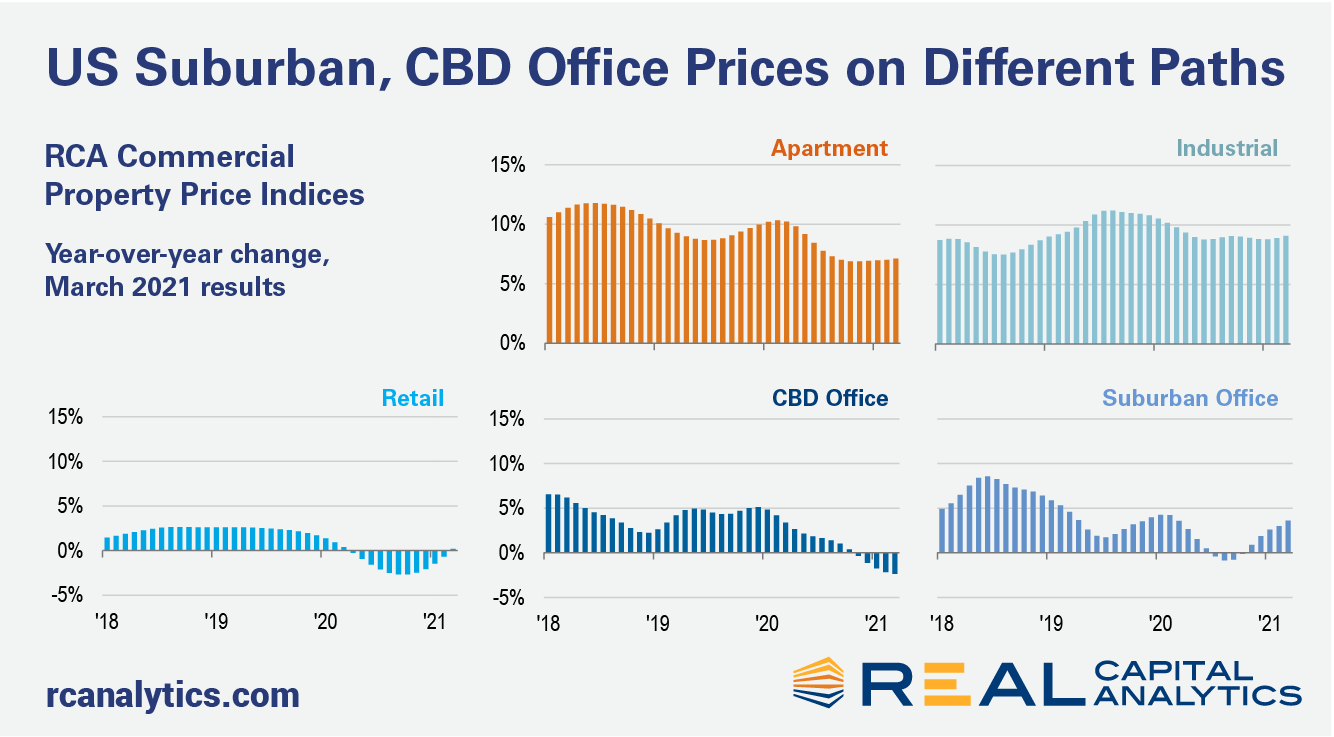

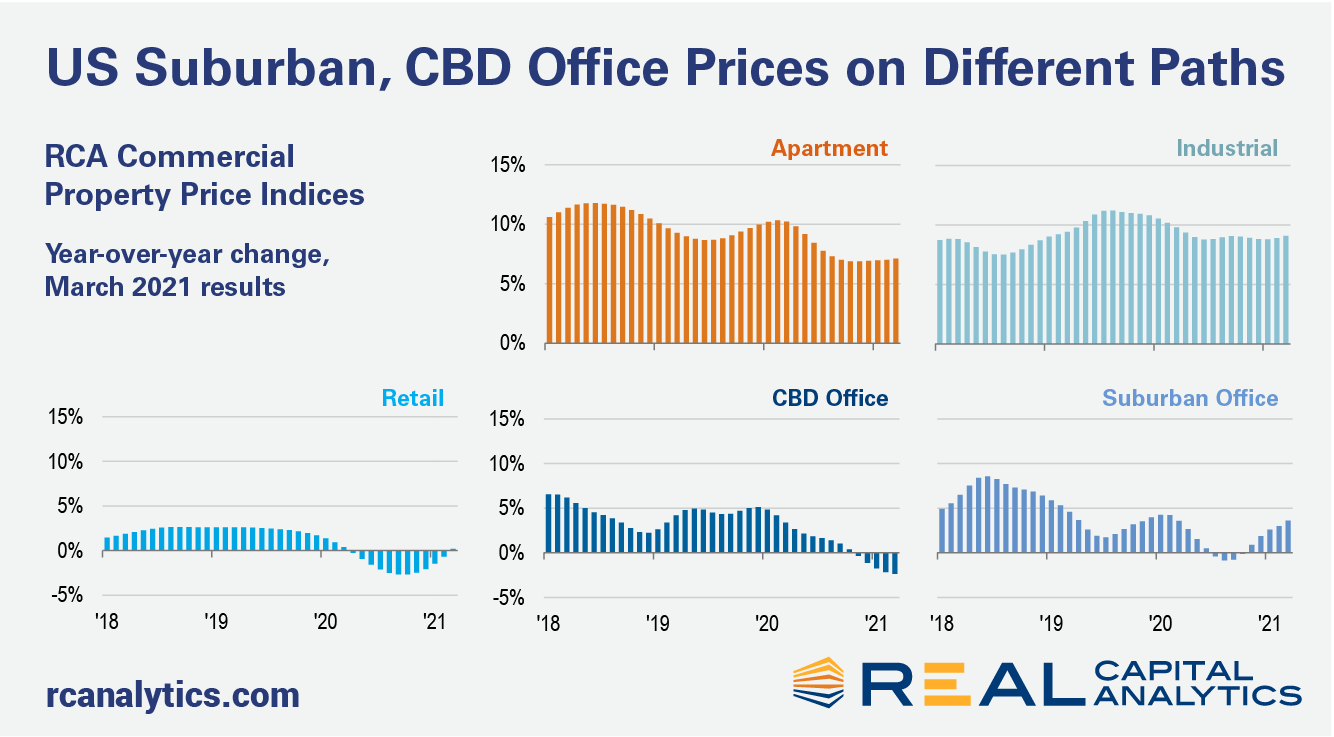

The headline annual rate of U.S. commercial property price growth posted a stronger gain in March, aided by industrial, apartment, and suburban office price increases, the latest RCA CPPI: US summary report shows.

The office sector subtypes continued to move in opposite directions in March. The CBD index declined 2.4% year-over-year, while suburban office accelerated to a 3.6% annual pace of growth. The differing paces reflect the recent outperformance in suburban deal activity, as shown in the new edition of US Capital Trends, also released this week.

The industrial index climbed 9.1% year-over-year in March, the fastest gain among the property sectors, while apartment prices rose 7.1%. The US National All-Property Index grew 7.8% from a year prior.

Retail prices posted the first positive annual return since March last year, inching up 0.2%. While it’s a minimal gain, it is considerably better than the near-3% year-over-year declines seen just a few months ago.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.