Landlords of shops in Hong Kong have had a rough ride over the past two years. The political unrest in the middle of 2019 had already exacted a heavy toll on retailers, with businesses disrupted by the clashes and overseas visitors unnerved. (This author too put his own family’s vacation plans on ice.) Then tourist numbers all but evaporated with the onset of Covid-19 less than a year later.

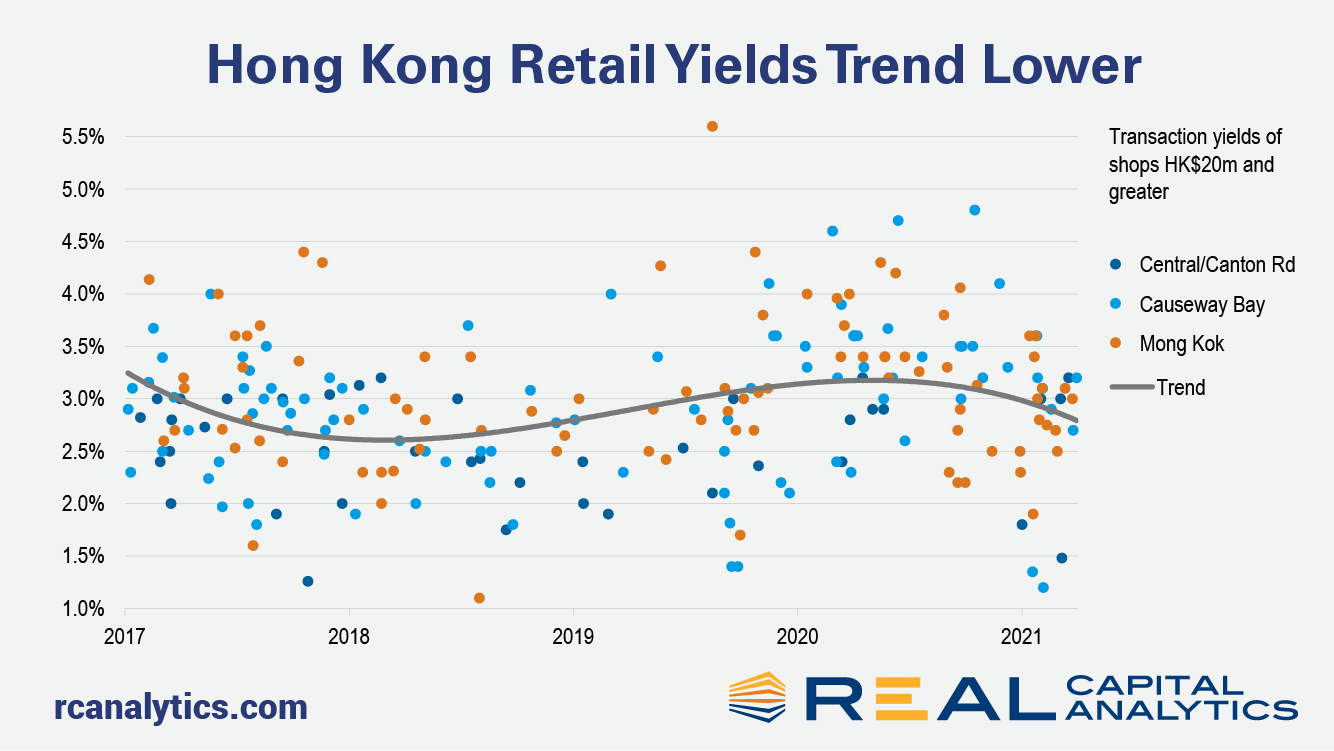

Resultantly, prices of CBD shops plummeted, as average quarterly yields headed upwards by 100 basis points between the middle of 2018 and the second quarter of 2020. (This analysis is based on retail assets trading at a value of HK$20 million — $2.5 million — and greater.) Throughout the whole of 2020, no shop assets traded at a sub-2% yield, according to Real Capital Analytics records. The last time the yield floor for such assets was this high was in 2008.

Towards the end of 2020 the trend began to reverse. With retail prices having fallen significantly from peak to trough – according to a custom RCA CPPI indicator, the decline was almost 20% – domestic investors were enticed to return to the market. The fall in investment into Hong Kong CBD shops finally bottomed out in the fourth quarter.

The recent removal of the double stamp duty on investment in commercial properties has ensured that dealmaking momentum has continued into 2021. Both CBD retail volume and deal count in the first quarter are well ahead of last year, although they remain significantly below levels in 2017-18 for now. But sentiment is gradually improving, as evidenced by the return of sub-2% yields across both the luxury boutiques in Central as well as high street shops in Causeway Bay and Mong Kok.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.