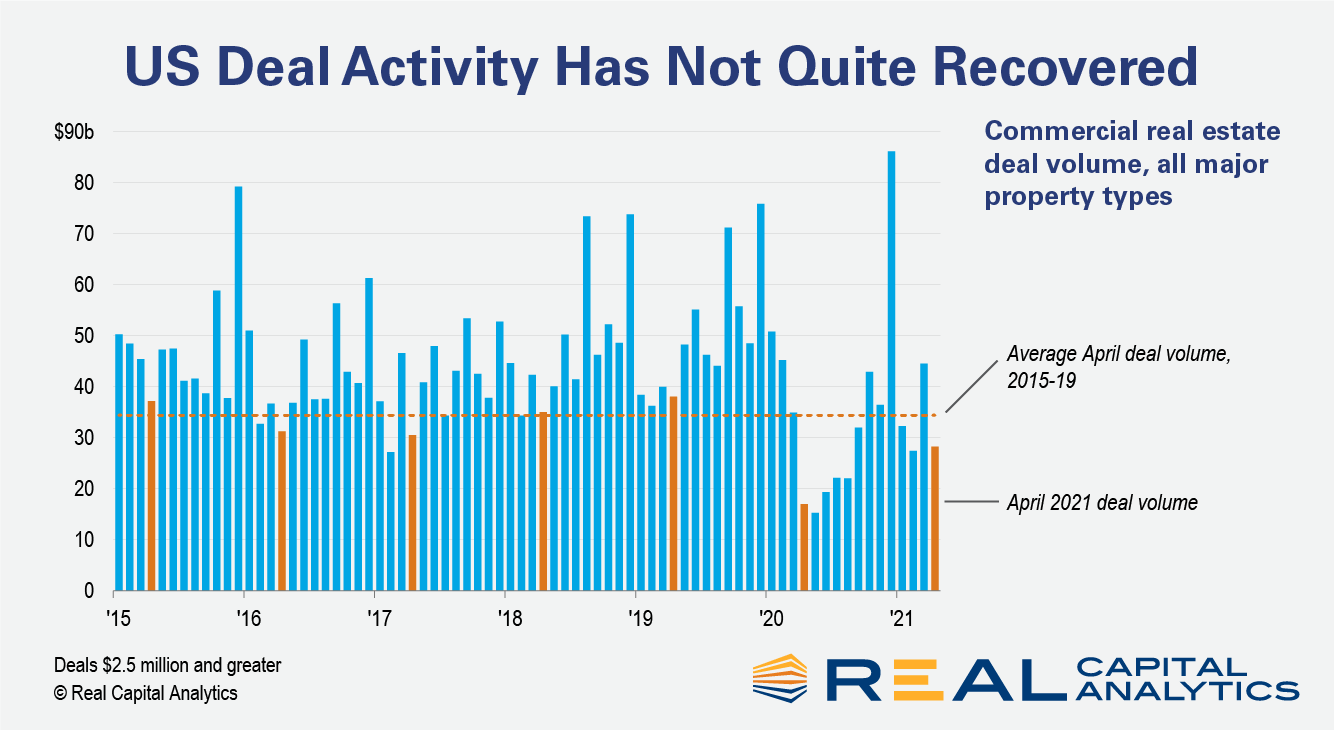

The increase in U.S. commercial real estate investment in April might suggest that the market is through the worst effects of the Covid-19 pandemic. Still, while there were high double-digit annual growth rates in commercial property sales for the month, all the problems from the pandemic are not yet in the rearview mirror.

The good news is that deal activity is climbing. Commercial property sales were up 66% from a year earlier in April. The market rarely grows that quickly, but the aberration here is not about deal volume in 2021; rather, it is a story about the pace of sales in 2020.

A year ago, we were on the precipice of the unknown. The global economy froze as workers were sent home; commercial property deal volume cratered as investors were hesitant and the mechanics of completing deals faced challenges. Over the coming few months, year-over-year comparisons will be problematic as an indicator of market health because of this base for comparison. Looking instead at the level of deal activity relative to trends before the pandemic can paint a clearer picture about the state of the market.

Total commercial real estate investment averaged $34.4 billion for April of every year from 2015 to 2019. So the activity for April 2021 was 18% below the levels which prevailed in the period before the Covid-19 pandemic.

There are standout sectors and subtypes, however. Investment activity for the industrial sector was 17% higher for the month than the average pace for each April in 2015 to 2019. The apartment sector is also doing well with deal volume effectively back to the pre-pandemic levels.

For other property sectors though, deal volume is still well below the levels seen in the five years before the pandemic. Potential buyers are still cautious about the ongoing economic challenges from the pandemic and current owners are generally hesitant to sell at prices that would provide enough of a discount to address the buyer caution. Until one of these groups blinks, deal volume is likely to remain muted.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.