We all know that eCommerce soared last year—and it’s not slowing down in 2021.

In March, online sales were up 49% year-over-year (YoY), making this the biggest increase since July 2020 when Americans received their first round of stimulus checks. Despite vaccines, people are still shopping online and it makes sense that brands are buying ads in the digital space.

Facebook advertising, in particular, keeps on climbing. Revenue was up 46% YoY in Q1. Even in Q2 last year, when successful media companies were stumbling due to the pandemic, Facebook’s ad revenue grew by $2 billion.

What’s driving Facebook’s growth and what changes do we expect to see later this year?

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Will This Revenue Surge Last?

According to Facebook’s commentary, the striking growth in Q1 profit was driven by a 30% YoY increase in average ad price and a 12% increase in the number of ads delivered. Facebook anticipates revenue growth to remain fairly stable in Q2, but is betting on headwinds in the second half of the year.

“We continue to expect increased ad targeting headwinds in 2021 from regulatory and platform changes, notably the recently-launched iOS 14.5 update, which we expect to begin having an impact in the second quarter,” according to Facebook’s press release.

Other tech analysts, like Tae Kim at Bloomberg, point out the transition into a post-pandemic world may slow down growth momentum. When stores and shopping patterns return to traditional patterns, hyper-personalized targeting and digital experiences may not be as critical.

CEO Mark Zuckerberg is well aware of the opposing forces coming his way and expressed what his company plans on doing about it.

“These efforts around creators, commerce, and the next computing platform are a few of the big areas that we were doubling down on going forward,” said Zuckerberg. “And in each of these, there is a unique opportunity to help people connect in deeper ways and to support a stronger economy for everyone.”

It’s clear that Facebook is focused on creating long-term solutions that enhance the experience of users and businesses. Its growth rate may slow down later this year, but by significantly investing in a new vision of AR/VR and online shopping, the platform will likely see strong performance over the long haul.

MediaRadar Insights

MediaRadar began tracking Facebook advertising at the beginning of 2020 by analyzing the ad buying behaviors of brands who spend at least $30,000 annually on the platform.

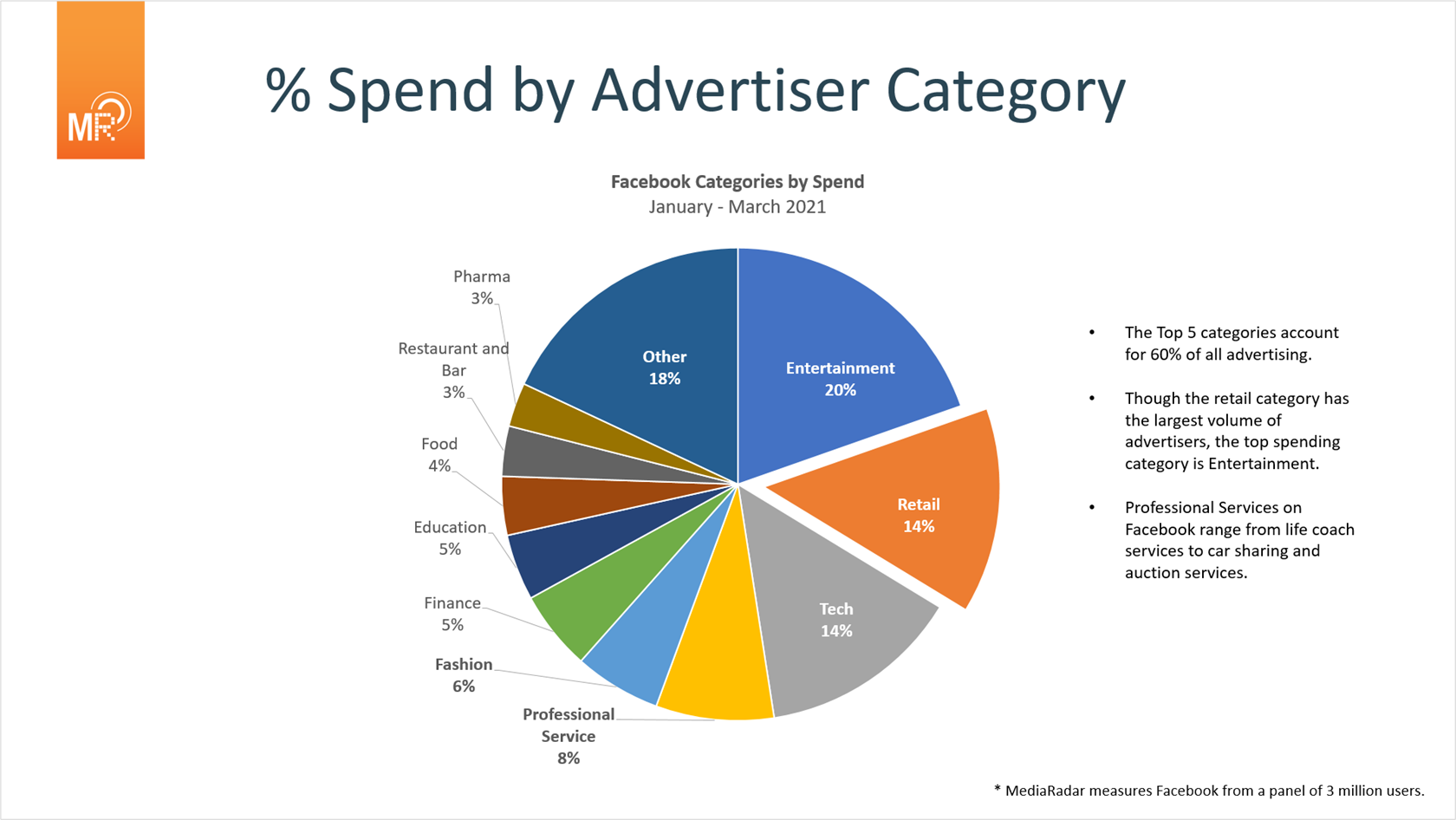

The most interesting categories are Entertainment, Retail and ‘Other.’ The reason why ‘Other’ is so significant is that many Facebook advertisers are really niche and don’t fit into a typical category.

Entertainment brands, especially streaming platforms, spend the most on Facebook ads. But, when looking at the volume of brands, Retail brands lean on Facebook the most.

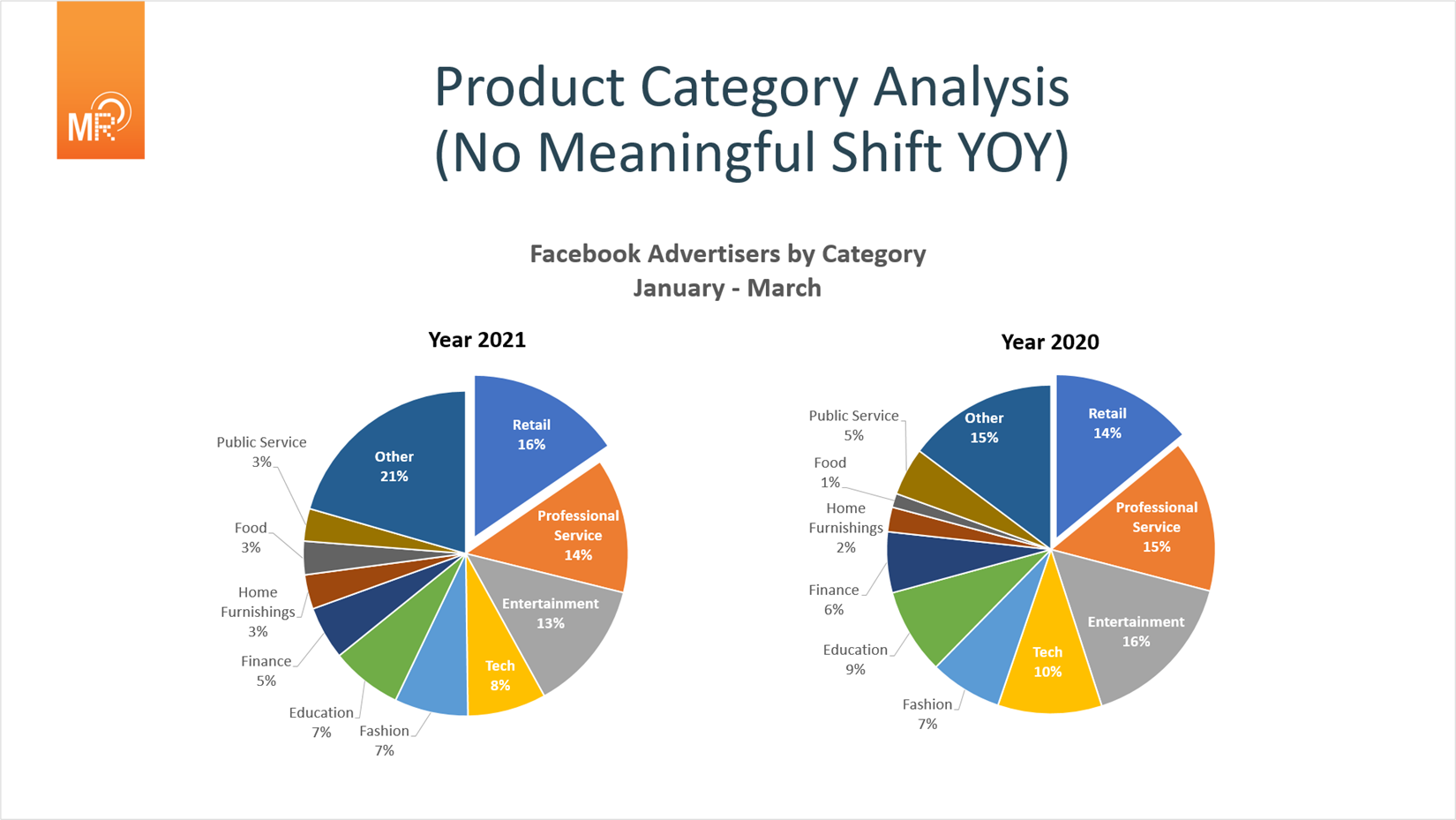

And this stays fairly consistent year-over-year.

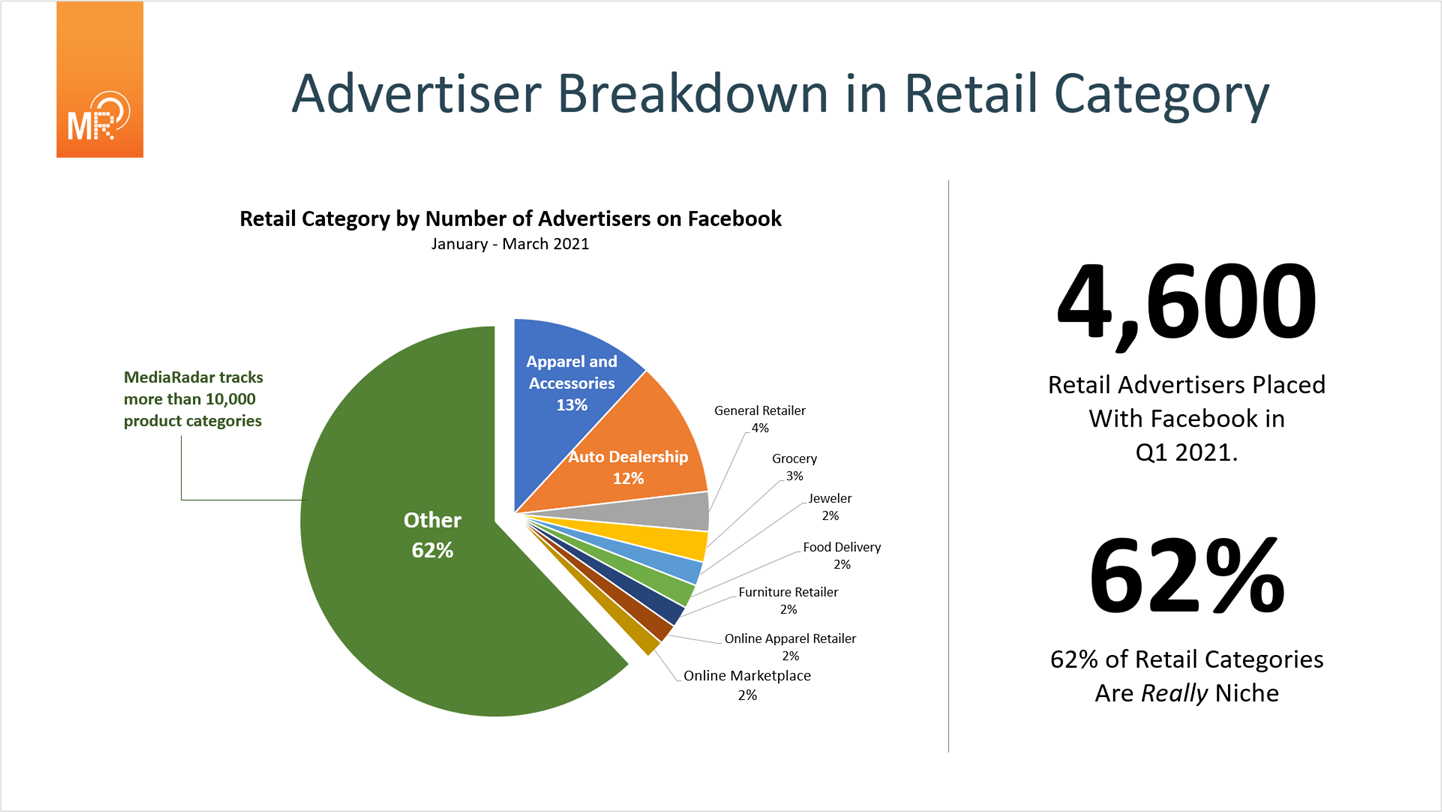

There are 4,600 retail brands who placed ads with Facebook this past quarter, and 62% of them are super niche. Facebook is a great platform for them because it makes hyper-personalized targeting easy and affordable for smaller brands.

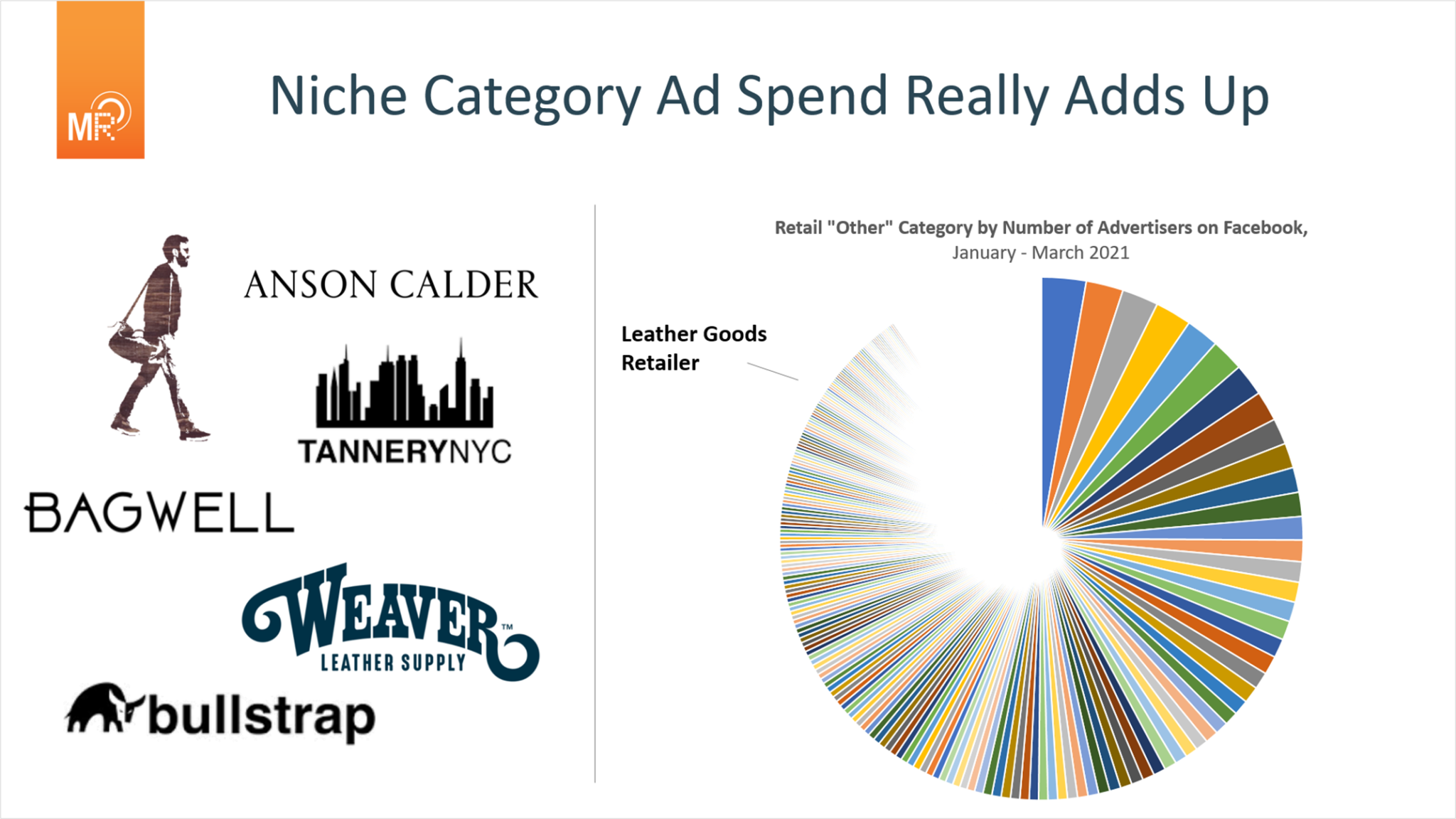

Though these small brands aren’t spending as much as large Entertainment companies, the small buys add up.

This strategy makes Facebook unique. On Facebook, the Retail category accounts for 16% of all advertisers, but on all other digital platforms this category makes up about 10% of advertisers.

And of these 4,600 brands, more than half (56%) advertise exclusively on Facebook.

Because Facebook offers such targeted advertising, niche advertisers such as cheese retailers, telescope retailers and dog leash retailers are able to target their audience with more accuracy than a traditional programmatic campaign. This is why the “other” category makes up 62% of retail advertisers—very small campaigns can purchase effective space.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.