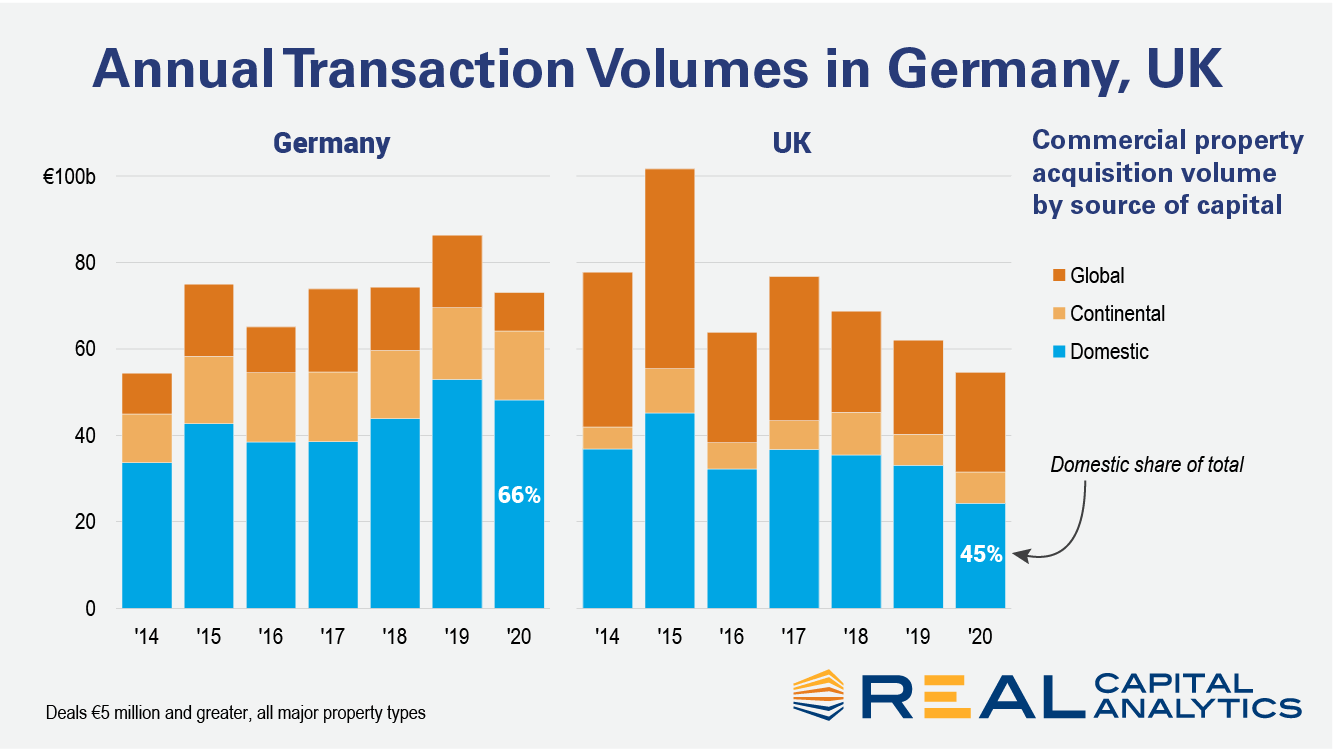

Since the end of 2015 Germany has attracted more investment capital than any other European commercial property market. Real Capital Analytics has recorded transactions totaling €372 billion ($438 billion) in the last five years, €47 billion more than in the U.K., the second most active market.

One of the explanations offered for this rise to prominence is the U.K.’s June 2016 decision to leave the European Union, subsequent to which, Germany has been labelled as Europe’s new safe haven and a home for capital that might previously have gone elsewhere.

There seems no accepted definition of the safe haven moniker, but investors from cash- or resource-rich nations with smaller and less developed asset bases often look for safer homes for their capital. Some of these investors are tasked as much with capital preservation, as in the case of some sovereign wealth funds, as with generating return. Investors from the Middle East and Asia, for example — not all of whom fall into the above bracket — have consistently bought commercial real estate in Europe’s core markets, with acquisitions of more than €240 billion in the last 10 years.

There are many reasons to invest in Germany. As well as being Europe’s largest economy, it has a deep and well-capitalized investor base, a federal system that fosters a number of large, liquid markets in which to invest, and a diversified commercial property stock. However, Germany’s rise to Europe’s number one spot did not come because non-European investors made a wholesale switch from the U.K. in search of an alternate safe haven, RCA data shows. Instead, it was a substantial increase in activity by German and other European investors, an increase that coincided with the start of the ECB’s quantitative easing program.

The monetary stimulus was a shot in the arm for eurozone economies, accelerating their recovery from the Global Financial Crisis and eurozone debt crisis. It also pushed large amounts of institutional capital into the real estate market as investors have gone in search of yield amidst the low rate environment. There was a substantial increase in investment across most of the eurozone from 2015 onwards, and this also marked the start of a period of appreciable levels of price growth in continental Europe’s core markets.

German investors spent €218 billion at home in the last five years, whereas domestic players in the U.K. spent €156 billion and French investors €123 billion in their home markets. Indeed, the strength of Germany’s domestic investor base is perhaps its secret weapon. Managers have access to huge amounts of equity and Germany-headquartered players are the second biggest buyers of global real estate behind those from the U.S. (based on income-producing properties only).

Post its referendum, the U.K. actually remained the number one European target for all cross-border capital, including that from the Middle East and Asia. These investors spent €53 billion on U.K. commercial property between July 2016 and December 2020, more than double the €21 billion spent in Germany. U.S.-headquartered groups have also spent more in the U.K. than in Germany since June 2016.

Germany is an attractive market for many reasons and overseas buyers do continue to acquire assets, but it is principally domestic activity that has driven up liquidity and caused prices to accelerate since the U.K. voted to leave the European Union.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.