price from 6.99 to 7.99 on March 26 in the US. Looking at customer reactions to historical Netflix price increases may provide some insight. When Netflix raised prices in January 2019 customers barely blinked, with steady increases in net subscribers through May. October 2020’s price increase hit harder though, with February customer counts actually down from earlier in the year. This may imply that an unsaturated service like Disney+ can survive raising its price while it is still new to the market, but should be more cautious as customers mature. However, it is more likely due to external factors, demonstrating that the influx of new services in 2019 and 2020 has made customers less loyal with more options. It remains to be seen if Disney’s unique positioning can help it stave off price increase churn.

Customer Return

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.