Overall HPI Growth

National home prices increased 13% year over year in April 2021, according to the latest CoreLogic Home Price Index (HPI®) Report. The April 2021 HPI gain was up from the April 2020 gain of 4.6% and was the highest year-over-year gain since February 2006. Low mortgage rates and low for-sale inventory drove the increase in home prices. While a pick-up in construction and an increase in for-sale listings as more homeowners get vaccinated may help moderate surging home price growth, affordability challenges may drive some potential home buyers out of the market which could reduce demand.

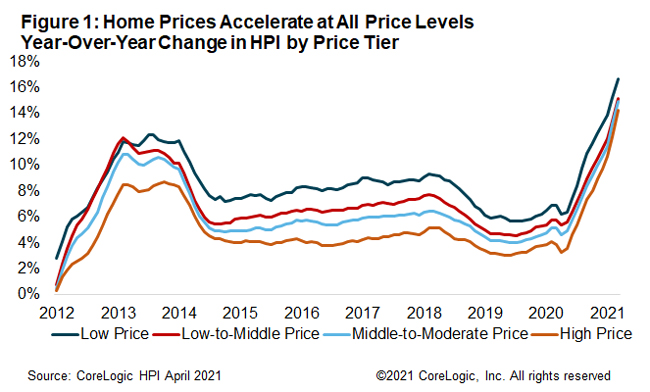

HPI Growth by Price and Property Type Tiers

CoreLogic analyzes four individual home-price tiers that are calculated relative to the median national home sale price. Home price growth accelerated for all four price tiers to the highest rates since 2005 for the low-price tier and high-price tier and since 2006 for two middle-price tiers.

The lowest price tier increased 16.7% year over year in April 2021, compared with 15.2% for the low- to middle-price tier, 14.9% for the middle- to moderate-price tier, and 14.2% for the high-price tier. While appreciation was highest for lower-priced homes, the difference in appreciation rates for the four price tiers is converging, showing that supply is restricted at all prices levels.

CoreLogic also provides the HPI separately for detached – or freestanding – properties and attached properties (such as condos or townhouses). Appreciation of detached properties (14.7%) was more than double that of attached properties (7.2%) in April as prospective buyers continue to seek out more space.

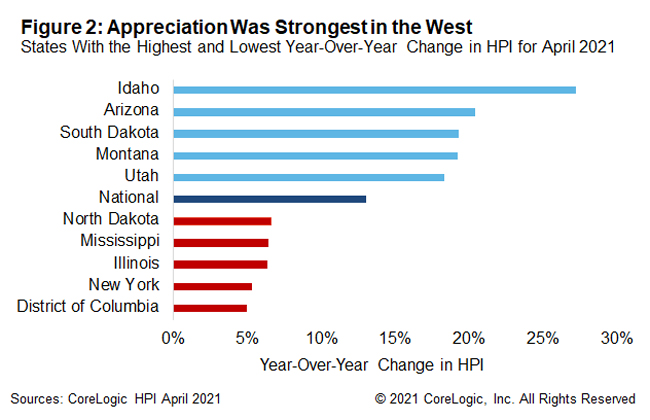

State-Level Results

Figure 2 shows the year-over-year HPI growth in April 2021 for the five highest- and lowest-appreciating states. While all states showed annual increases in HPI in April, appreciation was strongest in the West. Idaho posted annual appreciation of 27.2% in April, followed by Arizona with appreciation of 20.4%. At the low end, Washington, D.C., saw a home price increase of 5%.

The surge in home price appreciation was felt across the country, with all states showing higher appreciation in April 2021 than in April 2020. South Dakota and Idaho had the biggest acceleration in home price growth from April 2020 to April 2021. South Dakota is notable because prices increased by just 0.3% in this state in April 2020 but increased by 19.3% in April 2021. As with some other states, South Dakota has had an influx of buyers from other states in search of relatively less expensive housing, driving up prices.

Home prices posted their third straight double-digit increase in April 2021, and strong gains are expected to persist for much of this year. A supply shortage of homes for sale is a major factor in the surge in HPI growth. Affordability challenges may discourage potential home buyers, and this could work to moderate home price increases by early 2022. For more information on home price insights and trends.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.