Welcome to the PlaceIQ Social Distance Tracker.

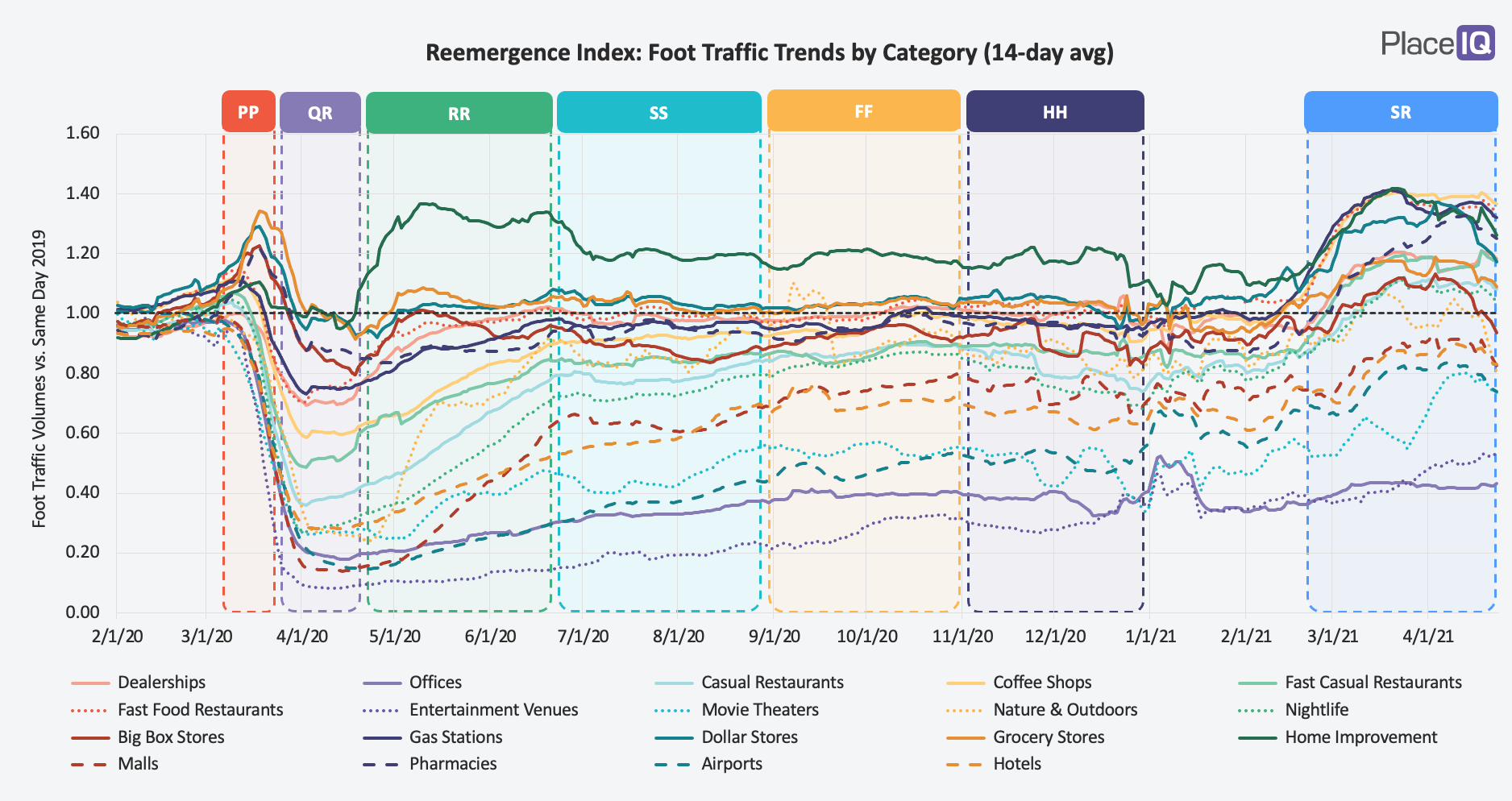

The second Reemergence we saw last issue has tempered a bit. A confluence of events — rising vaccine deployment, dropping case numbers, improving weather, federal stimulus, and more — drove people out of their homes seemingly all at once. Even businesses that were already doing well, like fast food restaurants, enjoyed a spike in traffic starting February 20th.

But we’re seeing much of that enthusiasm wane. It’s not disappearing, to be sure, but it is receding back to traffic levels closer to ‘normal’. Take a look:

The figures above are a 14-day moving average (as opposed to our usual 7-day) to make the macro trends a bit more clear. Again, traffic patterns are aligning with our three clusters:

Resilient businesses (like grocery and dollar stores) spiked with the 2nd Reemergence but are returning quickly to their baseline norms. They benefited as people ventured out in higher volumes, but are returning to a mean which we’d expect: normal, 2019 traffic levels.

Vacillating businesses (like movie theaters, bars, and casual restaurants) are mostly remaining at their higher levels, thanks to pent-up demand and more headroom between their previous levels and pre-pandemic norms.

Still Empty businesses (like offices and public transit) remain depressed, with the exception of Entertainment Venues, which are continuing upwards. Work-from-home is keeping this sector down, not just COVID directly.

We’re not discouraged by this drop. We didn’t expect grocery and big box stores to sustain 10-20% increases, but significantly impacted businesses held onto a good chunk of their gains even as initial enthusiasm subsides (except office buildings). Cases continue to decline and vaccinations continue to rise in America, foreshadowing an eventual end to our pandemic lifestyles.

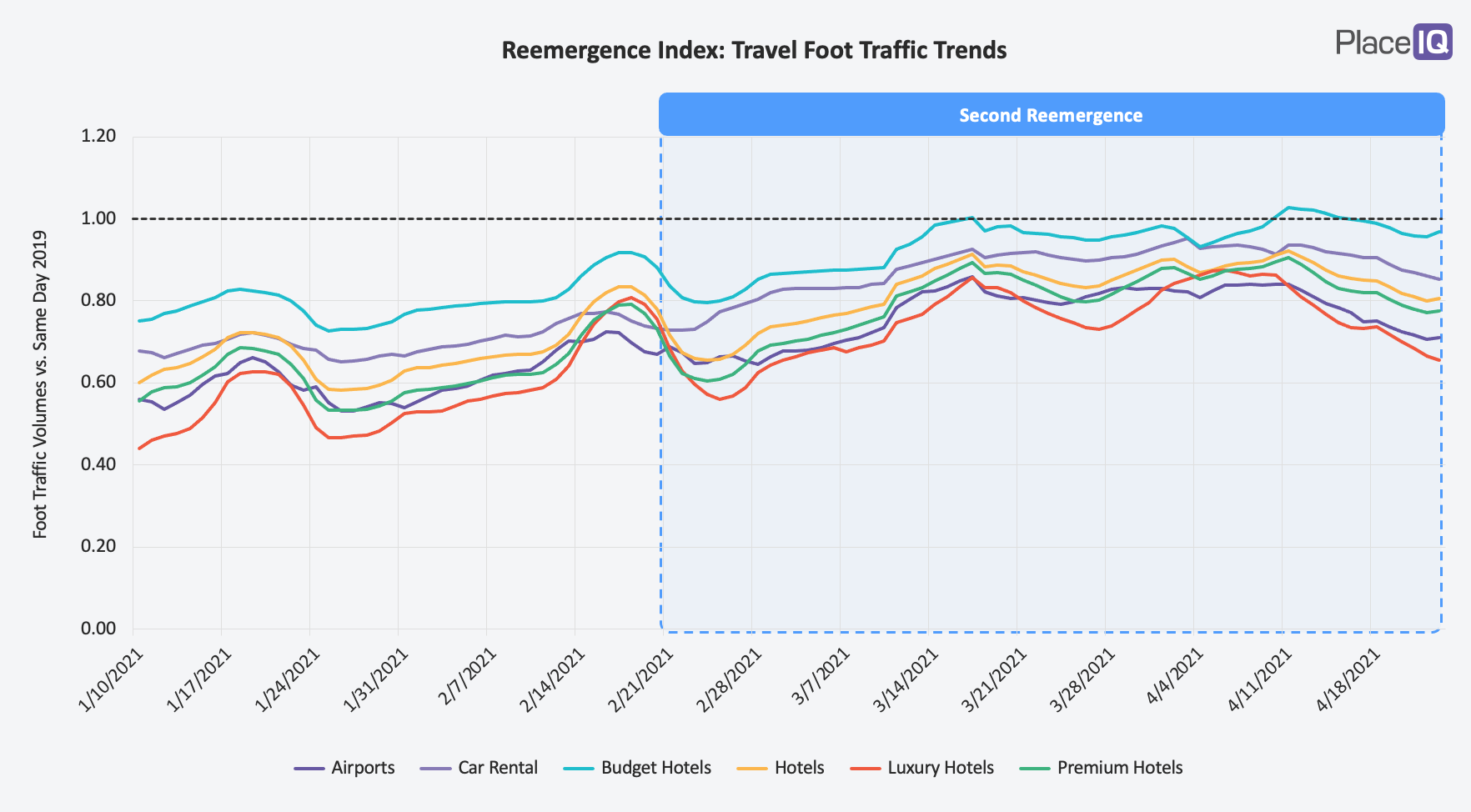

One sector that is finding a new, higher baseline is travel:

While the industry is drawing back a bit from our second Remergence spike, it appears to be finding a new floor. Hotels as a whole, for example, had been bouncing around an index of 0.6 since November but is now finding a footing closer to 0.8.

Since this sector is finding new traction, we’re going to take a look at airport visitors in this issue. In past trackers we’ve focused on road trips, the holidays, and regional trends. But as tourism steadily gains new ground we wanted to understand how people’s air travel behavior has changed.

After Arrival Travelers Get Supplies, Then Sunshine

Airport visitation is still down compared to early 2020, but these travelers look very different from pre-COVID flyers. Within a few hours of arrival, they’ve shifted their time spent from shopping destinations, offices, and indoor entertainment venues to supply stops (like grocery, convenience, and big box stores) and outdoor activities. They travel further from their destination airports than usual and are more likely to visit residential locations (like friends’ homes or vacation rentals).

This aligns well with our previous travel explorations: even those opting for air travel end up taking road trips.

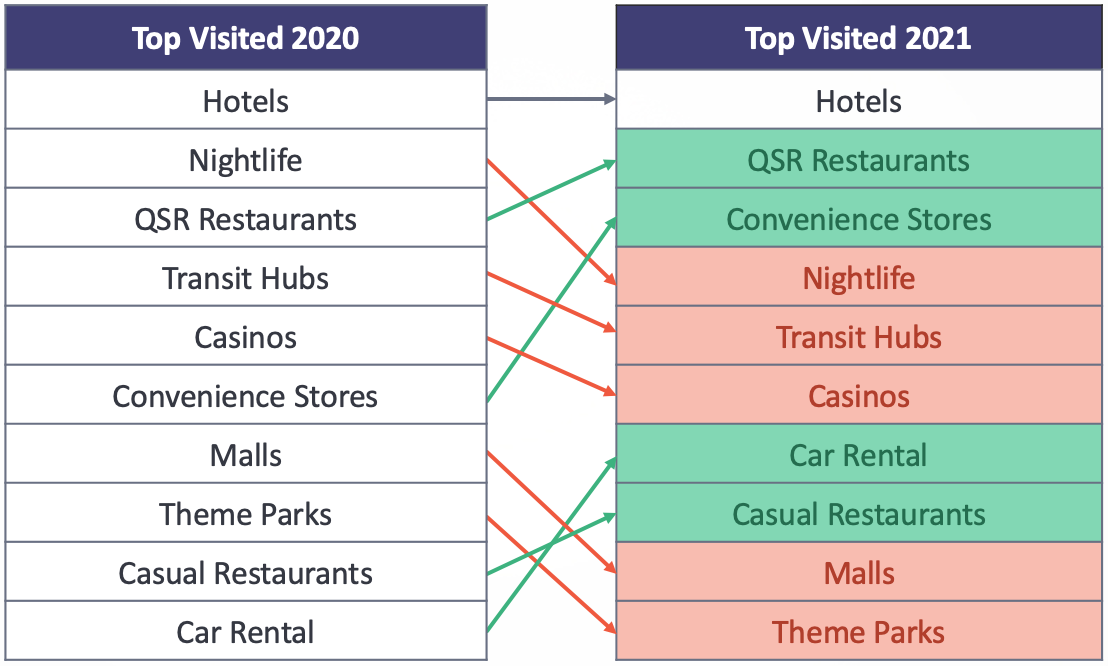

To understand this changing behavior, we took a look at what devices do within 12 hours of arriving at a destination airport. There’s quite a bit of shuffling when we look at top behaviors:

Travel habits and activities have shifted in important ways. Hotels continue to be the top visited place after arrival. Familiar dining brands are doing well (QSR, Casual Dining), as are road trip oriented places like Convenience Stores and Car Rental agencies. But urban activities — bars, casinos, malls, and theme parks — have dropped significantly in ranking. These venues are still visited. But even among those willing to venture to airports, urban activities have been largely traded for road trips and nature activities.

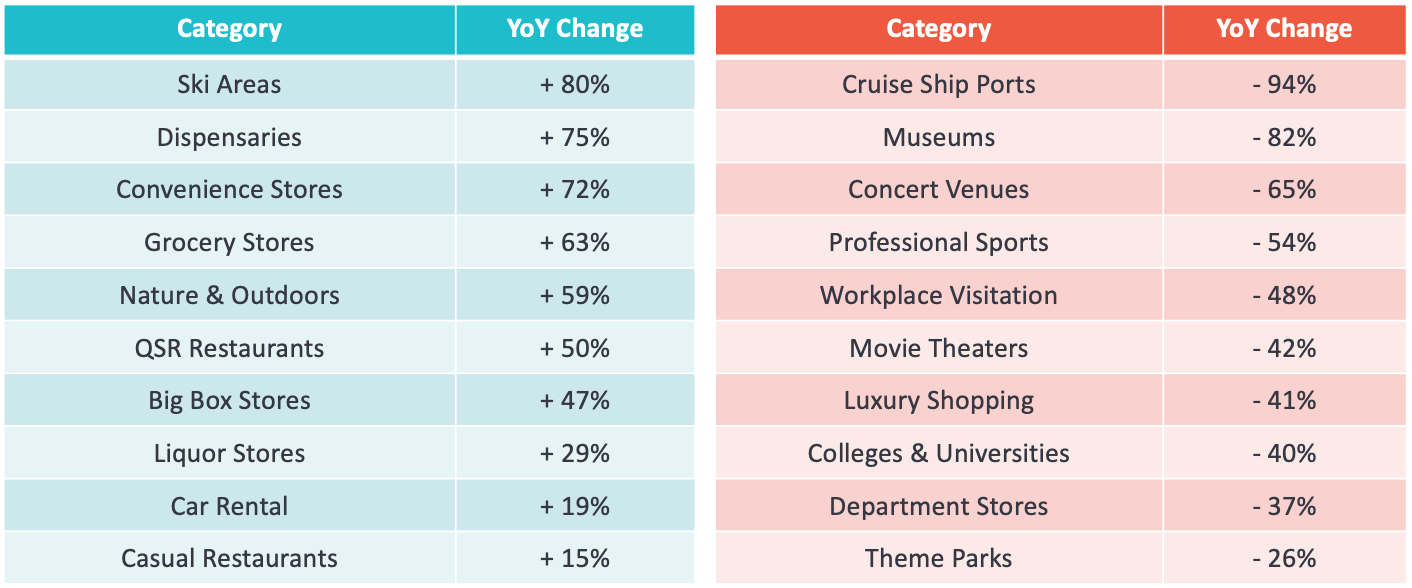

This becomes even clearer when we take a look at the categories that made the biggest gains and those that fell most significantly:

When people hit the ground, they pick up supplies. Rent a car, grab some groceries, wine, and weed. Meanwhile, shopping destinations, indoor activities, and offices are down significantly. It’s worth mentioning the above analysis is comparing January and February of 2021 to January and February of 2020 — so there’s not a winter bias going on tilting the results. Those gains are real.

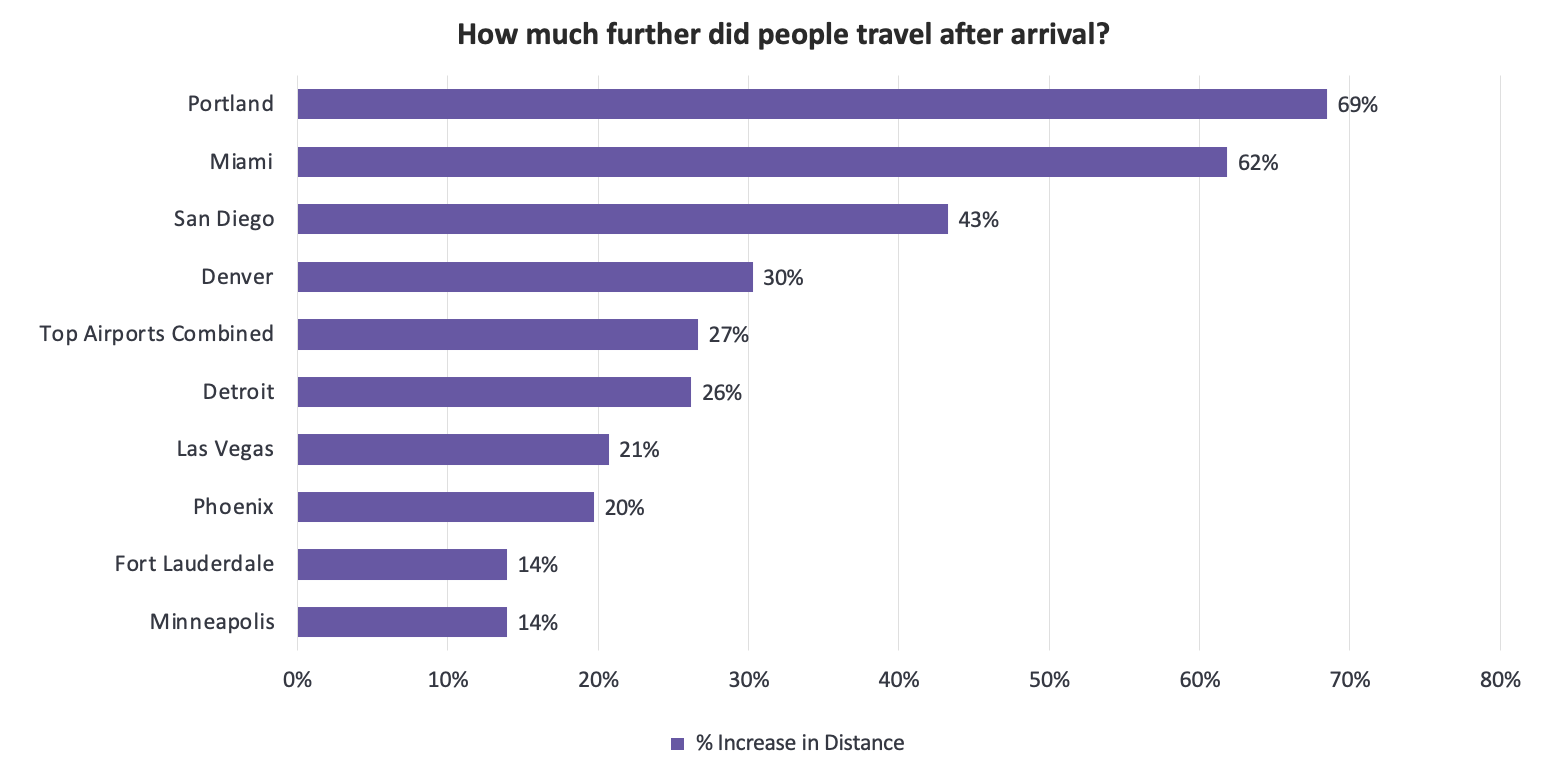

Not only have people’s choices in activities shifted, but they are now also driving further, and car rental visitation is up. Across some of the top airports in the US, distance traveled from the airport is up ~25%. One might expect this trend to exist in areas known for their natural beauty, but it’s also seen in some cities that are known for more relaxed COVID restrictions such as Miami, Las Vegas, Phoenix, and Ft. Lauderdale:

We’ve previously shown how extended stay hotels with kitchenettes were remarkably resilient throughout 2020, thanks to people wanting to avoid restaurants. We’re seeing more of the same among air travelers, but with an additional twist: air travelers in 2021 were 13% more likely to visit a residential location than travelers during the same period last year. This increase can be chalked up to both reunions with family and friends and a significant increase in home rentals.

Thanks to factors like work-from-home flexibility, people were looking for longer term stay options with comfortable accommodations. AirBNB notes that demand was strong, especially in the US, throughout the previous quarter.

Travel is picking up and staying up, riding the wave of our Second Reemergence. Still, we do not expect it to return to ‘normal’ quite yet. Cities aren’t fully open, many event venues and other destinations remain cautious, and American’s appetite for the outdoors has yet to wane. We expect travel to pick up quickly, but slowly transition back to its usual routine. Monitoring traffic and behaviors in emerging categories like travel remains highly relevant.

To learn more about the data behind this article and what PlaceIQ has to offer, visit https://www.placeiq.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.