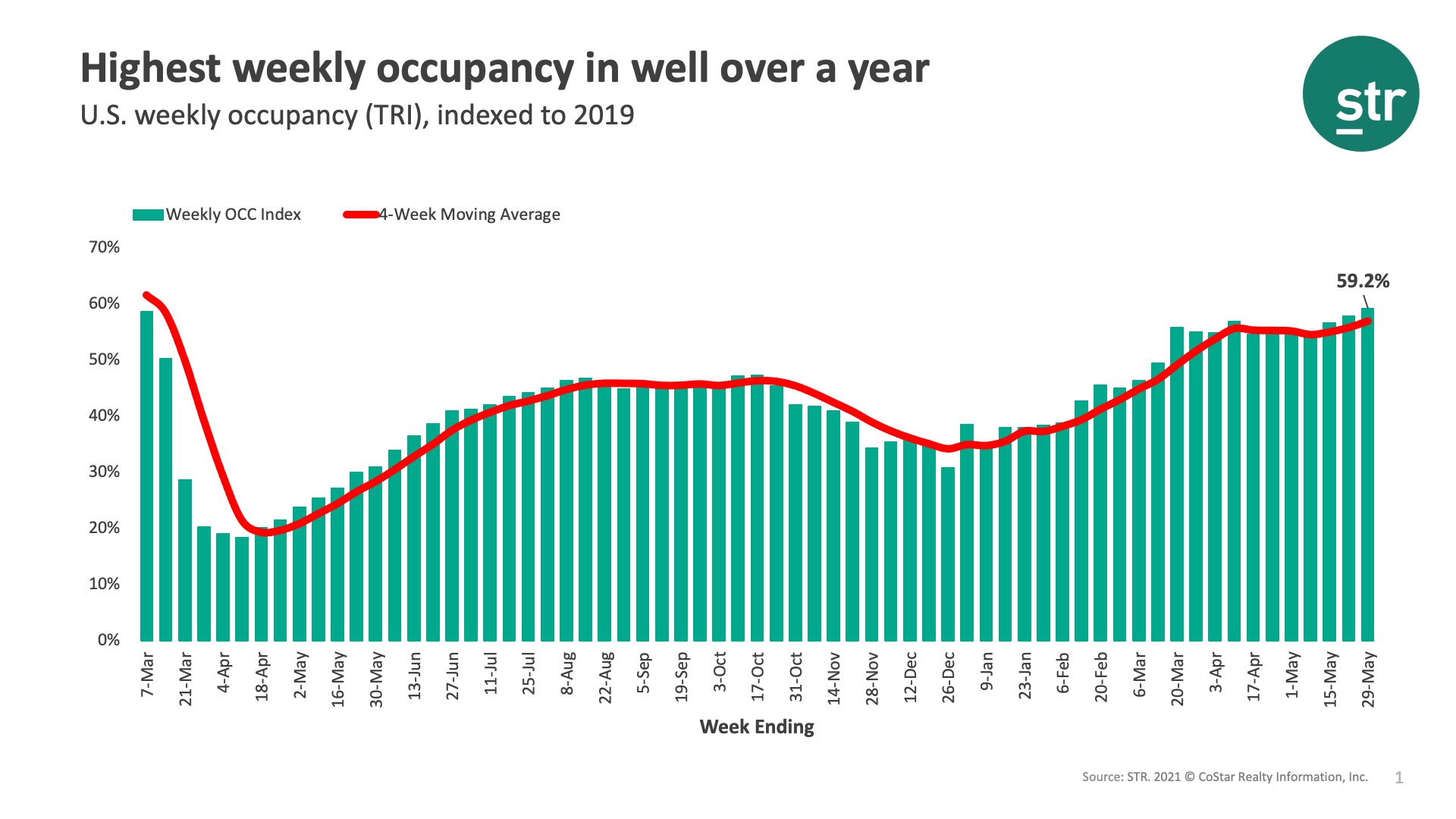

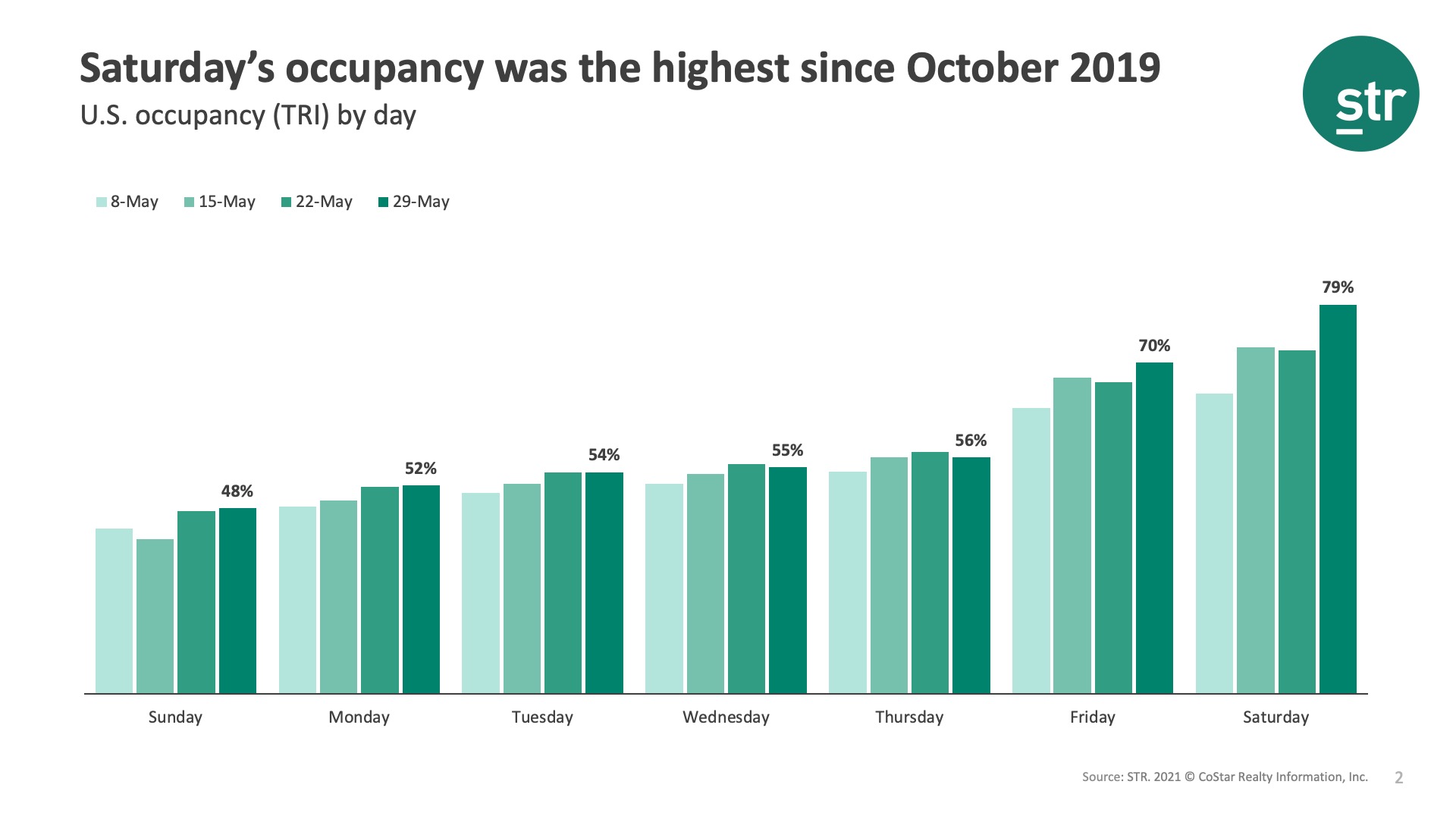

As anticipated, the Memorial Day weekend ushered in the highest occupancy the U.S. industry has seen since the start of the pandemic. For the week ending 29 May 2021, weekly occupancy reached 61.8%, the highest level since the final week of February 2020. On a total-room-inventory basis (TRI), which accounts for temporarily closed hotels, occupancy was 59.2%, which was also the highest since the pandemic’s start. During the first two days of the Memorial Day weekend, occupancy topped 78.3% (74.9% TRI), the highest weekend occupancy since October 2019. The weekend accounted for nearly all the week-on-week increase in occupancy as weekday occupancy was flat versus the previous week. Saturday saw the largest week-on-week jump, reaching nearly 83% (79% TRI).

The start of the summer travel season benefited most markets with only 17 reporting weekly TRI occupancy under 50% this week versus 47 markets four weeks ago. In fact, occupancy was 60% or higher in half of all U.S. markets. For the weekend, 77% of markets had an occupancy above 70% with 33% above 80%. Weekdays, however, remained weak as business travel and groups continue to lag. One third of all markets showed weekday occupancy under 50% last week, and total U.S. weekday occupancy saw no change from the previous week. Among the Top 25 Markets, six had TRI occupancy below 50%, including San Francisco, New York and Washington, D.C. Over the weekend, only one Top 25 Market had occupancy below 50% (New York), with most above 70%.

The picture looked even brighter with 61% of all hotels at an occupancy above 60% in the week. However, there are still 1,500 hotels with an occupancy below 30%, but that is the least since the start of the pandemic. Looking at the weekend, 40% of hotels reported an occupancy above 90%, the most since October 2019, and 37% of hotels had occupancy between 70% and 90%. Encouragingly, large hotels (300+ rooms), which have struggled due to the lack of business and group travel, continued to advance with weekly occupancy of 48%. Over the weekend, these hotels hit 70%. Granted, there are still a good number of large hotels that remain closed, which is likely bolstering occupancy for those that are open.

Weekly ADR reached another pandemic-era high and had its largest week-over-week gain (+5.4%) of the past 10 weeks. Weekend ADR increased 10.2% with the absolute value greater than what it was over the Memorial Day weekend in 2019. ADR in the Top 25 Markets increased 4.2% week over week, which was the largest weekly gain since early April.

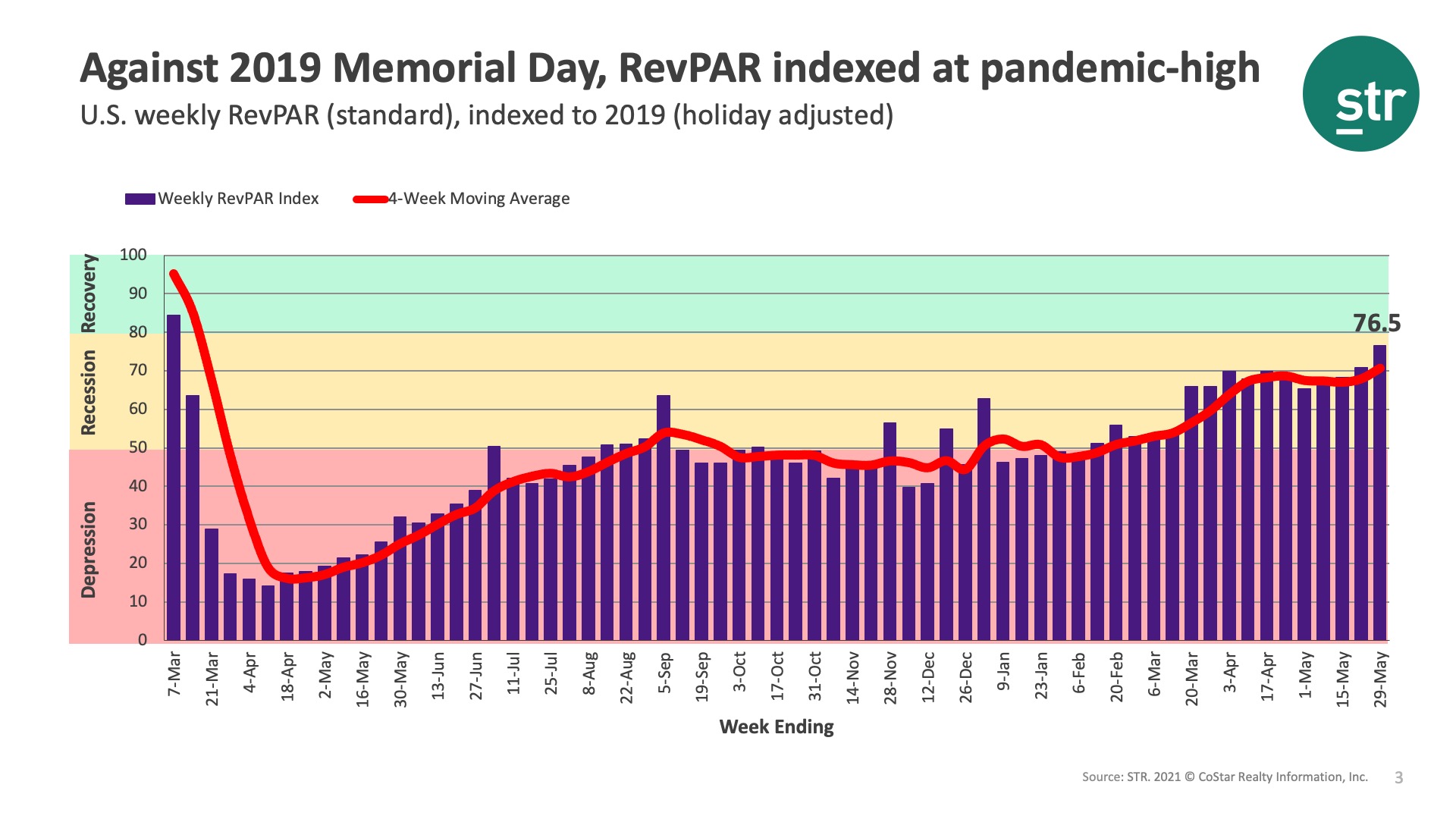

With strong week-on-week occupancy and ADR growth, RevPAR increased to its highest level (US$75, US $72 TRI) since the start of the pandemic. The week-on-week index of RevPAR to the same week in 2019 had a significant upward swing, but most of it was due to the shift in the Memorial Day holiday, which occurred a week earlier in 2019. Adjusting for the shift, TRI RevPAR indexed at 77, which is also a new high-level mark but still indicates that the industry persists in “Recession” while trending in the right direction.

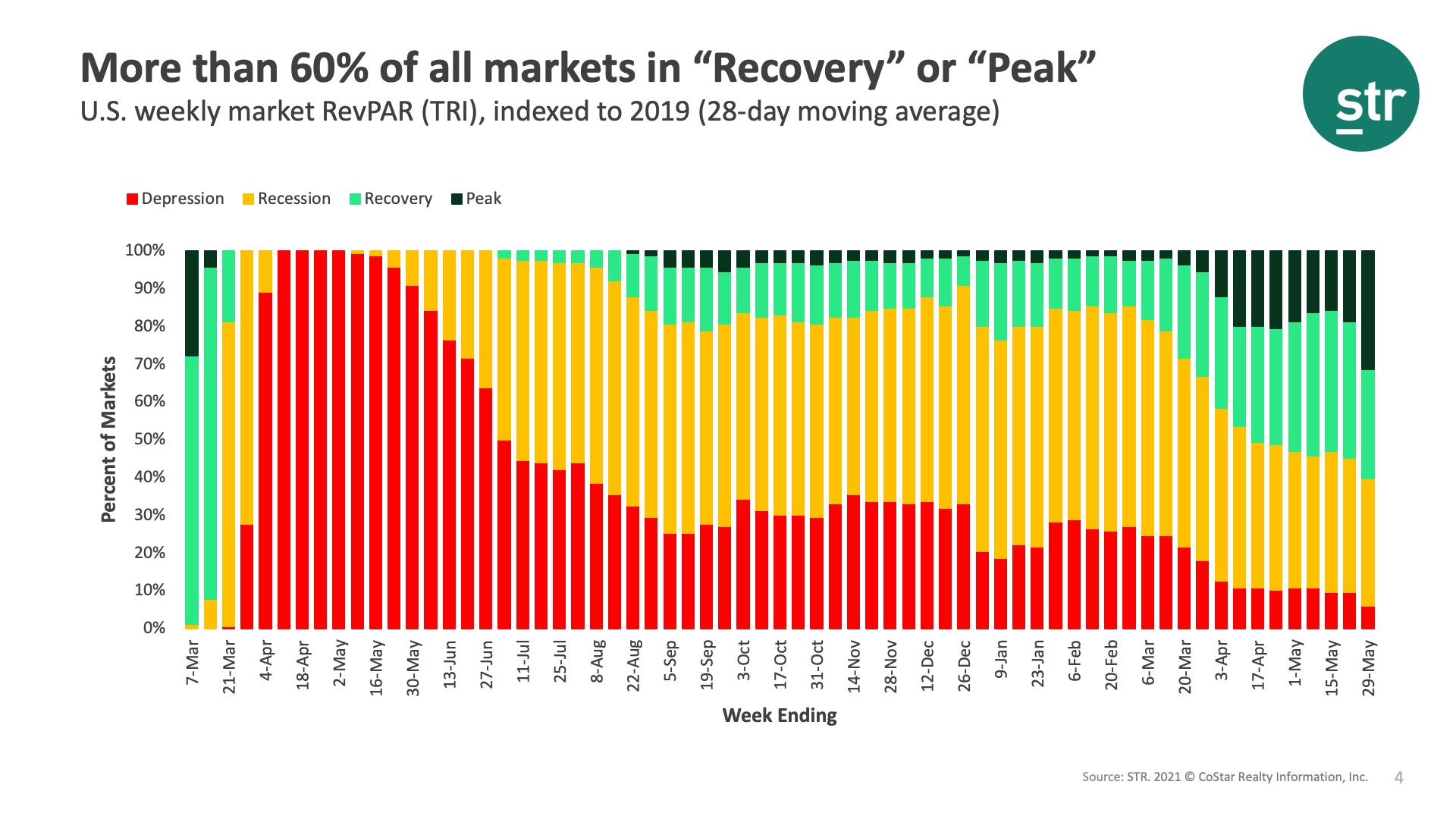

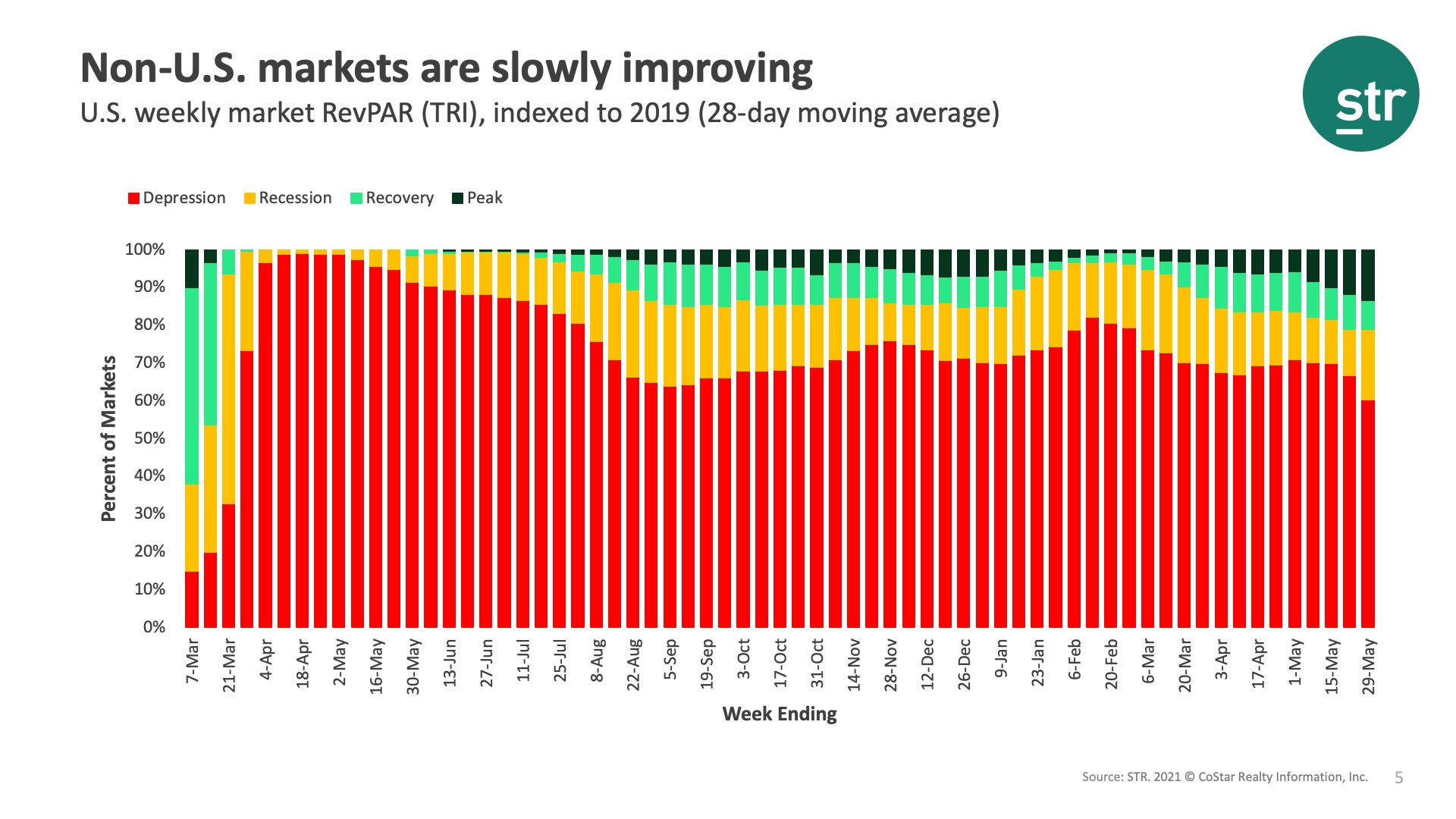

The Market Recovery Monitor also illustrated improvement with 60% of all markets now in “Recovery” (RevPAR between 80% and 100% of their comparable 2019 level) or “Peak” (RevPAR above the 2019 level). This indicator uses a 28-day moving total to account for some of the noise created by shifts in holidays, etc. Three Florida markets (Florida Keys, Sarasota, and Daytona Beach) had the highest RevPAR indexed to 2019 whereas San Francisco, New York and Boston remained at the bottom of the MRM indicator.

RevPAR in non-U.S. markets is showing signs of improvement, but most markets (60%) remain in the “Depression” category (RevPAR less than 50% of the 2019 level). Occupancy is also on the rise, with the U.K. achieving 49% (TRI) in the week, it’s best in some time. Of the 105 markets reviewed week, only five showed TRI occupancy above 60% with 83 reporting TRI occupancy below 40%.

While this week’s results were encouraging and welcomed, we expect that performance will mimic one of summer’s favorite rides, a roller coaster. Without a significant increase in business travel, we believe there will be many ups and downs over the next several weeks and months. We are certain the leisure surge will benefit our industry, but not everyone. The health of the industry will remain fragile for some time to come.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.